NEWS

Big Tech And Banks Buoy Markets

Big tech and bank stocks spent their day in the green while the rest of the market struggled to gain traction. Meanwhile, crypto prices stabilized, allowing many crypto-related equities to begin a new run. Let’s see what you missed. 👀

Today's issue covers Boeing buying Spirit Aerosystems, Roaring Kitty creating a chewy situation, and homebuilders breaking down. 📰

Here's today's heat map:

4 of 11 sectors closed green. Technology (+0.76%) led, & materials (-1.54%) lagged. 💚

The S&P Global manufacturing PMI showed a modest improvement in June, staying in expansion territory. Meanwhile, the ISM manufacturing index fell again in June, marking the 19th month of the last 20 in contraction territory. 🏭

Construction spending posted a larger-than-expected decline in May, falling 0.10% MoM and rising 6.40% YoY. Private residential construction fell 0.20% during the month, offset by 2.60% in public residential construction. 🏗️

Teva Pharmaceuticals fell after reports that the Federal Trade Commission (FTC) is investigating the generics company. The FTC cited the company's refusal to remove two dozen patents for its asthma and COPD inhalers. 💊

China-based electric vehicle (EV) makers reported upbeat delivery data for June and the second quarter. Nio, Li Auto, Xpeng, and BYD Co. Ltd. all rose. 🔋

Floor & Decor Holdings is the latest company under pressure from short sellers. In its newest short report, Spruce Point Capital Management questioned management’s credibility and overall strategy. 📝

NextEra Energy Partners fell 9% after the Royal Bank of Canada downgraded the stock to sector perform, citing a “challenging” road ahead. 🔻

Cruise stocks fell as Hurricane Beryl made landfall as a Category 4 storm. 🛳️

Other active symbols: $MARA (+13.65%), $TSLA (+6.05%), $CSIQ (-5.02%), $TDOC (-4.70%), $HE (-9.31%), and $CSLR(+32.14%). 🔥

Here are the closing prices:

S&P 500 | 5,475 | +0.27% |

Nasdaq | 17,879 | +0.83% |

Russell 2000 | 2,030 | -0.86% |

Dow Jones | 39,170 | +0.13% |

COMPANY NEWS

Boeing Buys Spirit Aerosystems

What’s better than one troubled company? Two troubled companies. At least that’s the math Boeing management is doing as it acquires its key supplier, Spirit AeroSystems…

The aerospace and defense giant will acquire Spirit Aero for $37.25 per share in stock, valuing the company at $8.30 billion, including debt. As for its equity, it’s valued at roughly $4.70 billion. 💰

Boeing CEO Dave Calhoun said, “By reintegrating Spirit, we can filly align our commercial production systems, including our Safety and Quality Management Systems, and our workforce to the same priorities, incentives, and outcomes.”

Meanwhile, Airbus will buy back some business from Spirit and receive $559 million in cash in a sweetheart deal for the Boeing competitor. 🤩

Shares rebounded about 3% on the news, continuing its recovery from the one-year low it set back in April. Right now, retail investors view this as an important next step in the company’s longer-term turnaround story. But time will tell if Boeing’s management team can stick the landing. 🛬

SPONSORED

Earn rebates on every options contract traded at Public.com

Are you an options trader? At Public.com , you'll earn a rebate on every contract traded with no commissions or per-contract fees. That's because Public offers a rebate on every contract you buy or sell. Joining Public is easy, and your rebates can add up fast. If you trade 1,000 option contracts on Public, you'll earn $60 to $180 in rebates and avoid up to $1,000 in fees that other platforms charge.

So, don’t change your strategy; change your platform—and start earning rebates on every options contract traded. Plus, get up to $10,000 when you transfer your existing portfolio to Public.

Discover why NerdWallet recently awarded Public five stars for options trading (and 4.6/5 stars overall), and earn rebates on options trades with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Roaring Kitty Creates A Chewy Situation…

The Roaring Kitty meme stock situation has escalated again, so let’s catch you up on this chewy situation… 🙃

Instead of meme traders getting a Sunday night drop from Kitty himself, they received a filing from the Securities & Exchange Commission suing Keith Gill for securities fraud over his promotion of GameStop. 🤯

This morning, Roaring Kitty followed up his “dog” tweet with an SEC filing showing he now owns 6.60% of online pet retailer Chewy. That sent shares up over 20% in pre-market trading, but optimism faded throughout the day, and the stock closed red.

More notably, though, his SEC Filing Form 13G seemingly had a section where he designated that he is, indeed, “not a cat.” 😐

By the end of the day, the SEC’s lawsuit against Roaring Kitty had been dismissed, equivalent to Spongebob and Patrick going to jail for stealing balloons on “free balloon day.” And if you don’t get that reference, then you probably don’t care about this meme stock situation anyway... 🤦

Overall, it appears the market is a little tired of Gill’s shenanigans, as Chewy, GameStop, Petco, and other stocks swooped up in the meme stock drama and closed red on the day. 🔻

While investors in these companies await clear plans from management about how they’ll make their core businesses profitable, they’ll continue to be distracted by the volatility associated with being a “meme stock” that could be sent in either direction at any moment.

We’ll have to wait and see how things develop in this shortened, light-volume holiday week. But for now, the game continues to evolve… 🤷

STOCKS

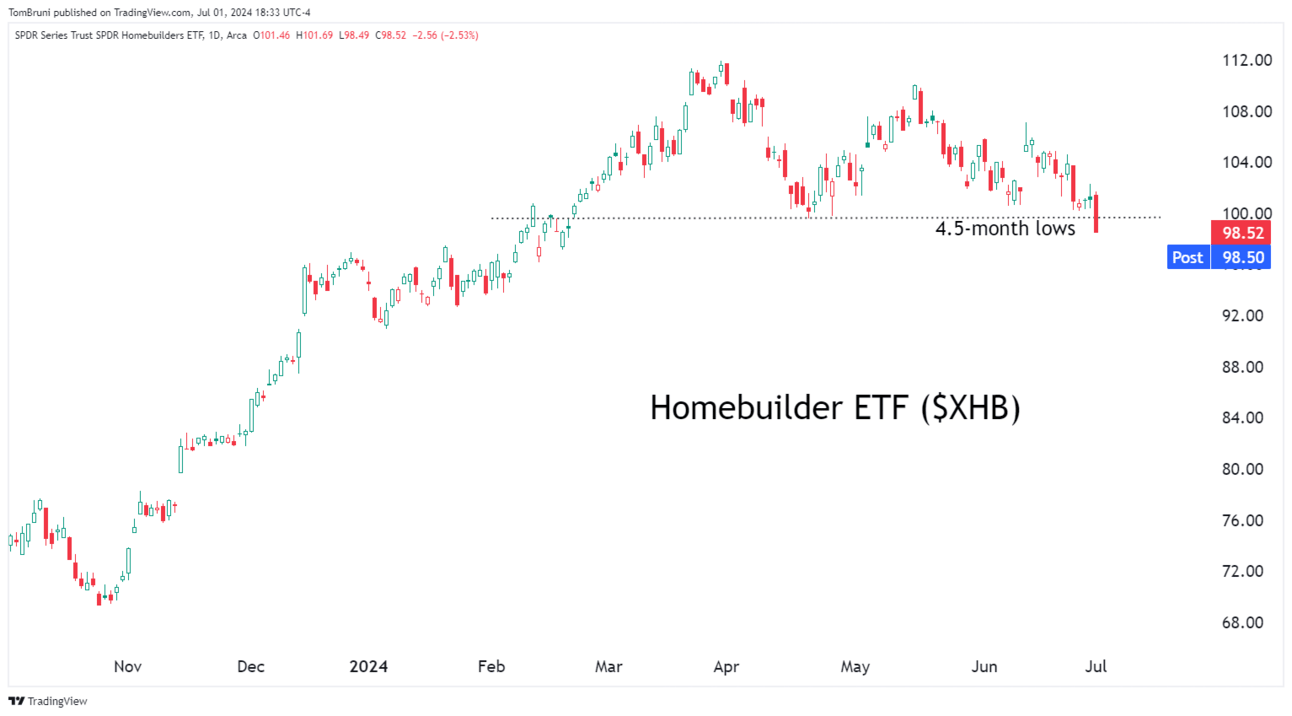

Homebuilders Breaks Technical Support

With the U.S. housing market being millions of units short of satisfying demand and existing home inventory at record low levels, homebuilding stocks have been on an absolute tear. 🏘️

However, in the near term, many homebuilders have quietly expressed concerns that record-high prices and high financing costs would keep a lid on demand. Elevated land, labor, and material costs have also made it difficult to create affordable housing at a margin that makes sense for them.

That’s why many builders have focused on upscale properties to cater to higher-income consumers. But now, with the labor market cooling materially and the economy softening, even that market is beginning to face challenges.

As a result, it’s not surprising that homebuilding stocks have come under pressure in recent weeks. With the homebuilder ETF ($XHB) and its peer ($ITB) both breaking down to nearly five-month lows, many traders and investors are warning of further downside. 📉

While the housing market’s structural trends remain a major tailwind for homebuilders, the short and intermediate-term concerns around demand are weighing on the sector. And with bonds getting hit following last week’s economic data and presidential debate, traders expect these vehicles to remain in the dog house for the foreseeable future. 😬

Bullets From The Day

❌ Meta accused of breaching EU antitrust rules. The Facebook parent company was accused by European Union (EU) regulators of failing to comply with the Digital Markets Act (DMA). It claims the company’s “pay or consent” model is a binary choice to force to “consensually” give up their data to the company. However, the EU’s preliminary view says this model does not let users opt for a service that uses less personal data but is still equivalent or gives users the right to “freely consent.” CNBC has more.

🤖 Robinhood makes an AI acquisition to spice up its app. The investment app is adding more artificial intelligence (AI) features by acquiring Pluto Capital. The AI-powered research platform will allow Robinhood to add tools that make identifying trends and investment opportunities easier, help guide users with their investment strategies, and offer real-time portfolio optimization. The startup’s founder, Jacob Sansbury, will join Robinhood and accelerate the app’s adoption of AI technologies. More from TechCrunch.

🧑⚖️ Supreme Court ruling allows a truck stop to sue the Federal Reserve. The highest court in the U.S. revived a lawsuit by a North Dakota truck stop challenging the fees banks can charge for debit card transactions in a ruling that could have much wider implications. This, along with Friday’s decision to overrule Chevron, means that even old agency rules can be challenged anew if they produce any contemporary harm. CNN Politics has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍