NEWS

ASML Sinks The Stock Market

Source: Tenor.com

The selloff in U.S. stocks accelerated after semiconductor giant ASML Holding accidentally released its worse-than-expected quarterly results a day before the market expected them. Under the surface, speculation continues to run rampant, with the small-cap Russell 2000 finally looking ready to join the bull market. 👀

Today's issue covers ASML’s sticky earnings situation, the explosion of speculative behavior in several stocks, and an overview of the biggest earnings movers. 📰

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with real estate (+1.25%) leading and energy (-3.22%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,815 | -0.71% |

Nasdaq | 18,316 | -1.01% |

Russell 2000 | 2,250 | +0.05% |

Dow Jones | 42,740 | -0.75% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $JDZG, $KLAC, $AMAT, $PHUN, $ERIC 📉 $RMCO, $COTY, $ACAD, $ANF, $LLY*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Semiconductor Giant’s Sticky Earning Situation 😬

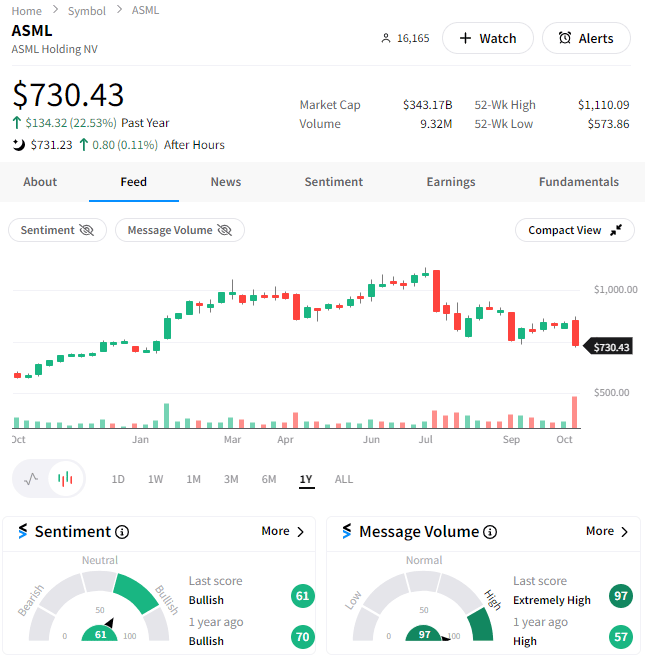

Dutch semiconductor equipment maker ASML is closely watched as a major bellwether of the chip industry, and its impact was certainly felt today.

A technology error caused the company to partially release its third-quarter earnings a day earlier than anticipated, with shares responding sharply less than an hour after the opening bell. That caused the company to share the remainder of its results to give investors the complete picture, which wasn’t what bulls hoped for. 😱

The company now expects net sales of 30 to 35 billion euros during 2025, landing at the lower end of its forecast. Net bookings for this quarter were 2.6 billion euros, well below the 5.6 billion euro consensus estimate, though its net sales of 7.5 billion euros did top expectations. 🔻

CEO Christophe Fouquet said, “While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected,”

In addition to industry-specific headwinds, China remains a major concern for the company. Last quarter, ASML said that roughly 49% of its revenues came from China, but CFO Roger Dassen provided a much more cautious view this time. ⚠️

He now expects the company’s China business to show a “more normalized percentage in our order book and also in our business.” More specifically, management expects China’s revenue to be roughly 20% of total revenue for the next year.

Today’s release shows that artificial intelligence (AI), while a large driver of semiconductor growth, is not enough to offset some of the cyclical weakness and customer-specific challenges facing ASML and the broader industry.

Shares fell roughly 16% on the day, dragging the rest of the chip sector and market down with it. Even as shares sit in a 35% drawdown from their highs, Stocktwits sentiment remains in ‘bullish’ territory as investors bet on the AI boom being enough to propel ASML and the rest of the sector higher for years to come. 🐂

Source: Stocktwits.com

SPONSORED

Over the last seven elections, this asset class has outpaced the S&P 500

Instead of trying to predict which party will win, and where to invest afterwards, why not invest in an ‘election-proof’ alternative asset? The sector is currently in a softer cycle, but over the last seven elections (1995-2023) blue-chip contemporary art has outpaced the S&P 500 by 64%, regardless of the victors, and we have conviction it will rebound to these levels long-term.

Now, thanks to Masterworks’ art investing platform, you can easily diversify into this asset class without needing millions or art expertise, alongside 65,000+ other art investors. From their 23 exits so far, Masterworks investors have realized representative annualized net returns like +17.6%, +17.8%, and +21.5% among assets held longer than one year.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

Wolfspeed Inc., which manufactures chips used primarily in electric vehicles, soared 21% on news it may win $750 million in U.S. government grants and $750 million in financing to support its factory expansion plans. 💵

Hims & Hers Health rose another 11% on news that the Food & Drug Administration (FDA) will allow pharmacists to continue making compounded versions of tirzepatide, the active ingredient in Eli Lilly’s diabetes and weight loss drugs. This can continue while the agency reconsiders its decision to remove the drug from its nationwide shortage list, preventing generic drugmakers from selling their versions. 💊

Walgreens soared 16% after its cost cuts helped drive an earnings beat. Management also said it will close another 1,200 stores by 2027 to give the company a “healthier store base” and “enable us to respond to shifts in consumer behavior and buying preferences.” ✂️

Swedish telecom equipment manufacturer Ericsson reported better-than-expected third-quart results. Strength in North America and its ongoing cost-cutting measures helped provide a new wave of optimism among investors who are betting on its recent AT&T contract win to provide momentum into the future. 📱

Charles Schwab signaled a strong comeback following four straight earnings misses, as revenue and earnings both topped expectations. Its transactional cash sweep balance rose $9.2 billion QoQ, helping it reduce its reliance on expensive bank supplemental funding by $8.9 billion. Schwab CEO Walt Bettinger called the quarter an inflection point on a call with analysts. 💸

Interactive Brokers fell 4% after third-quarter adjusted earnings missed expectations. Commission revenue rose 31%, with trading volume in options (+35%), stocks (+22%), and futures (+13%) all rising YoY. Driving the miss was a 67% increase in general and administrative expenses, with $21 million in one-time charges. 🔺

J.B. Hunt Transportation Services soared 7% after its earnings and revenue topped expectations on the back of demand for its intermodal service (the use of multiple forms of transportation to move an item from point A to B). 🚚

Coty shares reached nearly two-year lows and dragged their peers lower after management warned of a Beauty market slowdown. The owner of CoverGirl, Max Factor, Lancaster, and other beauty brands said retailers are taking a cautious approach to building inventories as the U.S. mass market slows. 💄

STOCKS

Some Crazy Behavior In Nano-Cap Stocks 🤪

We’ve spoken over the last few weeks about the ramp-up of speculation occurring in markets below the surface…and boy is that continuing this week.

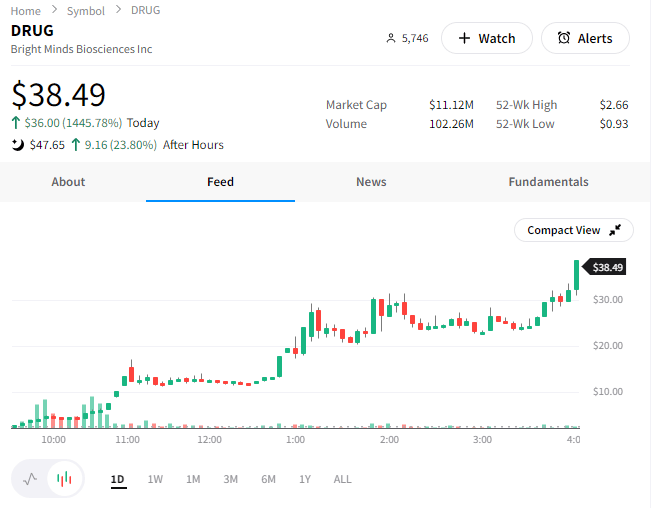

Today a nano-cap biotech company started the day with a share price of just over $2 and quickly soared nearly 1,500% to over $38 on no news. And as we’re writing this, we noticed another, STEC, Inc., rising over 300% in thin trading on no news. 🤯

Source: Stocktwits.com

Even stock market bulls say this type of speculative behavior typically occurs when the market is getting a bit extended to the upside, often signaling a need for the market to cool off.

Whether or not that happens is anyone’s guess. But for now, this callout aims to serve as a reminder of how risky and speculative these types of stocks are. We’ve seen more and more of them pop up on the streams lately, and they generally end badly for inexperienced traders who get involved. ⚠️

If you’re going to speculate in these types of names, know the game you’re playing, define your risk ahead of time, and don’t blow up trying to short the stock simply because “it shouldn’t be this high.”

Short squeezes are a powerful thing (in both directions), so stay safe out there and speculate responsibly. 🦺

QUOTE OF THE DAY

Fed Chair, The Greatest Job In Government? 😂

Former President Donald Trump‘s interview with Bloomberg Editor-in-Chief John Micklethwait got a lot of play today, causing several election-linked stocks like $DJT, $PHUN, $RUM, and others to give back some of their recent gains.

Putting what you thought of the interview aside, the point is that clearly people are watching what each candidate says closely and adjusting their market bets accordingly…especially as the November 5th election rapidly approaches.

For what it’s worth, the part about the Fed was pretty funny. We’d like to imagine Jerome Powell popping into the FOMC meeting, flipping a coin, and then calling it a day as much as anyone…but we’d certainly hope there’s a more nuanced approach than that lol. 🤷

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Indonesia interest rate decision (3:30 am ET), Import/Export Prices (8:30 am ET), European Central Bank President Lagarde Speech (2:40 pm ET). 📊

Pre-Market Earnings: Morgan Stanley ($MS), Abbott Laboratories ($ABT), U.S. Bancorp ($USB), Synchrony Financial ($SYF), and Prologis ($PLD). 🛏️

After-Hour Earnings: Alcoa ($AA), Kinder Morgan ($KMI), CSX Corp. ($CSX), Discover Financial Services ($DFS), Crown Castle ($CCI), Steel Dynamics ($STLD), and Equifax ($EFX). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Past performance is not indicative of future returns. Investment involves risk. See Important Regulation A disclosures at masterworks.com/cd. The content is not intended to provide legal, tax, or investment advice. No money is being solicited or will be accepted until the offering statement for a particular offering has been qualified by the SEC. Offers may be revoked at any time. Contacting Masterworks involves no commitment or obligation. “Net Annualized Return” refers to the annualized internal rate of return net of all fees and expenses, calculated from the offering closing date to the date the sale is consummated. IRR may not be indicative of Masterworks paintings not yet sold and past performance is not indicative of future results. For additional information regarding the calculation of IRR for a particular investment in an artwork that has been sold, a reconciliation will be filed as an exhibit to Form 1-U and will be available on the SEC’s website. Masterworks has realized illustrative annualized net returns of 17.6% (1067 days held), 17.8% (672 days held), and 21.5% (638 days held) on 13 works held longer than one year (not inclusive of works held less than one year and unsold works). Contemporary art data based on repeat-sales index of historical Post-War & Contemporary Art market prices from 1995 to 2023, developed by Masterworks. There are significant limitations to comparative asset class data. Indices are unmanaged and a Masterworks investor cannot invest directly in an index.

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋