NEWS

Apple Blasts Bears With Record Buyback

Money may not buy happiness, but it does buy a hell of a lot of Apple shares. While tech stocks had already launched a market rebound, traders hope Apple’s epic buyback program is enough to renew the stock’s momentum and take the broader market higher with it. Let’s see what you missed. 👀

Today's issue covers Tim Cook telling a compelling story, Rivian running amid the EV and China rebound, and more from the day. 📰

Here's today's heat map:

9 of 11 sectors closed green. Technology (+1.44%) led, & materials (-0.52%) lagged. 💚

Economic data showed that labor productivity was up 2.90% YoY in the first quarter, marking its strongest annual gain in three years. Meanwhile, unit labor costs rose to a 4.70% annualized rate. That, combined with historically low initial and continuing jobless claims, added to evidence that the labor market is strong but slowly weakening. 👨💼

Online home goods retailer Wayfair jumped 16% despite its sales falling in the first quarter. Its cost-cutting efforts helped narrow its loss by more than $100 million, allowing it to top Wall Street’s expectations. ✂️

Paramount Global soared 13% after receiving a letter from Sony and Apollo expressing interest in buying out the company for $26 billion as its exclusivity period with Skydance Media nears its end. 💰

Coinbase shares popped then dropped after the bell despite reporting earnings and revenues that handily topped expectations. Shareholders in the cryptocurrency exchange remain concerned about Bitcoin ETFs eating into their fees and insiders selling large amounts of stock during the first quarter. ₿

Real-estate marketplace Zillow fell 5% after its second-quarter revenue guidance came in below analyst expectations. Consistently high mortgage rates, low existing inventory, and concerns over the recent National Association of Realtors’ settlement’s impact weighed on the stock and its peers. 🏘️

Fortinet and Cloudflare were the latest tech companies to suffer from weak guidance, with shares falling 8% and 14%, respectively. Meanwhile, payment services provider Block rose 8% after its first-quarter top and bottom-line results beat consensus estimates. 🤖

Other active symbols: $BABA (+6.38%), $FSLY (-32.02%), $MRNA (+12.68%), $JAGX (+30.31%), $IBRX (+11.09%), $EBS (+70.98%), $CTMX (-12.28%). 🔥

Here are the closing prices:

S&P 500 | 5,064 | +0.91% |

Nasdaq | 15,841 | +1.51% |

Russell 2000 | 2,016 | +1.81% |

Dow Jones | 38,226 | +0.85% |

EARNINGS

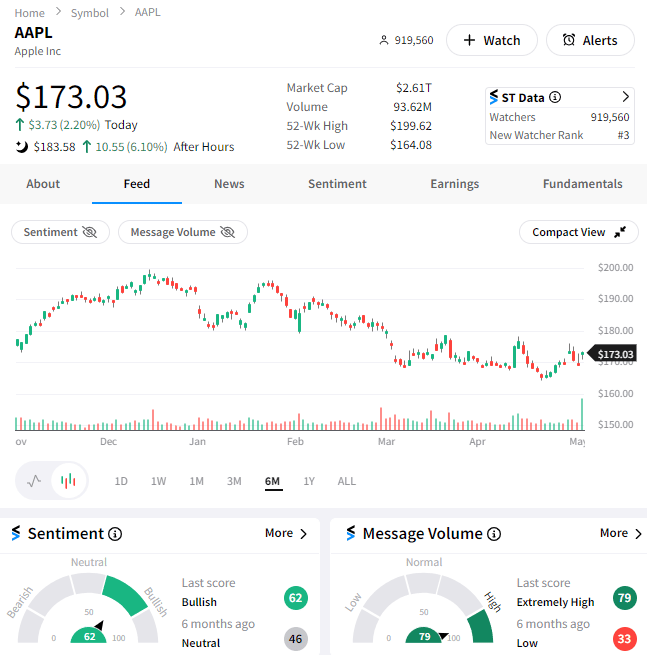

Investors Overlook Apple’s International Growth Concerns

If there’s anything that will help Wall Street overlook weaker-than-expected earnings, it’s cold. hard. cash. And luckily for Apple, the company has plenty of that to put to work, buying it more time to figure out its pesky growth problem. 🤑

Here’s CNBC’s summary of the numbers, showing iPhone, iPad, and other product revenues missing expectations while gross margins came “in line” with expectations. 👇

iPhone sales fell 10% YoY, with sales in Greater China falling 8% YoY to $16.37 billion, which was actually greater than the analyst community anticipated. Japan and the rest of the Asia Pacific market also saw sales declines YoY, with Americas down marginally and Europe up a hair.

The company didn’t provide formal guidance, but CEO Tim Cook said overall sales would grow in the “low single digits” during its next quarter, which may be enough to top analyst estimates.

You can read the rest of the press release and listen to the conference call for more information, but the stock is trading on two things right now.

Raising its buyback program to $110 billion (the largest one ever) and increasing its dividend by $0.01.

“Big plans to announce” at its iPad product event next week and its Worldwide Developers Conference in June.

These announcements overshadowed the rest of the earnings release and commentary, with investors focusing purely on how much cash the company is returning to shareholders. The bullish argument is that Apple has always figured out its next growth catalyst, so if you’re getting paid to wait, it makes sense to own the stock rather than trade it. 🐂

Critics say the company is not far from having a net debt position with negative to low single-digit revenue growth. So, if it can’t figure out growth, it’s setting itself up to be in a tough spot and will likely trade at a much lower multiple than it does today. 🐻

We’ll have to wait and see if the positive sentiment continues in the days ahead, but it’s taking hold right now as shares trade 6% higher after hours. 🤷

STOCKS

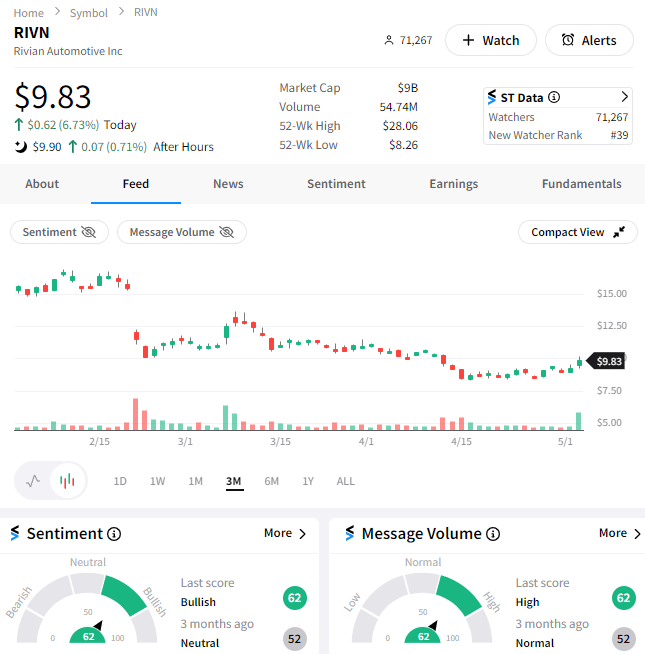

Rivian Runs As China and EV Rebound Continues

Electric vehicle (EV) stocks and China continue to rebound as positive news trickles into a market where sentiment is still severely depressed. 🪫

Luxury EV maker Rivian Automotive is the latest beneficiary of some good news. It announced that it received a $827 million incentive package from the State of Illinois to expand operations at its Normal facility.

The facility’s current capacity of 150,000 vehicles per year will be expanded to 215,000 as it begins producing its less-expensive midsize SUV R2 model.

More importantly, the infusion raises its cash and cash equivalents balance by roughly 10%, which will give it more runway as it works to preserve liquidity wherever it can. 💵

Rivian shares rose about 7% to three-week highs, joining its peers like Nio and Tesla that have rebounded sharply in recent weeks. Stocktwits sentiment and message volume ticked up into bullish/high territory as investors debated the company's (and stock’s) future. ⚔️

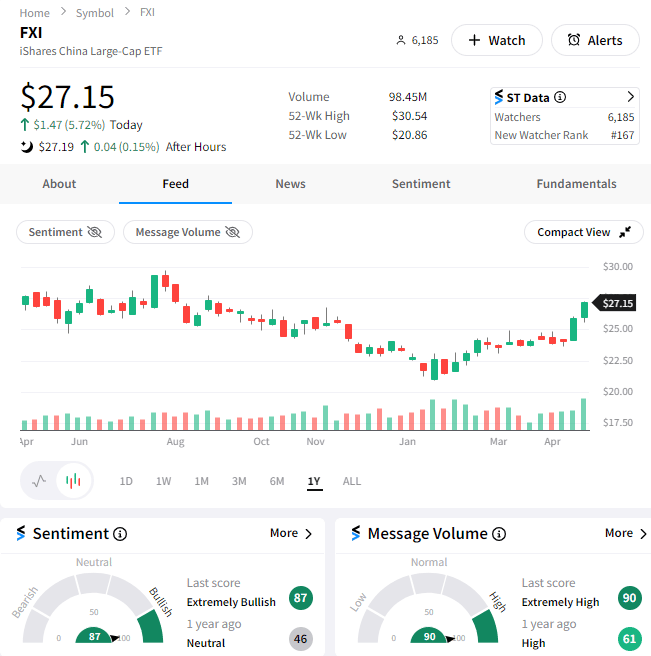

Meanwhile, Chinese stocks continue to mount a comeback, with stocks like Alibaba, Futu Holdings, Pinduoduo, and more trending heavily throughout the day as their upward price momentum accelerated. 🔥

Popular large-cap stock ETF $FXI was among the top gainers, rising to its highest level since November as sentiment/message volume pushed into “extreme” territory. 🐂

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

Bullets From The Day

❌ Peloton CEO steps down as turnaround plan fails to take shape. Barry McCarthy is stepping down just about two years after taking over from founder John Foley. The company is also laying off another 15% of its workforce after reporting third-quarter revenues and earnings that failed to meet expectations. Those hit hardest are in research and development, marketing, and international, as the company positions itself for sustained, positive free cash flow. CNBC has more.

💸 Microsoft invests $2.20 billion in Malaysia in its latest AI investment. The tech giant will spend that amount over the next four years on new cloud and artificial intelligence (AI) infrastructure in the country as it partners with the government to establish a national AI center. It’s the company’s single largest investment in the country, as it continues to spend heavily on building out its digital infrastructure and skilling worldwide. More from AP News.

📉 Russian energy giant plunges to first annual loss in 23 years. Gazprom’s net loss reached $7 billion during 2023 as sanctions and other responses to Russia’s war on Ukraine caused a historic decline in its gas sales to Europe. It comes after a record-breaking year of revenue and profit in 2022 and leaves the company with few levers to pull until the geopolitical (and physical) conflict between Russia and the West is resolved. Reuters has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍