Presented by

CLOSING BELL

Beautiful Cut

The market climbed into the close on Wednesday after the Fed delivered the rate cut everyone expected.

Small caps flew, the Russell hit an all-time high, and the Dow was up a beautiful 1%.

There was drama, though, from the FOMC's forward-looking rate and inflation predictions, but more on that later. What matters is that the market climbed within a hair's breadth of a fresh record.

In other news, Nvidia denied a The Information report that Chinese hyperscalers smuggled in Blackwell chips to train DeepSeek models, after the Trump Admin approved the sale of H200 chips, and analysts were careful not to upgrade the sales expectations on the chip giant.

The Trump administration seized an oil tanker off the coast of Venezuela on Wednesday. 🛢

AFTER THE BELL

Tonight's Earnings Review: Traders Are Getting Skimpy With Tech 💥

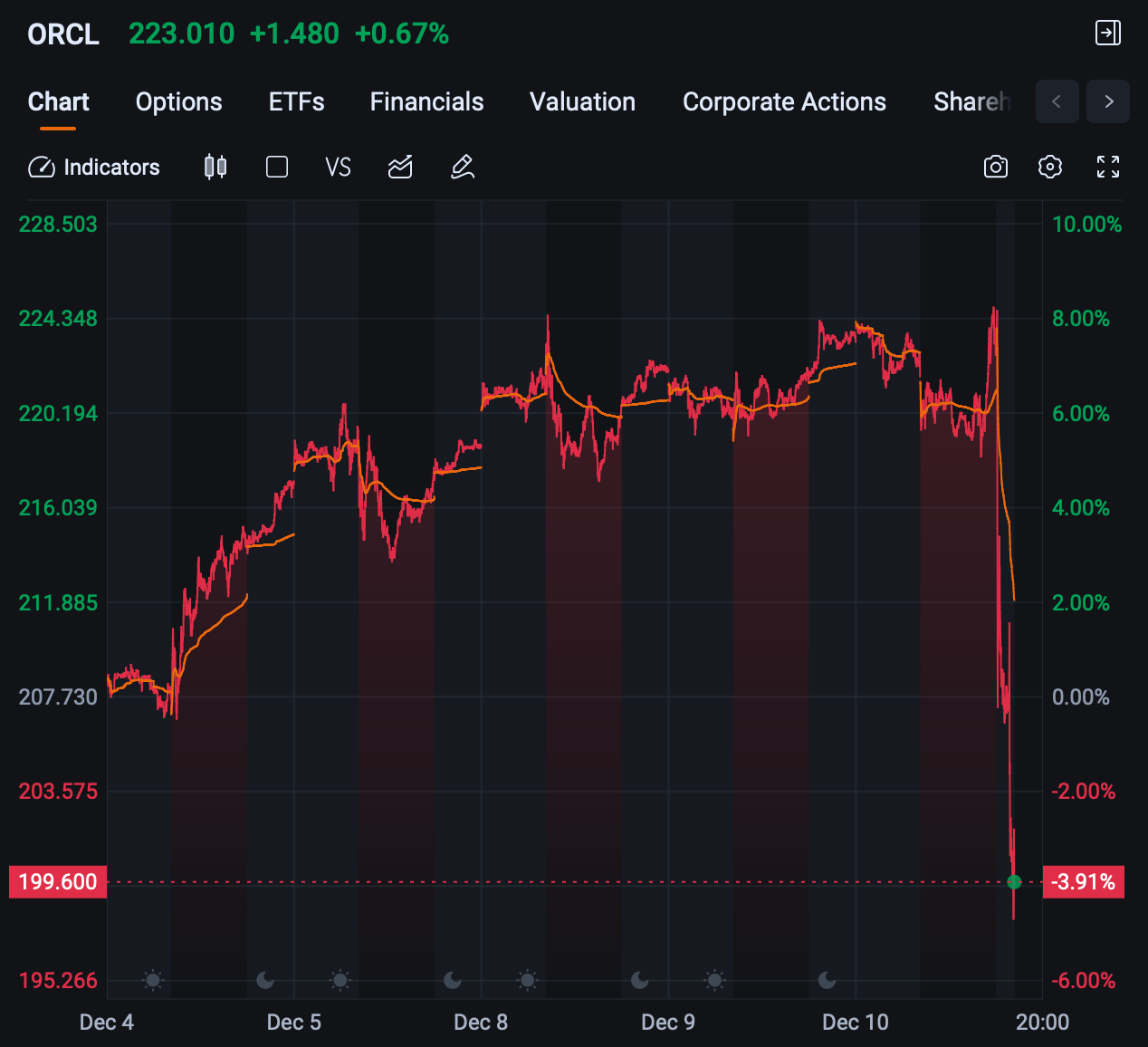

Oracle $ORCL ( ▲ 3.42% ) was falling 10$ post-market, and it had nothing to do with the raw numbers. The software cloud company showed revenue of $16.3 billion, right around forecasts, and it wasn’t enough.

Digging in: Cloud revenue grew 34% to $8B, but that was slightly below estimates. Most importantly, Oracle grew its bookings to half a trillion dollars, but that huge number is based on forward-looking datacenter sales that Oracle needs to finance. It needs cash to literally build miles of cooling racks, power generators, and GPUs to realize any of these sales.

The company is signing massive cloud deals driven by demand from large AI companies, but the question for investors is can they actually follow through.

Chairman and CTO Larry Ellison said they expect to double the number of datacenters they run to 71 in “the next several years.” Oracle grew its MultiCloud database revenue 817% in Q2.

Adobe $ADBE ( ▲ 3.44% ) climbed just slightly. The Photoshop digital media leader beat expectations across the board, posting non-GAAP earnings of $5.45 per share on Q4 revenue of $6.2 billion. The company provided robust guidance for fiscal 2026 through the strong monetization of its Generative AI features.

Synopsys $SNPS ( ▲ 4.73% ), the electronic design automation software giant, beat expectations for the fourth quarter, reporting adjusted EPS of $2.9, above the $2.3 estimate. Revenue reached $2.26 billion, topping the $2.25 billion forecast.

SPONSORED

The Newsletter Wall Street Hopes You Never Find

Wall Street has built an empire on investor ignorance. They sell “diversification” while feeding you old, recycled strategies.

With the H.E.A.T. Formula we show you what they won’t say out loud:

That most portfolios are sitting ducks — and your advisor probably doesn’t know it.

You’re not just reading a newsletter. You’re joining the side that sees the game for what it is — and knows how to play it.

The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

👉 Click here to get the one newsletter Wall Street prays you never find.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

🚨 FED CUTS RATES, But Dot Plot Dissagrees🚨

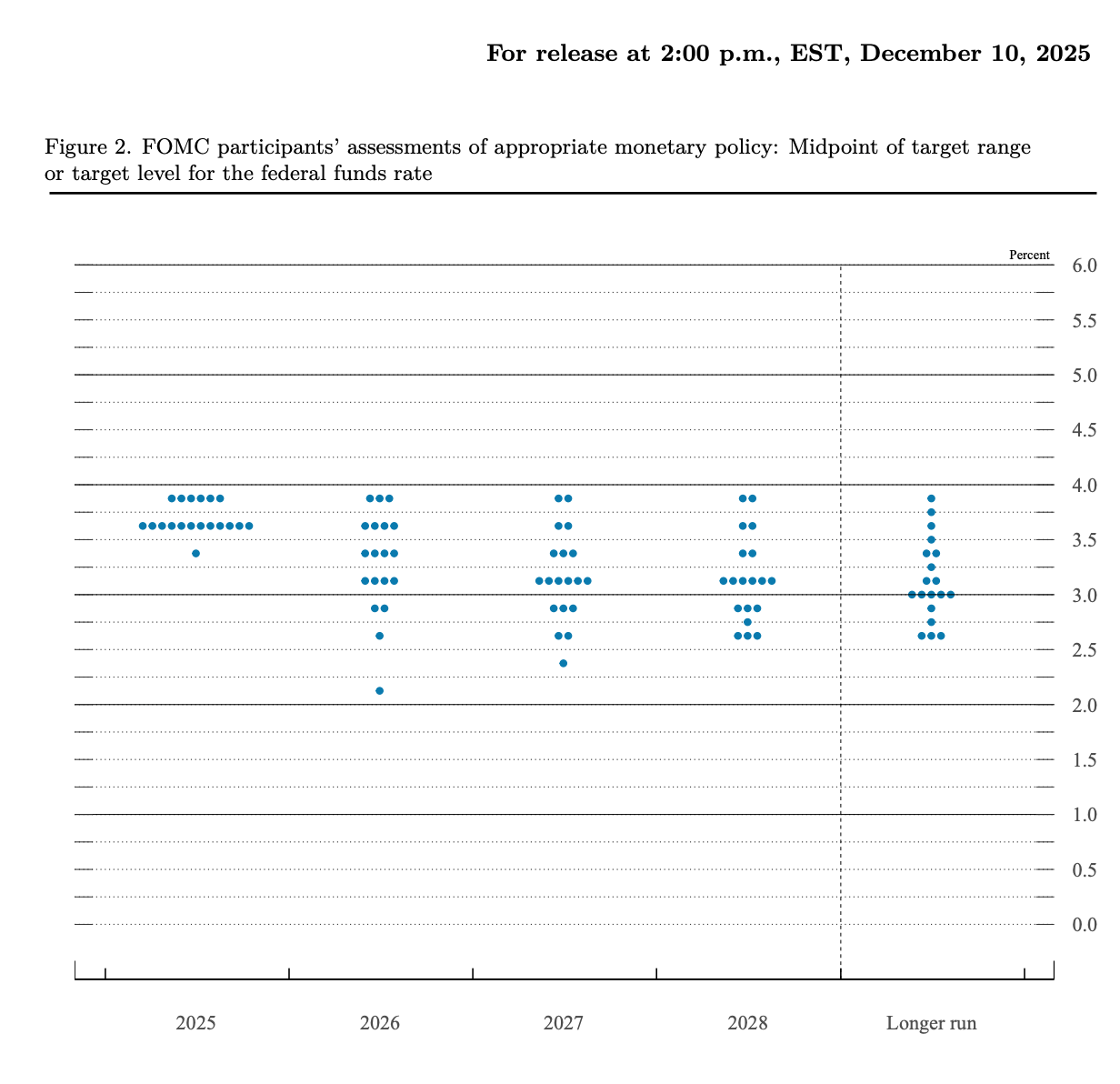

The Federal Reserve's Federal Open Market Committee delivered a widely expected 25 basis point rate cut, bringing the new target range for the Federal Funds Rate to 3.5% / 3.75%. Powell said that economic activity is expanding slowly, job gains have slowed, and the unemployment rate has edged higher, but inflation has mostly stayed put.

It’s the final rate cut this year, and final cut we may see under Powell’s watch, who did his best to organize a divided vote. He had his work cut out for him, and based on the split forward-looking projection, Kevin Hassett, or whoever takes Powell’s job in May, is in a tough spot too.

Betsey Stevenson, professor at the University of Michigan School for Public Policy, said people don’t care about the ‘inflation rate’ as much as media and policymakers do. Americans are frustrated with the price level: the prices of goods like food and rent are irreversibly higher. Keeping inflation in check slows the climb, but it doesn’t bring prices down.

She told Bloomberg Businessweek that Powell tried to tell the press corps that focusing on healthy employment is the only way to make Americans feel better.

The Political Tension in the Dot Plot

The most crucial takeaway from the meeting was the Dot Plot summary, which shows how individual members see inflation, growth, ect in the future. And boy, what a mess.

The median projection among policymakers calls for only one 25-basis-point cut in 2026. It’s a "hawkish” tone that sends the message that the Fed is cutting now solely to support the labor market, but is otherwise scared inflation is not yet under control.

2026 Forecasts: Unemployment at 4.4% and PCE inflation at 2.4%, and a 3.4 FFR.

The Conflict: The Fed expects inflation to be near its 2% goal, but it also anticipates a deteriorating labor market, which argues for more aggressive cuts than the single cut projected.

The Three Dissenters

For the first time since 2019, the decision was met with three dissents, marking a clear split in the committee:

Trump’s recent Fed Governor pick, Stephen Miran, voted against the cut, preferring a larger 50-basis-point reduction, arguing that labor-market weakness necessitates a bolder move.

Austan Goolsbee & Jeffrey Schmid: Both voted to hold rates steady (no change), likely prioritizing the fight against inflation, which remains above the 2% target.

The future-looking Dot Plot further showed that three or more voting members even saw rates going UP next year! Looking ahead, one member (likely Miran) foresees as many as five rate cuts in 2026, down to a 2.0% target rate. This widening range of views underscores the high-stakes debate over the future of monetary policy ain’t over yet.

IN PARTNERSHIP WITH

7 Mistakes People Make When Choosing a Financial Advisor

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

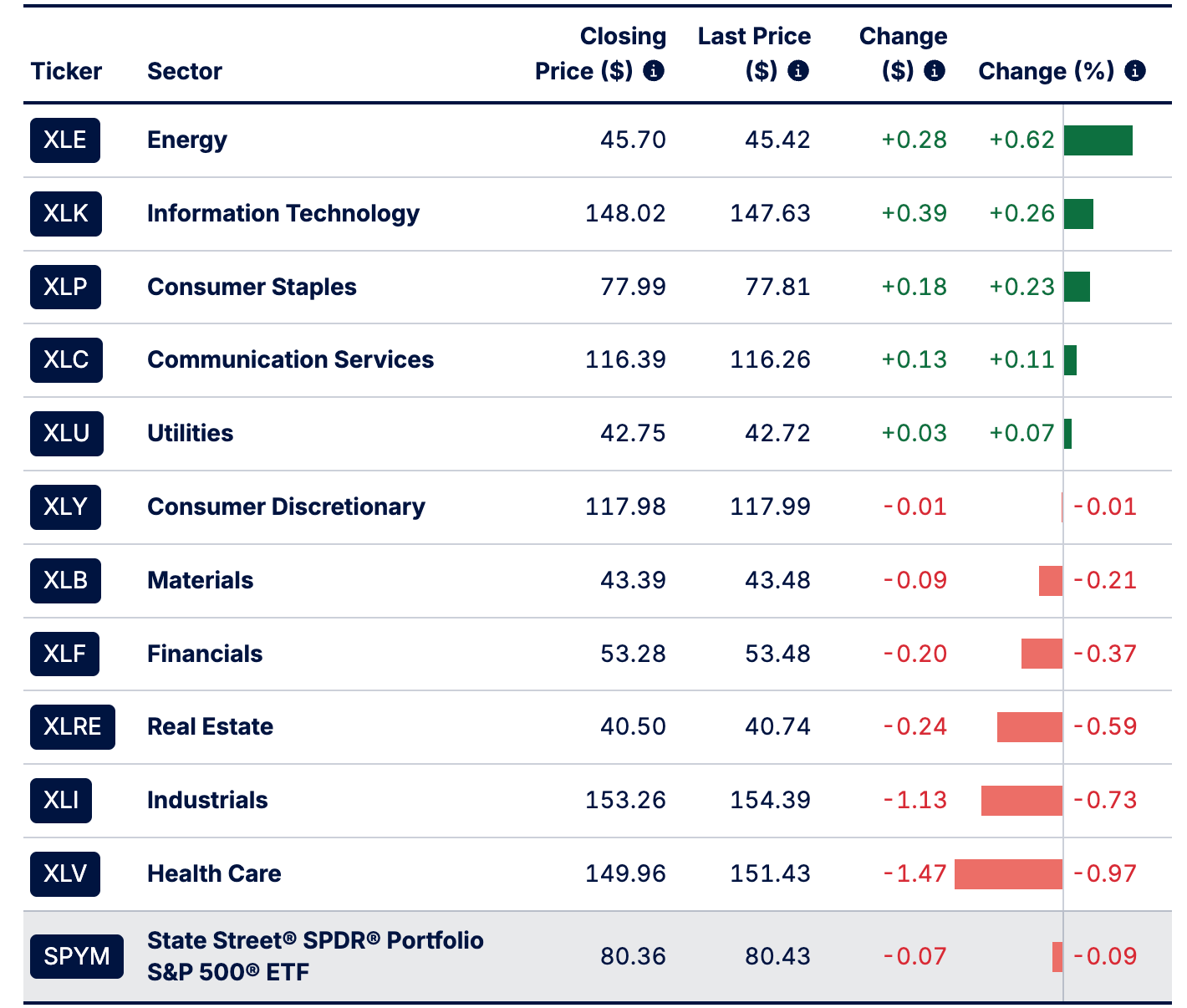

SECTORS

Twelve Days Of Silver 🥈

I am unabashedly stealing this idea from my college, Jonathan Morgan from Cryptotwits:

It’s the twelve days of silver, my true love (the market) gave to me:

🎵 Five Golden Crosses, Four Years of Deficits, Three Solar Panels, Two EVs, and a breakout past the 1980 hiiiiiiigh 🎶

Silver prices reached an all-time high of $61.85 per ounce on Wednesday, topping the $60 per ounce mark for the first time in history and marking a surge of 113% so far this year. This massive gain was triggered by the Federal Reserve's rate cut, which generally raises the appeal of non-yielding assets like precious metals.

The price action is driven by two main forces: a tight physical market of actual silver nuggets supported by rising industrial demand and the metal's recent designation as a critical mineral by the U.S. government. Rate cuts and economic uncertainty also help metals climb in value, of course.

POPS & DROPS

Top Stocktwits News Stories 🗞

Biotech Acquisition climbed 92% on acquisition completion.

Magnificent Seven has only one stock trading below its 200-DMA (META)

Nvidia denied claims of DeepSeek using banned Blackwell chips.

Photronics stock surged to 24-year high on strong earnings.

Lake Resources stock tanked 40% hitting nine-year lows.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IEA Monthly Report (4:00 AM), OPEC Monthly Report (7:00 AM), Continuing Jobless Claims (8:30 AM), Initial Jobless Claims (8:30 AM), Trade Balance (8:30 AM), 30-Year Bond Auction (12:00 PM), Fed's Balance Sheet (4:30 PM). 📊

Pre-Market Earnings 🛏️

CIENA Corp Analysts expect the networking hardware provider to report adjusted earnings of approximately $0.40 to $0.42 per share on revenue of about $1.11 billion for the fiscal fourth quarter, with the market focusing on updates regarding the persistent supply chain normalization and its impact on gross margins.

After-Market Earnings 🌕

Costco Wholesale $COST ( ▲ 1.26% ) Wall Street forecasts the warehouse club will report adjusted earnings of approximately $4.27 per share on revenue of roughly $67B billion for the fiscal first quarter, with the crucial metric to watch being comparable sales growth (ex-gas and foreign exchange) and any update on a potential membership fee hike.

Broadcom $AVGO ( ▼ 1.47% ) The semiconductor giant is projected to post adjusted EPS of around $11.10 per share on revenue of $13.3 billion for the fiscal fourth quarter, with the primary focus being on the accelerating demand for its custom AI chips and the initial integration and financial contribution from the recently closed VMware acquisition.

Lululemon Athletica $LULU ( ▲ 0.78% ) 🧘 Analysts expect the athletic apparel retailer to report adjusted earnings of about $2.21 per share on revenue of $2.4 billion for the third quarter, with attention centered on same-store sales growth in North America and the company's detailed guidance for the all-important holiday quarter.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋