NEWS

Bulls Win The August Battle

Source: Tenor.com

It was a long, hard-fought August, but the bulls came out on top again. Inflation’s continued progress and a slow market day allowed buyers to push prices back toward all-time highs to close out the month on a positive note. Let’s see what you missed. 👀

Today's issue covers Intel exploring a business shakeup, results from Goldman’s annual layoff process, and inflation’s continued downward progress. 📰

Here’s the S&P 500 heatmap. 11 of 11 sectors closed green, with consumer discretionary (+1.51%) leading and energy (+0.37%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,648 | +1.01% |

Nasdaq | 17,714 | +1.13% |

Russell 2000 | 2,218 | +0.67% |

Dow Jones | 41,563 | +0.55% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $APTO, $FCUV, $CRVS, $BBIO, $ESTC 📉 $ALAB, $GPMT, $JPM, $AMIX, $SXTC*

*If you’re a business and want to access this data via our API, email us.

COMPANY NEWS

Potential Intel Breakup Causes Stock Shakeup 🫨

The old-school semiconductor giant has been stuck in a downtrend while the rest of the space parties on, making it the target of activist investors who want management to create shareholder value…and fast. 😡

As a result, management finally responded by working with Morgan Stanley and other bankers to present the board of directors with ‘strategic options.’

CEO Pat Gelsinger’s longer-term plans have failed to convince investors that the company won’t be left out of the artificial intelligence (AI) boom. Activists still believe in splitting the company up and spinning off its foundry business.

Today’s news caused a 9% pop in the stock, but Stocktwits community sentiment remains in ‘bearish’ territory, highlighting continued skepticism among retail investors and traders. 😬

Source: Stocktwits.com

STOCKTWITS “TRENDS WITH FRIENDS”

The $30 Trillion AI Opportunity 🤖

COMPANY NEWS

Some Goldman Employees Get An Extra Long Vacation ☹️

The annual review process has wrapped up at the investment bank, with Goldman laying off 1,300 to 1,800 workers (or 3-4% of its workforce).

Typically the company aims to trim 2% and 7% of its workforce annually, with that range fluctuating based on market conditions and the bank’s financial outlook. 🧭

With the stock trading at all-time highs and the Federal Reserve expected to pull off its “soft landing,” cuts toward the lower end of their typical range show that the bank isn’t expecting any major near-term risks.

Still, the Stocktwits community is not so sure, with sentiment sitting in neutral territory as prices attempt to make new all-time highs. 😐

Source: Stocktwits.com

ECONOMY

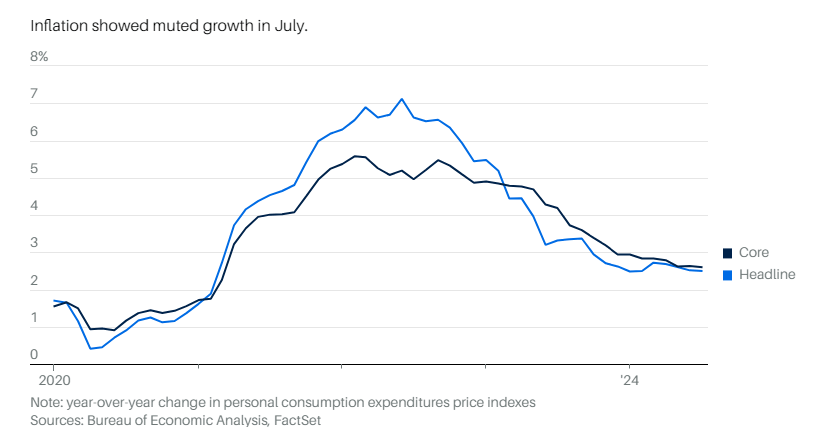

Downward Progress In Core PCE Continues 😎

The Fed’s preferred inflation metric continued its cooling trend during July, giving the bulls more ammunition to push stocks back toward all-time highs.

The headline personal consumption expenditures (PCE) index rose 0.20% MoM and 2.50% YoY, with the annual figure coming in 10bps better than expectations. Core inflation saw the same trend, rising 0.20% MoM and 2.60% YoY. 🔺

Source: Barron’s.com

Meanwhile, personal income rose 0.30% MoM, 10bps better than estimates, while consumer spending rose 0.50%, matching analyst expectations. 💵

Services inflation remained stickier than goods inflation, but the continued downward progress should give the Fed the ammo it needs to cut during the September meeting.

Now the market’s only question is whether they’ll cut 25 or 50 bps, so investors will closely watch next week’s labor market data for clues. 👨💼

COMMUNITY VIBES

One Tweet To Sum Up The Month 😂

Links That Don’t Suck 🌐

🤑 Is your portfolio ready for a boost? Let IBD Digital help––save over 70% on a 4-month subscription*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋