NEWS

Bears Battle To Keep Stocks Subdued

Source: Tenor.com

An uptick in inflation helped the bears hold back Bitcoin’s push above $90k, while semiconductors slumped on further fears that SMCI could be delisted from the Nasdaq if it doesn’t file its delayed annual report soon. And AMD cut 4% of its workforce, sparking some growth fears. Now, all eyes turn to tomorrow’s producer price index figures and Fed Chair Jerome Powell’s speech. 👀

Today's issue covers October’s inflation uptick, a kickoff of our Nvidia Day events, and other noteworthy pops and drops. 📰

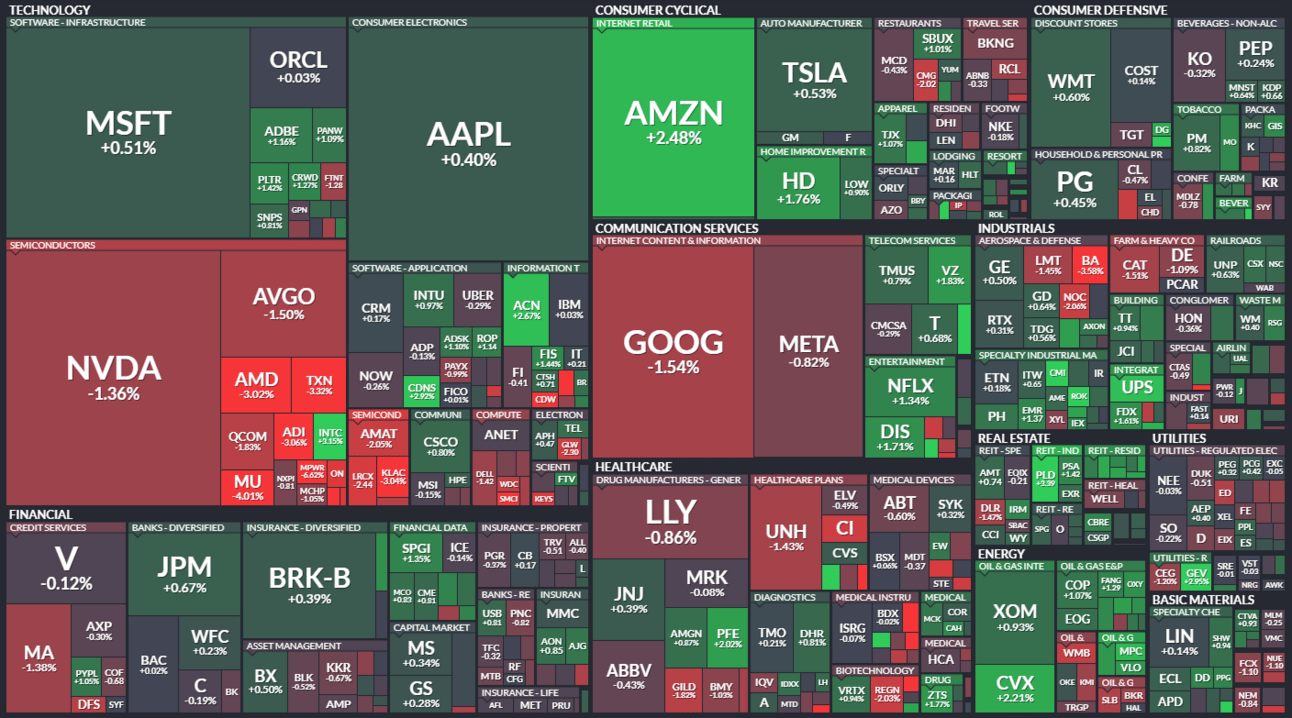

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with consumer discretionary (+0.85%) leading and technology (-0.35%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,985 | +0.03% |

Nasdaq | 19,231 | -0.26% |

Russell 2000 | 2,369 | -0.94% |

Dow Jones | 43,958 | +0.11% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $PET, $ARBK, $SWKS, $PAGS, $BTCM 📉 $DNMR, $ZETA, $HTOO, $CYBR, $VSAT*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Inflation Inches Higher Within Expectations 🔺

The consumer price index (CPI) increased 0.2% MoM in October, bringing the 12-month inflation rate up to 2.6% and matching expectations. Core inflation, which excludes food and fuel, met estimates by rising 0.3% MoM and 3.3% YoY. 📊

While goods prices have been a major tailwind of the U.S. disinflation trend, services inflation remains a key concern among investors and economists.

Shelter prices rose another 0.4% MoM in October, doubling its September uptick and rising by 4.9% YoY. They’re a third of the broader index’s weighting and were responsible for more than half this month’s gain in the “all items” measure. 🏘

Economists had estimated that shelter prices staying elevated was simply a matter of timing, given the significant lag between how the BLS calculates them and the current rates people are paying in the markets. However, after a year of waiting for that thesis to pan out, some are beginning to worry about goods inflation picking back up.

Used vehicle costs were a major driver of goods inflation in the post-pandemic environment and are back on the rise, jumping 2.7% MoM. With energy and food prices finding their own floor, any material uptick in these numbers without a respective fall in shelter prices (or overall services inflation) would prevent the Fed from reaching its 2% target. 😬

The positive news is that we’re not seeing a major acceleration higher in any of these individual categories yet, but investors (and the Fed) are monitoring this risk into 2025.

Bonds had a bad day following an initial jump, suggesting that market participants still believe there’s enough inflation risk to keep interest rates elevated—even as the Federal Reserve continues its rate-cutting campaign.

The rise in rates gave bears cover to put a short-term lid on the rally in stocks and Bitcoin. We’ll see if tomorrow’s producer price index (PPI) data shows similar risks and can further embolden the bears. Or if the bulls parade past this latest worry. 🤷

SPONSORED

Top Card Offering 0% Interest until Nearly 2026

This credit card gives more cash back than any other card in the category & will match all the cash back you earned at the end of your first year.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

Super Micro Computer: Shares slumped 10% after the company again delayed filing its 10-Q and 10-K forms with the Securities and Exchanges Commission (SEC). It needs to submit a plan to regain compliance with the Nasdaq’s exchange requirements by November 16th, or it will face delisting. 🤦

Advanced Micro Devices: Shares fell 3% after announcing it would reduce its global workforce by 4% as it “right sizes” to focus on its core growth opportunities. While the cuts target underperforming divisions, the news still sparked some growth fears among investors. 😬

Zeta Global: Shares declined another 37% after Culper Research announced a short position, alleging the company has formed “two-way” contracts with third-party consent farms wherein it simultaneously acts as both a supplier and a buyer of consumer data. Investors are fleeing the marketing tech company as a result. 😨

SoundHound AI: Shares fell 17% despite the maker of conversational AI voice technology posting a beat-and-raise third-quarter report. Ladenburg Thalmann analyst Glenn Mattson downgraded the stock to neutral on the news, citing significantly higher losses than previous expectations. However, most on the street say this was a “sell the news” reaction to an otherwise great quarter. 🙃

Ibotta: Shares dove 15% after the company beat expectations but showed lackluster growth potential outside of its Walmart program expansion. The free app allows users to earn cash back on things they purchase in-store or online at over 300 retailers. This quarter saw direct-to-consumer redemptions and redeemers fall 17% and 10% YoY, sparking growth fears. 🛒

Beazer Homes: Shares jumped 12% after the homebuilder reported a jump in current-quarter orders, helping revenue and earnings top analyst expectations. Management expects further expansion of its community count to lead to revenue growth and double-digit returns on capital employed. 🏡

CNH Industrial: Shares rose 8% after Greenlight Capital’s David Einhorn said he had taken a medium-sized position in the agricultural play. The position was revealed at CNBC’s Deliver Alpha conference in New York City, with Einhorn calling it an under-the-radar value play as the industry nears the end of a bearish cycle. 🚜

ZoomInfo Technologies: Shares plunged 20% after beating third-quarter expectations but issued fourth-quarter and full-year guidance that was in line with estimates. Still, revenue falling 3% YoY and stable net revenue retention left investors longing for growth they are not currently seeing. 😐

NVIDIA DAY COUNTDOWN

Nvidia Day Is Only A Week Away 👀

The world’s largest company is set to report earnings one week from today, with bulls hoping Nvidia will deliver enough good news to keep the gravy train rolling.

In honor of the upcoming event and to prepare you with all the information you need to navigate the results, we’ll share Nvidia-focused insights and events all week…leading up to the live earnings call on Stocktwits. 🤩

August’s Nvidia Day broke records, with over 10,000 listeners joining the Stocktwits live earnings call on top of the millions of page views our Nvidia symbol page garnered that week. And we expect this one to be even bigger, so don’t miss out!

Follow @Stocktwits on the platform and our socials (X, Instagram, YouTube) to stay updated on all the action. 🚨

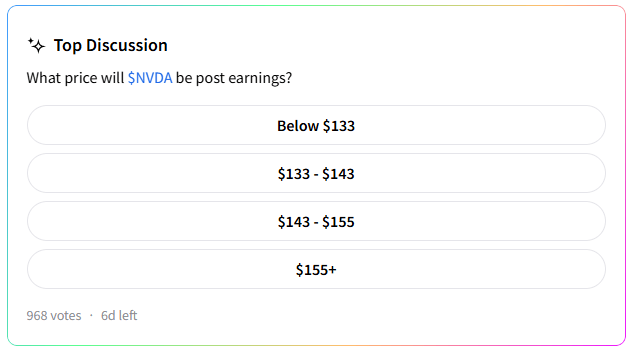

And to kick things off tonight, we’ve got a live poll asking what price Stocktwits users think Nvidia will be after earnings. Cast your vote; the results are surprising so far! 👀

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Producer Price Index PPI (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET), Fed Barkin Speech (9:15 am ET), EIA Energy Inventories (11:00 am ET), Chair Powell "Global Perspectives” Speech (3:00 pm ET). 📊

Pre-Market Earnings: Disney ($DIS), Workhorse Group ($WKHS), JD.com ($JD), BlueBird Bio ($BLUE), Intuitive Machines ($LUNR). 🛏️

After-Hour Earnings: T2 Biosystems ($TTOO), Hylion Holdings ($HYLN), AST SpaceMobile ($ASTS), Applied Materials ($AMAT), WISA Technologies ($WISA). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋