NEWS

Another Day, Another Big Tech Breakout

The U.S. stock market’s rally continued today on the back of strength in large-cap tech and consumer discretionary stocks. This Wednesday’s market holiday is certainly adding an element of uncertainty and keeping overall volumes light. 🤷

Today's issue covers GameStop’s shareholder meeting selloff, Tesla’s improving technicals, and La-Z-Boy’s post-earnings break. 📰

Here's today's heat map:

8 of 11 sectors closed green. Consumer discretionary (+1.76%) led, & utilities (-1.10%) lagged. 💚

Primo Water’s shares boiled over today on news that BlueTriton has agreed to a reverse merger with the company. Existing shareholders will hold 43% of the combined company, and BlueTriton backers will own the rest. 🌊

Autodesk rose 6% as activist investor Starboard Value accumulated a $500 million stake in the company. It’s weighing legal action over the software company’s delayed disclosure of its internal investigation into accounting malfeasance. 💰

AMC Networks is apparently jealous of how well AMC Entertainment has declined and wants to join the party. It filed to sell $125 million in convertible senior notes due 2029 via a private placement, sending shares down 35%. 💸

Space company Virgin Galactic shares fell 15% as its 1-for-20 reverse stock split took effect to keep the stock above the exchange’s $1 minimum price. ⏪

And small-cap biotech firm Shattuck Labs fell 20% after BTIG downgraded it from buy to neutral, citing some ambiguity in one area of the company’s latest clinical trial data, which could delay progress. 👎

Other active symbols: $PLTR (+6.15%), $MU (+4.58%), $AVGO (+5.41%), $LEN (-1.53%), $ASTS (+14.97%), and $AVTE (-93.30%). 🔥

Here are the closing prices:

S&P 500 | 5,473 | +0.77% |

Nasdaq | 17,857 | +0.95% |

Russell 2000 | 2,022 | +0.79% |

Dow Jones | 38,778 | +0.49% |

EARNINGS

Meme Stocks Lose The “Fundamentals” Game

Meme stocks are not known for their strong fundamentals. Instead, they’re known for their strong momentum among the retail investing and trading community. And today was a good reminder of that situation for two reasons.

GameStop’s shareholder meeting was supposed to be a major catalyst for the company’s shares, with investors hoping that management would provide an update on their plan to drive the company’s core business to profitability. 📝

After all, they’ve been able to raise billions of dollars on the back of this recent “meme stock” rally and are in a much better position financially. Instead, we saw more of the same vagueness and lack of imagination we’ve seen for the last few years. 😴

Chairman and CEO Ryan Cohen said, “With respect to retail operations, we plan to continue reducing costs and focusing on profitability,” talking about a smaller network of stores. He also said the company is focused on long-term shareholder value and not “hype,” but again lacked any details on the gaming retailer’s strategy.

As a result, $GME shares fell 12% on the day as investors and traders digested the “news,” if you can even call it that… 😐

In regards to another meme stock that’s not trading on fundamentals, take a look at AMC Entertainment. Disney’s blockbuster hit “Inside Out 2” helped the theater chain achieve its highest-grossing weekend of 2024…so surely the stock was up, right?

Wrong… $AMC shares were down 2% on the day. So much for that. 🙃

The point here is that these stocks continue to trade on social sentiment and momentum in the short term, while in the long term, they’ll trade on fundamentals. And clearly, neither company has figured out its core business enough to give investors confidence to come along for the ride.

At least that’s what the market is indicating so far… 🤷

SPONSORED

Maximize your options profits (and minimize your losses) at Public.com

Heads up, options traders: investing platform Public.com has a rebate that allows you to buy contracts for less and sell contracts for more. As a member, you'll earn rebates on every options contract traded with no commissions or per-contract fees.

"My options trading platform is free, though. How is this better?" While some platforms seem to allow free trades, many charge fees of $1 or more per contract traded. On the other hand, Public offers rebates for trading options—and they can add up fast. If you trade 500 contracts each month, you'll earn $350-$1,000+ in rebates by the end of the year. In other words, you don't pay money to place options trades; you earn it.

Discover why NerdWallet awarded Public five stars for options trading and 4.6/5 stars overall, and earn rebates on every options contract traded with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

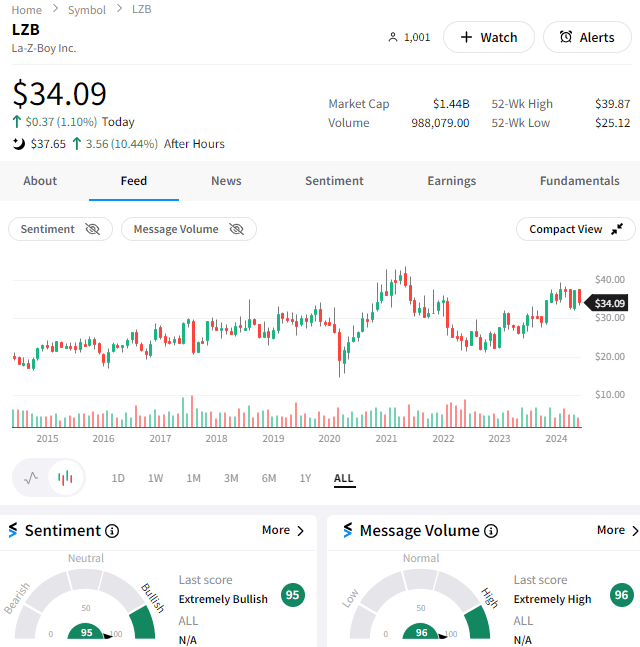

La-Z-Boy Leaps After Earnings

The market for discretionary goods has been soft, especially for retailers linked to the sluggish housing market like La-Z-Boy. 🛋️

However, today, shareholders received some positive news, as the company’s adjusted earnings per share of $0.91 beat estimates of $0.70. Revenues were down much less than anticipated, coming in at $553.50 million vs. $516 million expected.

The 1% YoY decline in sales bucked the broader industry’s 8% decline, as its cost-cutting measures, solid product mix, and promotional activity helped preserve earnings while buoying sales in a tough environment.

Executives expect delivered sales of $475 to $495 million in the first fiscal quarter and an adjusted operating margin of 6% to 7%. 👍

Shares rose more than 10% after the bell, with Stocktwits community sentiment pushing into “extremely bullish” territory. Despite the rally, the stock remains stuck in a longer-term range that bulls are hoping to see it break out of. 💪

STOCKTWITS “CHART ART”

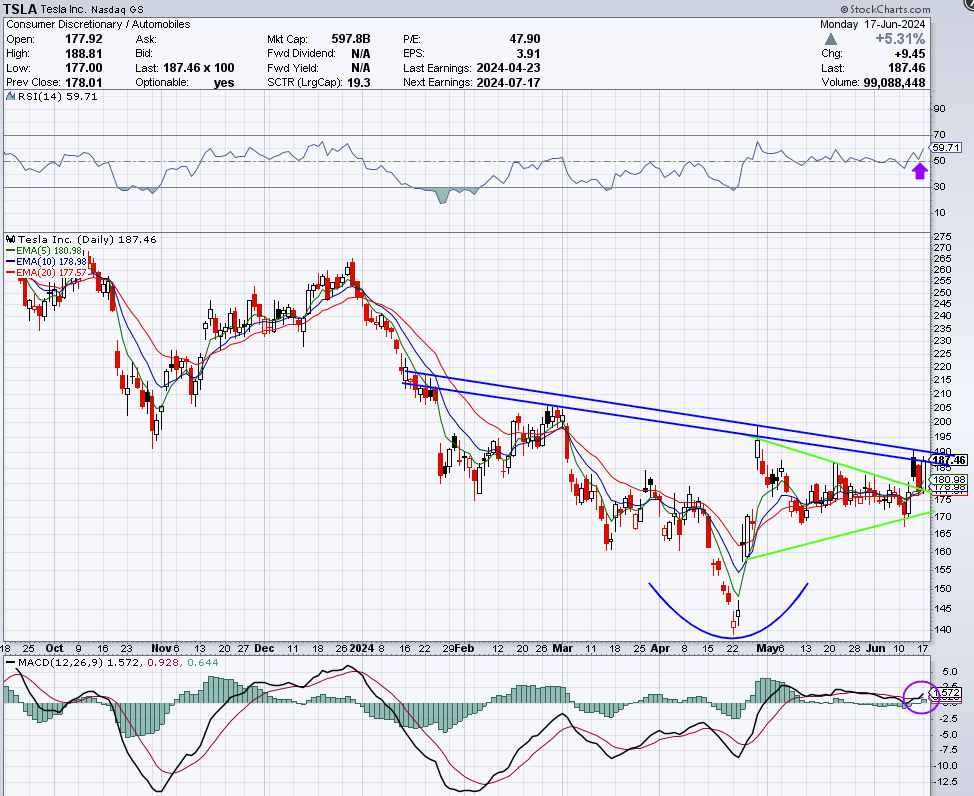

Tesla Keeps On Tapping Resistance 👀

The electric vehicle (EV) maker remains a battleground stock, with news around Elon Musk’s pay package mixing with a cocktail of industry-related headwinds and news. However, despite all the hubbub around the stock recently, prices have stopped going down which is certainly a start.

That’s the argument traders like Stocktwits user @Microm are making, showcasing a potential “inverse head and shoulders” reversal pattern that’s been forming. He explains below what conditions he needs to see before confirming this reversal pattern and getting the stock back on track.

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

🕵️ U.S. FTC targets software giant Adobe over its “deceiving” subscriptions. The Department of Justice (DOJ) claims that Adobe “has harmed consumers by enrolling them in its default, most lucrative subscription plan without clearly disclosing important plan terms.” Samuel Levine, director of the FTC’s Bureau of Consumer Protection, said, “Adobe trapped customers into year-long subscriptions through hidden termination fees and numerous cancellation hurdles.” The Verge has more.

😬 Ukraine’s effort to rework its bonds has derailed ahead of a critical deadline. The country has not been able to reach an agreement with a group of bondholders over restructuring about $20 billion in its international debt. That’s raised concerns from the global finance community that the war-torn country could fall into default. An agreement with its international bondholders allowed Ukraine to suspend payments after Russia’s invasion in 2022 ends soon, with the country desperately trying to reach a new agreement before the August 1st deadline. More from Reuters.

💳 Wells Fargo and Apple may have underestimated their consumer financing efforts. Fintech company Bilt made a credit card with Wells Fargo that allows customers to pay it (among other things), but their revenues are struggling significantly and the bank is reportedly losing $10 million per month on the partnership. Meanwhile, Apple is also shutting down its Pay Later program, as it charts a wider path toward offering a range of pay-over-time lending products from various providers. PYMNTS.com has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.