NEWS

Bulls Hold Off A CPI Slide

Source: Tenor.com

Bears found an edge early in the day after inflation data came out, but bulls battled back midday and held on into the close. Tomorrow’s a big day with retail sales and Walmart giving investors a much-needed read into U.S. consumer trends. Let’s see what else you missed. 👀

Today's issue covers inflation’s progress, $K shares rocketing to Mars, Victoria’s Secret soaring on CEO news, & Apple’s latest “innovation.” 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with financials (+1.22%) leading and communications (-0.57%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,344 | +0.01% |

Nasdaq | 16,781 | +0.21% |

Russell 2000 | 2,062 | -0.91% |

Dow Jones | 39,357 | -0.36% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $RSKD, $ALBT, $LITE, $VSCO, $SIGA 📉 $EAT, $VLD, $SPRB, $DLO, $SBUX*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Steelmaker Slump Prompts Global Economy Worries 😟

U.S. consumer price growth slowed to 2.90% YoY, its lowest rate since 2021. Core CPI rose 0.20% MoM and 3.20% YoY, meeting expectations and furthering the case for a September rate cut. 🔻

Certain aspects of inflation remain sticky, but shelter prices once again made up the vast majority of this month’s gains. Eggs and subscription/rental prices for videos/video games made headlines due to a more than 5% jump each.

Mortgage rates have fallen to their lowest level in over a year, and people are taking advantage, with refinances surging 35% WoW and 120% YoY. 🏘️

Despite some relief, consumer sentiment remains subdued by ‘recession-like’ symptoms hitting Americans across the low to middle-income scales.

Additionally, concerns about the global economy remain. China’s Baowu is the world’s largest producer of steel, controlling 7% of the market. It warned that China’s steel sector is experiencing a '“harsh winter” that will be “Longer, colder, and more difficult to endure than we expected.”

Industrial metals like steel are an important barometer of economic demand, and right now, China is dealing with a major oversupply issue given its sluggish economy and overall growth trajectory. ⚠️

M&A

Acquisition Bid Sends $K Shares To Mars 🚀

Earlier in the week, Kellanova shares soared on rumors that M&M owner Mars is acquiring the Kellogg spin-off company. Today, that rumor was confirmed.

Mars is buying the snack-focused company for $35.90 billion in cash, bringing together several of the largest U.S. candy and snack brands. 🥨

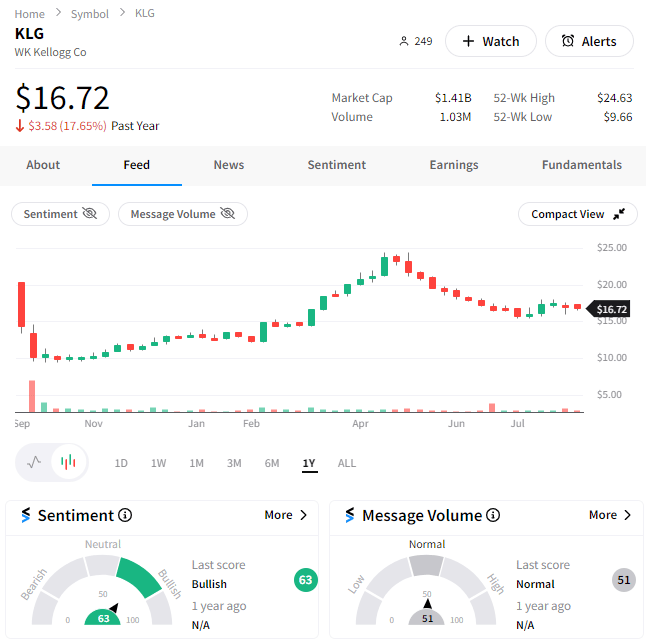

If it receives regulatory approval, the move will make WK Kellogg Co. the last publicly traded part of the business. The cereal segment will continue to trade under the ticker symbol $KLG.

Stocktwits sentiment ticked back into ‘bullish’ territory, but investors remain skeptical about the company’s long-term potential now that the “better” part of the spinoff has found a suitor. 🤷

COMPANY NEWS

The Latest “Stock Boost” Hack Is Executive Changes 💼

The easiest way to raise your stock price has been to mention artificial intelligence (AI), but for beaten-down companies where that’s not an option, executive changes are doing the trick.

Starbucks pulled the CEO lever by stealing Chipotle’s top guy, and its stock soared 25%. Today, Victoria’s Secret followed suit, snagging Rihanna’s Savage X Fenty CEO as its new leader and sending shares higher by 16%.

While the stock is still down significantly from its all-time highs, retail investors are betting on this experienced CEO to turn the ship around. Stocktwits sentiment hit a one-year high at 97/100 on the news. 🐂

Meanwhile, the market is scouring the latest 13-F filings to see what the biggest players did last quarter. 🕵️

Since we’re talking consumer brands, it’s worth mentioning Berkshire Hathaway taking a stake in Ulta Beauty, Bill Ackman buying Nike shares, and Michael Burry adding to his Alibaba position. 📝

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets on October 20-22. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Less than 50 tickets remain, so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

COMPANY NEWS

Apple Unveils Its Latest “Innovation” 🧐

The consumer tech giant’s plans “leaked” and were all the buzz on social media this afternoon. As expected, many poked fun at the ‘new,’ thinner iPhone 17.

Additionally, Bloomberg reported that Apple is moving forward with developing a pricey tabletop home device that combines an iPad-like display with a robotic limb. Again, not something anyone was asking for, but maybe it could be the next big thing. 🦾

Meanwhile, Cisco is jumping on the news that it will reallocate its resources toward AI and cybersecurity, cutting 7% of its workforce in the process.

While the “Magnificent 7” have more cash than they know what to do with, the other tech dinosaurs, like Cisco and Intel, struggle to find direction in this brave new world. Time will tell if their cuts are enough to turn things around. ✂️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: retail sales (8:30 am ET), initial/continuing jobless claims (8:30 am ET), industrial production (9:15 am ET), business inventories (10:00 am ET), and NAHB housing market index (10:00 am ET).

Pre-Market Earnings: Walmart ($WMT), Alibaba ($BABA), JD ($JD), Deere ($DE), Grab Holdings ($GRAB), Tapestry ($TPR), and Golar LNG ($GLNG). 🛏️

After-Hour Earnings: Applied Materials ($AMAT), H&R Block ($HRB), Sigma Lithium ($SGML), Coherent ($COHR), and Phoenix Motor ($PEV). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋