NEWS

All Eyes Turn To Nvidia Earnings

It was another light volume day in the U.S. stock market as traders and investors await Nvidia’s earnings to set the tone. Nonetheless, the major indexes continue to churn near all-time highs as individual stocks move under the surface. Let’s see what you missed. 👀

Today's issue covers a preview of tomorrow’s Nvidia earnings, the game not stopping in meme stock land, and more from the day. 📰

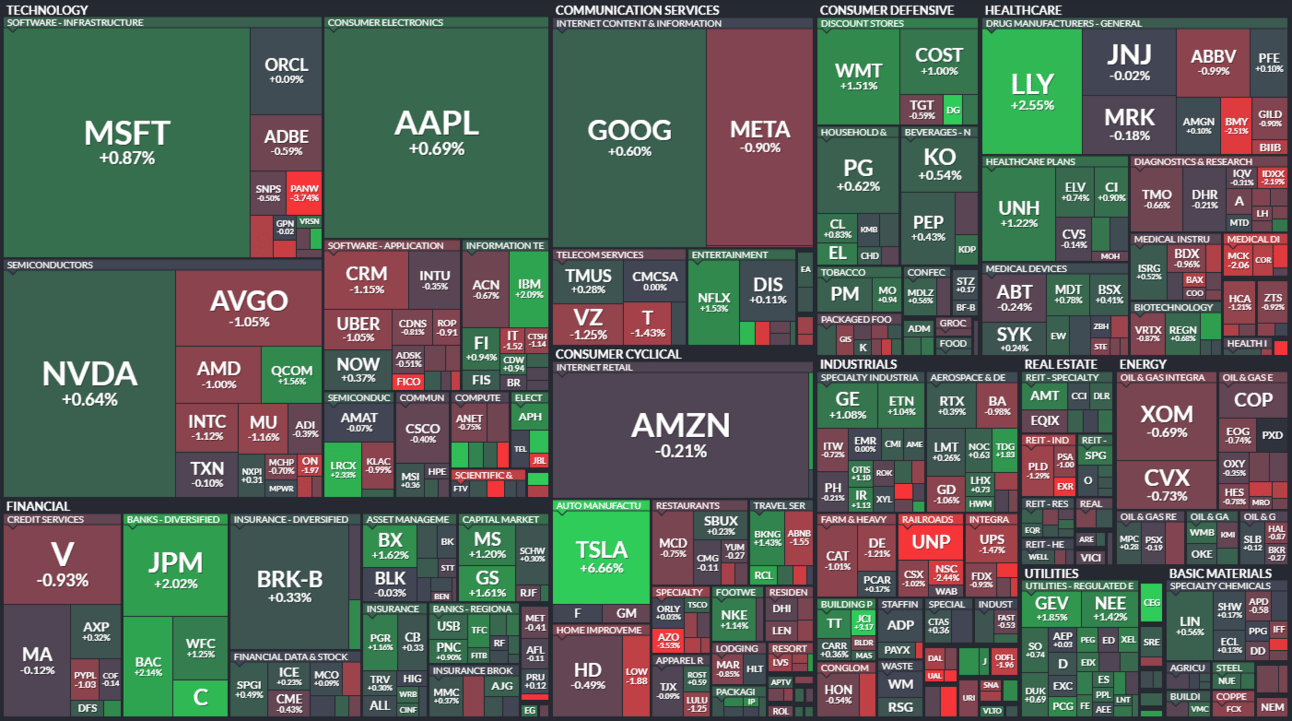

Here's today's heat map:

7 of 11 sectors closed green. Utilities (+0.90%) led, & energy (-0.49%) lagged. 💚

Fed Governor Christopher Waller was the latest to reiterate that he wants to see “several months” of good inflation data before lowering interest rates. However, he and others also noted that they do not believe further rate hikes will be necessary. ⏸️

Energy commodities pulled back slightly on news that the Department of Energy is releasing 1 million barrels of gasoline to lower prices ahead of the summer driving season and the July 4th holiday. ⛽

Chinese electric vehicle stocks remained mixed, with Li Auto declining after disappointing first-quarter results. Meanwhile, XPeng jumped 6% after beating estimates and expecting second-quarter deliveries to rise 25%-40% YoY. ⚡

Lowe’s shares came under pressure despite earnings and revenue beating expectations, while Home Depot’s revenue missed. The company said sales still fell YoY as do-it-yourself customers bought fewer higher-priced items amid the macroeconomic uncertainty and stalled housing market. 🪚

Software company BlackLine fell 9% after offering $500 million in convertible senior notes due in 2029. Healthcare company Haemonetics also fell 8% after announcing $525 million in notes at essentially the same offering terms. 💰

Peloton was also down 16% following yesterday’s unveiling of its “global refinancing” process, which is needed to support a broader turnaround. 🚲

Modine Manufacturing fell 10% after the thermal management company’s fourth-quarter revenues fell below analyst estimates. 🥶

First Solar helped boost the sector today after receiving several price target lifts from Piper Sandler and UBS, as analysts look to artificial intelligence (AI) demand to drive renewable energy needs. 🌞

Other active symbols: $MTC (-15.24%), $FFIE (-22.78%), $TSLA (+6.66%), $GWAV (-62.72%), $AMC (-3.73%), & $CTNT (-92.00%). 🔥

Here are the closing prices:

S&P 500 | 5,321 | +0.25% |

Nasdaq | 16,833 | +0.22% |

Russell 2000 | 2,098 | -0.20% |

Dow Jones | 39,873 | +0.17% |

EARNINGS

The Most Important Earnings On Earth

On the one hand, we’re being a bit facetious with the title. But on the other hand, we’re really not. A lot of riding on Nvidia’s results, so let’s quickly review the price action and expectations heading into tomorrow’s print. 👇

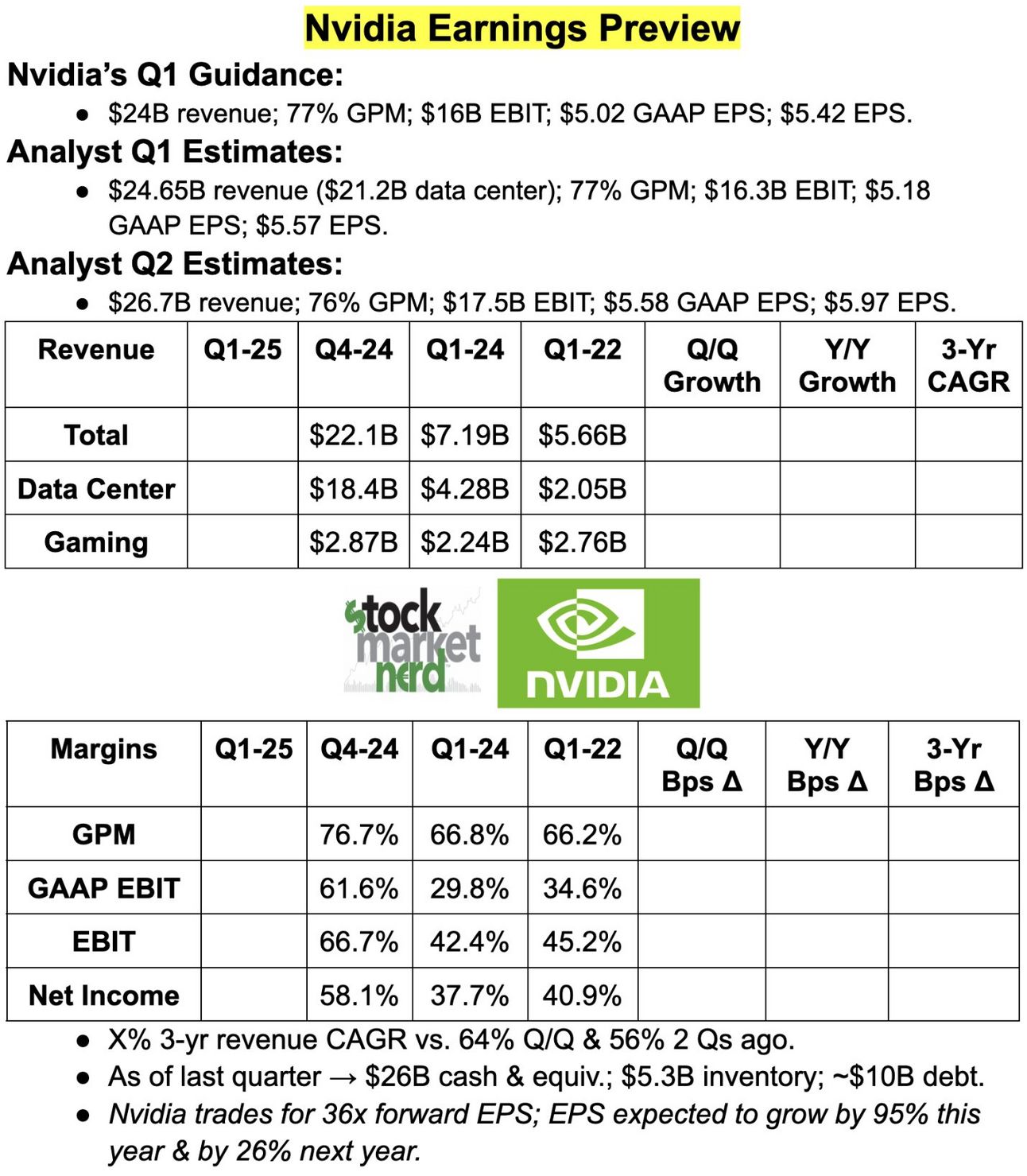

Starting with the fundamentals, Nvidia has beaten expectations for the last five quarters, blowing the last three out of the water. Since then, however, analyst expectations have been ramping up significantly.

Stocktwits user @Stockmarketnerd does a solid job of outlining the company’s guidance and Wall Street estimates for the most widely followed metrics. 🕵️

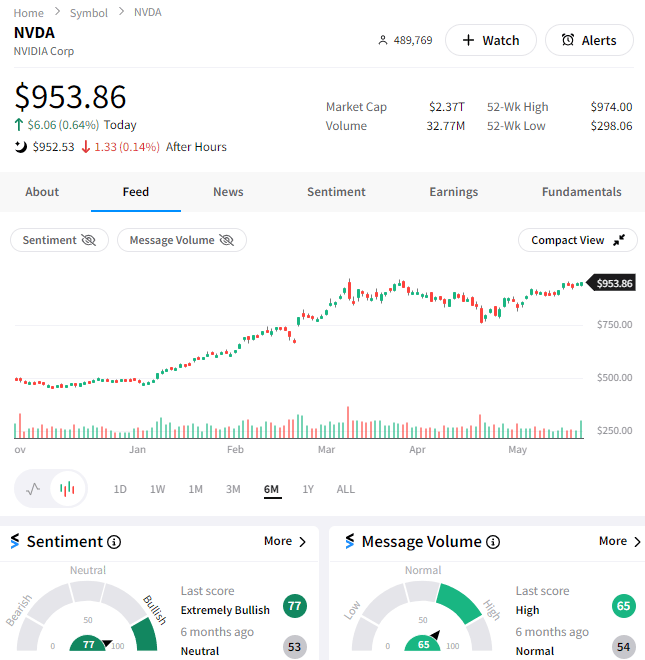

As for the stock, Nvidia shares are trading just below all-time highs. They’ve spent the last three months consolidating with and tracking the broader market’s action, which many technical analysts view as a healthy digestion of recent gains.

Additionally, as highlighted in recent “Chart Art” newsletters, other semi stocks have flexed their strength, with many moving to new highs in anticipation of the market leader delivering a great outlook for itself and the overall sector. 🤩

On Wall Street, the average price target for the stock is $1,040, implying a roughly 10% upside from current levels. Additionally, of the 52 analysts covering the stock, only four rate it a “hold” or below (meaning not a single sell rating). Now those are some high expectations…

Stocktwits sentiment remains in “extremely bullish” territory, signaling that retail investors are also betting on more upside after buying the April dip. 🐂

We’ll have to wait and see if the company can deliver, but most expect the results to set the tone for the broader market going forward. Much is hinging on artificial intelligence (AI) being a major growth engine across industries, with Nvidia’s outlook being the best barometer for where things are headed. 🧭

As for the actual report, all the action will take place on Stocktwits. Join us on the $NVDA stream to share your thoughts as the results roll in tomorrow shortly after the bell. We’ll see you there! 👀

STOCKS

The Game Does Not Stop (Ever)

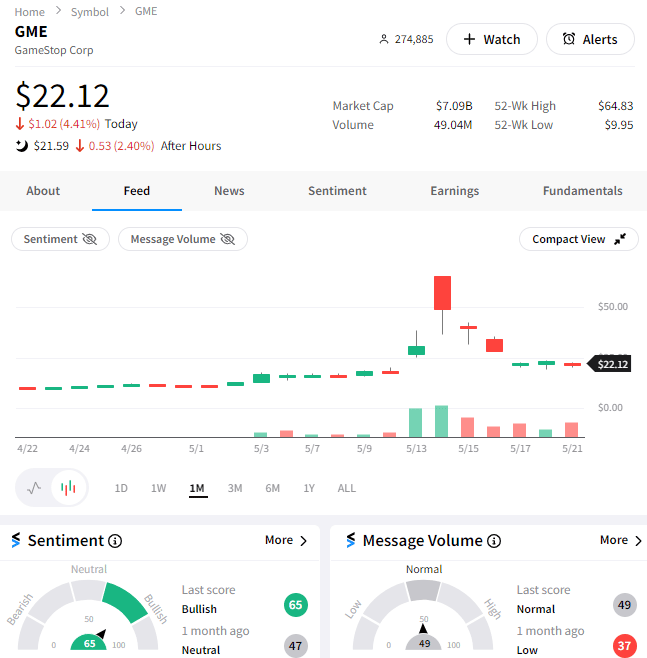

In case you thought the GameStop situation was different this time, more and more high-profile people are coming out of the woodwork to remind us it’s just as ridiculous as the last. 🤦

While Roaring Kitty has remained silent since Friday, leaving GameStop supporters waiting with bated breath, others have tried to hop on the bandwagon and fill his big shoes.

Today’s contestant also happens to be a candidate for the U.S. Presidential election…and no, it’s not Joe Biden or Donald Trump. Though they’re known to meddle in the financial markets a bit as well…

But for now, independent candidate Robert F. Kennedy Jr. is defending “free and fair “ markets, likely hoping to use the current wave of excitement to drum up support for his own campaign. 🗳️

His tweet below explains (although does it really?).

And to show that he’s serious in his quest to “…support the Ape retail rebellion and enact aggressive Wall Street reforms.” he’s invested $24,000 in GameStop and will likely continue participating in the recent discourse to increase his own relevance and reach a new audience of voters.

Our social team did a solid job of capturing the overall sentiment:

GameStop shares have given back much of their recent gains but still remain up on the year, awaiting a catalyst to reignite the recent rally. Despite the silence from Roaring Kitty, Stocktwits community sentiment remains in bullish territory as traders bet on a bigger “meme stock” comeback. 🤑

The company reports earnings on Wednesday, June 5th after the bell, but has sandbagged its results a bit with last week’s preannouncement and share offering. Until then, it remains the wild wild west, with influencers and presidential candidates alike looking to leverage the attention of the “meme stock” crowd for their purposes. 🤷

IN PARTNERSHIP WITH MONEYSHOW

Join Me At MoneyShow’s Virtual Expo This June 👀

My presentation, “Where Retail Investors & Traders Are Making Money in 2024,” will take place on June 11th, 2024, from 11:15 to 11:45 am ET. Register for free, and I’ll see you there! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

Bullets From The Day

🤑 French AI startup raises $220 million seed round. A seed round above $10 million is rare, but not in the field of artificial intelligence (AI), apparently. Paris-based startup H has announced a $220 million seed round just a few months after the company’s inception. Its impressive founding team is looking to work on AI agents, automated systems that can perform tasks traditionally performed by human workers. That’s the holy grail in the AI space, so investors are willing to pay up to get in on the ground floor of this big bet. TechCrunch has more.

📺 Comcast reveals pricing for its new streaming bundle. The legacy cable TV business continues to shrink, but that isn’t stopping providers from building our new cable-style bundles for the streaming era. Beginning next week, the cable giant will offer StreamSaver, a package that includes Peacock Premium (with ads), Netflix Basic (with ads), and Apple TV+ for the 35% off price of $15/month. More from Variety.

🛳️ Younger generations are hopping on the Boomer cruise bonanza. Norweigan Cruise Line CEO Harry Sommer says younger generations are becoming more interested in the company’s offerings, becoming the fastest-growing segment of its customer base. He says consumers are finding major value for their money, which is important in an environment where inflation continues to pinch people’s wallets. Time will tell if this trend among younger customers sticks, but for now, it’s helping the cruise lines deliver record results. CNBC has more.

Links That Don’t Suck

🧇 Wendy’s will offer $3 breakfast deal, as rivals such as McDonald’s test value meals to drive sales

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍