NEWS

Bulls Press Their Bets Ahead Of Fed

The U.S. stock market indexes closed on a high note today ahead of the Federal Reserve’s rate decision and economic projections. Despite that, S&P 500 sentiment on Stocktwits hit its lowest level of the year, showing some signs of caution into the event. Let’s see what else you missed. 👀

Today's issue covers market sentiment ahead of tomorrow’s Fed decision, the Bank of Japan’s big policy change, and a recap of our awesome event with Fundstrat’s Tom Lee and Bitwise CEO Henry Horsley. 📰

Here's today's heat map:

10 of 11 sectors closed green. Energy (+1.14%) led, & communications (-0.04%) lagged. 💚

New home construction jumped 10.70% in February, its biggest gain in nine months. Building permits also rose 1.90%, its highest since August. 🏘️

Super Micro Computer shares tumbled 9% after the company filed a plan to sell two million additional shares of common stock, which would increase its outstanding shares by about 4% to 58 million. 💸

Packaged software provider dLocal fell 17% after a weaker-than-expected earnings report, with its full-year revenue guidance also being at the low end of expectations. 🔻

Luxury department store Nordstrom rose 9% on reports that it’s working with strategic advisors to see if private equity firms are interested in taking the company private. 🏬

Tencent Music shares jumped 6% after seeing more than 20% annualized growth in the number of paying users, yet revenues still fell YoY. 🎶

Other symbols active on the streams: $ROOT (-21.29%), $FUSN (+99.06%), $PLNT (-5.44%), $EH (+15.55%), $ATNM (+25.54%), $GNS (-10.53%), & $SOL.X (-15.66%). 🔥

Here are the closing prices:

S&P 500 | 5,179 | +0.56% |

Nasdaq | 16,167 | +0.39% |

Russell 2000 | 2,036 | +0.54% |

Dow Jones | 39,111 | +0.83% |

STOCKS

Price And Sentiment Diverge Ahead Of FOMC

Tomorrow, the Federal Reserve will announce its interest rate decision and release new economic projections, more commonly known as “the dot plot.” 📝

Over the last few months, we’ve discussed rate cut expectations being pushed out given the stickier-than-anticipated inflation, strong labor market, and continued rise in asset prices.

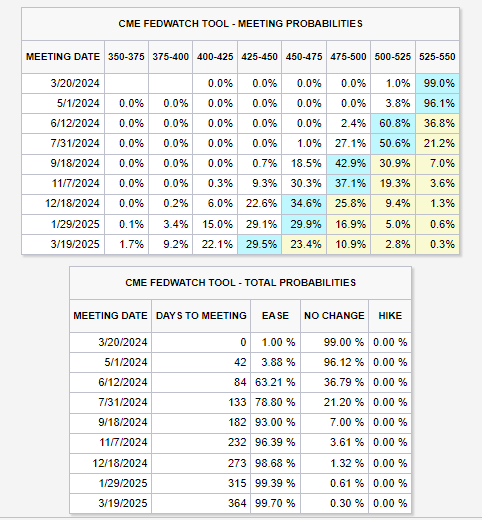

Heading into tomorrow, the bond market assigns a 99% probability that the Fed will keep interest rates where they are, not cut rates in May, and potentially cut rates for the first time in June. 🤔

While the stock market won’t get the six rate cuts it had hoped for this year, analysts say two or three would be enough to continue supporting stock prices and the overall economy. That’s likely why the S&P 500 and other major U.S. indexes are trading at all-time highs ahead of the event. 🤩

However, S&P 500 sentiment in the Stocktwits community has turned bearish, hitting its lowest reading of the year despite prices continuing to rise. It’s hard to tell what edge retail investors/traders see heading into tomorrow, but many have been pointing out the growing divergences and weaknesses in certain market leaders, as we’ve discussed recently.

We’ll have to wait and see who’s right. But for now, skepticism remains even as stocks trade near all-time highs. 🧐

STOCKTWITS CONTENT

Today’s Market-Moving Discussion 🤩

This afternoon, thousands of attendees joined us for a discussion with Tom Lee of Fundstrat and Bitwise CEO Hunter Horsley, covering all things crypto and markets.

We had an absolute blast and have highlighted some of our favorite quotes from the chat below. 👇

Tom Lee on Bitcoin’s price: “People should be more imaginative about where prices could go. In the near term, our $150k year-end target may be too low, given that our initial forecast was based on more conservative estimates of ETF flows.”

Hunter Horsley on Bitcoin ETFs: “This moment is essentially Bitcoin’s IPO. Many people have followed crypto or Bitcoin but have not had an easy way to participate in the asset class.”

Tom Lee on crypto’s risks: “There is risk in crypto, but I think a lot of people overestimate the risk because of the visible flameouts and failures like FTX. Stocks famously have many flameouts—in the last 50 years, over half the universe of 44,000 stocks fell 90%, and half of those went to zero.”

Hunter Horsley on crypto and AI: “AI is going to create a vacuum that demands the notary that blockchain provides.”

The quotes above barely scratch the surface of everything covered during the hour. If you missed it, listen to the recording here. 🎧🎶

POLICY

Japan Ends The Era Of Negative Rates

Japan’s central bank was the last holdout in the globe’s orchestrated fight against inflation, keeping its ultra-loose policy in place well after the rest of the world began to raise interest rates. 🌎

The country’s lackluster economic growth and low inflation readings kept the pedal to the metal at the expense of the Japanese Yen currency falling and its stock market soaring.

However, the era of super-easy money gave way to a slightly less easy-money policy today. The Bank of Japan raised its short-term interest rates from 0.10% to 0-0.10%. That marks the central bank’s first time raising rates since 2007 and ending the world’s only negative rates regime. 🔺

With that said, it cautioned that it’s not about to embark on aggressive rate hikes, saying that it “anticipates that accommodative financial conditions will be maintained for the time being,” given the fourth-largest economy’s tepid growth.

Other measures it’s also taking include:

Stopping its radical yield curve control policy for Japanese sovereign bonds, which it has used to target longer-term interest rates through open-market purchases and sales.

Stopping the purchase of exchange-traded funds and Japan real estate investment trusts (J-REITS).

Slowly reduce its purchases of commercial paper and corporate bonds, aiming to stop completely in about a year.

Still, it will remain somewhat accommodative by purchasing government bonds worth “broadly the same amount” as before, or roughly 6 trillion yen per month.

Overall, it was a historic moment for the central bank, but some fear the policy change has not gone far enough. Some see the current posture as risky, given that “core inflation” (excluding food and energy prices) has exceeded the central bank’s 2% target for more than a year. 🌡️

The Japanese Yen fell against most major currencies, and interest rates ticked up marginally on the news. We’ll continue to monitor their markets in the weeks ahead as the situation develops. 👀

Stocktwits Spotlight

If the market indexes seem like choppy messes lately, that’s likely because they have been. 😵💫

Stocktwits user HCPG shared this chart of the Nasdaq 100 ETF, which is essentially at the same levels it was in early February. The Bollinger bands indicator (which measured volatility) around it shows a lack of follow-through on both the upside and downside.

It’s likely tomorrow’s Fed decision will help push the market in one direction or another. But for now, we’re stuck in no-man’s land. 🤷

If you like this type of technical view and want more analysis like this, follow HCPG on Stocktwits! 👀

Bullets From The Day

⚡ An upcoming emissions rule will determine the electric vehicle (EV) revolution’s fate. The Environmental Protection Agency (EPA) is expected to release final rules for slashing tailpipe emissions on Wednesday, but where the threshold is set will determine how strong a tailwind it is for all-electric vehicles. The Verge has more.

🤖 Microsoft tapes DeepMind co-founder as CEO of its new AI unit. Mustafa Suleyman, a co-founder of the AI startup Google acquired in 2014, will lead Copilot AI initiatives and report directly to CEO Satya Nadella. Additionally, after raising $1.3 billion to build a “more personal AI,” Inflection is being absorbed by its lead investor, Microsoft, which continues to diversify its bets in the space. More from CNBC.

👚 The latest U.K. fashion collapse is Ted Baker. The High Street fashion chain is set to be put into administration after the brand owner said “damage done” during a tie-up with another firm was “too much to overcome.” While Ted Baker will continue to trade and customer orders will be fulfilled, the company is in advanced discussions with several potential buyers for the brand. However, the fate of the company’s 975 employees, 46 stores, and other operations hangs in the balance. BBC News has more.

Links That Don’t Suck

🤑 MarketSmith is now MarketSurge--check out the new features today and get 80% off the regular price*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of crypto enthusiasts? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍