NEWS

Amazon Misses $2 Trillion Mark

It was a rough day across all asset classes following hotter-than-expected wage growth and housing market data. Inflation concerns continue to weigh on the market, with Amazon’s earnings after the bell unable to bail the bulls out. Let’s see what you missed. 👀

Today's issue covers Amazon’s “good” earnings results, marijuana’s reclassification rumors, and a long-term look at a popular cannabis industry ETF’s trend. 📰

Here's today's heat map:

0 of 11 sectors closed green. Healthcare (-0.08%) led, & energy (-2.98%) lagged. 💔

The S&P/Case-Shiller home price index rose 0.30% MoM and 6.40% YoY in February, its fastest rate of annual growth since November 2022. Despite mortgage rates staying elevated, a tight existing supply is keeping prices high as buyers fight for available inventory. 🏘️

U.S. consumer confidence fell to a 21-month low as inflation concerns around food and gas prices erode sentiment. On the other hand, Americans’ pay continues to rise faster than anticipated this year. The Employment Cost Index (ECI) rose 1.20% last quarter, raising more red flags about the Fed’s fight to bring inflation back to its 2% long-term target. 🔻

Chicago PMI fell for the fifth straight month to its lowest level since November 2022. It’s now in contraction territory for five consecutive months. 🏭

McDonald’s shares were flat despite the fast-food giant posting a rare profit miss. The company said boycotts in its Middle Eastern stores weighed on results and noted lower-income consumers are becoming tired of price increases. 🍟

PayPal shares popped to nine-month highs after its first-quarter revenue numbers topped analyst estimates. 💳

Another beaten-down stock, 3M, also popped 6% after its earnings and revenue expectations. Notably, it cut its dividend after spinning off its healthcare unit. It had previously raised the dividend for 64 consecutive years. 😮

Crypto remains under pressure along with other risk assets, with the Stocktwits community pointing to breakdowns in cryptocurrencies themselves and crypto-related stocks like Coinbase and MicroStrategy. Meanwhile, Binance founder Changpeng Zhao (CZ) was sentenced to four months in prison for failing to establish adequate anti-money laundering protections. ₿

Other active symbols: $SMCI (-11.85%), $CGC (+78.85%), $ROOT (+29.21%), $PINS (+18.31%), $GMM (+59.09%), $SOFI (-3.76), & $MULN (+41.67%). 🔥

Here are the closing prices:

S&P 500 | 5,036 | -1.57% |

Nasdaq | 15,658 | -2.04% |

Russell 2000 | 1,974 | -2.09% |

Dow Jones | 37,816 | -1.49% |

EARNINGS

Market’s Mood Sullies Amazon’s Results

Amazon’s hopes of becoming the fifth U.S. tech giant to cross the $2 trillion market capitalization mark will have to wait another day. Although the company’s headline results seemed to meet the mark, they weren’t enough to offset today’s market meltdown. ☹️

Adjusted earnings per share of $0.98 on revenues of $143.30 billion topped expectations of $0.83 and $142.50 billion. Amazon Web Services (AWS) revenues of $25 billion and advertising revenues of $11.80 billion also beat. 💪

Operating income rose more than 200% YoY to $15.30 billion as its cost-cutting measures boosted bottom-line results. Cloud growth was strong, but advertising saw the best YoY increase as Prime Video ads helped bolster sales.

Looking ahead, executives expect revenue growth of 7%- 11%, which is below the 12% analysts were anticipating. On a positive note, they anticipate profitability will continue to rise, albeit at a more normalized pace.

However, unlike many of its big-tech peers, the company did not announce the start of a quarterly dividend or increase its buyback program despite having nearly $74 billion in cash on its balance sheet. 🤑

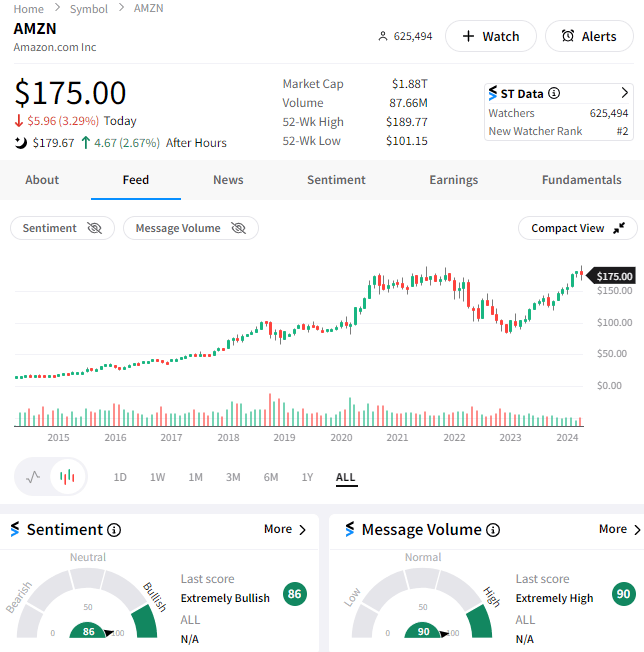

Amazon shares were up marginally after the bell, leaving the company about $180 billion shy of the $2 trillion mark bulls were hoping to see. Still, Stocktwits community sentiment is in “extremely bullish” territory, suggesting retail investors and traders are looking for the stock to make new highs soon. 👍

POLICY

Sources Say DEA Nears Marijuana Reclassification

The Associated Press (AP) reported that the U.S. Drug Enforcement Administration (DEA) will move to reclassify marijuana as a less dangerous drug, in a move that would represent a historic shift in American drug policy. 😮

The proposal, which still must be reviewed by the White House Office of Management and Budget (OMB), would recognize the medical use of cannabis and acknowledge it has less potential for abuse than other drugs.

It would not, however, legalize marijuana outright for recreational use. ❌

This is the last major hudrle before the policy change can take effect. Once OMB signs off, the DEA would take public comment on the plan to move marijuana from a Schedule I drug to Schedule III. After that period and review by an administrative judge, the final rule could then be published.

With the upcoming elections and nearly 70% of adults supporting legalization, many see this as a push by Democratic lawmakers to draw in more support for the Biden administration in November. 🗳️

The news helped boost marijuana stocks, which have been trying to bottom-up since these rumors began swirling back in August of last year. While the rule stops short of full legalization and decriminalization at the federal level, increased medical use should help demand to grow materially.

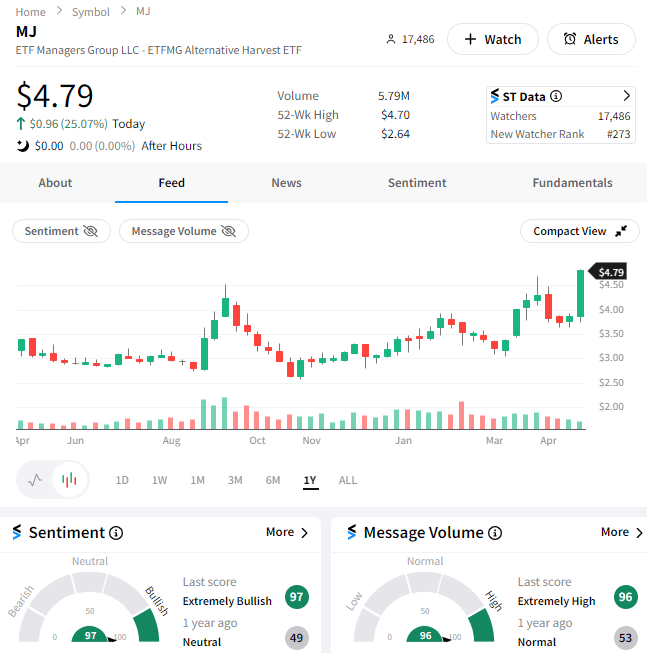

As we’ve seen, any step in the right direction is enough to get stocks going in heavily-shorted sectors. That held true today in the marijuana sector, with popular ETFs like $MSOS, $MJ, $YOLO, and others all rising by double digits. 📈

Unsurprisingly, the Stocktwits community is getting in on the excitement, with sentiment pushing into “extremely bullish” territory as investors and traders discuss the long-term potential. 🐂

STOCKTWITS “CHART ART”

Marijuana ETFs Make New Cycle Highs 🥦

If you liked this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

📊 Eurozone Q1 GDP beats expectations as region’s laggards play catch up. Some positive news coming out of the EU: promising Q1 GDP growth and cooling inflation. With the inflationary tempo set at a steady +2.40% and GDP growth stepping up to +0.30%, whispers of an imminent ECB rate cut in June continue. However, ECB officials did drop hints and advised cautious optimism. From ForexLive.

💼 Morgan Stanley makes a push into crypto. Morgan Stanley is stepping up its game in the crypto arena by filing with the SEC to include Spot Bitcoin ETFs in a dozen of its investment funds. This move underlines the bank's strategy to mesh traditional financial services with growing interest in digital assets. Earlier this month, they announced their plan to allow 15,000 brokers to recommend spot Bitcoin ETFs. More from Bitcoinist.

🛒 Walmart scraps one major initiative and begins another. It’s the latest retailer to launch its own grocery brand, looking to capitalize on inflation-weary shoppers looking for value when spending on necessities. At the same time, the company is shuttering its health division, closing 51 clinics and its virtual care option in the process as it reprioritizes towards better growth opportunities. Rising costs and competition have caused it to reverse course on its plans to expand the initiative. CNBC has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍