NEWS

All Eyes Turn To America’s Election

Source: Tenor.com

Stocks rebounded today on the back of big tech as investors and traders prepared their portfolios for U.S. election-related volatility. Now, we all sit and wait for the U.S. election results, plotting how we’ll adjust our portfolios once the outcome is known. 👀

Today's issue covers Super Micro’s shadowy future, traders and investors hedging election volatility, and other noteworthy pops and drops. 📰

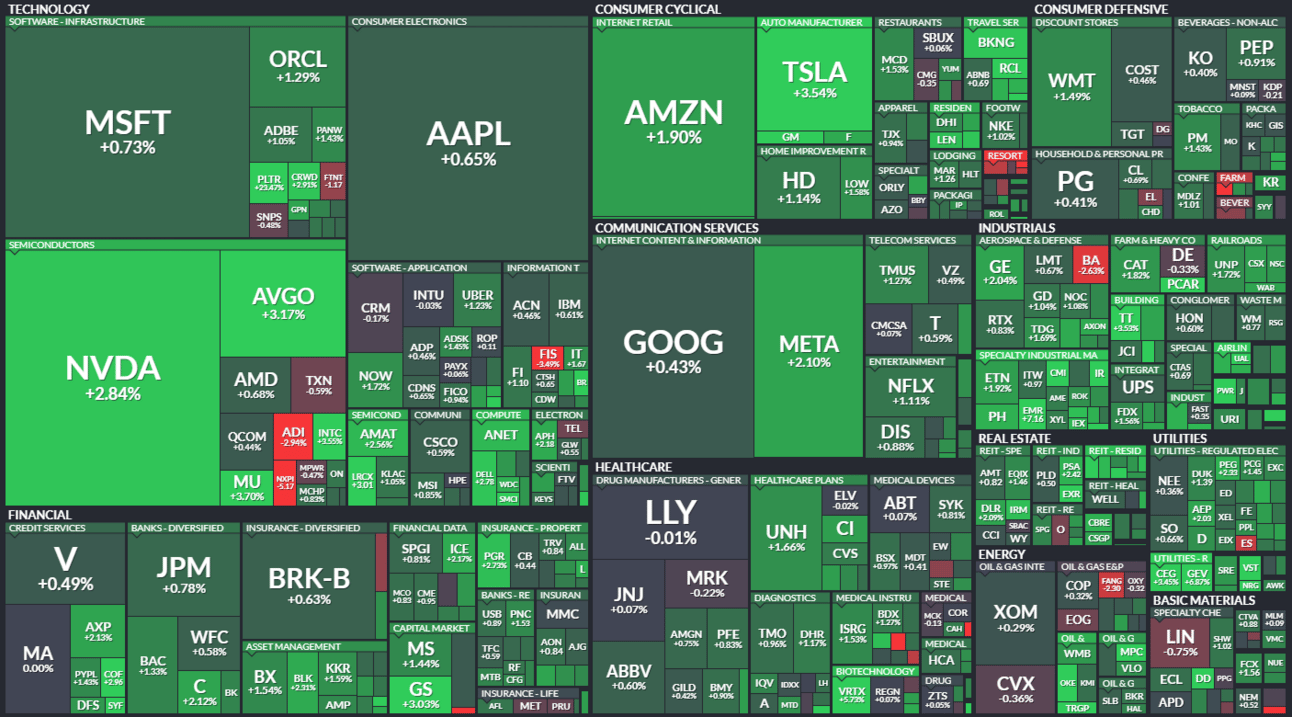

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with consumer discretionary (+1.77%) leading and materials (+0.15%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,783 | +1.23% |

Nasdaq | 18,439 | +1.43% |

Russell 2000 | 2,261 | +1.88% |

Dow Jones | 42,222 | +1.02% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $QLYS, $ZCAR, $TSHA, $TDUP, $XMTR 📉 $VRCA, $NXPI, $SQNS, $CPS, $LSCC*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Super Micro Further Sullies Its Reputation 🙃

The embattled semiconductor company has fallen from grace over the last six months, with investors hoping for answers during its latest earnings report. Unfortunately, instead of providing clarity, management stirred up more confusion.

For the quarter ending September 30th, the company reported net sales of $5.9 to $6 billion, well under analysts’ expectations of $6.45 billion. Adjusted net income of $0.75 to $0.76 per share. These numbers are not audited, so they could eventually be worse (or better?) than initially reported. 😐

Still, the company has far more pressing issues than selling its servers and computer systems right now.

Last week, its auditor, Ernst & Young (EY), resigned. And if Super Micro doesn’t file its delayed annual report with the Securities and Exchange Commission (SEC) by mid-November, it faces potential delisting from the Nasdaq exchange. 😱

On the earnings call (which thousands of investors tuned into live on Stocktwits), management said it wouldn’t discuss any questions related to EY’s decision and that it’s actively in the process of hiring a new auditor.

CEO Charles Liang said, “We are working with urgency to become current again with our financial reporting…” Additionally, the company’s board of directors commissioned a special committee to look into EY’s concerns, but the three-month investigation found “no evidence of fraud or misconduct” from management. 🤷

Liang continually shifted the focus back to Nvidia’s latest GPU, Blackwell, saying that demand is strong and its capacity is ready. Management reiterated its “deepest of relationships” with Nvidia, trying to quell fears about the companies’ relationship.

With shares down 80% from their March highs and urgent issues facing the company, management failed to renew investors' confidence. $SMCI shares fell 15% in the after-hours session. For now, the clock ticks as the SEC, Nasdaq, and investors await audited financials and more clarity about the future. ⌛

CHART OF THE DAY

Market Participants Race For Protection 😨

The Stocktwits election poll continues to pop off, with over 70,000 users voting and Donald Trump maintaining his lead over Kamala Harris. With this expected to remain a tight race, let’s see how market participants are positioning. 😬

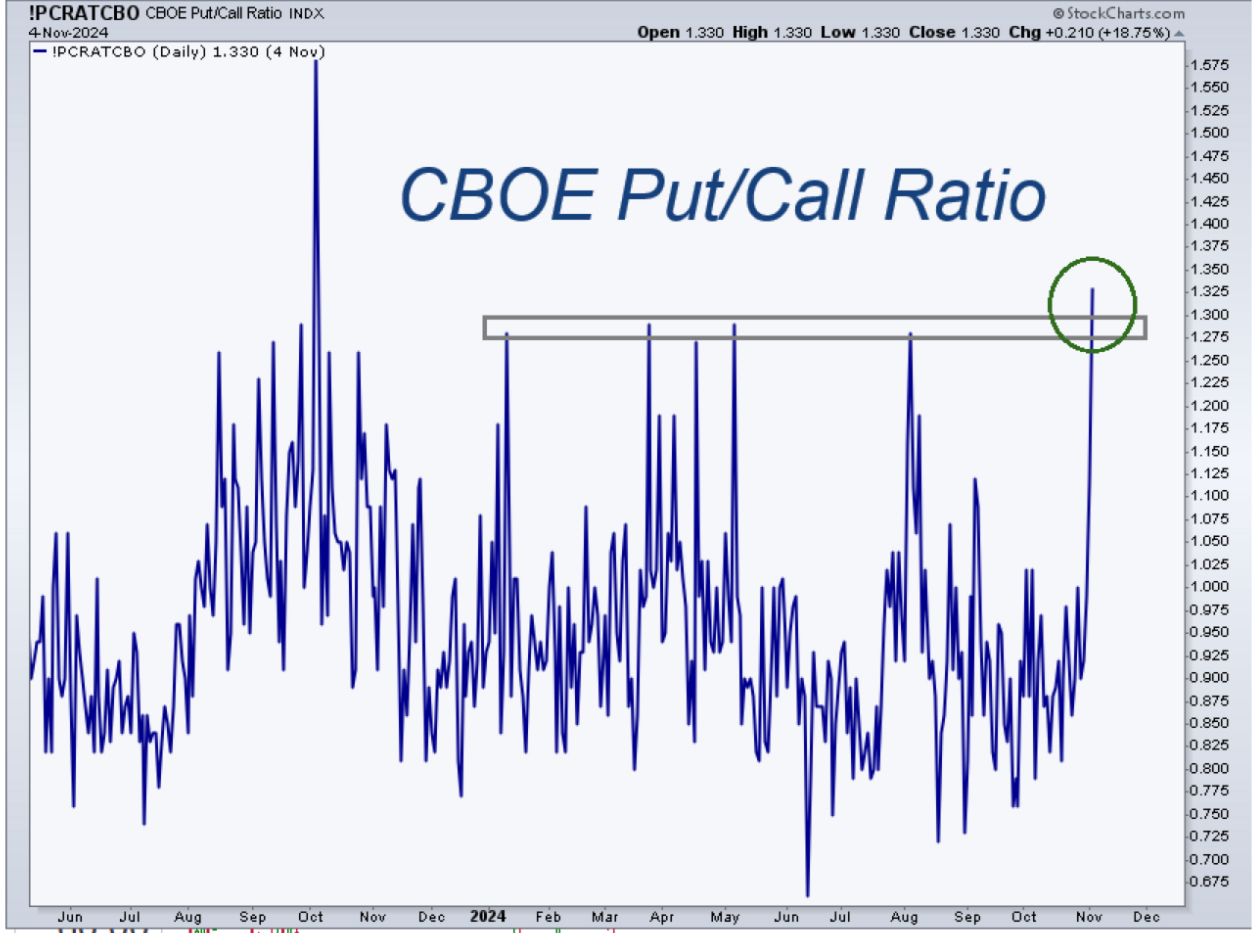

Stocktwits user @allstarcharts shared a chart of the CBOE put/call ratio rising to new 52-week highs even as stocks sit near all-time highs, signaling a rush for “protection” through at least the end of this week’s events.

J.C. sees this as a bullish sign that the market could be caught flat-footed if stocks continue higher. However, many others view this less as a contrarian signal and instead as a sign that any downside, if it does occur, could be somewhat limited given that many market participants grabbed protection in the options market. 🛡

For more charts & trade ideas like this, get today’s “Chart Art” newsletter. 🎯

STOCKS

Other Noteworthy Pops & Drops 📋

Archer Daniels Midland: Shares fell 6% after the food-processing and ethanol giant’s earnings and missed expectations. The company also lowered its full-year earnings guidance and postponed its third-quarter earnings call as it works to finalize its financial statements. It continues to struggle with accounting issues but has told investors it’s nearing a resolution. 📝

AstraZeneca: Shares fell 7% after reports that dozens of its senior executives in China were potentially implicated in an insurance fraud case. In September, five current and former employees were detained by Chinese police for alleged violations of data privacy laws and importing an unapproved cancer drug. 👮

Trump Media & Technology: Shares are gyrating wildly around the election, but the company also reported a $19.2 million loss on $1.01 million in revenue after the bell. The surprise SEC filing was likely an effort to put out results while the world is focused elsewhere. 🤫

Astera Labs: Shares soared 37% after the Nvidia supplier reported 47% QoQ and 206% YoY revenue growth and a net loss of $0.05 per share. It makes chip-based connectivity products to boost the efficiency of AI for customers, including Nvidia, Advanced Micro Devices, and Intel. 🤖

Wynn Resorts: Shares fell 9% after the casino operator missed third-quarter profit and sales forecasts. It cited weakness in its Las Vegas operations and mixed results at its Macau properties. It also invested $18.2 million in its 40%-owned joint venture being built in the United Arab Emirates (UAE). 🃏

Marqeta: Shares declined 42% after the payment processing firm missed earnings and revenue expectations marginally. Meanwhile, its fourth-quarter revenue guidance for 10% to 12% YoY growth was well below the 17% analysts expected. 💳

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: U.S. Election Updates, ECB President Speech (9:00 am ET), EIA Energy Inventories (10:30 am ET), Brazil Interest Rate Decision (4:30 pm ET). 📊

Pre-Market Earnings: Aurora Cannabis ($ACB), Celsius Holdings ($CELH), Novo Nordisk ($NVO), CVS Health ($CVS), Teva Pharmaceuticals ($TEVA, WW International ($WW), Toyota Motors ($TM), Scotts Miracle-Gro ($SMG). 🛏️

After-Hour Earnings: AMC Entertainment ($AMC), elf Beauty ($ELF), Qualcomm ($QCOM), Lyft ($LYFT), ARM Holdings ($ARM), SolarEdge ($SEDG), Joby Aviation ($JOBY), IonQ ($IONQ), MercadoLibre ($MELI), Match Group ($MTCH), Innovative Industrial Properties ($IIPR). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋