NEWS

‘Best Week Of 2024’ Drives Record Highs

Source: Tenor.com

A clear election outcome, Fed cut, and optimism about Trump’s pro-business stance have the bull market raging on, with a week for the record books. While it was a muted day on Wall Street at the index level, many stocks continued to shoot higher under the surface as the bulls bet on further gains into year-end. 👀

Today's issue covers a rundown of this week’s records, why tariff terrors are sweeping the globe, and one stock that sums up the madness. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with utilities (+1.92%) leading and materials (-0.91%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,996 | +0.38% |

Nasdaq | 19,287 | +0.09% |

Russell 2000 | 2,400 | +0.71% |

Dow Jones | 43,988 | +0.59% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $EVH, $INDI, $SMSI, $AVPT, $REVB 📉 $GTN, $FLR, $ASRT, $QRTEA, $RAPP*

*If you’re a business and want to access this data via our API, email us.

STOCKS

A Day Of Record Highs… 🥳

It was a wild week in the markets, with bulls running the show and making it feel like we were back in a 2020-2021 environment. Here are some notable moments to sum up election week:

The S&P 500 crossed 6,000 for the first time. Every major index hit new all-time highs, except the Russell 2000 which is steps behind.

The S&P 500 posted its largest post-election day gain ever (+2.53%).

Bitcoin hit a new all-time high, with prices crossing $77,000.

The altcoin market cap crossed back above $1 trillion.

Of the "Magnificent 7,” Amazon hit all-time highs, Nvidia replaced Apple as the most valuable company, and Tesla soared 29% following Trump’s victory.

S&P 500 company profits rose 8% YoY in Q3 vs. expectations of 3%.

These were just a few of the monster moves and developments in the markets this week. If you want an idea of what happened under the surface, check out our “Chart of The Day” below. It’ll blow your socks off, lol.

For now, the bulls are in control and making hay while the sun shines. Looking ahead, it’s unclear what the catalyst would be to break up momentum. However, as 2020 and 2021 taught us, when everything is working, it is often a good time to review your plan and ensure you know what to do when the tide eventually shifts. 👍

SPONSORED

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

CHART OF THE DAY

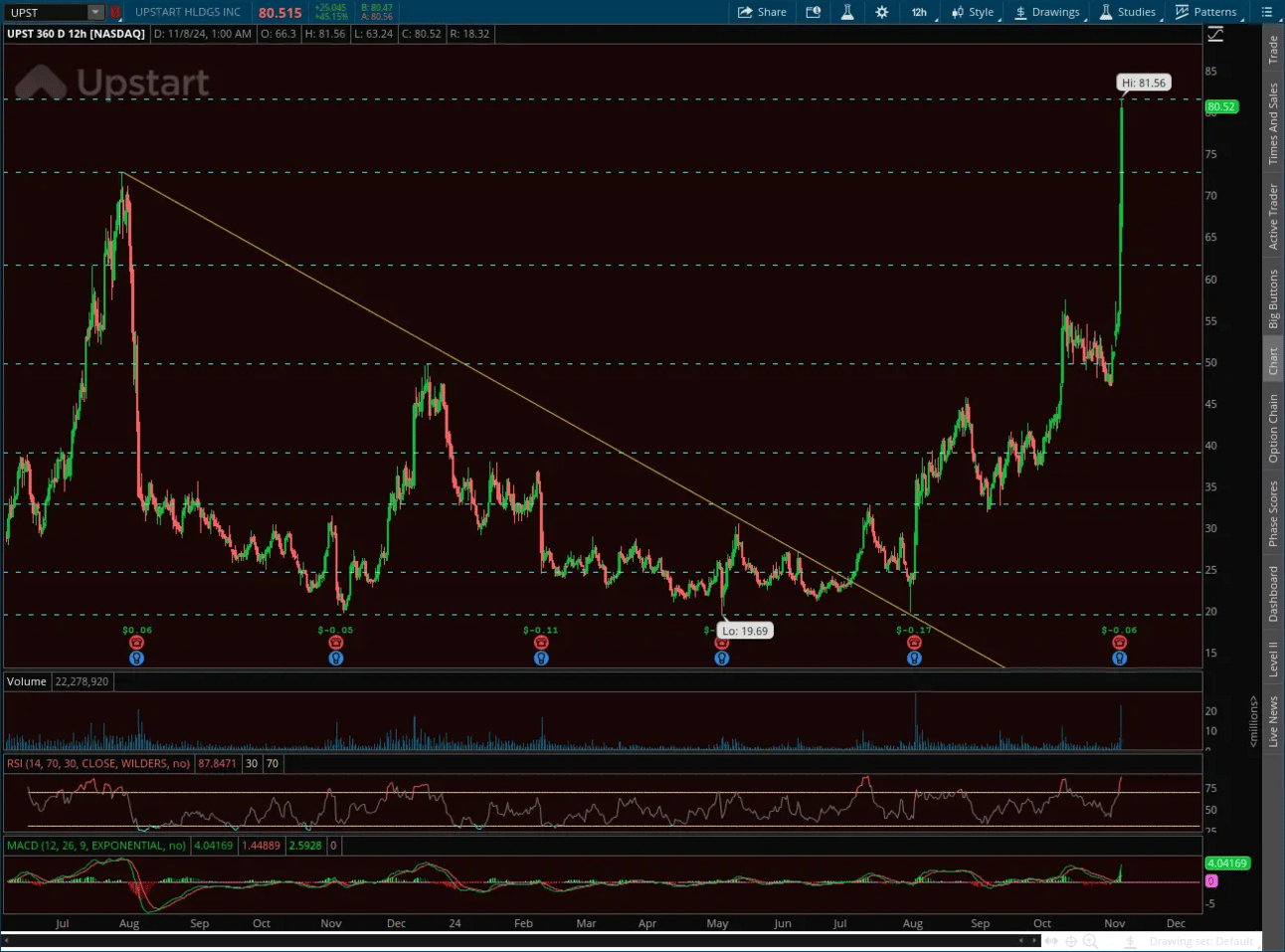

What Does Upstart Do??? It Goes Up! 👀

Mr. Minervini, it really doesn’t matter what Upstart does! That’s how you should’ve answered it back in 2021! With that said, the less you knew, the better you did during the great Covid years. Damn, what a market it was! It’s not half bad right now. 😉

But in all seriousness, Upstart reported strong earnings and an optimistic sales outlook, with a 43% sequential growth in lending volume thanks to improved predictive models— now, they aren’t just giving loans to anyone anymore!

Stocktwits user @diamondoptionsinc points out the wild extension in $UPST today and how people are still actively running after it in the options market (*many might just be rolling up their calls and shorting stock against it, you never truly know)

Nonetheless, it shows just how hard the bulls are partying if beaten-down stocks like this are soaring at neck-break speeds. The momentum will slow at some point, but traders are pressing their bets while they still can. 💸

For more charts, trade ideas, and analysis, get today’s “Chart Art” newsletter. 🎯

POLICY

The Tariff Terror Is Already Beginning 😨

One of President-elect Donald Trump’s primary running points was rebuilding the U.S. economy and putting America first. While there are various tools available to do that, one he leaned on heavily was the idea of tariffs. 💵

Given that his election could turn these from talking points into reality, many are rushing to understand tariffs and their implications for the economy.

Just take a look at Google Trends for the term “tariff,” which is hitting its highest level since early 2018, when he imposed tariffs on solar panels, washing machines, steel, aluminum, and other goods that covered roughly 4% of U.S. imports.

Source: Google Trends

But just how serious is Donald Trump about tariffs this time around? 🤔

At the Chicago Economic Club this October, Trump said, “To me, the most beautiful word in the dictionary is ‘tariff,’” showing his fondness for this specific economic tool. And while his policies in 2018 were very targeted, Trump has floated a 10% or 20% universal tariff on all imports and a tariff of at least 60% on Chinese goods…causing economists, business leaders, and other leaders to sound the alarm.

The primary concern for U.S. consumers is inflation, as they’ve struggled with several years of high inflation following the pandemic. And by many estimates, broad-based tariffs would actually increase the costs of goods for the average American. 🛒

For example, an analysis by the Tax Policy Center indicated that a 20% worldwide tariff and a 60% tariff on Chinese goods could raise the average household’s costs by $3,000 in 2025. That’s because the “vast majority” of additional costs companies pay are passed onto consumers. AutoZone CEO Philip Daniele said during the company’s September conference call: “If we get tariffs, we will pass those tariff costs back to the consumer.” And it’s safe to say he’s not alone in that thinking… 😐

Nevertheless, it seems some level of tariffs will be imposed during the Trump administration, so some companies are preparing for the worst.

Steve Madden’s CEO said the company will reduce the goods it imports from China by as much as 45% over the next year. Because of regulatory risks, labor shortages, and supply chain disruptions, it and other retailers have already pushed to diversify sourcing from China. However, Trump’s election should further accelerate this trend. ⏩

U.S. companies have already received major pushback from consumers on prices and “shrinkflation” and do not want to risk losing demand even further. As a result, they’re taking this potential policy seriously and looking for ways to stay ahead of it. Expect to hear more about this in the current and future quarter earnings calls.

Time will tell how this situation develops. But for now, the tariff terror is being felt globally. 😬

COMMUNITY VIBES

One Tweet To Sum Up The Week 🚀

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋