NEWS

Big Tech Boom Offsets Stagflation Scaries

This morning’s theme was all about the Meta meltdown dragging stocks lower as U.S. economic data turned sour. However, Microsoft, Alphabet, and Snap all delivered after-hours earnings beats and are helping the indexes push into positive territory. Let’s see what else you missed. 👀

Today's issue covers big tech earnings buoying markets, why today’s economic data renewed stagflation fears, and Bristol Myers bucking the healthcare boom. 📰

Here's today's heat map:

5 of 11 sectors closed green. Materials (+0.71%) led, & communications (-3.56%) lagged. 💚

Pending home sales jumped 3.40% MoM in March despite mortgage rates topping 7%. The median home price rose 4.80% YoY to $393,500, its highest since August 2023 and marking a record high for the month of March. 🏘️

Kansas City Fed manufacturing activity fell again in April, remaining in contraction territory and volatile on a MoM basis. U.S. wholesale and retail inventories both shrunk more than anticipated during March, with the previous month’s growth revised downward. 🏭

Microsoft-backed cybersecurity startup Rubrik jumped 21% in its New York Stock Exchange (NYSE) initial public offering (IPO). It’s the latest tech startup to take advantage of a thawing deal market, raising $752 million in an upsized offering of 32.50 million shares. 💰

Mining giant BHP bid $39 billion for its smallest competitor, Anglo American, as it looks to beef up its copper mining operations amid rising prices. With that said, several sources said the offer was not viewed as attractive and that BHP’s interest could spur others to begin bidding on the company. ⚒️

Southwest Airlines fell 7% after it missed both earnings and revenue expectations and warned that Boeing’s airplane delays would pressure its growth plans into 2025. Meanwhile, American Airlines popped 2% after missing earnings expectations but guiding higher for its upcoming quarter. ✈️

Hertz shares plunged 20% after reporting another $200 million loss on its electric vehicle (EV) fleet. It’s now going to sell 10,000 more EVs than planned as it continues to pull back sharply on its EV bet. 🪫

Comcast fell 6% despite posting an earnings and revenue beat, with investors focused on its quarterly broadband subscriber losses of 65,000. 📺

Intel dipped another 8% after missing sales estimates and providing a weak forecast for the current quarter. It continues to lag behind its semiconductor peers in a big way, with investors unsure about its long-term foundry bet. 📉

Other active symbols: $TSLA (+4.96%), $IBRX (+6.02%), $CDTX (+5.78%), $NEM (+12.46%), $RBRK (+19.35%), & $HOLO (+7.23%). 🔥

Here are the closing prices:

S&P 500 | 5,048 | -0.46% |

Nasdaq | 15,612 | -0.64% |

Russell 2000 | 1,981 | -0.72% |

Dow Jones | 38,086 | -0.98% |

EARNINGS

Big Tech Earnings Save Us From The Other Big Tech Earnings

Meta may have dropped the ball for bullish investors, but Microsoft, Alphabet, and Snap gave the market a more positive outlook after hours. Let’s quickly summarize how they each did. 👇

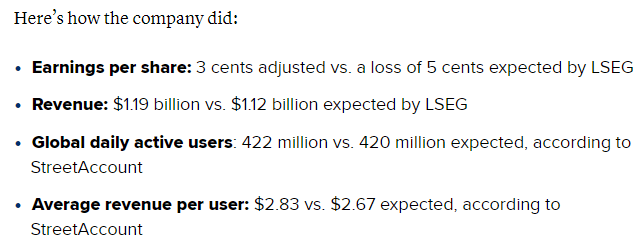

Let’s start with Alphabet, which soared 12% to new all-time highs after reporting better-than-expected results and issuing its first-ever dividend.

As this CNBC graphic shows, the company topped estimates on basically all major metrics, with YouTube advertising and cloud revenue rebounding and operating income in its cloud business quadrupling to $900 million. 😮

And since the company is printing cash, it has plenty to prioritize shareholders while also investing in its longer-term growth initiatives like artificial intelligence (AI).

As a result, it was able to announce a $0.20 per share dividend and a $70 billion share buyback. Looks like investors and traders will be in good company buying shares at/near their all-time highs. 🤑

Next up is Microsoft, which saw its cloud growth accelerate due to its broader artificial intelligence (AI) efforts. 🌤️

Adjusted earnings per share of $2.94 on revenues of $61.86 billion topped the $2.82 and $60.80 billion expected. Total revenue was up 17% YoY, with revenue from Azure and other cloud services accelerating from 30% growth last quarter to 31% today. Analysts had anticipated about 29% growth.

It appears the company’s first full quarter selling its Copilot add-on for commercial Microsoft 365 subscriptions was successful enough for investors to stay onboard for the ride. The rebound in personal computer (PC) sales expected throughout 2024 and 2025 should also provide a tailwind. 🤖

Lastly, we cannot forget about Snap, which is always volatile after earnings. The good news for bulls is that its volatility was to the upside this time after several quarters of downside. 🤩

The snippet below sums up the quarter well, with it beating handily across its most widely-followed metrics.

Revenue growth of 21% YoY showed a meaningful improvement from the six straight quarters of single-digit growth or sales declines. It’s been trying to rebuild its ad business since 2022, and it looks like it may have found some traction. 👍

Additionally, its cost-cutting efforts have helped it buoy profitability metrics like adjusted EBITDA, giving it more time to figure out the revenue side.

When expectations are low, improvements like this are enough to get people excited again. $SNAP shares are up 25% after the bell, with Stocktwits community sentiment pushing into “extremely bullish” territory. 🐂

Time will tell if the gains in these names hold until tomorrow’s open. But for right now, it looks like investors are looking past Meta’s woes and to more positive news from these three companies. 🥳

SPONSORED

FinChat.io Is The Complete Stock Research Platform For Fundamental Investors

With comprehensive data on more than 100,000 stocks, FinChat has everything you need to track and manage your investments.

From standard financial metrics like revenue and EPS to company-specific measures like AWS Revenue and Tesla Deliveries, FinChat tracks everything so you don't have to.

Best of all, FinChat’s conversational AI assistant can quickly and accurately answer all your investing questions.

“Show me Microsoft’s Cloud Revenue over the last 10 years”

“Summarize Palantir’s latest earnings call”

“How many paying subscribers does Netflix have?”

Get started for free or use code “STOCKTWITS” at checkout for 15% off any paid plans.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ECONOMY

Q1 GDP Numbers Spark Stagflation Debate

Just when we all got on the same page that the economy was holding up well, the labor market was strong (but not too strong), and inflation would slowly make its way back towards 2%, the economy threw us another curveball. 🙃

This morning first-quarter gross domestic product (GDP) rose 1.60% YoY, well below analyst estimates of 2.40% and down from 3.40% and 4.90% during the last two quarters. 🔻

Consumer spending was also lower than anticipated, rising 2.50% YoY vs. the 3.30% gain in the fourth quarter and estimates of 3.00%.

Meanwhile, the personal consumption expenditures price index (PCE), rose at a 3.40% YoY pace, marking its biggest gain in a year. Core PCE, which excludes food and energy, rose 3.70%, nearly double the Fed’s 2% target. 🥵

Slower economic growth and sticky inflation is the Fed’s worst nightmare, and the opposite of the “soft landing” that many believed had been achieved.

While it’s too early to tell if this is a new trend or some volatility in the short term, some bearish investors were quick to break out the “stagflation” calls, which would mean persistently high inflation combined with high unemployment and stagnant economic demand.

Clearly, it’s too early to declare that a reality, but that didn’t stop people from making predictions saying that we’re ultimately headed for another 1970s-style economy and market environment. ⚠️

If we see consistently similar data in the next six, twelve, or eighteen months, then we’re in a much different situation and have that discussion. But for now, market participants are continuing to focus on medium-term inflationary bets like commodity stocks as the inflation risk is clearly heating up. 🌡️

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

EARNINGS

Bristol Myers Bucks Broader Healthcare Boom

Pharmaceutical giant Bristol-Myers Squibb has been a contrarian in the healthcare sector lately, but not by its own choice. Its stock price has lagged its peers materially, with that gap widening today after its earnings report. 📝

Its adjusted loss per share was $0.04 narrower than anticipated, and revenues of $11.87 billion exceeded the $11.46 billion consensus estimate.

The company said much of the loss reflects a one-time charge of $6.30 per share related to recently closed deals. ❌

However, that forced it to lower its 2024 adjusted earnings guidance to $0.40-$0.70 per share. That’s down significantly from its previous forecast of $7.10 and $7.40, which did not include buyout and divestiture-related charges.

Still, in a low-growth environment where it expects a low single-digit rise in revenues for the full year, every penny of earnings matters. Management recognizes that, saying it’s implementing a “strategic productivity initiative” to drive $1.50 billion in cost savings by the end of 2025. ✂️

In the longer term, the company believes its acquisitions and related costs will help revive revenue growth and drive significant shareholder value. But in the short term, all investors see is new and existing drugs in the company’s pipeline underperforming expectations, giving them pause about believing management’s big-picture projections.

That disconnect between today’s results and tomorrow’s promises caused $BMY shares to fall another 9% today, extending its underperformance relative to the broader healthcare ETF $XLV. 📉

Despite the recent stint of underperformance, retail investors appear confident that the stock can stage a turnaround. Stocktwits community sentiment is in “extremely bullish” territory. We’ll have to wait and see what it takes to heal this divergence and get the company back on track. ❤️🩹

Bullets From The Day

🛜 Net neutrality is officially back after FCC vote. The Federal Communications Commission (FCC) banned internet service providers (ISPs) from messing with customers’ internet speeds, restoring tougher rules that were rolled back during the Trump administration. While the rules are nearly the same as those passed in 2015, the decision is setting the stage for a major legal battle with the broadband industry, which wants more control over how they power the modern digital economy. CNN Business has more.

🎃 Home Depot scares shoppers by starting to sell Halloween merchandise already. With the sales environment remaining slow, retailers are cooking up various ways to spur demand. One of those ways is by starting holiday sales earlier…and we mean way earlier than normal. Home Depot said that it’s holding its first-ever “Halfway to Halloween sale” online with select items, marking a stark contrast to last year’s timeline when products were made available online in July and in stores after Labor Day. Still, it says massive demand for several of its “skeleton” products last year prompted the change, and it expects some to still sell out despite its efforts to beef up supply. Now, that’s a scary thought... More from Axios.

⚡ Honda to build a “comprehensive EV value chain” in Canada. The Japanese automaker is partnering with several unnamed parties on a joint venture that will invest $11 billion in Ontario, Canada. The plans include new assembly and battery plants, as well as other facilities to support production of the all-electric and fuel cell-powered vehicles. While many automakers have pulled back their EV plans due to short-term headwinds, the largest players are pushing ahead with investments to prepare for the “all-electric” future many countries are aiming for. CNBC has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍