NEWS

Buyers Battered Amid Big Tech Results

Yesterday’s rally might’ve been a fever dream because today, money resumed its flow out of big tech and into defensive sectors like utilities and assets like bonds. Earnings reports from several of the sector’s ‘MVPs’ failed to inspire confidence, with many falling further after hours. Let’s see what you missed. 👀

Today's issue covers iPad kids saving Apple’s quarter, the Bank of England’s first rate cut, three tech names Stocktwits users are buying the dip in, and other earnings pops and drops. 📰

Here’s the S&P 500 heatmap. Notably, 5 of 11 sectors closed green, with utilities (+1.80%) leading and technology (-3.73%) lagging.

And here are the closing prices:

S&P 500 | 5,447 | -1.37% |

Nasdaq | 17,194 | -2.30% |

Russell 2000 | 2,186 | -3.03% |

Dow Jones | 40,348 | -1.21% |

P.S. We’re experimenting with different formats to streamline your experience. Like something, don’t like something, hit me up. I want to hear from you. 👍

EARNINGS

iPad Kids Save Apple While Amazon’s Outlook Looks Cloudy

Apple reported after the bell, and though it managed to stay slightly in the green, it was not the savior market bulls hoped for. With that said, the company did have an unexpected savior of its own this quarter…iPad kids. 🙃

The consumer tech giant’s core metrics all beat estimates except for Mac revenue, which came up just shy. But the standout was its iPad division, which grew nearly 24% YoY to $7.16 billion on the back of its first new model since 2022 being released during the quarter. 🤩

CEO Tim Cook said about half of iPad buyers hadn’t owned one before, suggesting to analysts that there could be more room for growth before the tablet market is completely saturated.

Services were the other standout, growing 14% to $24.21 billion in revenues, in line with Apple’s forecast and analyst estimates. 📈

Overall, it was a decent quarter, but investors had hoped for more specifics about artificial intelligence (AI) and its impact on future results.

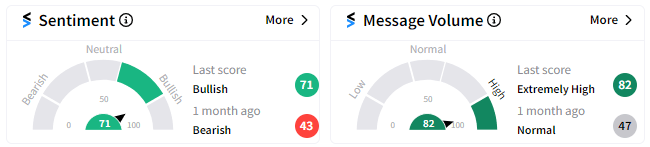

Sentiment on Stocktwits ticked up into ‘bullish’ territory on the news, suggesting some retail investors view Apple as a potential ‘safe-haven’ amid the market’s recent uptick in volatility. 🛡️

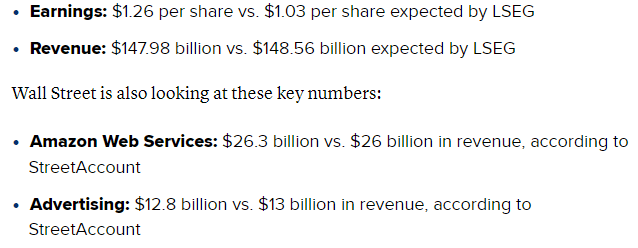

As for the other “A” reporting today, Amazon had a rougher time because of disappointing third-quarter guidance.

As CNBC’s summary shows, the company’s total revenue missed expectations this quarter as advertising came in light.

Amazon’s core retail business continues to face competition from U.S. retailers and foreign competitors like Temu and Shein, so revenues rose just 5% YoY. The miss this quarter was primarily driven by consumers buying cheaper products than anticipated, leading to lower average selling prices. 🔻

Amazon Web Services (AWS) was a bright spot, though its 19% YoY growth is lower than Microsoft and Google’s, raising concerns about the company’s ability to keep up with its competition.

Management’s third-quarter revenue forecast lagged the consensus analyst estimate, with CFO Brian Olsavsky saying consumers being distracted by world events makes it a “tough quarter to forecast.” 😵💫

Investors are not giving companies the benefit of the doubt in this environment, especially big tech, where stock prices and expectations have risen quickly to record levels.

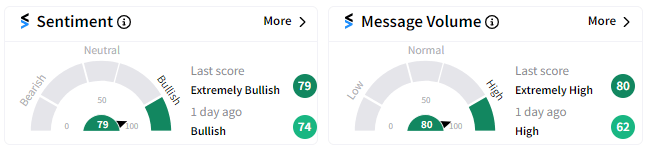

Shares are down 7% after the bell, though Stocktwits users may be buying the dip as the sentiment meter settles in ‘extremely bullish’ territory. 🐂

STOCKTWITS “TRENDS WITH FRIENDS”

Bitcoin Bulls, Biotech Breakouts, & Global Market Shifts 👀

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

This week, technology expert and investor Michael Parekh is back to discuss Bitcoin’s long-term bullish trajectory, why eyes are on Solana, AI infrastructure companies like Vertiv, and the shift in global market trends.

POLICY

Bank Of England ‘Brexits’ Its Tightening Cycle

Developed market central banks around the globe are cutting rates, and Britain is getting in on the action. This caps off the longest-running series of successive rate hikes in a century.

The U.K. central bank cut interest rates today for the first time in four years. The 25 bp decline brought its benchmark rate to 5% and set the stage for more cuts, though not quickly, as the decision to cut passed with a 5-4 majority. 🗳️

The vote narrowly passed, with members in favor of the cut looking to buoy economic activity now that inflation is back near its 2% target. However, dissenters are worried that the move is premature, given services inflation remains above 5% and has proven to be stickier than anticipated. 😬

As a result, the Bank of England said, “Monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further,”

Analysts expect future rate decisions to be equally close until the committee gains additional confidence that its battle against inflation is won. Still, the consensus view is we will see another BoE rate cut in November. 🗓️

In the U.S., initial jobless claims rose to a one-year high. Also, Q2 productivity accelerated as labor costs eased, furthering signs of a cooling labor market.

Investors will be watching tomorrow’s nonfarm payroll data for more info, but for now, all of the markets’ eggs are in the ‘September rate cut’ basket. 🧺

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Space is going quickly so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

EARNINGS

Retail Bets On A Rebound In These Names

Big tech stocks are today's main focus, and coverage wouldn’t be complete without touching on Intel, Arm, and Snap. All their shares are down sharply, but Stocktwits sentiment suggests retail is sticking with them. 🤔

Intel: The chipmaker is taking drastic steps, cutting 15% of its workforce as part of a $10 billion cost-reduction program after its earnings and revenue missed expectations. Revenues fell 1% YoY, with its Data Center and AI unit posting a 3% YoY decline and raising concerns among investors. 💽

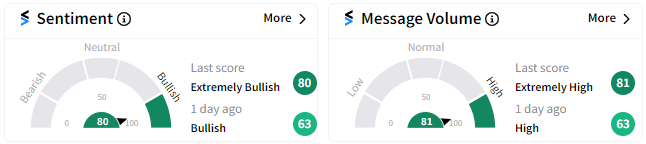

Intel shares fell over 25% today and hit their lowest level in a decade after hours. However, Stocktwits sentiment in ‘extremely bullish’ territory suggests some users are still looking to buy the dip.

Arm Holdings: The chip design company beat first-quarter earnings and revenue expectations, but its revenue guidance fell short. The new guidance factors in a growth rate from royalties in the low twenties, down from April's mid-twenties guidance. 😕

Additionally, the company added uncertainty to the situation (and bad vibes) by saying it will no longer share the number of Arms-based chips that were reported as shipped. Generally, investors view management pulling/changing how they report numbers as a bad sign.

The stock fell 16% on the day, but like intel, retail investors appear to be taking a contrarian stance with Stocktwits sentiment in a ‘bullish’ zone. 🐂

Snap: The social media company also plunged after issuing weak guidance and missing second-quarter revenue and global average revenue per user estimates. While monthly active users rose from 800 million in February to 850 million as of the end of June, the company continues to struggle with its monetization efforts. 👎

Despite shareholders’ gains ‘disappearing’ just like a message in the app, Stocktwits sentiment pushed into ‘extremely bullish’ territory after hours.

EARNINGS

Other Noteworthy Pops & Drops

Moderna: The vaccine-maker reported a narrower-than-expected second-quarter loss, and revenues topped expectations despite falling 30% YoY.

Management slashed its full-year sales forecast, citing struggles with EU sales and uncertainty over COVID-19 vaccine demand. Stocktwits sentiment pushed into ‘extremely bearish’ territory as shares plunged 21%. 🤢

Teladoc: The telehealth company tumbled after posting a wider-than-expected loss and revenue below estimates. The firm’s BetterHelp mental health platform continues to drag down overall performance and contributed to management pulling its full-year and three-year outlooks. ✂️

Stocktwits users were not thrilled with the poor results and added uncertainty about the future, causing sentiment to hit ‘extremely bearish’ as prices fell 9%.

Mobileye: The automotive supplier plummeted to new all-time lows after cutting its full-year estimates due to customers reducing their production plans. Shares fell 22%, but notably, Stocktwits sentiment was in ‘bullish’ territory as investors digested the news. 🚗

Shake Shack: The restaurant chain saw second-quarter profits rise 39% and revenues top analyst estimates. Its revenue beat in a challenging environment was enough to fuel a 17% rally and push Stocktwits sentiment into ‘extremely bullish’ territory. 🍔

DoorDash: The delivery platform posted 23% YoY revenue growth, helping it top Wall Street estimates. Total orders for the quarter were up 19% YoY to 635 million, while the total value of orders rose 20% YoY to $19.71 billion. Shares rose 13%, and Stocktwits sentiment maintained its ‘bullish’ reading. 🚴

Links That Don’t Suck

🧑💻 Register for a free 2-hour trading workshop on 8/10 to learn the fundamentals of sound investing*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍