NEWS

Bulls Keep On Streaking

Stock markets around the globe continued their push to new highs, with the S&P 500 now green for 16 of the last 18 weeks. Meanwhile, tech stocks continue to rally, with Nvidia closing above the $2 trillion market cap mark for the first time ever. Let's see else what you missed. 👀

Today's issue covers the market rally recharging heavily-shorted stocks, physical gold and crude oil joining the party, and mid-cap stocks new milestone. 📰

P.S. Over the next month, we’re transitioning our newsletter platform to Beehiiv. If you’re reading this, you’ve been switched over and may notice some changes as we tweak the formatting. To ensure our emails reach your inbox, please whitelist [email protected]

Here's today's heat map:

9 of 11 sectors closed green. Technology (+1.83%) led, & utilities (-0.61%) lagged. 💚

The ISM Manufacturing index contracted for the sixteenth consecutive month, with demand moderating and output dropping. U.S. consumer sentiment also ticked down slightly as persistent uncertainty about the U.S. economy weighs on sentiment. 🔻

Fisker shares recovered some of its post-earnings losses on news that Nissan is in talks to partner with, and invest in, the company. Terms being discussed include investing more than $400 million in Fisker's truck platform and building its planned Alaska pickup at one of its U.S. assembly plants. ⚡

Boeing remained volatile after confirming that it's in talks to buy back fuselage maker Spirit Aerosystems after a series of quality defects. Meanwhile, Daimler Truck surged to all-time highs after announcing a record full-year profit and a 2 billion euro share buyback. 🏭

Social media giant Reddit is reportedly seeking a valuation of up to $6.50 billion for its upcoming initial public offering (IPO). 💰

Other symbols active on the streams: $MRVL (+8.30%), $AVGO (+7.59%), $AMD (+5.25%), $DELL (+31.62%), $SOUN (-18.67%), $BIVI (+52.42%), $JL (+15.50%), & $MINM (+35.12%). 🔥

Here are the closing prices:

S&P 500 | 5,137 | +0.80% |

Nasdaq | 16,275 | +1.14% |

Russell 2000 | 2,076 | +1.05% |

Dow Jones | 39,087 | +0.23% |

STOCKS

Plug Power Recharges Amid Market Rally

It was another day of records for the U.S. stock market as more and more stocks got snatched up in the bullish animal spirits. Let's continue this week's trend of pointing out the ragingly bullish action traders have been dealing with. 👇

Below is a chart of the S&P 500 showing prices rising for 16 of the last 18 months, posting a 25% rally since the end of October. It was also announced after the bell that Super Micro Computer and Deckers Outdoor will join the index, replacing Whirpool and Zions Bancorp. 📈

Meanwhile, the "Amazon of Africa" we highlighted over a month ago has rebounded sharply. The one-month chart of 30-minute candles shows how steep and orderly the rally has been, as heavily shorted stocks continue to be squeezed. 🛒

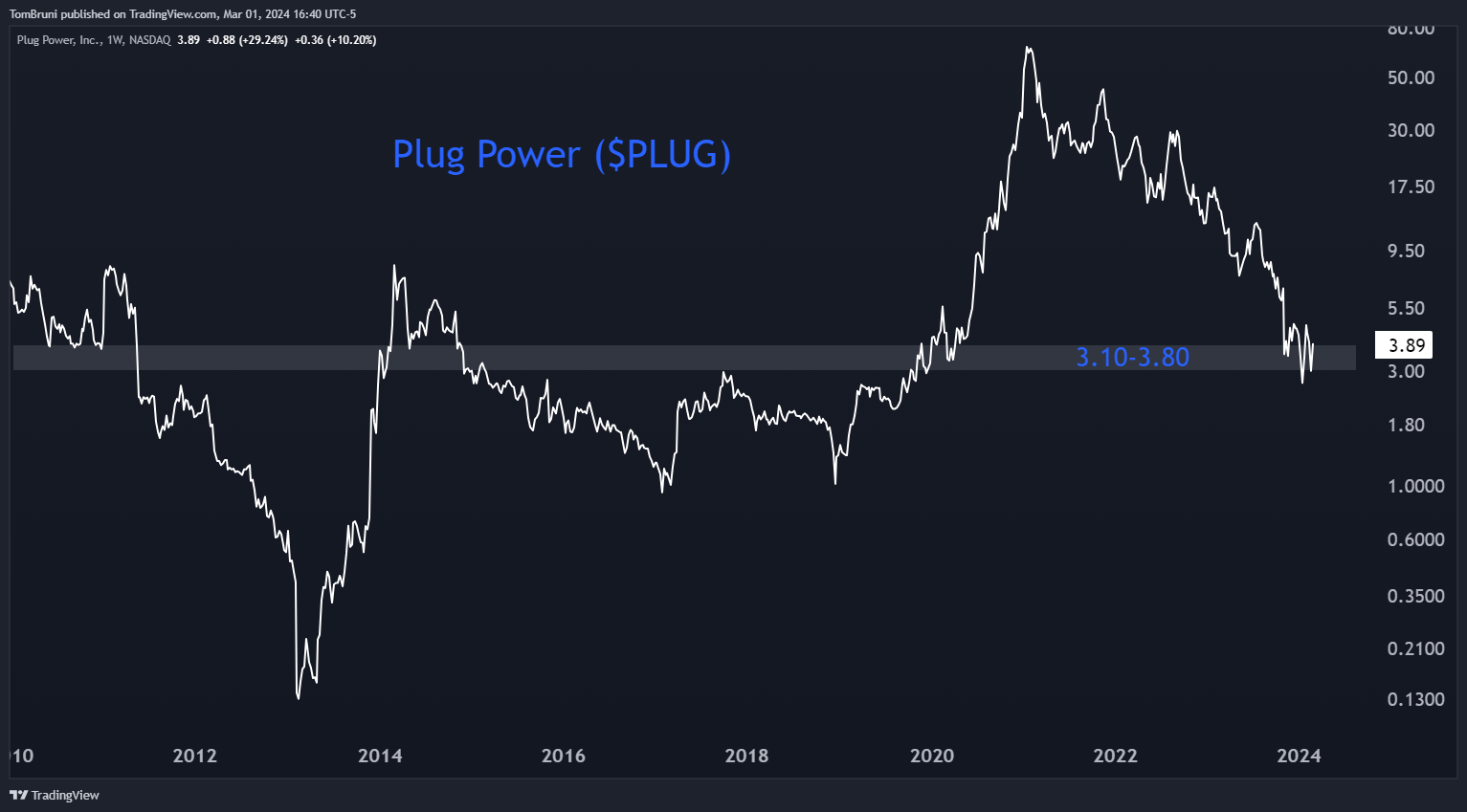

Speaking of heavily shorted stocks, Plug Power is trying to stabilize after saying its "going-concern" risk no longer exists. The hydrogen-technology company's 2023 results missed analyst expectations, but its recent cost-cutting efforts and government grants have helped bolster its financial position. 💸

With the stock at a transition zone, investors and traders are watching closely to see if buyers can retake control. 👀

The message here is not specifically about trading Jumia or Plug; instead, it points out the recurring behavior we're seeing in beaten-down stocks like them. Bears say these types of short squeezes signal the end of the bull run is near, as even the crappiest companies get snatched up. Bulls say it's just the improving market breadth everyone's been looking for and is a positive sign.

As always, the market will let us know who is right in due time. But for now, buyers are in control. 🤷

STOCKTWITS CONTENT

Following Us On YouTube Yet?

Stocktwits community lead Tommy Tranfo is joined by co-founder Howard Lindzon and resident chart wizard Ivanhoff every week on our flagship show "Momentum Monday."

COMMODITIES

Physical Gold & Oil Join The Party

It's Friday, and we're all looking forward to the weekend, so we'll keep this article short. With almost every speculative asset on the planet participating in the recent rally, let's quickly check in on two commodities making moves. 👀

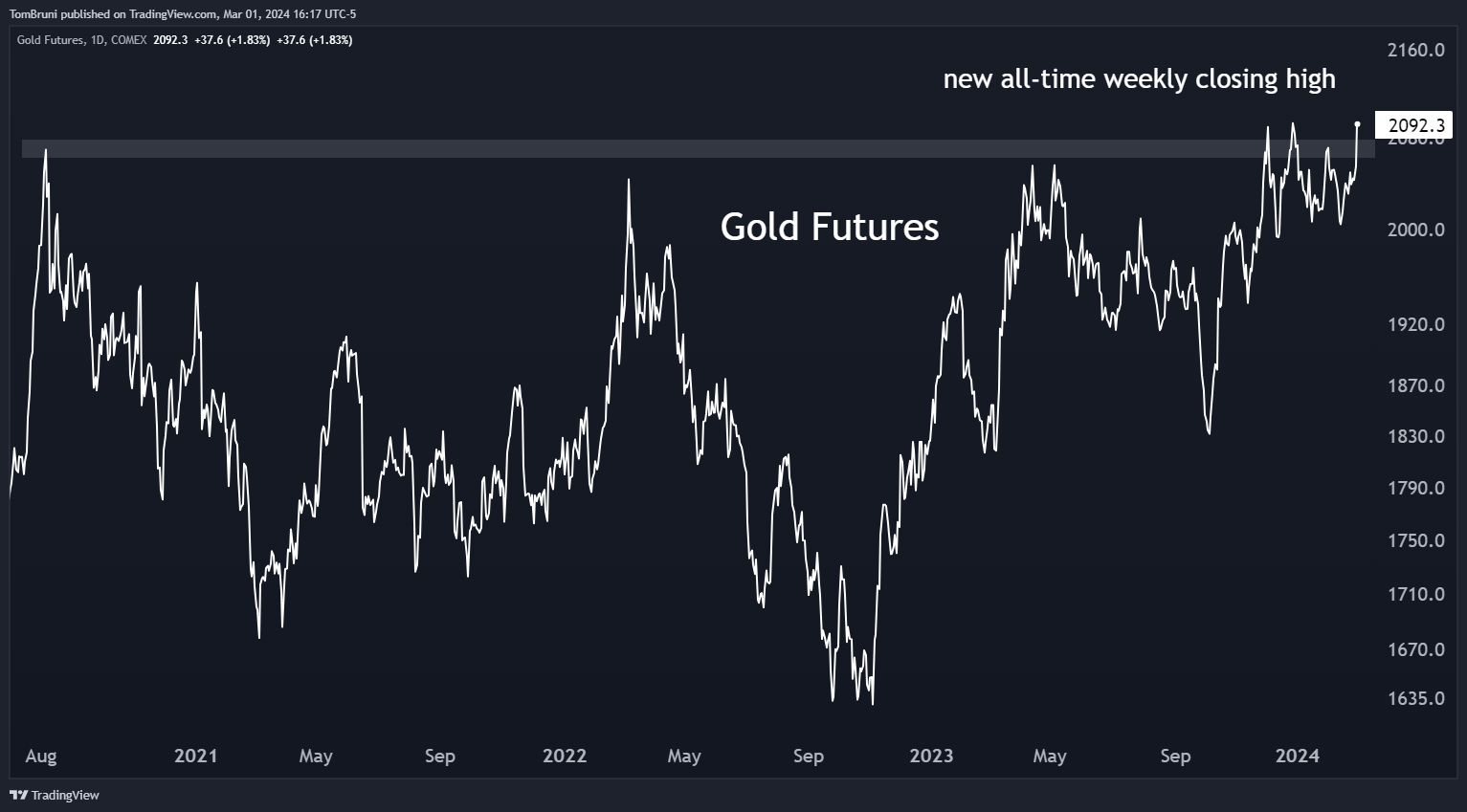

We know digital gold (aka Bitcoin) has been absolutely crushing it, but physical gold has failed to participate. That is at least until today... 🤔

The nearly three-year chart shows a new all-time weekly closing high in prices, as buyers look to clear resistance in the mid to high $2,000s. Sellers have stepped in at these levels for the last three years despite inflation and economic uncertainty rising.

We know technically oriented traders and investors are watching to see if gold can decisively clear this level in the coming days and weeks. 🪙

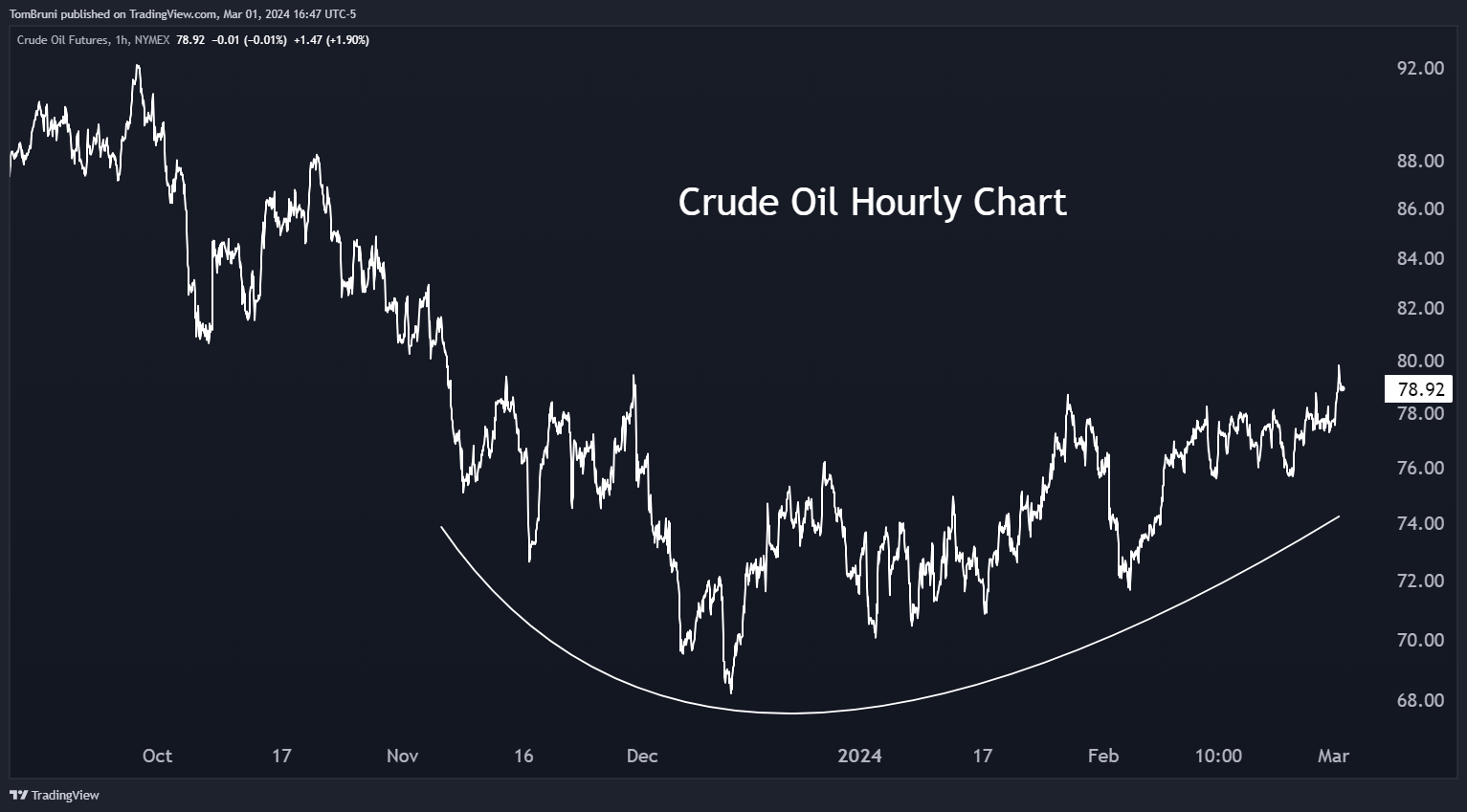

Next up, we want to point out that crude oil is creeping higher. The hourly chart shows prices bottoming in December and slowly grinding to the upside. While the rest of the market is focused elsewhere and economists declare inflation dead, it's an interesting development worth watching. Especially as other commodities like cotton, cocoa, and more have rallied sharply. 🛢️

Overall, commodities have not been in focus for quite some time. But we all know how riled-up market participants can get over gold and oil, so we'll likely see them make headlines in the weeks and months ahead. 📰

Stocktwits Spotlight

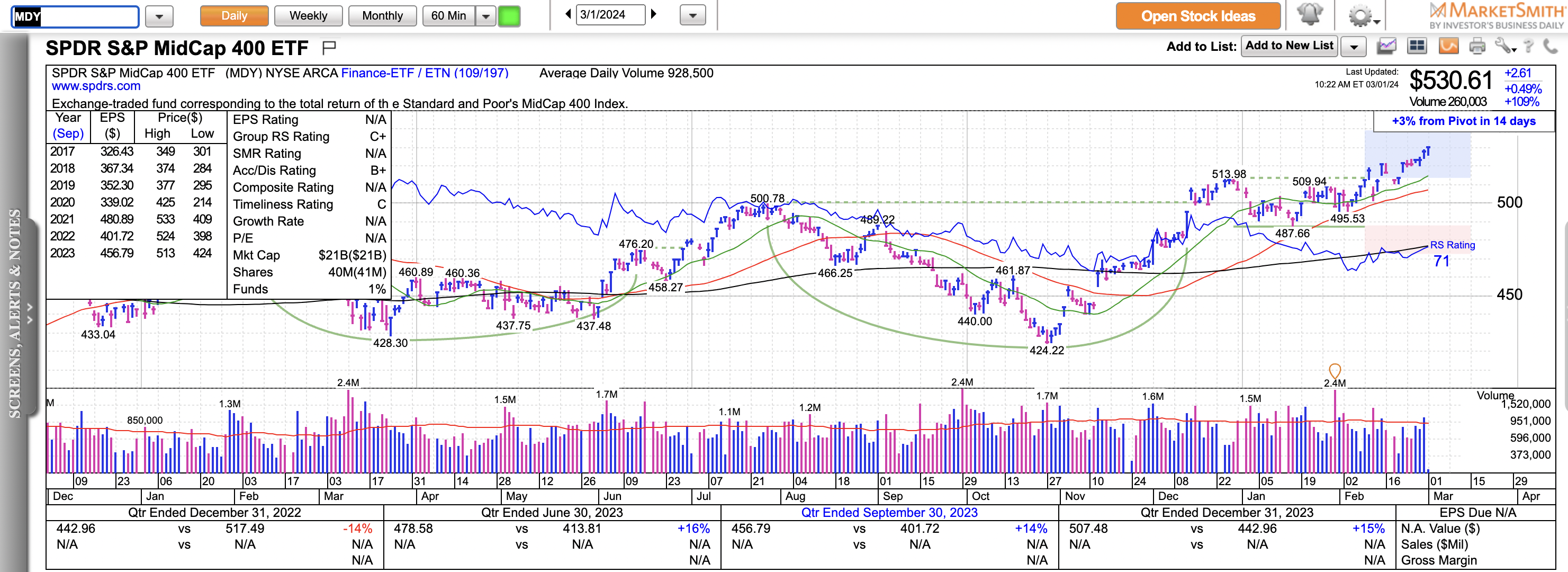

Stocktwits user ivanhoff shared the chart above showing mid-cap stocks making all-time weekly closing highs, as the market's breadth continues to expand. He shared the chart weeks ago during the initial breakout and bringing back to the forefront as it reaches this next milestone. 🤩

With the industrial, consumer discretionary, financials, and technology sectors accounting for nearly two-thirds of this market-cap segment, those are the areas of the market people are looking for opportunities. Although the bears continue to cry fowl, the bulls continue to buy up anything and everything that's not tied down. 🛒

If you want to see how this setup develops and enjoy technical analysis like this, make sure you're following ivanhoff on Stocktwits! 👀

Bullets From The Day

🤩 The exclusivity economy is absolutely booming. One of the fastest-growing areas of the economy is clubs selling exclusivity by persuading the very rich that what they're offering is worth the massive price tag. However, this trend is beginning to permeate beyond the upper class through instances like boatloads paying for Taylor Swift tickets and attendance dropping at SoHo House when it was perceived to have accepted too many applicants. Overall, with asset prices booming, people are once again looking to buy meaning and status wherever they can. Axios has more.

🤖 AI chip startup Groq forms a new business unit with acquisition. A startup developing chips to run generative AI models faster than conventional hardware is eying the enterprise and public sector. It's forming a new division, Groq Systems, focused on greatly expanding its customer and developer ecosystem. As part of creating this unit, Groq has acquired Definitive Intelligence, which offers business-oriented AI solutions, including chatbots, data analytics tools, and documentation builders. More from TechCrunch.

⚠️ Chinese factory data raises more economic warning signs. The country's manufacturing industry has Beijing looking to do more to boost growth. The official Purchasing Managers' Index (PMI) showed that business activity spent its fifth straight month in construction territory. Next week, thousands of delegates across China will gather in the capital for theannual session of the National People's Congress (NPC) at which the country's growth target for the year is expected to be revealed. CNN Business has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Have feedback on The Daily Rip? Shoot me (Tom Bruni) an email at [email protected]; I’d love to hear from you.

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here.