NEWS

AI Plays Have Had Better Days

Source: Tenor.com

A continued cooling of labor market data made for a mixed day on Wall Street, as investors struggle to determine if ‘bad’ news for the economy is good news for stocks. Despite the market weakness, defensive sectors slumped and Tesla became the latest AI play. 👀

Today's issue covers Broadcom breaking down after a double-beat, traders eying Tesla’s technical breakout, an auto parts giant preparing to accelerate, and why Trump-linked stocks aren’t having any $PHUN. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with consumer discretionary (+1.13%) leading and healthcare (-1.37%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,503 | -0.30% |

Nasdaq | 17,128 | +0.25% |

Russell 2000 | 2,132 | -0.61% |

Dow Jones | 40,756 | -0.54% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ZUMZ, $VOR, $TVTX, $BRZE, $ABUS 📉 $MCK, $SWBI, $GOSS, $MBLY, $NWBO*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

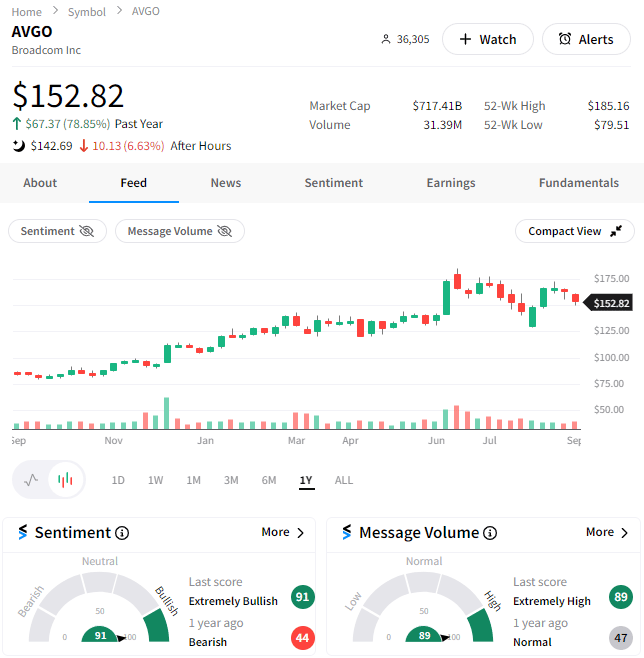

Broadcom Is The Latest AI Bust 👎

Semiconductor giant Broadcom sank 7% despite delivering earnings and revenue beats. Like many of its peers, the stock came into its report hot, and expectations proved a bit too high for the company to match. 😬

Adjusted earnings per share of $1.24 on revenues of $13.07 billion topped the expected $1.20 and $12.97 billion. Its semiconductor solutions segment saw $7.30 billion in revenue, while infrastructure software generated $5.80 billion.

CEO Hock Tan emphasized the company’s role in the artificial intelligence (AI) boom, saying he now expects a record $12 billion in revenue from AI parts and custom chips during fiscal 2024, up from a previous forecast of $11 billion. 🦾

Still, investors are trying to figure out how to value the company, which remains far more diversified to categories like networking, broadband, server storage, wireless, and industrials than competitors seen as ‘pure AI’ plays.

Shares had risen over 75% over the last year in hopes that it would become a major player in the space. And although it has, its guidance simply meeting analyst expectations was not enough to keep investors excited in the near term, especially in an environment where even Nvidia is under pressure... 😐

Traders and investors will be watching closely to see how the stock digests this news in the coming days and weeks. Currently, the after-hours price action is at odds with Stocktwits community sentiment, which remains in ‘extremely bullish’ territory. 🧐

STOCKTWITS “TRENDS WITH FRIENDS”

Should Investors Hedge Their Nvidia Shares? 🤔

COMPANY NEWS

Tesla Tops Resistance As Musk Touts FSD 🤖

Despite other electric vehicle (EV) stocks remaining stuck in neutral, Tesla is regaining its momentum and popping back up on traders’ radars.

Driving the move was the company announcing that its Full Self Driving service (a paid add-on driver assistance feature) will launch in Europe and China during the first quarter of 2025…pending regulators’ approval.

On the one hand, this is certainly a positive development for the business. However, the strong stock reaction raised some eyebrows from bears who said this announcement is nothing new since, in July, Elon Musk said he expected regulatory clearance for those two regions by the end of 2025. 🤔

Still, the bulls are running with the news, and the stock showcased its relative strength in an otherwise mixed market.

Technical analysts are watching the stock’s latest breakout attempt above its multi-year downtrend line. And fundamental analysts like Wedbush Securities’ Dan Ives believe the company is ‘ the most undervalued AI play.’

Still, the Stocktwits community remains skeptical…with sentiment sitting in ‘extremely bearish’ territory. 🙃

Source: TradingView.com

And while we’re talking about EV stocks, we should mention Nio Inc., which rebounded 15% after its revenue and delivery guidance topped expectations. Bears say the numbers are concerning since delivery volumes growing faster than sales signals weak pricing. They say that will ultimately impact margins and profitability and hurt the company long-term. ⚡

Still, bulls are looking beyond that and instead focusing on the company’s narrowing loss per share and improving top-line momentum.

Stocktwits sentiment hit its highest level since July today, and our engagement question brought out the company’s biggest bulls. With momentum improving, this one’s expected to stay on traders’ radars for the days and weeks ahead. 👀

STOCKTWITS “CHART ART”

Auto Parts Giant Prepares For Breakout Attempt 🚗

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

MEME STOCKS

Trump-Linked Stocks Are Not Any Having $PHUN 😫

Politically charged stocks are expected to remain hot topics through the upcoming November election. Unfortunately for investors in Trump-linked stocks, momentum has not been on their side since early this year.

Below is a year-to-date (YTD) performance chart of three stocks typically seen as proxies for Trump’s presidency, showing that two-thirds of them recently fell into negative territory. 📉

Source: Koyfin.com

Trump Media & Technology ($DJT), Phunware ($PHUN), and Rumble ($RUM) all benefitted early in the year from the former President’s return to the limelight. However, they’ve struggled to maintain their strength despite consensus forecasters expecting November to be a tight race. 🗳️

Like other ‘social-momentum’ or ‘meme’ stocks, much of their performance is driven by feelings rather than fundamentals. That’s because many of these underlying companies have yet to prove that their business models can generate a consistent profit and return for shareholders. 🌡️

And right now, the vibe toward these stocks is far from bullish, as investors realize they’ve given back all their gains and are left wondering what the next potential upside catalyst could be.

Time will tell if that changes in the coming weeks and months heading into the election. But for now, it seems the bulls have left the building. 🤷

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls/Average Hourly Earnings and the Unemployment/Labor Force Participation Rates (8:30 am ET). 📊

Pre-Market Earnings: Big Lots ($BIG), ABM Industries ($ABM), and Genesco ($GCO). 🛏️

After-Hour Earnings: None — have a great weekend! 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋