NEWS

Bulls Win Out In Shortened Week

The U.S. stock market indexes closed the quarter out at their highs as bulls remain in control. Like yesterday, rate-sensitive sectors like small-caps, utilities, and real estate caught a bid as bonds bounced. Let’s see what else you missed. 👀

Today's issue covers FTX’s SBF sentenced to 25 years, the new fund giving investors private market exposure, and more from the day. 📰

Here's today's heat map:

8 of 11 sectors closed green. Energy (+1.08%) led, & consumer discretionary (-0.31%) lagged. 💚

The final fourth-quarter GDP update was notched up to a 3.40% annual pace, as the labor market and consumer spending remain strong. Meanwhile, Chicago PMI fell to a 10-month low, its fourth-straight monthly decline. 🏭

U.S. consumer sentiment jumped to its highest level since July 2021, with long-term inflation views easing to 2.80%. Consumers are now broadly agreeing that inflation will continue slowing in the short and long term. 👍

Software company Palantir Technologies fell 6% on the day after analyst Brian White cut his rating from neutral to sell, issuing a 12-month price target of $20. He cited an ‘excessive’ valuation as the catalyst. 🔻

Home Depot shares ticked marginally lower after acquiring specialty distributor SRS for $18.25 billion as it expands its bet on pro sales. 🏘️

Luxury home retailer RH jumped 17% after its full-year forecast for demand and revenue growth beat expectations, outweighing a fourth-quarter miss. 🛋️

Reddit shares fell 15% after CEO Steve Ladd Huffman disclosed he sold 500,000 shares of Chief Operating Officer Jennifer Wong sold 514,000 shares. 🤑

And original meme stock AMC Entertainment plunged another 14% after saying it would sell $250 million worth of stock as it struggles to drive its core business toward profitability. 💸

Other active symbols: $MSTR (-11.18%), $APAC (+30.71%), $DJT (-6.43%), $NKLA (+14.40%), $AKBA (-18.30%), $WNNR (+32.04%), & $DOGE.X (+17.18%). 🔥

Here are the closing prices:

S&P 500 | 5,254 | +0.11% |

Nasdaq | 16,379 | -0.12% |

Russell 2000 | 2,125 | +0.48% |

Dow Jones | 39,807 | +0.12% |

CRYPTO

Sam Bankman-Fried Gets 25 Years

While the crypto markets were quiet today, FTX founder Sam Bankman-Fried (SBF) had a busy day himself in Manhattan federal court. 👨💼

He’s been battling fraud and conspiracy charges, and three of his former colleagues testified against him after pleading guilty to their own criminal charges related to FTX and Alameda Research.

Judge Lewis Kaplan handed down a 25-year prison sentence, which was at the midpoint of the 5-6.5 years the defense wanted and 40-50 years federal prosecutors wanted. He’ll also be required to pay $11 billion in forfeiture to the U.S. government. 🧑⚖️

During the sentencing, the judge said that in the 30 years on the federal bench, he had “never seen a performance” like SBF’s trial testimony. He noted that he never heard “a word of remorse for the commission of terrible crimes.”

What Bankman-Fried will do with his time in prison remains to be seen, but he didn’t sound optimistic when saying, “My useful life is probably over. It’s been over for a while now since before my arrest.”

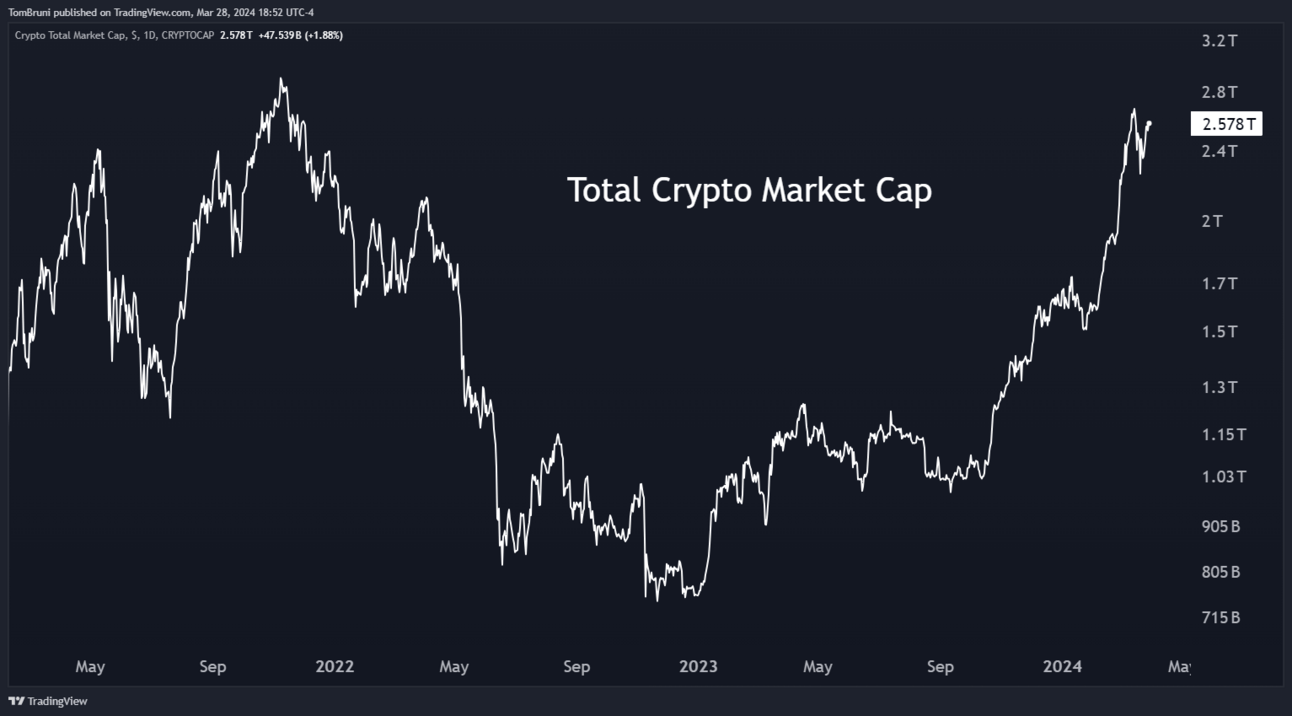

While the FTX blowup and fallout had major impacts at the time, the crypto market has since pressed forward, further emboldening the bulls’ thesis. 🐂

Crypto’s total market cap is $2.60 trillion, and many believe it’s on track to reach its 2021 highs (and beyond) due to the spot Bitcoin ETFs' popularity, halving event, and other factors. 📈

As always, we’ll have to wait and see what happens from here as the world continues its transition into a post-FTX and SBF world. 🌎

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

STOCKS

Retail Raves Over Private Market Exposure

With the initial public offering (IPO) and dealmaking business still recovering and companies taking longer to go public than in past history, one asset manager is taking a new approach to bringing these companies to the public. 🤔

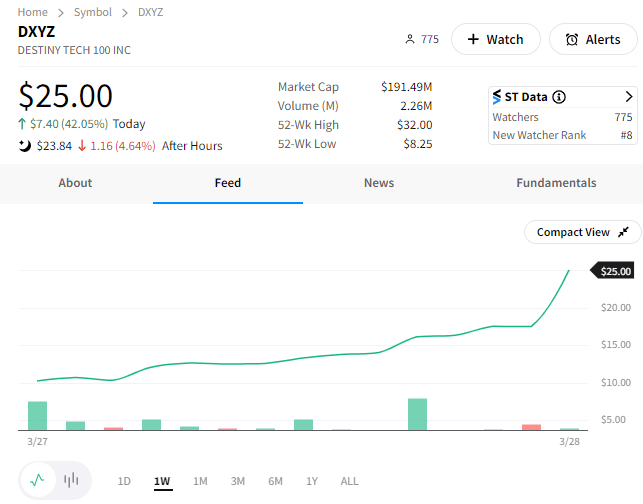

The Destiny Tech100 is a closed-end fund that creates a portfolio of 100 of the top venture-backed private technology companies. While it currently holds 23 companies, its eventual goal is to reach 100, charging a 2.50% annual management fee for the exposure.

The portfolio’s top five holdings and weighting include SpaceX (34.60%,) Axiom Space (9.70%), Boom Supersonic (4.60%), Epic Games (4.00%), and Brex (4.00%). It’s also invested in OpenAI, Stripe, Public, Discord, Klarna, and several other popular names, as well as 9.10% cash. 🧺

With so many of the world’s fastest-growing companies staying private for longer, retail investors have been clamoring for ways to invest in them.

As we saw most recently with the Bitcoin ETF being approved, the trend of public-market vehicles tracking private-market equities and other assets like collectibles is only going to grow from here. Liquidity is king, and Wall Street is looking to get paid for bringing liquidity to illiquid markets and “democratizing” access to as many assets as possible. 💰

Given that the portfolio’s holdings include several “hot” names, it’s no surprise that the retail crowd is hopping on the trend.

$DXYZ shares had a strong market debut, opening at $8.25 on Tuesday and closing the week at $25.00. The Stocktwits community seemingly took notice of this, with nearly 800 people adding it to their watchlist so far. 👀

Regardless of how you feel about this particular vehicle and its holdings, this trend is an important one to keep an eye on as it encompasses the animal spirits happening on both Wall Street and Main Street. 🐂

We’ll be watching and are excited to see what similar products the world’s largest asset managers have in the pipeline. 🕵️

Bullets From The Day

🦺 Boeing union wants a bigger say in how the company operates. The company’s largest union is in contract talks for the first time in more than a decade, and it’s taking its shot at driving cultural change. The negotiations are coming as the airplane manufacturer goes through a major shakeup as safety issues mount. Union leaders are pushing for a board seat, saying it would serve as a check on the CEO and help drive a culture of safety. Axios has more.

📱 X is testing out “adult content” as its bet on becoming the “everything app” expands. The social media platform is reportedly working on an addition to its Communities feature that would let users create groups for X-rated material. Researcher Daniel Buchuk of Watchful found the feature by reverse engineering the app, sharing screenshots that show what the NSFW communities could look like on the platform. More from TechCrunch.

📺 The Disney Plus-Hulu merger is more than just a streaming bundle. Hulu is now a tile in Disney Plus, but the tech that powers the app is changing the way Disney does everything. While the company has worked to integrate Hulu into Disney Plus, it’s taking the opportunity to better integrate everything from login tools to advertising platforms to metadata and personalization tools. That should enable it to create an experience that feels like a single product across the whole company. The Verge has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍