NEWS

Bulls Hold The Bears At Bay

Higher rates pressured stocks and risk assets again, but bulls are not going down without a fight. Eyes are on Friday’s nonfarm payroll data, which many expect will decide the market’s next directional move. Let’s see what else you missed. 👀

Today's issue covers disclosures sending two stocks plummeting, Apple’s next big bet, and a chart highlighting silver’s long-term breakout. 📰

P.S. Want the best charts and trade ideas delivered straight to your inbox? Starting next Monday, we’re doing just that with our new “Chart Art” newsletter. See what to expect and subscribe for a free gift toward the end of today’s newsletter. 🎁

Here's today's heat map:

7 of 11 sectors closed green. Communications (+0.79%) led, & consumer staples (-1.10%) lagged. 💚

Labor market strength continued as ADP private payrolls increased by 184,000 in March, with those switching jobs seeing a 10.10% YoY increase in wages compared to 5.10% for those staying in their jobs. 💼

The services sector stayed in expansion territory during March, with the S&P Global Services PMI and ISM Services PMI both ticking lower but staying above their respective expansion/contraction thresholds. 🔺

Commodities remain in focus, with oil paring gains after U.S. crude stocks rose unexpectedly last week. Notably, the Biden Administration said it will not refill the Strategic Petroleum Reserve given the recent rise in prices. 🛢️

Gold pushed to new all-time highs while silver surged as it played catch-up, and copper continued to break out. Mining stocks have been hot lately, but silver miners specifically have seen significant runs in recent days. ⚒️

Cannabis stocks also remain in focus as buyers squeeze the shorts while the sector’s upward momentum is still intact. Canopy Growth jumped 28%, Aurora Cannabis rose 50%, and many others were on the move, too. 🥦

Disney shares shed 3% on news that Bob Iger won the hard-fought proxy battle against activist investors Trian Fund Management and Blackwells Capital at its annual shareholder meeting. 🐭

Speaking of the media space, Paramount Global soared 15% on news that it’s entered exclusive merger talks with Skydance for the next 30 days. The company is looking to secure a deal better than Apollo’s $26 billion offer. 🤑

The market continues to fiercely debate Tesla’s future, with a prominent bear saying the automaker could “go bust” and fall to $14 per share. We’ll be hosting a live chat tomorrow at 5 pm ET with @WholeMarsBlog and @SawyerMerritt to discuss Tesla’s fate. Reserve your spot here. 👀

Other active symbols: $LEVI (+7.50%), $ELF (-11.92%), $KULR (+0.44%), $APAC (+43.03%), $VNDA (+29.16%), $LGVC (-7.24%), & $HYMC (+8.90%). 🔥

Here are the closing prices:

S&P 500 | 5,211 | +0.11% |

Nasdaq | 16,277 | +0.23% |

Russell 2000 | 2,076 | +0.54% |

Dow Jones | 39,127 | -0.11% |

COMPANY NEWS

Apple’s Next Big Bet Is Personal Robotics

With Apple abandoning its electric vehicle (EV) ambitions, the world is impatiently awaiting news on what the consumer tech giant’s next big bet will be. And today, we got a glimpse into that courtesy of Bloomberg.

It’s reported that Apple has teams investigating a push into personal robotics, with engineers exploring a mobile robot that can follow users around their homes. It’s also developed an advanced tabletop home device that uses robotics to move a display around. 🤖

These endeavors are still in their early stages and are one of many “small bets” that the company hopes can turn into “big bets” over time. Others include its push into mixed-reality goggles and embedding AI into its current products.

Ultimately everyone knows Apple prints money from its current operations, buying back shares and paying a dividend to reward shareholders. 💰

But the core issue remains flatlining revenue growth, which management doesn’t have a clear plan to accelerate at scale. Until that issue is solved, Apple’s shares will likely be overshadowed by “sexier” market stories. 🤷

While Apple looks to nail its next big decades-long bet, other companies, like JPMorgan Chase, are capitalizing on shorter-term opportunities.

The nation’s largest bank said it’s created a new unit called Chase Media Solutions, which will let marketers put targeted deals and discounts in front of customers based on their spending history. 💳

The company already offered customers less-targeted deals through a program called Chase Offers. However, it plans to supercharge that program by working directly with marketers to add more relevant offers brokered through Chase Media Solutions.

We’ve talked a lot about the proliferation of advertising across every aspect of our lives and don’t see that trend ending anytime soon. Attention is a valuable asset class, and yours is always for sale to the highest bidder. 💾

At least you’ll get some coupons out of it…thanks, Chase. 🙃

COMPANY NEWS

Some Dire Disclosures

Two stocks were on the move today after revealing some unpleasant news about their underlying businesses. 📰

The first was chip giant Intel, which revealed a $7 billion operating loss for its semiconductor manufacturing business (AKA the foundry business). Sales in 2023 fell 31% YoY, while its operating loss widened nearly 35%.

This is the first time Intel has disclosed revenue totals for its foundry business alone since it typically designed and manufactured its own chips and reported a final chip sale number. 🧐

However, it’s been pitching investors on a plan to continue making its own processors, but begin making chips for other companies. While it may be a solid strategy in the long term, it will require patience from investors.

That’s because management expects the foundry’s losses to peak in 2024 and eventually break even “midway” between now and the end of 2030. 😬

As a result, the stock isn’t getting any short-term love, especially as it underperforms most of its peers. Shares fell 8% today, but notably, Stocktwits sentiment remained in bullish territory as retail debated the news. 📉

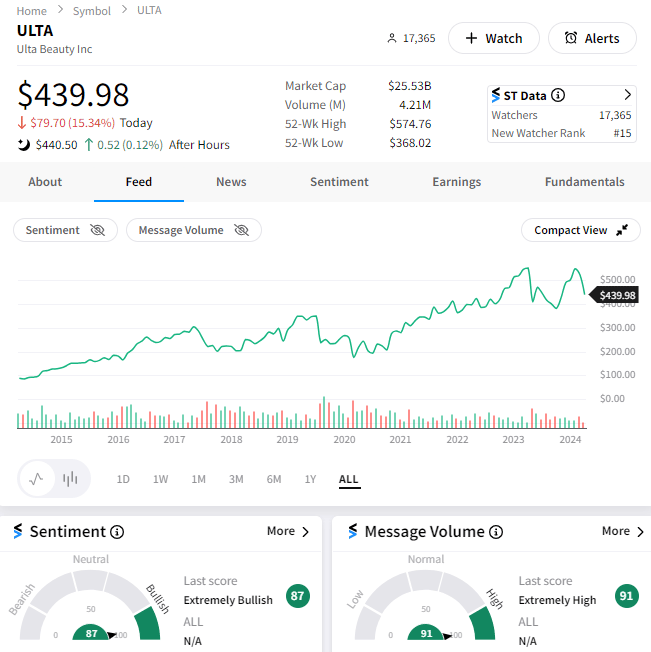

Next up is Ulta Beauty, whose CEO warned of cooling demand in the beauty category. While management had expected demand to moderate, it said the slowdown has been “a bit earlier and a bit bigger than initially thought.” ⚠️

At the same time, other retailers, such as Macy’s and Kohl’s, have been trying to drive sales growth by expanding their beauty offerings.

Slowing demand and increased competition aren’t a great combination, so Ulta’s shares led the decline today and dragged E.L.F. Beauty, Estee Lauder, Coty, and other industry players down with it.

Interestingly enough, Stocktwits sentiment remains in “extremely bullish” territory despite prices falling 15% today alone. We’ll see if retail’s optimism toward buying the dip pays off or if there’s more downside ahead. 🐂

STOCKTWITS “CHART ART”

Silver Shines Amid Commodity Comeback 🤩

If you liked the chart and commentary above, you’ll love our new “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

We’re officially launching on Monday, April 8th. But to sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

🫨 Taiwan earthquake misses the world’s largest semiconductor hub. The epicenter of the 7.4-magnitude quake was 90 miles south of the capital, Taipei, where Taiwan Semiconductor Manufacturing’s main facilities are located. While operations were suspended temporarily, it appears there was no damage to critical tools, and overall operations remain normal. With the country making 80% to 90% of the highest-end chips, disruptions would have had a material impact on many major companies. Axios has more.

💵 Spotify raises prices again, blaming audiobooks. With last year’s price hike not impacting churn and new user growth all that much, the music streaming company is trying to squeeze in another $1 to $2 increase for several countries by the end of April and for U.S. customers sometime “later this year.” Spotify has had to raise prices to support its push into audiobooks but recognizes not everyone wants to pay for this type of content. So, it’ll also roll out a “basic” plan at current rates to keep those customers happy. More from The Verge.

❌ OpenAI-backed Ghost Autonomy is shutting down. The startup working on autonomous driving software for its automaker partners raised nearly $220 million but is still shutting down. The path to long-term profitability was uncertain, so the company is currently exploring how to find a new home for its technology during a challenging time for the industry. Recent issues at GM’s Cruise unit faced major setbacks last year, renewing the regulatory and public spotlight on the autonomous vehicle space that often moves at a “two-steps forward and one-step back” pace. TechCrunch has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍