NEWS

Bond Breakdown Invigorates The Bears

Higher interest rates helped bears mount their latest assault against prices, closing the market red with the exceptions of several tech giants and commodity-related stocks. Let’s see what you missed. 👀

Today's issue covers stocks succumbing to the CPI surprise, Delta losing altitude despite solid results, and $RENT shares making a run for it. 📰

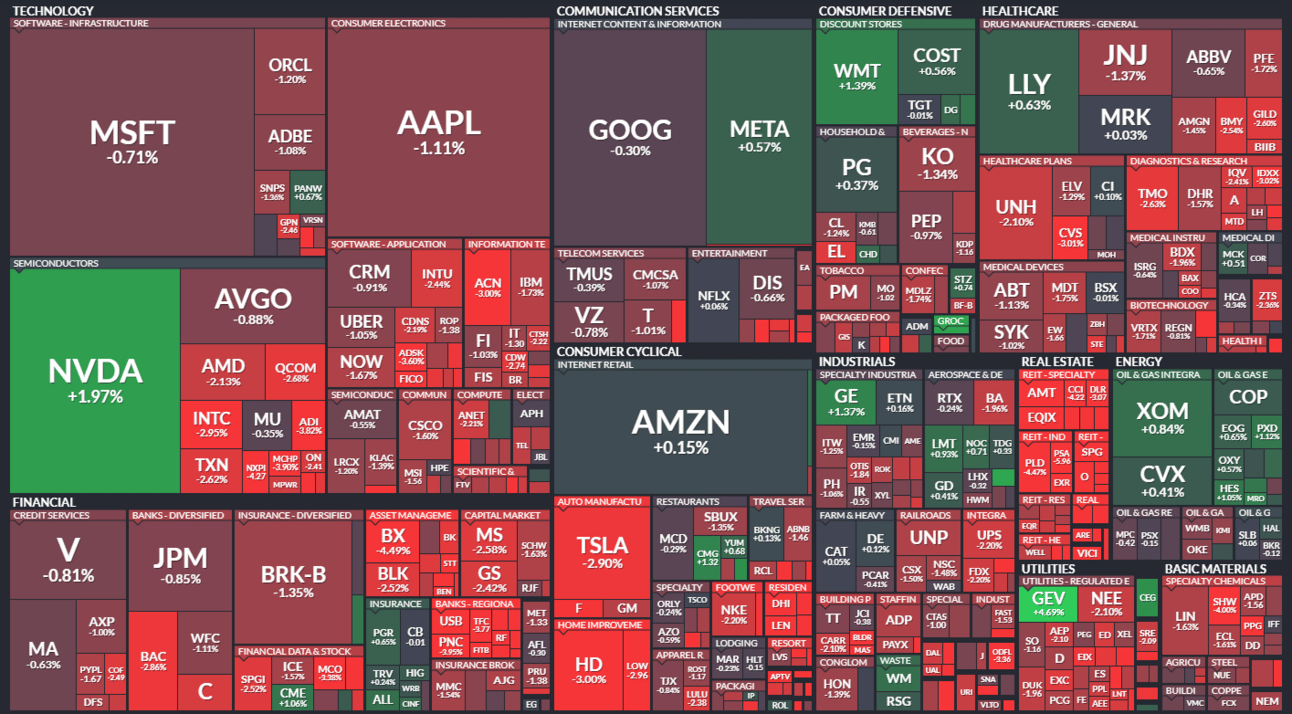

Here's today's heat map:

1 of 11 sectors closed green. Energy (+0.31%) led, & real estate (-4.11%) lagged. 💚

The Bank of Canada is the latest central bank to seek more disinflation proof before it moves forward with rate cuts, opting to keep its policy rate steady for a sixth straight meeting. ⏯️

U.S. wholesale inventories jumped 0.50% in February, bouncing back from a 0.20% decline in January and topping estimates for no change. 📦

Paramount Global shares remain volatile, falling 4% on news that three directors are stepping down as it continues merger discussions with Skydance Media. 📺

Alpine Immune Sciences soared on news that Vertex Pharmaceuticals will purchase the clinical-stage biotech company for $65 per share, or $4.90 billion in cash, as the healthcare consolidation continues. 💰

Alibaba shares popped 2% after founder Jack Ma praised the company’s reorganization over the past year via an internal memo. 👍

The Securities and Exchange Commission (SEC) found its next crypto target, sending Uniswap a Wells notice warning of a coming enforcement action. 🎯

Other active symbols: $TSLA (-2.90%), $DJT (-8.57%), $DXYZ (-12.50%), $RAPT (+6.87%), $BMR (-8.00%), $WING (+1.62%), & $SUKU.X (+130.23%). 🔥

Here are the closing prices:

S&P 500 | 5,161 | -0.95% |

Nasdaq | 16,170 | -0.84% |

Russell 2000 | 2,028 | -2.52% |

Dow Jones | 38,462 | -1.09% |

EARNINGS

Stocks Succumb To The CPI Scaries

For months, we’ve been discussing the disconnect between the market’s expectations for six rate cuts in 2024 and the Fed’s messaging around disinflation’s progress. ⚠️

Despite growing signs that inflation was stickier than many had hoped and that rates would need to stay higher for longer, the stock market partied on. But after a month or two of no progress in the major indexes and rates hitting YTD highs, it seems like the market is finally getting the message.

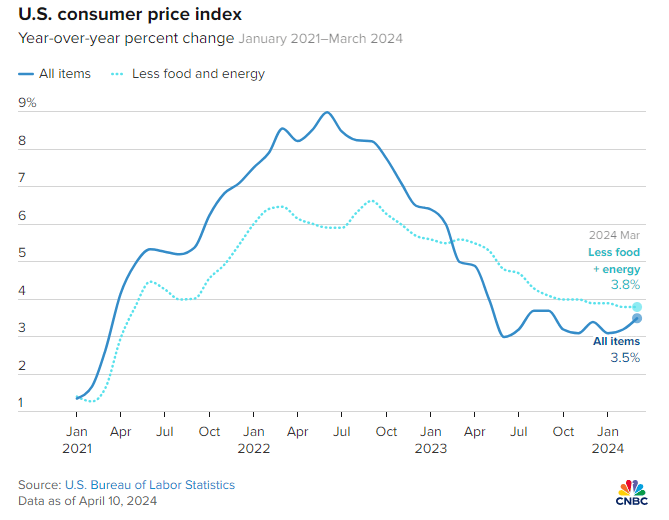

March’s consumer price index (CPI) rose 0.40% MoM and 3.50% YoY, 10 bps higher than economists anticipated. Core CPI, which excludes food and energy, also rose 10 bps more than expected at 0.40% MoM and 3.80% YoY.

While there remains some progress under the surface, services inflation continues to run hot on the back or surges in things like auto insurance and shelter. Meanwhile, the prices we all see at the pump ticked up as energy rebounded sharply. 🥵

As the chart above shows, inflation is not accelerating to the upside materially yet. But it’s not making further progress toward the Fed’s 2% long-term target either. As a result, it’s not surprising that the FOMC Minutes showed that members want more confidence in inflation moving towards their target before changing the policy approach.

Today’s data caused U.S. interest rates to hit new year-to-date highs and strengthened the U.S. Dollar, pushing it to 34-year highs vs. the Japanese Yen. 🫨

The market was betting big on rate cuts early this year, and now it seems like we might not get any until after the election. If that’s the case, then there’s a lot of pressure on the upcoming earnings season to deliver profit growth to support current valuations.

We’ll have to wait and see how the market handles tomorrow’s producer price index (PPI) data and Friday’s bank earnings. For now, though, there seems to be a cautious undertone among Wall Street professionals.

On the other hand, retail became more bullish after today’s action. The Stocktwits sentiment reading on the S&P 500 ticked up materially today, reaching “extremely bullish” territory for the first time in recent memory. 🐂

Retail has been right to buy the dip in the past and seems to be making that bet again. We’ll see if it pays off for them. 🤑

COMPANY NEWS

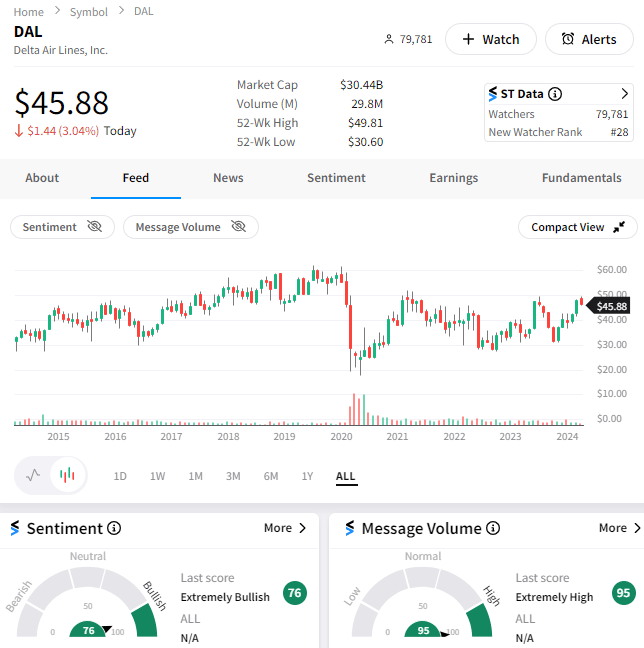

Delta Dives Despite Beating Expectations

The post-COVID travel boom should’ve been a slam dunk for travel-related companies like airlines. But in many cases, the opposite has been true, with even best-of-breed names like Delta failing to gain traction in the stock market. 😓

That disconnect between what’s happening in the economy vs. these stocks continued today, with Delta Air Lines falling after an earnings beat.

Adjusted earnings per share of $0.45 per share topped the $0.36 expected, but adjusted revenues of $12.56 billion were $0.03 billion shy of estimates. 💰

CEO Ed Bastian said bookings for both leisure and business travel remain strong ahead of peak travel season, even as inflation persists.

Business travel was a bright spot again, with corporate travel sales rising 14% YoY due to strength in the tech, consumer, and financial services sectors. On the revenue side, Delta is leaning into more premium offerings and looking to squeeze more dollars out of existing customers and driving record first-quarter domestic unit revenues. 💼

That said, growth is normalizing from its breakneck levels over the last few years. As a result, the company is focused primarily on optimization, restoring its most profitable core hubs, and delivering efficiency gains. Headcount at the airline is expected to rise in the low single digits YoY this year as it looks to minimize unit cost growth, which rose 1.50% YoY (ex-fuel). 🔺

Overall, the company reiterated its full-year forecast for earnings of $6-$7 per share and free cash flow of $3-$4 billion.

Despite prices failing to crack the $50 level once again and remaining well below pre-pandemic highs, the Stocktwits community is sticking with it. Sentiment remained in “extremely bullish” territory amid surging message volume, showcasing the fierce debate happening around today’s results. 🐂

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

EARNINGS

$RENT Shares Go For A Run

Designer clothing rental subscription company Rent The Runway has had a rough go of it as a public company, incinerating shareholder value on a regular basis. However, every once in a while, the heavily-bet-against stock will pop back on the radar after reporting some good news. 👍

Today is one of those days, with the company reporting fourth-quarter revenues of $75.80 million, topping the $74.20 million expected. Meanwhile, the company’s loss per share narrowed from last year but was still wider than analysts anticipated.

Revenue flatlining is better than a decline, with ending and average active subscribers both falling just 1% YoY. Additionally, adjusted EBITDA rose to $11.20 million, but gross margins fell by 480 bps to 39.40%. 📊

Driving the improvements was the launch of a premium personal concierge service, which executives believe can drive growth and get free cash flow to breakeven levels during fiscal 2024.

The cost-cutting progress and stabilization of revenues and members were enough to get shareholders excited about the company’s turnaround potential. Notably the stock rose nearly 40% before reporting after the bell, adding another 60% on the news. 🤷

It’s been a while since the stock has run at all; traders will be stalking this stock to see if it can continue this upward momentum. Meanwhile, longer-term investors and traders are still debating whether this is a short-term rally or the start of a sustainable trend reversal. Time will tell. 🤷

Bullets From The Day

📱 Apple doubles India iPhone production as shift away from China continues. The consumer tech giant produced $14 billion worth of iPhones in India over the last fiscal year, meaning it now makes about 14% of its iPhones in the country. In addition to becoming a major manufacturing hub for Apple, it’s also looking to tap India’s massive potential consumer base for future growth. But so far, sales have been off to a rocky start in the country. CNBC has more.

📝 Hollywood labor backs AI transparency bill as copyright debate heats up. As generative artificial intelligence tools make their way into the entertainment industry, those supporting the industry are throwing their weight behind a bill introduced by Rep. Adam Schiff on Tuesday. It would require firms to disclose copyrighted works used to train generative AI systems in a long-shot bid to provide companies and creators some recourse in their fight to maintain ownership of their creative works. More from The Hollywood Reporter.

🤖 Meta unveils new custom AI chip as tech giants race to claim the top spot. The company has invested billions in its own AI efforts, with a large chunk of it being spent to develop hardware (chips) to run and train its AI models. Its most recent update is a “next-gen” Meta Training and Inference Accelerator (MTIA), which runs models including for ranking and recommending display ads on Meta’s properties. However, the company admits this won’t replace GPUs for running or training models. Instead, it will complement them. TechCrunch has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍