NEWS

Another Day, Another All-Time High

That makes forty new highs for the S&P 500 this year, a pace that puts it on track to have the most of any year ever. Big tech continues to pull the market higher, with traders wondering when laggards like Amazon and Netflix will join the party. Let’s see what you missed. 👀

Today's issue covers the latest stocks soaring on AI news, Gary Gensler’s update on spot Ethereum ETFs, and the struggle for luxury retailers selling discretionary goods. 📰

Here's today's heat map:

5 of 11 sectors closed green. Technology (+0.79%) led, & energy (-0.92%) lagged. 💚

Producer prices (PPI) declined 0.20% MoM, reversing April’s 0.50% rise and beating expectations for a 0.10% jump. Core PPI, which excludes food and energy, was flat MoM vs. expectations for a 0.30% increase. 🔻

Seasonally adjusted initial jobless claims rose to a nine-month high last week, with some analysts saying that the next few weeks’’ data will determine whether this is driven by California’s new minimum wage law and other factors. Or if this is the start of a broader softening in the labor market. 💼

GameStop’s annual shareholder meeting had to be delayed after heavy traffic crashed its host’s servers. In classic meme stock fashion, the meeting began 48 minutes late and was “immediately adjourned” due to technical issues preventing shareholders from joining. Despite that, GameStop shares rose sharply on the day. 🙃

Speaking of games, Dave and Buster’s fell 11% after the entertainment giant’s first-quarter revenues missed expectations by a wide margin. 🎮

Tesla shares continued to rebound as CEO Elon Musk indicated he had the votes needed to secure his $56 billion pay package (confirmed after the bell). Still, legal battles remain regarding this pay package…and a new issue, shareholders suing him for starting a competing artificial intelligence (AI) company. 🔋

Tyson Foods remains under pressure following the news that it’s suspended CFO John R. Tyson, who was arrested for the second time in two years for drinking-related infractions. This adds more uncertainty to an already challenging environment for the chicken giant. 🐔

Paramount Global shares fell another 7% on news that Mario Gabelli's legal threat played a significant role in the company’s potential $8 billion deal with Skydance Media falling apart. Meanwhile, Warner Bros Discovery dropped following news that Liberty Global is acquiring enough shares to take a controlling interest in the company. 📉

Space tourism company Virgin Galactic dipped another 14% after the board of directors approved a 1-for-20 reverse stock split to push its price back above the $1 required to remain listed on the major U.S. exchanges. 🚀

Other active symbols: $AVGO (+12.27%), $SMCI (+12.44%), $BTDR (+20.71%), $MSOS (-5.98%), $MNKD (+6.55%), & $DDC (-25.97%). 🔥

Here are the closing prices:

S&P 500 | 5,434 | +0.23% |

Nasdaq | 17,668 | +0.34% |

Russell 2000 | 2,039 | -0.88% |

Dow Jones | 38,647 | -0.17% |

EARNINGS

Add Adobe To The AI-Hype List…

Just like it was cool to add “blockchain” or “crypto” to your business during the last cycle, artificial intelligence (AI) has become the phrase to fix all of your businesses’ problems. And today, we’ve got two fresh examples. 🦾

The first is software giant Adobe, which reported adjusted earnings per share of $4.48 on revenues of $5.31 billion. Both beat expectations of $4.39 and $5.29 billion, with revenues growing 10% YoY.

Net new digital media annualized recurring revenue rose to $487 million, well above its $440 million forecast. Its total digital media ARR of $16.25 billion was helped by its recent AI push. 📊

CEO Shantanu Narayen said, “We’re driving strong usage, value, and demand for our AI solutions across all customer segments and seeing early success monetizing AI technologies across our Digital Media and Digital Experience businesses.”

However, the company declined to provide any material measures of the contribution its AI efforts have made to its financials. Executives said they want to be “thoughtful” about how they approach reporting. However, they shared that adoption continues to rise, citing the nine billion images created to date with Adobe’s Firefly AI software.

It also raised the lower end of its full-year revenue guidance and ratcheted its earnings guidance by about 2%. 🔺

That forecast update and commentary around AI was enough for the market to send Adobe shares up 15% after the bell and Stocktwits community sentiment into “extremely bullish” territory. 🐂

Meanwhile, Adobe wasn’t the only one capitalizing on the AI hype. Book publisher John Wiley & Sons saw shares rise 12% as its cost-cutting efforts paid off, and it began to realize AI’s potential via data sales.

It benefited from a $23 million content-rights project for training generative AI models, noting it will realize another project with a second large tech company in fiscal 2025. 🤑

The company's data-selling business helped buoy results and allowed executives to raise their full-year 2025 guidance (in addition to beats in the current quarter).

However, some analysts remain concerned about generative AI’s long-term negative impact on the company’s core products, given that students and teachers are already heavily using ChatGPT and other tools. 🤨

Shares are rebounding from multi-year lows but still stuck in a long-term range. Still, Stocktwits users are optimistic about the potential, with sentiment hitting “extremely bullish” territory for the first time this year. 📚

CRYPTO

SEC Staff To Spend Summer With ETH ETF Apps

Gary Gensler had difficult news for anyone at the Securities and Exchange Commission (SEC) hoping to enjoy their summer, updating the market on the tentative timeline for approving spot Ethereum ETF applications.

When the SEC approved 19b-4 proposals for eight spot ETH ETFs on May 23, 2024, expectations were they would launch within weeks to months…or within 90 days like Bitcoin ETFs. 🗓️

And it seems the longer end of that timeframe is most likely, with SEC Chair Gary Gensler suggesting the final approvals should be finished this summer during a budget hearing with senators.

He told the subcommittee of the Senate Appropriations Committee hearing that the process is “working smoothly” and that final registration requirements (S-1s) are being handled at the “staff level.” 📝

Once those S-1s are approved, the new ETFs can be listed and begin trading.

As for Ethereum’s reaction, well, there wasn’t much of any. Like Bitcoin, it’s stuck in the middle of its recent highs and lows, attempting to find support at the 50-day simple moving average. 👀

With many traders and investors looking to the Ethereum ETF approval and trading as the next major catalyst for crypto, prices may need another reason to get moving this summer while the SEC does its thing. 🤷

P.S. If you want regular crypto coverage and analysis, subscribe to the Litepaper newsletter from our resident expert, Jonathan Morgan.

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

EARNINGS

Luxury Retailers’ Sales Slump Sparks Selloff

The higher-end consumer is still doing relatively well, but as we’ve discussed over the last year, the appetite for discretionary goods like jewelry and home furnishings remains weaker than companies would like. 🛍️

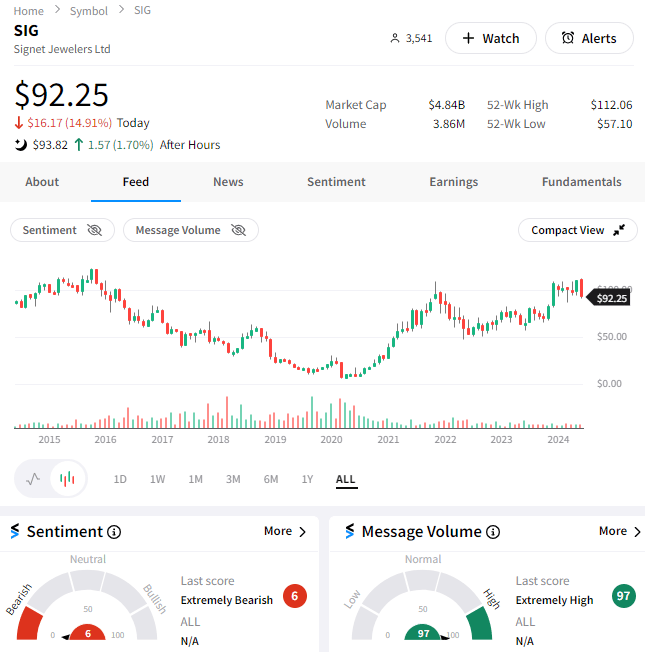

Signet Jewelers is the latest victim, with its adjusted earnings of $1.11 beating estimates of $0.85 per share and its sales of $1.511 missing the consensus view of $1.516 billion. Same-store sales also fell 8.90%, worse than the 8.10% decline anticipated.

Slowing sales momentum has caused the company to increase spending on marketing and staffing expenses, weighing on margins already pressured by increased promotional activity in the industry. 🔻

As a result, its second-quarter profit guidance of $50 to $75 million fell well short of the $86 million anticipated by analysts. Its $1.46 to $1.52 billion revenue guidance straddled the $1.51 billion Wall Street estimate. 👎

Demand remains depressed due to the downturn in engagement activity, so the company is actively developing strategies to become more competitive in an environment flush with inventory.

Shares of Signet slumped 15% on the day, with Stocktwits sentiment sitting in “extremely bearish” territory. While the company’s efforts are helping it navigate this tough environment, many expect it to struggle until we see a cyclical shift in its core market. 😬

And if you thought engagement activity was bad, don’t even talk about housing, which remains hampered by low inventories and record prices. 😢

That’s why shares of luxury home retailer Restoration Hardware (now known as RH) are down another 11% after the bell, following a larger-than-expected first-quarter loss and weak second-quarter revenues forecast.

The company said it’s dealing with “the most challenging housing market in three decades.” And so far, its efforts to drive demand have not paid off, leaving it with a bigger-than-expected product backlog. 🛋️

Until housing turnover picks up, it’s going to remain a very tough environment for this luxury retailer. 🤷

Bullets From The Day

🛡️ Every Microsoft executive now has a cybersecurity mandate. One-third of the “individual performance” portion of top executives’ bonuses will be tied to a review of their cybersecurity work. Additionally, individual employees will discuss their cyber contributions with their managers in twice-annual reviews that will factor into their compensation. It comes as more firms prioritize cybersecurity due to increased regulatory requirements and scrutiny. CNBC has more.

🚗 New tech and regulations may be needed to stop driving fatalities. We all know speeding is one of the most deadly things you can do in a vehicle, with over 40,000 people dying in traffic accidents in 2023. However, other efforts to reduce the behavior have failed to deliver material changes. As a result, new regulations are looking to standardize the technology that limits people’s ability to drive above the speed limit as a final attempt to mitigate this issue. More from The Verge.

❌ Oracle exits the advertising business after an epic revenue collapse. The software giant’s advertising revenue slumped from $2 billion annually during 2022 to $300 million during fiscal 2024, so it’s decided to focus its efforts elsewhere. Industry experts say this represents a major opportunity for other players at an interesting time for the space, which is seeing new innovation around contextual and personalized advertising offerings. Yahoo Finance has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍