NEWS

An Unprecedented Market Rally

It’s officially small-cap summer, with the Russell 2000 index surging over the last week and leaving its large-cap counterparts in the dust. Market breadth is expanding across the board, and traders are finding new setups in a variety of sectors and market-cap segments. Let’s see what you missed. 👀

Today's issue covers context on the small-cap surge, a recap of bank earnings, and a software company tied to the financial sector.📰

Here's today's heat map:

10 of 11 sectors closed green. Industrials (+2.49%) led, & technology (-0.33%) lagged. 💚

U.S. retail sales, excluding automotive, rose 0.40% MoM in June, marking its largest increase since April 2023. The data bucked the recent slowdown in consumption growth as a cooling labor market and economy weighed on consumer confidence. 🛍️

The International Monetary Fund (IMF) warned that slower disinflation could result in ratings staying higher for “even longer” while raising its 2025 growth estimate to 3.30%. 🔺

The NAHB housing market index fell to its lowest level of the year as higher mortgage rates weighed on homebuilder confidence. Meanwhile, homebuilding stocks have rebounded back toward all-time highs as the market prices in a 100% chance of a September rate cut. 🏘️

Activist investor Starboard Value unveiled a more than 6.50% stake in Match Group, citing product innovation and margin improvement opportunities. Shares rose 7% but remain 80% off their 2021 highs. 📲

UnitedHealth shares rose 6% after its earnings and revenue topped expectations. Analysts were concerned about margin pressures due to the higher medical spending since the end of the pandemic, but management has seemingly managed expectations well enough to get back on track. 📊

Five Below shares fell 9% after the discount retailer said its CEO is stepping down “to pursue other interests.” The company also posted weak second-quarter earnings and revenue guidance. 🏬

Shopify rebounded following a Bank of America upgrade from neutral to buy, citing revenue growth and healthy margin expansion. 🛒

EPAM Systems rose 5% after Jeffries upgraded the software engineering stock from hold to buy, citing valuation and an underappreciated AI opportunity. 🤖

And BuzzFeed shares popped and dropped after the Pulte family revealed an activist stake, supporting Vivek Ramaswamy’s proposed changes. 💰

Other active symbols:$GME (+5.70%), $SOFI (+5.73%), $AEHR (+14.21%), $BYND (+11.79%), $HUMA (+4.64%), and $RIOT (+10.63%). 🔥

Here are the closing prices:

S&P 500 | 5,667 | +0.64% |

Nasdaq | 18,509 | +0.20% |

Russell 2000 | 2,264 | +3.50% |

Dow Jones | 40,954 | +1.85% |

STOCKS

It’s Officially Small-Cap Summer

With market participants now pricing in a 100% chance of a Fed rate cut by September, rate-sensitive sectors like small-cap stocks, are catching fire. 🔥

Why small-caps specifically? Companies with under a $2 billion market cap rely heavily on debt (specifically floating-rate debt) to fund growth, so higher interest rates and tighter lending standards impact them most.

But now, with rates potentially coming down, market participants are looking to diversify out of big tech and other winners into small-cap catchup plays.

So, how big has the small-cap move been since last week? Steve Deppe on Twitter said the 9.94% outperformance vs. the S&P 500 over the last four days was the largest spread on record. The last time it happened was in early 2020. 🫨

Bespoke offered another perspective, showing that the Russell 2000 closed 4.4 standard deviations above its 50-day moving average. A record for all of the major U.S. indexes. 🤯

So where does this move leave the Russell 2000? The ETF shows prices blasting through former support/resistance near 207 quickly and approaching its next major resistance level near 235.📈

Technical analysts say that prices are very stretched in the short-term but that any weakness towards 207 (or the 200-day moving average near 195) would likely be bought as investors bet on longer-term strength.

Retail investors seemed excited about the move, with Stocktwits sentiment pushing into “extremely bullish” territory toward the top of its YTD range.

Time will tell if this is another headfake or the start of a new trend in small-caps vs. large-caps. But for now, it appears “small-cap summer” is officially on. 😎

EARNINGS

Banks Continue To Break Higher

Financials are another market segment that is on fire, even as many major players report quarterly results.

First, Bank of America jumped 5% after its earnings and revenues topped expectations. Its net interest income (NII) rose just 3% as higher deposit costs offset higher asset yields and modest loan growth. Its provision for credit losses also rose 36% YoY to $1.50 billion. Investment banking revenues also rebounded, helping offset retail banking weakness. 🔺

Second, Morgan Stanley topped earnings and revenue expectations. However, its bread-and-butter wealth management division saw modest YoY growth due to interest income falling 17%. Like other banks, it’s dealing with high-net-worth clients moving their money parked in deposits towards higher-yielding assets. 💵

Third, Charles Schwab fell sharply after its bank deposits, net interest revenue, and new brokerage accounts all missed analyst expectations. Its CEO, Walt Bettinger, also indicated that the company will adjust its long-term bank strategy. Overall, investors remain worried about the company’s supplemental borrowing levels, given that cash in sweep accounts remains low. 💸

Overall, banks are trending well so far this earnings season. Consumer banking is softening slightly, but improvements in investment banking/capital markets activity partially offset this. However, net interest income will continue to rule the day, so all eyes are on money flows and provisions for credit losses. 👀

STOCKTWITS “CHART ART”

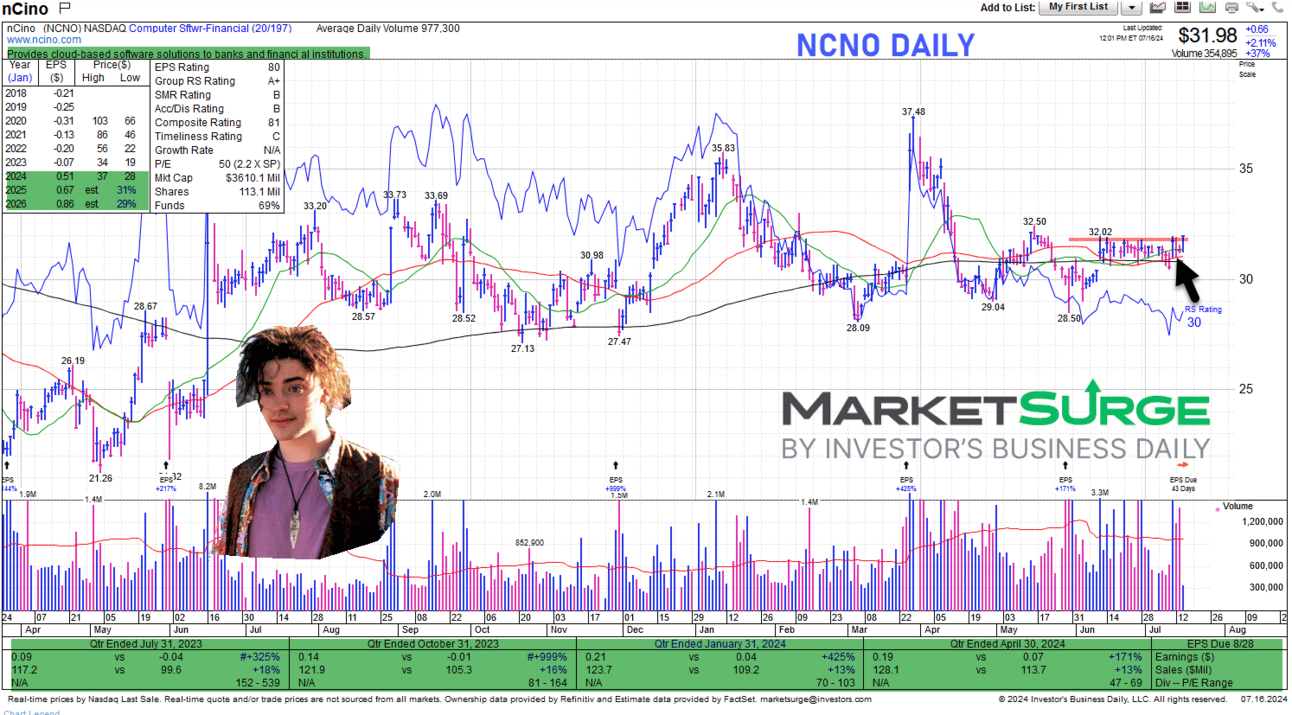

Bank Software Solutions Provider Breaks Out 🏦

With banks and the broader financial sector making new all-time highs, some traders are looking to ride the next potential wave…companies that support the sector.

Stocktwits user @alphatrends pointed to cloud-based banking software company nCino Inc. as a catch-up candidate while it breaks out of a multi-week base to three-month highs. 💸

If you like this chart and commentary, you’ll love our “Chart Art” newsletter.We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

What type of content would you like to see more of in The Daily Rip?

Bullets From The Day

❌Kaspersky Labs shuts down U.S. operations. The closing of its U.S. offices marks the end of a years-long fight between the Russian antivirus maker and the U.S. government. The company had previously vowed to fight the July 20th ban on its software by the Commerce Department but has determined business opportunities in the U.S. are no longer viable. Axios has more.

📍Elon Musk is moving SpaceX and X headquarters to Texas. The billionaire is doubling down on his commitment to Texas, vowing to move the headquarters of his other companies to Austin, Texas, where Tesla is headquartered. Given that a substantial portion of their operations are still in California, the larger ramifications for the proposed move of both companies remain unclear. He will likely follow the same path as he did with Tesla, simply moving headquarters and not significant operations. More from TechCrunch.

🕵️ Microsoft faces an antitrust investigation over hiring Inflection AI staff. The Competition and Markets Authority (CMA) is looking at the tech giant’s AI partnership under merger rules. The CMA is now opening a phase one merger investigation with a September 11th deadline, citing that hiring Inflection AI staff for its new AI division could stifle competition. The Verge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey.📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍