NEWS

Breaking A Streak Of Sh*tty Septembers

Source: Tenor.com

U.S. stocks persevered through the seasonally weak period and closed in positive territory for the first September since 2019. With the market holding onto strong gains through the third quarter…investors and traders are now asking whether that strength will continue into year-end. 👀

Today's issue covers China’s bull market behavior, Stellantis's failure to regain traction, and surprising quarter-end stats. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with real estate (+0.86%) leading and materials (-0.56%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,762 | +0.42% |

Nasdaq | 18,189 | +0.38% |

Russell 2000 | 2,230 | +0.24% |

Dow Jones | 42,330 | +0.04% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $EMKR, $PRME, $TTEC, $ZCMD, $KZR 📉 $HUBC, $UAVS, $PSTV, $OTLY, $ANF*

*If you’re a business and want to access this data via our API, email us.

STOCKS

SoftBank’s Soft Spot For Moonshot Bets 😄

Domestic investors and traders in China finally got the memo about the government’s stimulus efforts and are rushing to buy stocks, causing the biggest single-day rally since 2008. 🤩

Domestic A-shares registered their highest-ever turnover, with foreign vehicles like U.S. ETFs experiencing the most call volume since 2020, trading 3.40 million contracts last week alone.

The stimulus program outlined last week is designed to not only prop up the economy, but the markets as well. A new swap program allows funds, insurers, and brokers easier access to capital to buy stocks.

What could possibly go wrong there, right? 🙃

Hong Kong’s market will be closed on October 1st, while Shanghai’s Stock Exchange will close from October 1st to 7th for the “Golden Week” holiday. That should cool the recent fervor a bit, but investors and traders alike will be closely watching the action to see just how far this new bull run can go. 🐂

Meanwhile, its neighboring market, Japan, tumbled after Shigeru Ishiba’s surprise victory in the ruling party’s leadership race dampened bets on a boost of more monetary stimulus. After decades of a low-rate policy, Japan’s new leadership is taking a more hawkish approach to stabilize the yen while not cutting off economic growth. 💹

With Chinese stocks (and global stock markets) roaring back, Japan’s SoftBank reportedly plans to invest $500 million in OpenAI’s latest round from its Vision Fund. SoftBank has had a rough bout of timing its other high-flying investments, so many market participants view this as another sign that conditions are getting a bit “frothy” in markets once again.

Time will tell if their move is prudent or foolish. But for now, Asia’s investors are partying on … when they return from their holiday, that is. 🎊

COMPANY NEWS

Stellantis Still Hasn’t Regained Traction 🪫

While Stellantis’ stock shares the same letters as Tesla in its ticker symbol, it has unfortunately not shared the same performance as the electric vehicle leader.

The world’s fourth-largest carmaker slashed its full-year earnings forecast today, blaming a “deteriorating global industry backdrop.” It anticipates finishing the year with a negative cash flow of $5.60 to $11.20 billion instead of the positive territory it initially expected to land in. 😨

Management said it’s trying to accelerate efforts to turn its North American operations around, bringing dealer inventory levels to no more than 300,000 vehicles by the end of 2024, one quarter ahead of schedule. It’ll do so by reducing shipments of vehicles by 200,000 and offering sales incentives.

After a dismal first-half performance, the struggling Jeep and Ram maker seeks a new CEO to succeed Carlos Tavares. United Auto Workers (UAW) union leadership met with the company to review contract violations and Stellantis's alleged “illegal behavior.” 👨💼

$STLA shares fell 13% on the day to new 52-week lows, with Stocktwits sentiment sitting in neutral territory as investors and traders debated the company’s future prospects. 😐

Source: Stocktwits.com

Meanwhile, competitor Ford is rolling out a new program to boost its electric vehicle (EV) sales. It will now include free home-charging installation and other benefits for new buyers, addressing concerns that may have left some consumers on the sidelines. 🔌

Still, Ford shares remain at the lower end of a multi-year range as the auto industry continues to face rising costs and lower pricing power in key markets.

STOCKTWITS COMMUNITY EVENTS

Join Us For A Live Event In NYC: Oct. 9th 🧑🏫

The CMT Association and Stocktwits are hosting a "Pitch The Pros" event live in NYC on October 9th. This “first-of-its-kind” event will allow young professionals, students, or anyone else to share their analysis and receive feedback from three Wall Street professionals. 🧑🏫

This is a great chance to hone your skills, especially since participation and attendance are free! We’ll also have a networking happy hour with investors, traders, analysts, media professionals, and others, chatting about the market’s latest trends! Register below, and we’ll see you there. 🍻

STOCKS

Surprising Quarterly Performance 😮

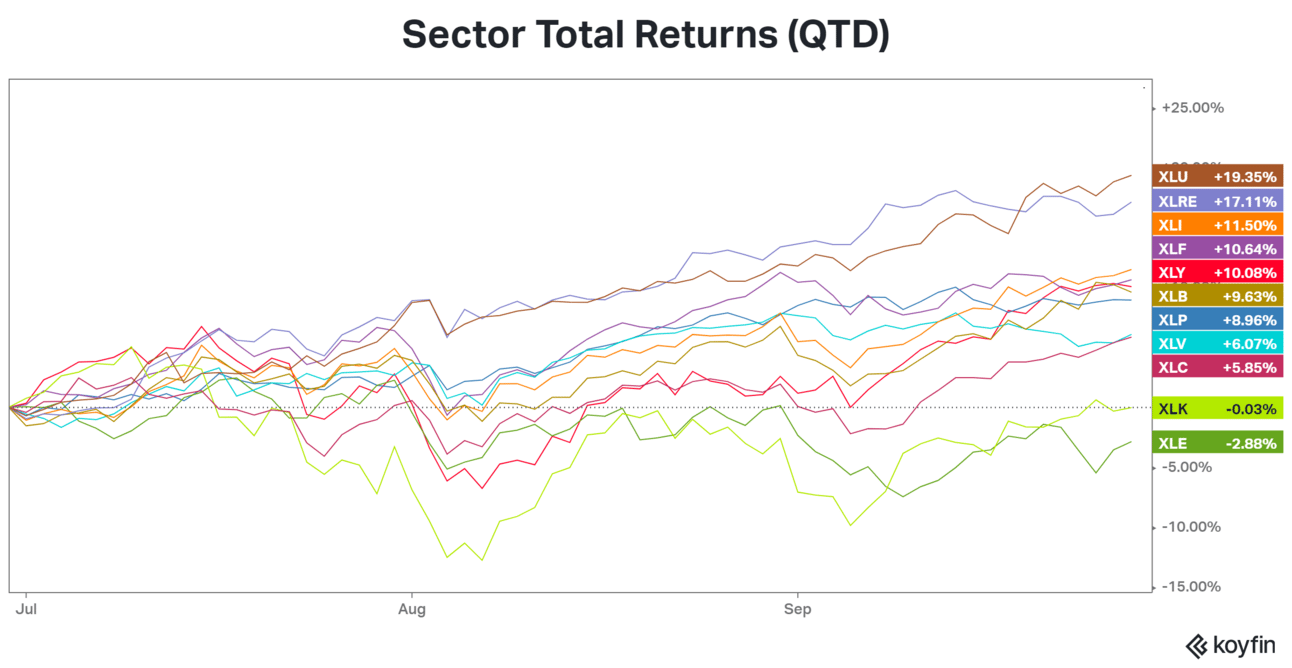

It was another solid quarter for the stock market. But one stat worth sharing is that the technology sector was down during this period, joining energy in its slump.

On the upside, utilities and real estate were the clear beneficiaries of the market’s rate-cut bets, followed by cyclical sectors like industrials, financials, and consumer discretionary. ✂️

Source: Koyfin.com

From an asset class perspective, agricultural commodities rebounded sharply, along with precious metals and the yen. In the stock market, the small-cap Russell 2000 finally caught up with its larger-cap peers, though investors and traders are waiting for it to finally make a new high. Maybe in Q4? 🌾

Source: Finviz.com

Investors and traders continue to debate what the rest of the year will look like. Will we see a repeat of this quarter’s themes, or are we set for a new leadership group to take the baton?

We’ll have to wait and see. But overall, it appears Wall Street and retail investors alike are betting on further upside from the major stock market indexes around the globe. 🤑

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: S&P Global Manufacturing PMI (9:45 am ET), JOLTs Job Openings (10:00 am ET), ISM Manufacturing Employment (10:00 am ET), Fed Bostic & Cook Speeches (11:00 am ET), Fed Barkin/Bostic/Collins Speeches (6:15 pm ET). 📊

Pre-Market Earnings: Palatin Technologies ($PTN), Paychex ($PAYX), United Natural Foods ($UNFI), and Acuity Brands ($AYI). 🛏️

After-Hour Earnings: Nike ($NKE), Cal-Maine Foods ($CALM), Lamb Weston Holdings ($LW), and Resources Connection ($RGP). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

/

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋