NEWS

A Final Salute to Jim Simons

We lost of one of the greatest of the greats today, Jim Simons. Undoubtedly, future investors, traders, and analysts will regard him with the same awe that we reserve for legendary figures like Jesse Livermore. Let’s see what else you missed. 👀

Today's issue covers Simon’s life and career, along with amazing facts about the man and his firm, Renaissance Technologies. Also on deck - a quick run down of NVAX and TSM earnings. 📰

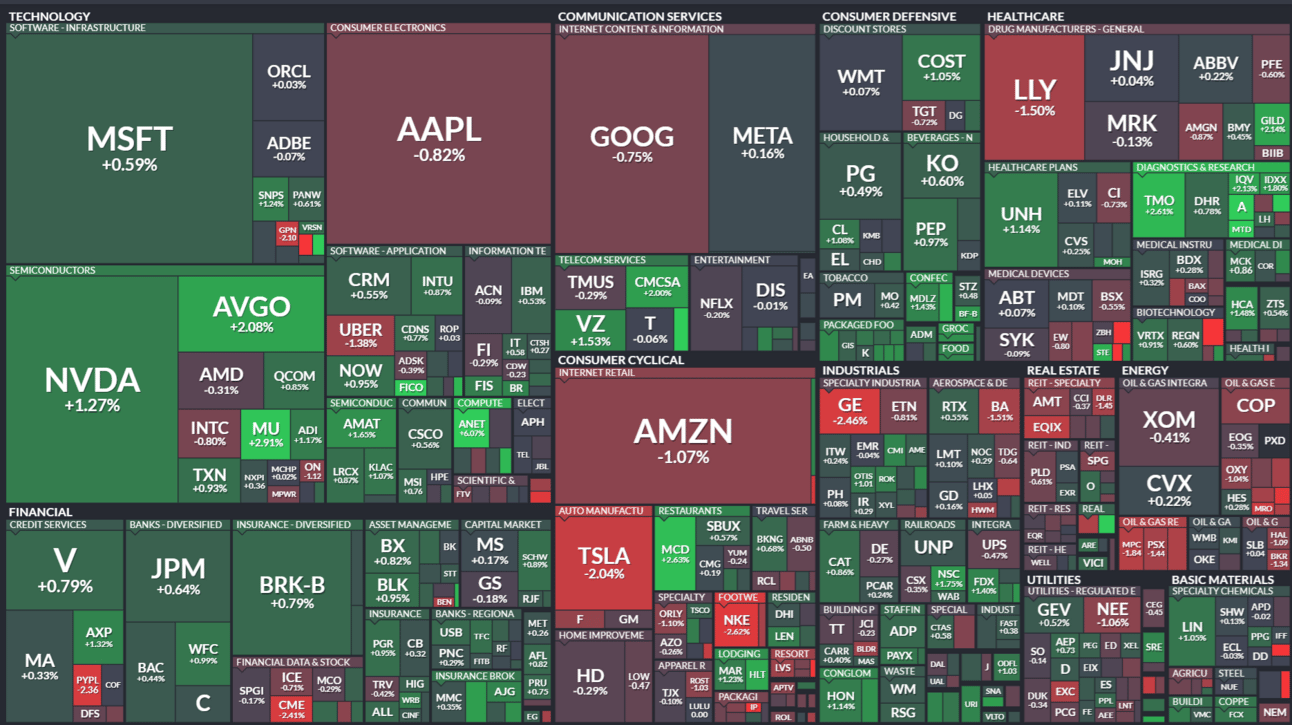

Here's today's heat map:

6 of 11 sectors closed green. Consumer staples (+0.64%) led, & consumer discretionary (-0.61%) lagged. 💚

May's preliminary consumer sentiment index from the University of Michigan plunged to 67.4, blowing the expected 76.0 and falling from last month’s 77.2. This decline is mirrored in both current conditions and expectations, suggesting rising unease about inflation—which ticked up to 3.5% for the one-year outlook, the highest since last November. 📉

Atlanta Fed President Raphael Bostic remains optimistic about a rate cut this year, although the exact timing remains up in the air, with robust job growth still in play. Bostic hints at a potential September start for easing rates, depending on continuing economic conditions, but maintains that any decision will prioritize careful timing over the extent of rate cuts. 🏦

Dallas Federal Reserve President Lorie Logan expressed uncertainty about the current tightness of U.S. monetary policy, suggesting it may not be sufficient to lower inflation to the Fed's 2% target. ✅

A recent ATTOM report reveals a worrying trend in the U.S. housing market: the proportion of ‘seriously underwater’ mortgages increased to 2.7% in the first quarter of 2024, as the share of equity-rich properties declined. 🏚️

Oklo Inc., a clean power technology firm, began trading on the NYSE under the ticker $OKLO after a successful business merger with AltC Acquisition Corp, bringing in $306 million to propel its innovative energy solutions. The new board is chaired by Sam Altman. ☢️

And thank you for letting me grace your mailboxes this week! Your regular Daily Rip programming will begin again next week with Mr. Tom Bruni - it’s been a pleasure! This is your Litepaper newsletter writer, Jon Morgan, signing off!

$SHOP (-5.62%), $AFRM (-9.25%), $PYPL (-2.36%), $CLSK ($-6.15%), $TSLA (-2.04), $BTC ($-2.85%), $MARA (-12.7%), and $LIDR (+115%). 🔥

Here are the closing prices:

S&P 500 | 5,222 | 0.16% |

Nasdaq | 16,340 | -0.03% |

Russell 2000 | 2,058 | -0.74% |

Dow Jones | 39,512 | 0.32% |

IN MEMORIAM

Jim Simons: The Quant King Who Revolutionized Wall Street and Mathematics ⚗️

Jim Simons, the mathematical prodigy who leveraged numbers into creating one of the world's most successful hedge funds, Renaissance Technologies, passed away at the age of 86 in his Manhattan home. 😢

This event marks the end of a remarkable chapter in the annals of both finance and science. Simons, who hailed from Brookline, Massachusetts, amassed a fortune exceeding $30 billion through his pioneering quantitative investment strategies, radically transforming the landscape of financial trading.

Before venturing into Wall Street, Simons had a distinguished career in academia. He completed his Ph.D. in mathematics from the University of California, Berkeley, by the tender age of 23 and went on to teach at MIT and Harvard. His early professional years were also spent cracking codes for the National Security Agency, a role from which he was dismissed due to his vocal opposition to the Vietnam War. 🪖

A New Chapter in Finance

Simons’ transition from academia to finance wasn't driven by mere chance but by a visionary belief in the predictability of financial markets through mathematical models. In the late '70s, he founded Monemetrics, a precursor to Renaissance Technologies, in a Long Island shopping mall office.

His approach was unconventional; while others relied on instinct and networking, Simons assembled a team of mathematicians and scientists to decode market patterns. His firm’s flagship, the Medallion Fund, famously achieved an average annual return of 66% from 1988 to 2018, significantly outperforming industry giants. 🤯

Legacy of Philanthropy and Influence

Simons was a passionate philanthropist, particularly in the realms of science and mathematics. His Simons Foundation has been instrumental in advancing research and education, highlighted by a record-breaking $500 million donation to Stony Brook University’s endowment. In his later years, Simons also emerged as a significant political donor.

Simons’ journey was not just about amassing wealth; it was deeply entwined with his love for mathematics and his commitment to scientific inquiry. He often remarked that his life's narrative was about doing math, making money, and giving it all away—a succinct encapsulation of a life lived at the intersection of brilliance and benevolence.

As the financial world and the academic community mourn his loss, Jim Simons' legacy is poised to endure, characterized by his profound impact on quantitative trading and his generous philanthropic efforts. 👍

STOCKTWITS

10 Amazing Facts About Jim Simons 👨💻

Math Prodigy Turned Finance Wizard: Jim Simons wasn't always a finance mogul. He started his career as a mathematician, contributing to the field of geometry, and even won the prestigious Oswald Veblen Prize in Geometry in 1976.

Code Breaker Extraordinaire: Before he conquered Wall Street, Simons did a stint as a code breaker for the Institute for Defense Analyses in the mid-1960s.

Renaissance Technologies: In 1982, Simons founded Renaissance Technologies, a private hedge fund that became notorious for its Medallion Fund. This fund, often cloaked in mystery and nerd lore, has achieved average annual returns of over 66% before fees—beating the pants off the broader market.

The Medallion Fund: Speaking of the Medallion Fund, it's exclusively for Renaissance’s employees. That's right, it's a closed party. This fund is known for its intense secrecy and for utilizing complex mathematical models to predict market changes.

Philanthropy Focus: Through the Simons Foundation, which he co-founded with his wife Marilyn, he focuses on advancing research in math and science, supporting projects and research that push the boundaries of human knowledge.

Education Advocate: Simons is a former math professor and department chair at Stony Brook University. He's funneled millions into educational initiatives, particularly in math and science education reforms.

Political Player: Jim Simons isn’t shy about playing in the political arena. He’s one of the top donors in U.S. politics, supporting various candidates and causes that align with his vision for a better future.

The Quants’ Quant: Among his peers, Simons is often referred to as the "quant king," a nod to his pioneering role in the use of quantitative analysis in investments. This method relies heavily on complex mathematical models and algorithms—because why gamble when you can calculate?

Love for Science: His foundation also supports a variety of scientific research, including the study of autism, a deeply personal cause for Simons, whose family has been affected by it.

Hidden Depths: Beyond his financial and philanthropic endeavors, Simons is a bit of a mystery man with eclectic interests, including a passion for sunken treasure and scientific mysteries of the universe.

STOCKTWITS

10 Amazing Facts Jim Simon’s Ressaisance Technologies 💻

Scholarly Work Environment: The work environment at Renaissance Technologies resembles that of an academic research institute more than a typical Wall Street firm.

The Medallion Fund: This is the crown jewel of Renaissance Technologies. It's widely regarded as the most successful hedge fund in history.

Employee-Only Investment: The Medallion Fund is notoriously exclusive, only allowing RenTech employees to invest. This keeps its strategies and performance tightly under wraps and maintains an air of mystery and allure around its operations.

Quantitative Approach: RenTech was one of the first hedge funds to develop and rely heavily on quantitative data and automated trading systems.

Secretive Culture: Secrecy is the name of the game at Renaissance. Employees are known to have stringent non-disclosure agreements, ensuring that the magic behind their methods remains a closely guarded secret.

Technological Edge: The firm invests heavily in technology, employing top-notch scientists, mathematicians, statisticians, and computer scientists. These aren't your average Wall Street traders; they're more likely to discuss advanced algorithms than bullish and bearish trends.

Fees Higher Than Industry Standard: While the standard hedge fund fee structure is often quoted as "2 and 20" (2% management fee and 20% performance fee), the Medallion Fund charges a 5% management fee and a 44% performance fee. High, yes, but evidently worth it for its investors.

Diverse Employee Base: Unlike traditional finance firms that might lean heavily on MBAs, RenTech’s team is a smorgasbord of PhDs and former academics from fields as varied as astrophysics, linguistics, and computer science.

Pioneering Machine Learning: Renaissance Technologies was one of the early adopters of machine learning algorithms in the finance sector. They use these sophisticated models to predict price changes in securities, a technique that has since become a standard in the industry but was revolutionary at the time of its inception.

Research and Innovation: The firm’s success is built on constant innovation in the field of algorithmic trading. They are pioneers in developing new techniques for modeling very noisy and unpredictable financial markets. The quest for the Holy Grail of algorithms never ends at Renaissance Technologies.

STOCKTWITS “CHART ART”

Overbought Signals on S&P Give Traders Pause ⏸️

Indices have been giving us mostly sideways action this week as price slowly climbs back towards previous resistance levels. Even though markets are still in an uptrend, it may make sense to take some profit until the index gives us an “all clear” signal that traders are still watching out for.

EARNINGS

Friday Earnings Recap 🥳

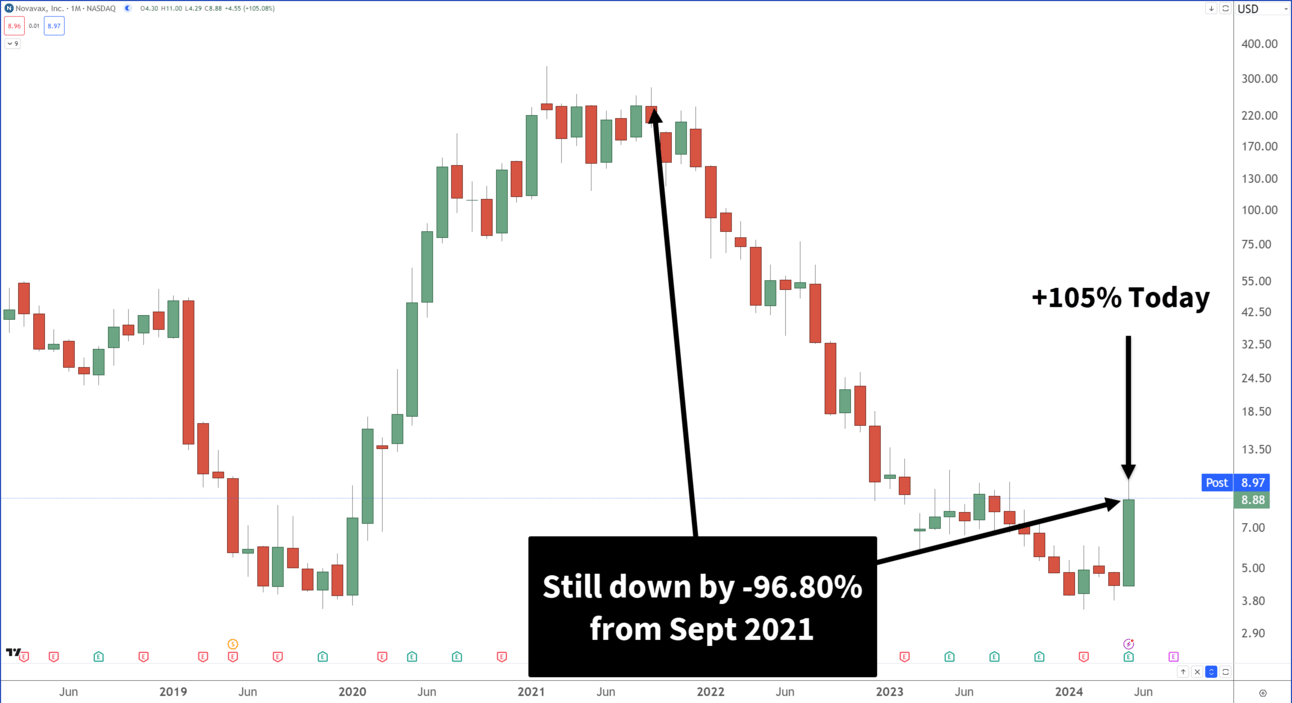

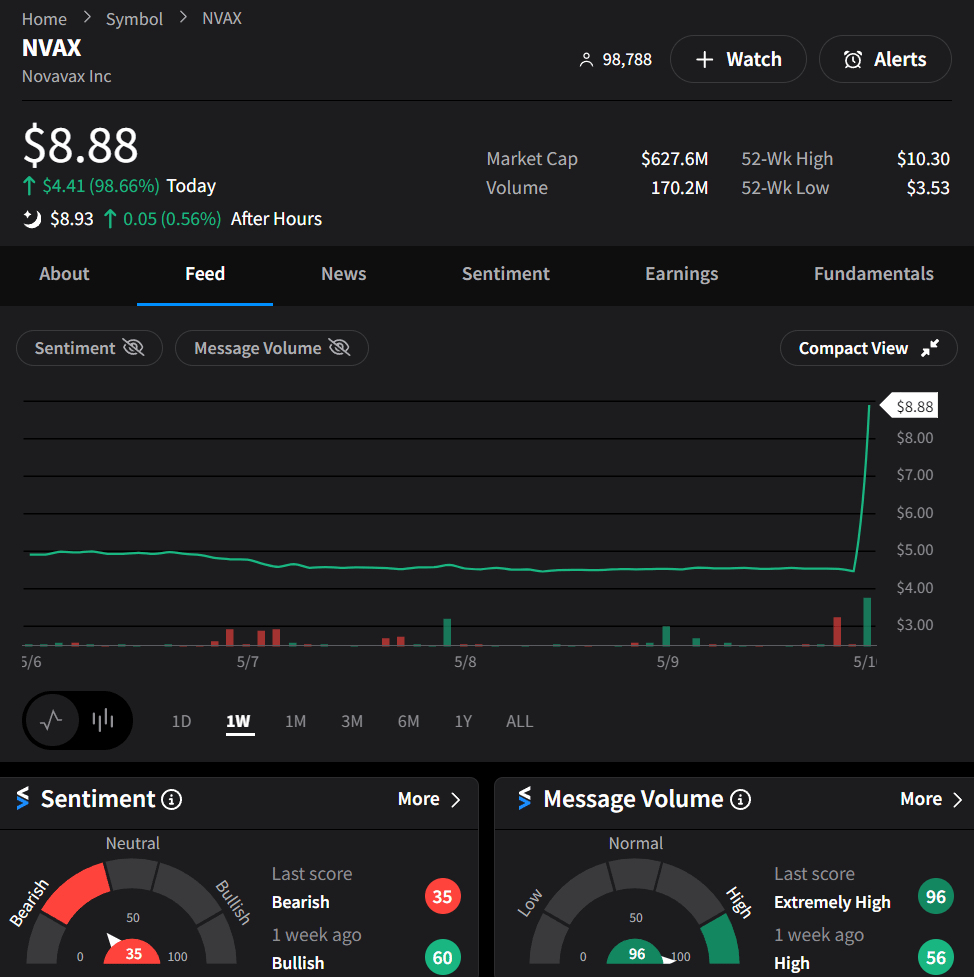

Novavax Inc.

$NVAX shares surged after the company announced a $1.2 billion licensing agreement with Sanofi to commercialize a combined Covid-19 and flu vaccine. Under the terms of the agreement, Novavax will receive $500 million upfront and could gain an additional $700 million based on the achievement of specific development, regulatory, and launch milestones. Additionally, Sanofi will acquire a minority equity stake of about 5% in the U.S. biotech firm. ⚕️

However, Novavax also disclosed a quarterly loss that exceeded expectations and missed revenue estimates. The company's stock has experienced a notable decline since the beginning of the year, contrasting sharply with the broader market gains. This licensing deal could be a critical turning point for Novavax as it seeks to stabilize its financial situation and regain investor confidence.

Taiwan Semiconductor Manufacturing Company

$TSM experienced a notable increase after the company reported a 60% jump in year-over-year revenue. This surge was primarily driven by strong demand for advanced semiconductors, particularly those used in artificial intelligence applications. 💻

TSM's impressive financial performance has not only boosted its stock price but also solidified its position as a leader in the global semiconductor market. Over the past year, TSM has seen its stock price increase by over 78%, with a staggering 293.58% gain in the last five years.

Analysts remain optimistic about TSM's prospects, reflecting confidence in its continued growth driven by strategic expansions in the United States and Japan. These expansions aim to diversify production and mitigate geopolitical risks, further strengthening TSM's market dominance. 💻

Bullets From The Day

📊 Hedge Funds Attract Pension Money to Risky Credit Investments

Pension funds and insurers are increasingly investing in the riskiest segments of the $1.3 trillion credit market, specifically the equity tranches of collateralized loan obligations (CLOs), driven by the chase for higher yields. Despite the high returns associated with these investments, concerns are mounting over the potential risks and the adequacy of returns relative to those risks, especially given the volatile nature of recovery rates. Bloomberg has more.

📱 Apple Pulls Controversial iPad Ad Amid Backlash

Apple ($APPL) has issued an apology and pulled a recent iPad Pro ad that showed musical instruments and other creative tools being crushed. Celebrities like Hugh Grant condemned the ad for symbolizing the destruction of the arts, leading Apple to concede that it missed the mark on celebrating creativity. Despite the, um, out-of-tune ad, Apple remains committed to supporting artistic expression through its products. More from MarketWatch.

🍔 McDonald's Eyes $5 Value Bundle to Lure Inflation-Weary Diners

McDonald’s ($MCD) is testing a $5 value meal deal, featuring a choice between a McChicken or McDouble, with fries and a drink, as it struggles to draw consumers back. While franchisees initially rejected a value proposal, ongoing discussions hint at potential approval as the fast-food giant aims to counter declining restaurant visits and attract price-sensitive customers. Despite efforts to boost traffic with attractive pricing, franchisees are cautious. From Restaraunt Business.

Links That Don’t Suck

👨🔧 Dave Portnoy unloads on anti-Israel college protesters: 'I wouldn't hire any of these activists'

🐊 Man says his emotional support alligator, known for its big social media audience, has gone missing

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍