NEWS

Buyers Don’t Take Vacation Breaks

While the rest of the market’s participants are out starting their Independence Day holidays earlier, buyers are working overtime…especially in big tech stocks. The large-cap major indexes made a new all-time high, and traders say the path of least resistance remains higher. Let’s see what you missed. 👀

Today's issue covers Tesla topping expectations, Palladium perking up at support, and Peloton kicking its cash concerns down the road. 📰

Here's today's heat map:

9 of 11 sectors closed green. Consumer discretionary (+1.95%) led, & healthcare (-0.37%) lagged. 💚

Fed Chairman Jerome Powell spoke at the European Central Bank (ECB) forum, acknowledging inflation’s downward progress but that there’s still work to be done. While the ECB cuts rates, the U.S. keeps rates elevated because of the economy and labor market’s relative strength vs. the rest of the world. ⏯️

The U.S. Job Openings and Labor Turnover Summary (JOLTS) report showed that job openings unexpectedly rose in May for the first time in three months. Despite the jump, the labor market continues to cool as the 1.22 jobs per unemployed worker sit at 3-year lows. 👨💼

The Realclearmarkets/TIPP economic optimism index remained negative for the 35th consecutive month but jumped 9.10% to 44.20. 😐

Novo Nordisk and Eli Lilly shares came under pressure after U.S. President Joe Biden and Senator Bernie Sanders, in a jointly authored opinion piece, called on the companies to reduce prices of their weight-loss and diabetes drugs. 💊

Trump Media and Technology popped and then dropped after the company shared that it raised $105 million through the cash exercise of warrants. This is a double-edged sword because it gives the company much-needed operating cash but dilutes the stock price by increasing the number of shares outstanding. 💸

Paramount Media’s shares popped 9% of news that David Ellison’s Skydance has reached a preliminary deal to acquire the media company’s parent, National Amusements. This would be a resurrection of a previously failed deal. 📺

Electric vehicle manufacturer Polestar fell % after its first-quarter loss widened from $37.70 million to $274.30 million. Its 80% QoQ increase in car deliveries was not enough to offset its negative results and headwinds. 🪫

Other active symbols: $RDDT (+10.39%), $ANVS (+76.09%), $RDZN (+82.10%), $ARDX (-30.25%), $MAXN (-67.22%), and $OPTT (+86.10%). 🔥

Here are the closing prices:

S&P 500 | 5,509 | +0.62% |

Nasdaq | 18,029 | +0.84% |

Russell 2000 | 2,034 | +0.19% |

Dow Jones | 39,332 | +0.41% |

COMPANY NEWS

Tesla Tops Estimates & Tests Resistance

Tesla has been the talk of the town for much of the first half of 2024, but not for a good reason. The electric vehicle (EV) maker had lagged behind its big-tech peers, who were seemingly making new highs on a daily basis. 🪫

However, some suggest that the tide has finally turned after its second-quarter production and deliveries report topped expectations.

It produced 410,831 vehicles and delivered 443,956, with that latter number down about 4.80% YoY. Analysts had anticipated just 439,000 deliveries. Also, deliveries outpacing units produced helped quell some fears about the company’s inventory building up unsustainably. 🙂

Still, some analysts remain concerned about the company’s ability to navigate an environment of tepid demand and intense competition, which is creating pricing and margin pressure.

For now, though, the news was enough to keep the stock's recent upward momentum going, as it jumped another 10% today. 👍

On the technical side, analysts say the stock is testing a major resistance level at the downtrend line from its 2021 highs. That has kept a lid on prices for the last few years, so everyone will be watching to see if sellers strike again…or if buyers can blast through. 👀

Despite the improving price action and fundamentals, retail remains skeptical of the company’s ability to manage its many headwinds. Stocktwits sentiment remains near one-year lows in “extremely bearish” territory as investors and traders debate the news.

Time will tell who is right. But for now, the technical picture remains in focus as prices look to top the trendline that’s kept a lid on prices for 3 years. 🔍

P.S. Quick shout out to several of the traders highlighted in our “Chart Art” newsletter pointing out Tesla’s improving technicals at various points over the last two months. If you’re not subscribed yet, click here to get the best of the Stocktwits community straight to your inbox each day. 📬

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Space is going quickly so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

POLICY

Peloton Kicks Its Cash Crunch Down The Road

The struggling fitness company faced $800 million in loan payments due November 2025 and another $400 million due in early 2026. Given that it is still finding its road to profitability, these looming debt payments threatened to push it into bankruptcy. 😨

Luckily, the connected fitness company secured a $1 billion term loan, issued $350 million in convertible senior notes, and received a new $100 million line of credit from JPMorgan Chase and Goldman Sachs.

The new financing reduced its total debt burden by about 11% and extended the date its debt is owed until 2029.

Still, like other “meme stocks” and “pandemic darlings,” the company still hasn’t identified a way to make its core business profitable. It has not turned a net profit since December 2020, and sales have fallen for nine straight quarters. 📉

Executives say the new financing will extend their runway and put the company on the path to sustainable, profitable growth. Still, investors remain skeptical about the long-term potential, given management’s inability to stabilize sales and consistent reliance on cost-cutting.

Still, retail chatter and sentiment on Stocktwits are hitting their highest levels of the last year. As a result, the stock will likely remain on traders’ radars for a few weeks as they assess whether prices can maintain some upward momentum on the news. 😐

POLICY

Commercials Are Picking Up Palladium At Low Prices

While gold and silver have received much attention for their recent performance, palladium is one precious metal that’s lagged significantly. However, technical analysts have pointed to several factors suggesting the metal could begin to play catchup. 👀

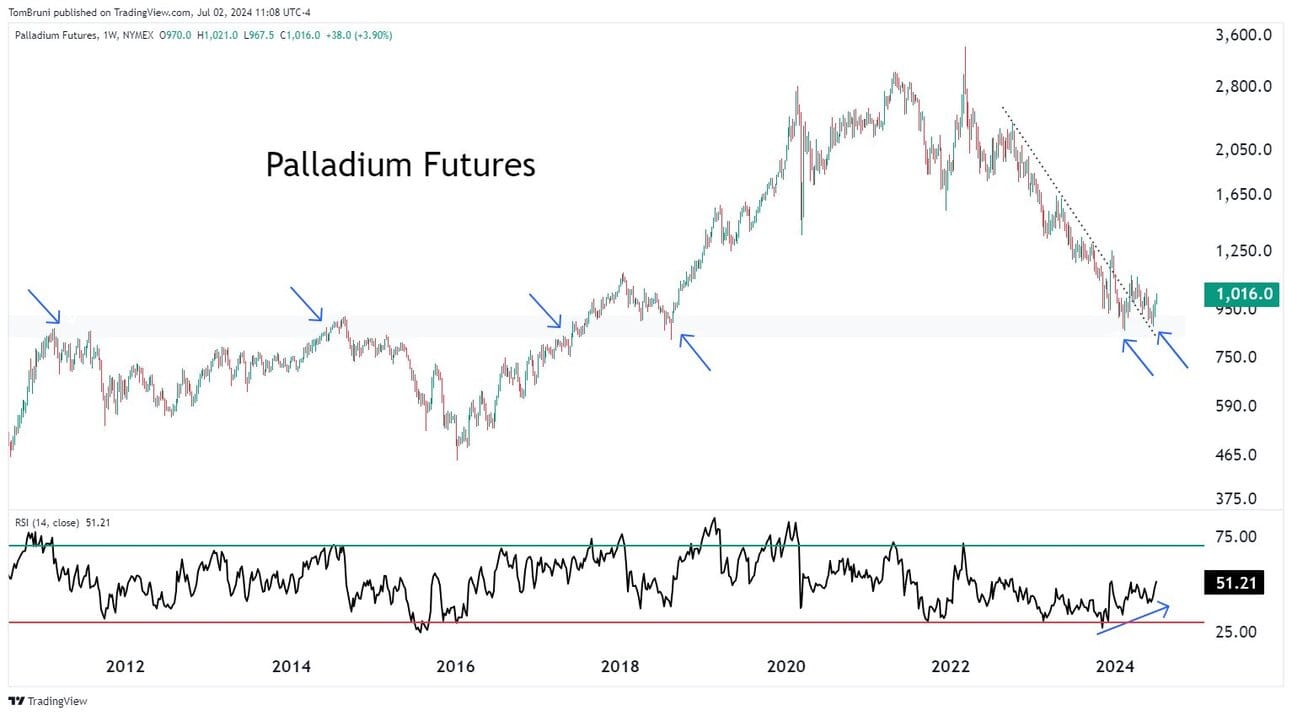

Below is a roughly 12-year weekly chart of palladium futures. As we can see, the 800-900 price range has been a material transition area for this asset, acting as resistance when prices are below and support when they are above.

In addition to this, commercial hedgers have one of their largest net-long positions in history. This is relevant because hedgers are the ones in the actual business of producing and using palladium, which tends to give them an informational edge over speculators betting on the price going up or down. 🧐

While commercial hedgers typically have very deep pockets and can be hard to follow into trades, their huge long position suggests they believe the risk is to the upside in prices. And with prices rebounding once again from a very clear technical level of support, technical analysts suggest the risk is very well defined on the long side.

We’ll have to see if the bullish forecast is correct. But for now, the Stocktwits community is bulled up on the asset, with the sentiment score for the most popular ETF tracking palladium ($PALL) pushing into “extremely bullish” territory. 🤷

Bullets From The Day

⚡ Google’s carbon emissions surge by 50% due to AI demand. The tech giant’s AI-related emissions threaten its goal of achieving net-zero emissions by 2030. The 50% spike compared to 2019 levels is attributed to an increase in data center energy consumption and supply chain emissions driven by rapid advancements and demands in the industry. CNBC has more.

❌ FTC unanimously moves to block Tempur Sealy’s purchase of Mattress firm. The Federal Trade Commission (FTC) brought a lawsuit against mattress maker Tempur Sealy to block the $4 billion acquisition of its competitor, which regulators say would allow the world’s largest mattress supplier to suppress competition and raise prices for shoppers. The deal was announced in May 2023 and hailed by analysts as a value-accretive move; the regulator’s concerns will need to be addressed before it can move forward. More from AP News.

💰 Biden bets on tech with another $504 million to support the sector. The new funding will support 12 technology hubs around the U.S., focusing on quantum computing, biomanufacturing, lithium batteries, computer chips, personal medicine, and other rapidly growing STEM fields. These hubs are in addition to the 31 approved in October 2023 as part of the Commerce Department’s Economic Development Administration program. NBC News has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍