NEWS

Bulls Get A PCE Of The Action

Source: Tenor.com

After several weak sessions, U.S. stocks finally caught a bid, but sentiment remains bearish territory as investors fear tariffs and other weekend surprises. With many leading stocks down several days and a better-than-expected inflation print coming together, the market is setting the stage for a potential comeback next week. 👀

Today's issue covers January’s cooling inflation rate, Terawulf’s turnaround, a specialty insurance provider popping, and more from the day. 📰

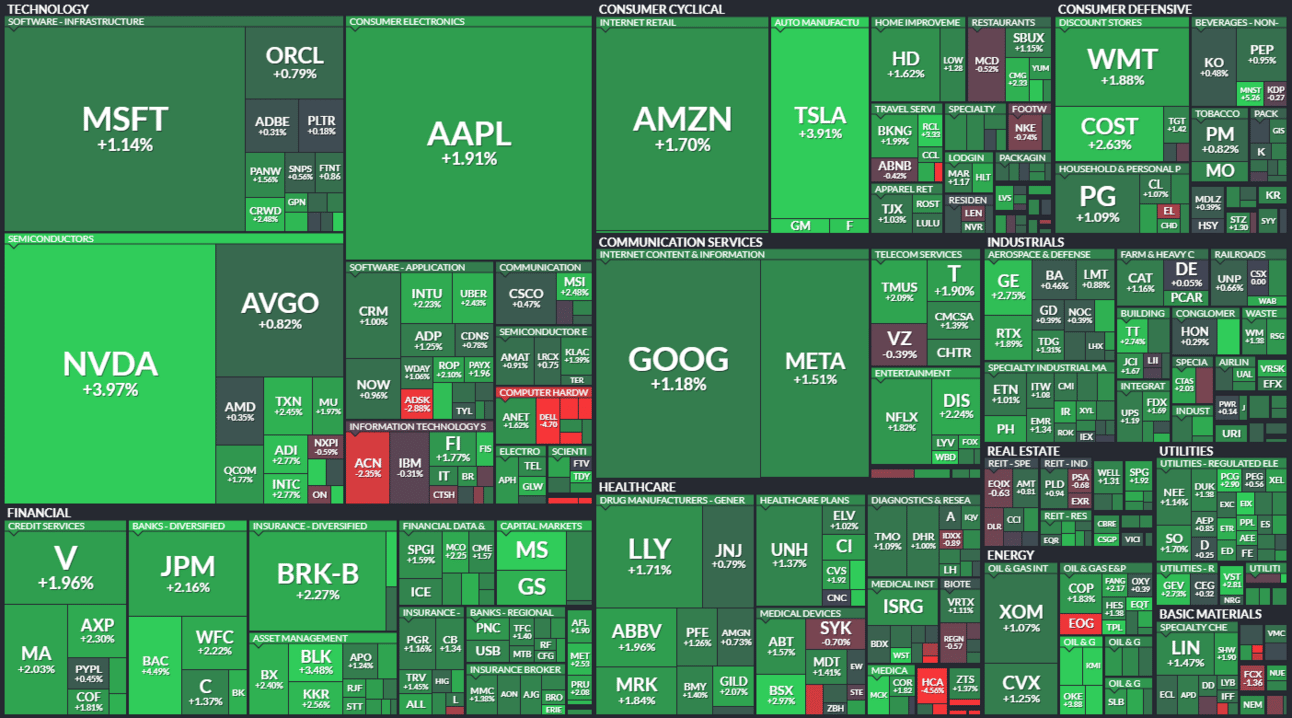

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with financials (+2.05%) leading and real estate (+0.70%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,955 | +1.59% |

Nasdaq | 18,847 | +1.63% |

Russell 2000 | 2,163 | +1.09% |

Dow Jones | 43,841 | +1.39% |

ECONOMY

Fed’s Key Inflation Measure Cools 🌡

The Federal Reserve’s preferred inflation metric, the core PCE price index, fell to a seven-month low during January, helping ease concerns from other inflation metrics that prices could accelerate to the upside again.

Healthcare services costs drove the growth slowdown, falling 0.13% MoM and rising just 1.8% YoY. This metric has a 19% weighting in core PCE, so changes in it make big waves in the overall metric. 🔻

Still, this does little to change the market’s overall rate cut hopes. Instead, investors view this as slightly reducing the risk of a sharp upside surprise in inflation.

However, consumer spending flipped sharply negative during January despite personal income rising much faster than expected (+0.9% vs. 0.3% estimated). Government benefits like Social Security, higher compensation, and higher dividend income drove the increase. 💸

Consumer spending slipped 0.2% in January after rising 0.8% in December, driven by a 1.2% decline in goods spending. Colder-than-anticipated weather across the country and overall macro uncertainty weighing on consumer sentiment are the likely culprits. However, investors still watch these numbers closely due to their large weighting in the GDP calculation.

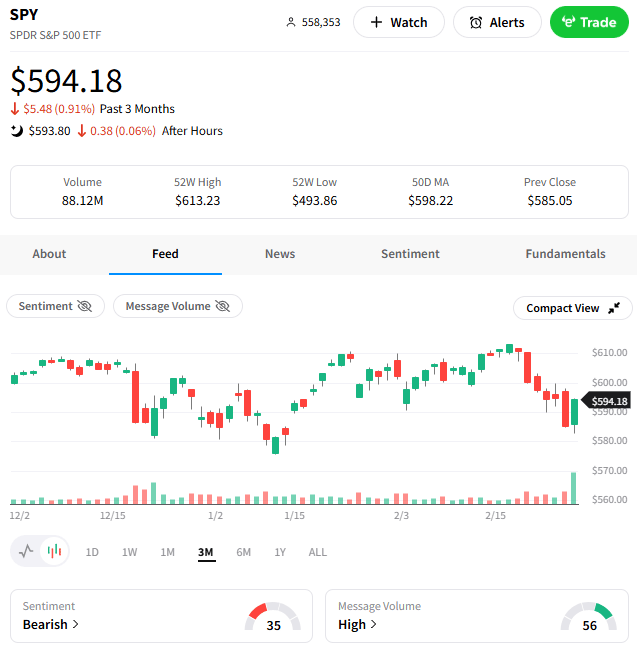

Despite today’s bounce in stock prices, Stocktwits sentiment remains in ‘bearish’ territory. Geopolitical concerns, particularly around the U.S.’s approach to the Russia vs. Ukraine war, remain at the top of investors’ minds. And with tariffs and other news bringing downside surprises lately, many are taking a cautious approach to risk. 🛡

SPONSORED

Outperforming Tesla: The Battery Tech Smart Money Is Backing

$TSLA owners, pay attention: Paladin Power's system CRUSHES Powerwall specs - replacing up to 8 units with ONE, delivering 7X inverter output at HALF the cost per watt hour.

The proof? 500% YoY sales growth. $8M+ already secured from investors who recognize an asymmetric opportunity when they see it. You're looking at the company that will dominate the $150B battery market.

For a limited time: 20% discount on shares + up to 40% product discounts. The battery sector doubles every 2-3 years, and Paladin is positioned perfectly for this exponential ramp.

Smart money moves early. More than 2,500 investors already have. Will you?

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Paladin Power’s Regulation CF offering. Please read the offering circular and related risks.

COMPANY NEWS

Terawulf Tears Up The Shorts After Earnings 🪙

The Bitcoin miner bucked the broader crypto market’s trend after announcing an expansion into AI-focused high-performance computing (HPC) hosting. Its expansion into this new business line overshadowed missing fourth-quarter earnings and revenue expectations. 🥳

Full-year revenue doubled YoY to $140.1 million, even as fourth-quarter revenue missed expectations by nearly 10%. Self-mining capacity rose by 94% YoY to 9.7 exahashes per second (EH/s). ⛏

The company also strengthened its balance sheet and has repurchased over $150 million shares from its $200 million share buyback program. However, like its peers Marathon Holdings and Riot Platforms, Terawulf is diversifying its business to help reduce exposure to Bitcoin’s price cycles and utilize its expertise in power-intensive infrastructure to service other industries.

Shares surged 16% today and found support in a region similar to the one it has in the past year. Stocktwits sentiment improved from ‘bearish’ to ‘bullish’ as investors applauded the business update and long-term potential. 🐂

PRESENTED BY STOCKTWITS

“The Weekend Rip” With Ben & Emil 😆

Hosts Ben and Emil talk Katy Perry going to space, Steve Cohen’s bear thesis, retail’s market sentiment sinking sharply, Dave Portnoy’s ironic questions, Fuzzy Panda’s short thesis on AppLovin, the current state of the meme coin market, and more from a crazy week in the financial markets. 😵💫

STOCKS

Other Noteworthy Pops & Drops 📋

Rocket Labs ($RKLB +4%): The end-to-end space company received several price target cuts from Wall Street following weak earnings and forward guidance.

Frontline ($FRO +5%): The oil tanker shipping company’s fourth-quarter results topped estimates, with revenue rising 7% YoY but higher costs hitting earnings.

NextDecade Corp. ($NEXT +13%): The company outlined its development plans for expansion capacity at the Rio Grande LNG Facility site beyond Trains 1 through 5.

DoubleVerify Holdings ($DV -36%): The digital media measurement, data, and analytics platform provider announced disappointing results for the fourth quarter of the fiscal year 2024 and issued mixed guidance.

Bitcoin ($BTC.X -1%): Stocktwits sentiment sank into bearish territory following its first break below its 200-day moving average since October.

CHART OF THE DAY

Specialty Proper Insurance Provider Pumps To New Highs 🤑

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

COMMUNITY VIBES

One Tweet To Sum Up The Week 🤣

Links That Don’t Suck 🌐

😂 Citi reportedly transfers $81 trillion to client account erroneously, mistake rectified within hours

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋