NEWS

Follow-Through Friday

Source: Tenor.com

A hotter-than-expected retail sales number and ‘hawkish’ comments by several Fed members had stock market bears on the offensive. The market closed lower for the fourth straight day, giving back some of its post-election gains in the process. 👀

Today's issue covers the Nasdaq 100’s “island reversal,” Palantir’s executives enjoying the bull market a bit too much, and more from the day. 📰

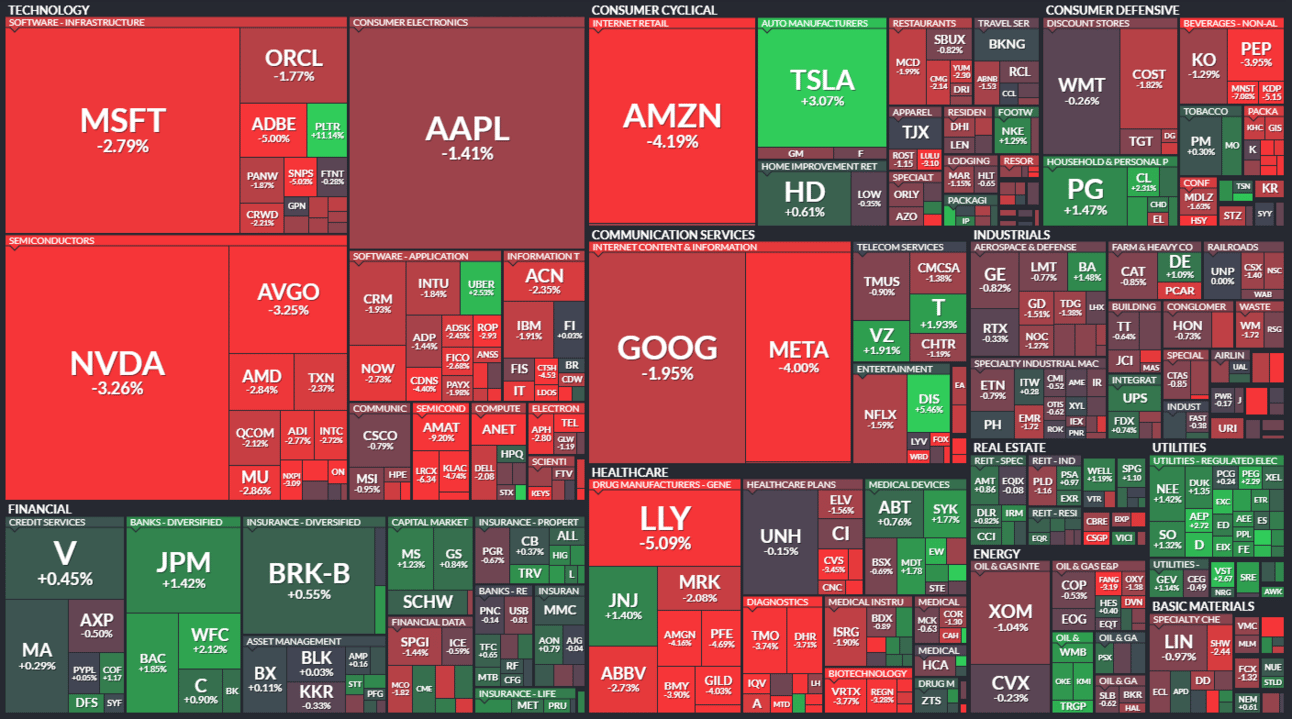

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with utilities (+1.50%) leading and technology (-2.48%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,871 | -1.32% |

Nasdaq | 18,680 | -2.24% |

Russell 2000 | 2,304 | -1.42% |

Dow Jones | 43,445 | -0.70% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $CMP, $ERNA, $BE, $ABUS, $CYCN 📉 $IPG, $POOL, $TOI, $TWST, $PLTR*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Late Buyers Left Stranded On An Island 🏝

On Monday, we discussed how far many stocks were from their long-term trends using a common technical indicator, the 200-day moving average. We noted then that this often represents an elevated level of risk in the market, particularly when speculative assets like DogeCoin and other risky assets are seeing such strength. 💸

Little did we know that Tuesday would mark the start of a stock pullback that has lasted straight through the end of the week. And some technical analysts are saying this selloff could just be starting because the Nasdaq 100 has formed an ominous “island reversal” reversal pattern.

Below is a longer-term chart of the Nasdaq 100 ETF ($QQQ) with a pic of the last week's worth of trading. As we can see in that box, prices gapped up, traded in a range for several days, and then gapped down. This price action traps buyers on an “island” and often forces them to exit their positions as their losses mount. 😨

Source: TradingView.com

If this bearish reversal pattern holds (i.e., if prices don’t fill this gap), then technical analysts say the next logical level of long-term support is at the uptrend line from their 2023 lows and the 200-day moving average near 462. 🎯

As for what sparked this selloff, it depends on who you ask. However, an easy thing to place blame on is October’s retail sales data, which showed that Americans stepped up spending last month. Retail sales rose 0.4% MoM in nominal terms, or 0.1% adjusted for inflation. 🛍

Additionally, Boston Fed President Susan Collins raised further doubts about future rate cuts by saying December “isn’t a done deal.”

On top of that, the weakness in semiconductors we highlighted yesterday continued today, increasing its drag on the market and turning everyone’s attention back to Nvidia earnings, which are due Wednesday after the bell. 👀

NVIDIA DAY COUNTDOWN

Your Chance To Win Exclusive Nvidia Merch 🤩

Think you know Nvidia stock better than the 546,846 other people following it on Stocktwits? Now’s the perfect chance to flex your muscles. 💪

Use our “Price Prediction” tool to forecast its Thursday opening price. The first person to predict it correctly will win exclusive, limited-edition $NVDA merch worth $120. And bragging rights, of course. 😉

And be sure to follow @Stocktwits on the platform and our socials (X, Instagram, YouTube) so you don’t miss out on all the Nvidia action before they report after the bell on Wednesday! 🚨

STOCKS

Other Noteworthy Pops & Drops 📋

Super Micro Computer: Shares surged 20% after the bell on news that three independent broker-dealers have gathered and acquired a 5.3% stake in the company (30.8 million shares). However, roughly 22.6 million are through stock it has the right to buy through options. So a big bet ahead of its potential delisting, but not one they’re willing to go all-out on. 💰

Alibaba: Shares fell 2% after the company posted a profit beat that was primarily driven by the performance of its equity investments. Revenue did rise 5% YoY, but it remained below analyst forecasts even as China’s government tries to revive tepid consumer spending and overall economic growth. 🛒

Bloom Energy: Shares soared 59% after the company announced a new deal with American Electric Power (AEP). Under the agreement, AEP will use Bloom’s fuel cell technology to provide power solutions for artificial intelligence (AI) data centers. ⚡

FuelCell Energy: Shares popped 30% before fading to close down 12%. The company announced a global restructuring plan aiming to reduce operating costs by 15% and reallocate resources towards core technologies. ✂

SolarEdge Technologies: Shares plunged 17% after Morgan Stanley downgraded it and Maxeon Solar due to ongoing challenges in the sector and uncertainty around overall regulatory support for the group. 🪫

Nike: Shares rose 1% after the struggling sportswear giant announced a $0.03 increase in its quarterly dividend, bringing it to $0.40 per share. Billionaire investor Bill Ackman raised his stake in the company by 440% during the third quarter. Retail sentiment on Stocktwits turned ‘extremely bullish’ on the news. 👟

Disney: Shares rose 6% after several Wall Street analysts upgraded the stock following its better-than-expected quarterly results. On Stocktwits, a poll revealed more than a quarter of retail investors see the stock ending the year in the range of $120 to $140, representing a potential three-year high. 🐭

AST SpaceMobile: Shares tumbled 9% as investors focused on the sharp rise in quarterly losses and putting little weight on its major launch service agreements. Roughly $237 million of its losses were due to the measurement of warrant liabilities, but still, investors are anxiously awaiting some much-needed revenues. 🚀

Intuitive Machines: Shares surged 19% after Cantor Fitzgerald, Canaccord, Benchmark, and Roth MKM all raised their price targets for the space exploration company following Thursday’s third-quarter earnings beat. 👍

PRESENTED BY STOCKTWITS

ICYMI: “The Weekend Rip With Ben & Emil” 🤑

“The Weekend Rip With Ben & Emil” premiered live today on Stocktwits. The inaugural show covered Domino’s Pizza's jump, Spirit Airlines’ dump, Cathy Wood’s whacky ways, and more of the “best worst” financial advice on the internet.

STOCKS

Palantir Exec Drinks Too Much Kool-Aid 😵💫

The software giant has been a massive winner this year, recently rising to all-time highs on the back of revenue and earnings momentum. 📈

The company’s CEO, Alex Karp, and the broader management team have been big proponents of bolstering their retail shareholder base and leaning into it hard. The company is taking that one step further, switching its listing from the New York Stock Exchange (NYSE) to the Nasdaq Exchange beginning on November 26th.

The reasoning? It expects to meet the eligibility requirements of the Nasdaq 100 Index, turning hundreds of billions in passive investing funds into potential Palantir shareholders. 🤑

Unfortunately, the hype may have gotten to founding employee and board member Alex Moore. Mr. Moore tweeted this gem down below, hoping to stir up retail investors’ excitement, before realizing how cringe (and likely illegal) it was. Don’t worry; he deleted his X account, which should totally fix it. 🙃

Source: X.com

That’s certainly bull market behavior if we’ve ever seen it. Time will tell if that marks the top in Palantir or if it’s just a blip on the stock’s journey to the literal moon. Notably, Stocktwits sentiment is in ‘extremely bearish’ territory, so clearly, some in retail are skeptical of the recent rally.

COMMUNITY VIBES

One Tweet To Sum Up The Week 😩

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋