NEWS

Bulls Take A Much-Needed Break

Source: Tenor.com

An uptick in inflation and some pre-holiday profit-taking weighed on markets, specifically as big tech and its peers sold off on Dell’s lackluster earnings guidance. It’s been a historic year in the markets, with many expecting the Thanksgiving festivities to spark even more speculation in crypto and other risk assets into the end of the year. 👀

Today's issue covers team transitory’s rising doubts, crazy coffee prices hitting consumers, and Nvidia’s precarious pre-holiday position. 📰

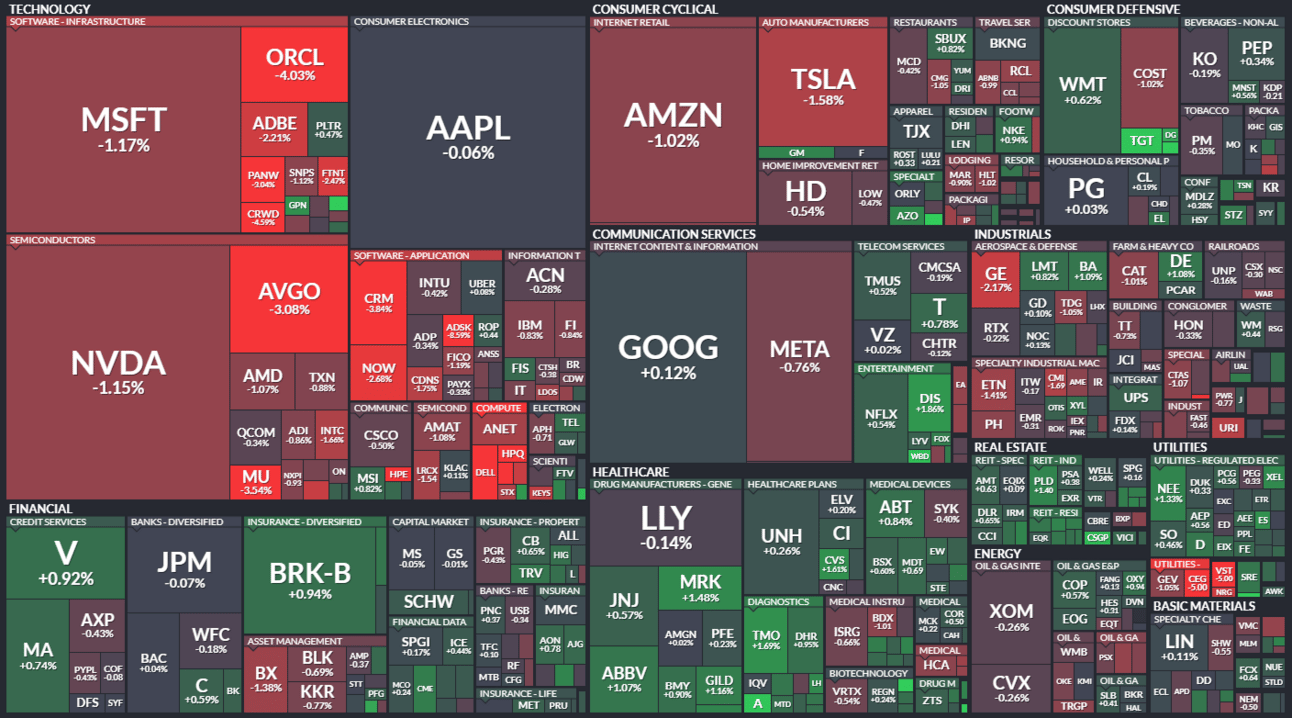

Here’s the S&P 500 heatmap. 6 of 11 sectors closed green, with real estate (+0.69%) leading and technology (-1.35%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,999 | -0.38% |

Nasdaq | 19,060 | -0.60% |

Russell 2000 | 2,426 | +0.08% |

Dow Jones | 44,722 | -0.31% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $CPIX, $DELL, $URBN, $OTLK, $CYCN 📉 $APLT, $EVTV, $ARWR, $BMRA, $HPQ*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Team Transitory Faces Some Trouble 😬

The latest estimate indicated that U.S. GDP grew at a 2.8% annualized rate during the third quarter, with business investment revised upwards and consumer spending ticking slightly lower to 3.5% YoY.

The U.S. economy continues to show durability despite higher interest rates, global activity concerns, and overall political uncertainty. However, lingering price pressures accompany that durability. 👎

October’s core personal-consumption-expenditures price index (PCE) ticked up 0.27% MoM and 3.3% YoY, representing its largest sequential increase since March. The Fed’s preferred inflation metric remains elevated due to services prices, which rose 0.4% MoM, offsetting a 0.1% decline in goods prices.

Wall Street Journal chief economics correspondent Nick Timiraos shared a chart showing the YoY change and the six—and three-month annualized rates stabilizing above the Fed’s 2% inflation target and turning higher. 🔺

Source: X.com

Consumer spending was still solid during October, while personal incomes also jumped double the 0.3% rate expected by analysts. The labor market is still strong enough to help keep wage growth above inflation, raising concerns that further cuts by the Fed into 2025 could contribute to a resurgence in prices.

While 2024 was the year of looking past inflation, recent data suggests that “Team Transitory” may have a tougher time reaching their ultimate goal than anticipated. We’ll see if that starts to matter for the stock market and other risk assets again or if we can just continue to climb the “wall of worry.” Time will tell. 🤷

SPONSORED

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Nvidia’s Action Raises Red Flags 🚨

As we head into the Thanksgiving Day break, its no doubt portfolios will be a topic of conversation with friends and family following a historically strong 2024 market. One stock that’s bound to be top of mind is Nivida, especially as it heads into the holiday sitting in a precarious position.

Technical analysts are circulating a chart similar to the one below, showing Nvidia shares threatening to break below the uptrend line from their 2022 lows. After a more than 1,300% rally, the last two blowout quarterly earnings reports could not keep the upward momentum going. 😐

Source: TradingView.com

And with other semiconductor leaders lagging since the middle of the summer, many have looked elsewhere for opportunities. However, investors and traders remain selective, waiting for their pitch before jumping into the latest trend. 🕵

A solid example of this is the initial public offering of the Chinese self-driving firm Pony AI (IPO). The stock priced at the upper end of its range ($13), opening with an initial pop to $15 before fading throughout the day. back to $12.

While investors are looking for growth opportunities in the market, it’s still a “show me what you got” market, where investors want to see some signs of business momentum before jumping into a hot story or trend. They’re rewarding businesses executing (or showing early signs of it) and punishing or avoiding those who aren’t.

If Nvidia and semiconductors begin to break down meaningful, risk appetite in the overall market will likely face a headwind until a new catalyst to replace the “AI boom” is uncovered. We’ll find out how the stock acts on Friday and next week. 👀

COMMODITIES

Coffee Prices Boil To All-Time Highs 😨

We’ve got bad news for breakfast fans, as coffee futures join orange juice and cocoa at or near all-time highs following supply concerns.

Arabica beans, favored for specialty brews, have risen nearly 70% this year, driven by a severe drought in Brazil fueling worries about the country’s output. Meanwhile, a different bean variety grown in Vietnam was hit by a deadly combination of dryness and heavy rain. 🥵

Source: TradingView.com

The price surge has been significant and long-lasting enough that companies across the coffee supply chain are responding to protect their margins, primarily by passing costs along to consumers. The world’s biggest coffee maker, Nestle SA, said it will raise prices and make packs smaller to offset the impact of bean prices.

Much like the unique circumstances driving orange juice, cocoa, eggs, and several other agricultural commodity prices, this problem has no easy fix. Concerns about Brazil’s 2025-26 season output and potential shipping or logistical issues caused by tariffs are fueling the rally lately, pushing prices to their highest since 1977. 🔥

And speculators are betting big on further gains, with their net-long position in Arabica coffee futures sitting near their highest level on record.

So, while you’re taking the day off of markets and enjoying your breakfast on Thanksgiving, savor every drop of your coffee…because analysts say prices are unlikely to get cheaper anytime soon. 😢

STOCKS

Other Noteworthy Pops & Drops 📋

We’ll start our list of unusual moves with a stock called Unusual Machines (+82%). The drone maker nearly doubled in price after announcing that President-elect Donald Trump’s son, Donald Trump Jr., will join its advisory board. 🚀

SolarEdge (+9%): The solar company will shut down its energy storage unit, reduce its workforce by 12% and refocus on its core business. It will sell its energy storage assets, including battery cell and pack manufacturing facilities, to shore up cash. ☀

VCI Global (+135%): The Malaysia-based conglomerate disclosed that its subsidiary, V-Gallant, received a condition letter of award valued at roughly $24 million for a proposed data center project. 💵

Arrowhead Pharmaceuticals (+24%): The biotech jumped after announcing a $1 billion licensing agreement with Sarepta Therapeutics, which includes an $825 million upfront payment. Sarepta also rose 6% on the day. 🤝

ASP Isotopes (-16%): The advanced materials company fell for a third straight day following short seller Fuzzy Panda’s accusations of fraud and failed technology. 📝

Symbotic (-35%): The robotics warehouse automation company identified an error related to system revenue recognition, so it will revise its quarterly reports. 🤔

SOS (+51%): The crypto miner surged after its board of directors approved a plan to invest $50 million to purchase Bitcoin, as it joins the latest group of companies to copy the MicroStrategy approach to driving “shareholder value.” 🙃

STOCKTWITS SHOP

Get 20% Off Exclusive Stocktwits Merch 🎁

There’s no better way to celebrate the holidays than with exclusive “The Weekend Rip With Ben & Emil” and “Daily Rip Live” merch. We’re giving 20% off and free shipping on orders over $100 to celebrate their launches. Snag it while you can! 🛒

Source: Shop.Stocktwits.com

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋