NEWS

A Tariffic Turn Of Events

Source: Tenor.com

Trump’s inauguration speech and flurry of executive orders have so far pointed to less aggressive action on trade, giving investors the go-ahead to place further bullish bets. Add to that a solid start to earnings season and Trump’s announcement of a $500 billion AI investment program, and you’ve got a market of stocks moving higher. 👀

Today's issue covers Netflix earnings stealing the show, the weekend’s wild Trump Coin activities, and more from a busy day on Wall Street. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with industrials (+2.05%) leading and energy (-0.51%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,049 | +0.88% |

Nasdaq | 19,757 | +0.64% |

Russell 2000 | 2,318 | +1.85% |

Dow Jones | 44,026 | +1.24% |

EARNINGS

Netflix Shines After Earnings Beat 🤩

Earnings season is the market’s next major hurdle to overcome, but so far many stocks have been surprising to the upside…including Netflix.

Shares are up 14% after hours, nearing $1,000 per share, following the streaming giant's “beat and raise” fourth-quarter results. 📈

Earnings per share of $4.27 topped the $4.20 expected, while revenues of $10.25 billion beat the expected $10.11 billion. Paid memberships were the big winner, rising to 301.63 million vs. the 290.9 million forecasted by Wall Street. 💵

Management touted its fourth-quarter content slate, including season 2 of “Squid Game,” live sporting events like Jake Pual vs. Mike Tyson, and the Christmas Day National Football League (NFL) games.

It signaled another price increase for some streaming tiers, ranging between $1 and $2 per month. It also noted that more than 55% of sign-ups were ad-supported in countries where the option is available, growing roughly 30% QoQ. 📊

The streamer will now start reporting a bi-annual “engagement report” alongside its second—and fourth-quarter earnings releases. During 2025, the company will focus heavily on improving its offer to advertisers.

Stocktwits sentiment is ‘extremely bullish’ as prices rally and investors digest the results, signaling some are looking for further upside. Time will tell if they get it! 🍿

SPONSORED

JOIN THE "BEST BROKER FOR OPTIONS TRADING 2025" AS RANKED BY INVESTOPEDIA!

Old trading walks into a bar. New trading raises it.

It's time you got serious at tastytrade. Tools and tech made for tough markets. Pricing that fits the way you trade.

Stocks. Options. Futures and more. All in one place.

Up your trading game with order chains, backtesting, visualized analysis, and courses to help you trade smarter.

If you can see opportunity differently, then you can seize it differently.

We’re upgrading options trading. See it in action.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. tastytrade, Inc., and Stocktwits are separate and unaffiliated companies that are not responsible for each other’s services, products, and policies.

STOCKS

Other Noteworthy Pops & Drops 📋

Moderna (+7%): The U.S. Health and Human Services Department awarded it $590 million to accelerate its bird flu vaccine development.

InMed Pharmaceuticals (-12%): Announced that its INM-901 small molecule drug candidate for Alzheimer's disease demonstrated promising results in a recent clinical trial. The study showed that INM-901 significantly reduced several markers of neuroinflammation, both in plasma and the brain.

FTAI Aviation (-27%): A Muddy Waters report alleged that the jet aircraft lessor’s financial reporting was “highly misleading.”

Seagate Technology Holdings (+7%): A Morgan Stanley analyst named the data storage devices company his top IT pick, replacing Apple. Analyst Erik Woodring attributed his optimism to Seagate's high short interest, greater confidence in June quarter revenue recovery, and his above-consensus gross margin outlook.

JetBlue (+5%): Became the first airline to accept Venmo as a payment option for online bookings. Sliding oil prices also helped boost the industry.

Pitney Bowes (+3%): Acquired the presort business of Royal Alliances, a provider of technology-enabled shipping and mailing solutions headquartered in Irving, Texas.

Viasat (+35%): The company was selected for a $4.82 billion contract from the National Aeronautics and Space Administration (NASA). The NASA contract involves providing support to the agency’s direct-to-earth (DTE) capabilities through Near Space Network (NSN) services.

TempusAI (+47%): The company launched an artificial intelligence (AI)-enabled healthcare concierge app for patients, sending the retail community into a tizzy.

Prologis (+6%): The real estate investment trust’s (REIT) fourth-quarter profit more than doubled.

SoundHound AI (+25%): The voice and conversational artificial intelligence (AI) solutions provider announced a collaboration with roadways intelligence systems company Rekor Systems, Inc. ($REKR). Retail sentiment did not reflect the optimism.

3M (+4%): CEO William Brown said the fourth quarter capped a year of strong results as the firm returned to positive organic revenue growth in the full year.

Charles Schwab (+6%): The brokerage reported upbeat fourth-quarter results driven by record net inflows into the company’s Managed Investing Solutions.

Apple (-4%): Jefferies analyst Edison Lee downgraded Apple stock to ‘Underperform’ from ‘Hold’ and lowered his price target to $200.75 from $211.84.

Space stocks skyrocketed in the first trading session following Turmp’s inauguration, highlighting the administration’s enthusiasm for space exploration.

CRYPTO

$TRUMP Coin: Here’s What Happened 😵💫

In case you lived under a rock over the long weekend and missed all the meme coin drama, we’ve got a quick summary of the OFFICIAL TRUMP coin that launched and everything that followed… Shout out to Jonathan Morgan, the writer of our Litepaper crypto newsletter, for this summary. Be sure to subscribe for more!

Meanwhile, with meme coin madness happening, Trump’s Securities and Exchange Commission (SEC) has launched a ‘crypto task force’ to develop clear regulations.

Anyway, let’s get into this weekend’s events. 👇

Friday And Saturday Surge

Price debuts near $0.18 late Friday evening as soon as Trump’s socials drop the $TRUMP memecoin bombshell.

Skeptics cry “hack,” until a second post confirms it.

Token volume rockets, with the chart printing a wall of green candles up to $7.

Early risers on Saturday find $TRUMP around $8, but it’s only catching its breath.

A swift jump past $9 triggers FOMO across Solana’s DEXs.

By mid-afternoon, it’s already sprinted to $20 and beyond.

Sunday Blow-Off Top

Wild weekend momentum carries $TRUMP to $67.

Fully diluted valuation flirts with $60+ billion, overshadowing any normal altcoin.

Inauguration hype adds extra fuel.

Melania’s Sunday Surprise

Around 4 PM EST on Sunday, an abrupt post from First Lady Melania Trump about her own coin sends $TRUMP holders scrambling.

Price plunges from $73 to $38 over a two-hour period.

MLK Holiday And Inauguration Slide

A partial rebound above $50 tries to restore hope, but everyone’s now side-eyeing those huge insider token allocations.

Solana’s volume skyrockets, but users are frustrated after failed transactions pile up.

MLK Day weekend ends with $TRUMP mania overshadowing just about everything else.

$TRUMP ended Monday in the $30 value area.

Tuesday after-hours update: The coin slid over 30% after Trump said “he didn’t know much about it.” What a time to be alive… 😂

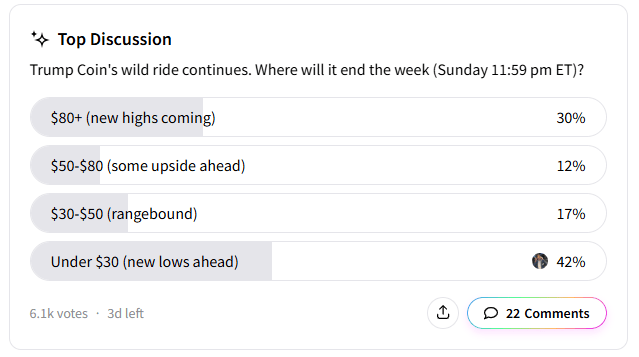

As for how the Stocktwits community is playing it, roughly 42% of the 6,100 respondents signaled they believe new lows are ahead before the end of the week!

PRESENTED BY STOCKTWITS

“Trends With Friends” Guest Ariel Seidman 🤑

Howard, Phil, and Michael are joined by Ariel Seidman, founder of HiveMapper. The lively discussion covers the rise of meme coins and their impact on the market, the psychology affecting meme coin traders, challenges and opportunities in the crypto space, HiveMapper’s structure and tokenomics, and more!

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: CB leading economic index (10:00 am ET) and ECB President Lagarde Speech (10:15 am ET). 📊

Pre-Market Earnings: Johnson & Johnson ($JNJ), Procter & Gamble ($PG), Haliburton ($HAL), Abbott Laboratories ($ABT), Ally Financial ($ALLY), GE Vernova ($GEV), Textron ($TXT), Travelers Companies ($TRV), Comerica ($CMA). 🛏️

After-Hour Earnings: Alcoa ($AA), Kinder Morgan ($KMI), Discover Financial Services ($DFS), Steel Dynamics ($STLD), SL Green Realty ($SLG), Hexcel ($HXL). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋