NEWS

Buyers Flee Ahead Of Busy Week

U.S. stocks started with a bounce but faded throughout the session to close nearly flat. A busy week of earnings and economic data is keeping volatility elevated as investors and traders take a more cautious approach to buying the recent dip. Let’s see what you missed. 👀

Today's issue covers McDonald’s rare earnings miss, one semiconductor stock retail loves (and one they hate), and Tilray topping estimates. 📰

Here's today's heat map:

7 of 11 sectors closed green. Consumer discretionary (+1.67%) led, & energy (-0.86%) lagged. 💚

The Dallas Fed manufacturing index fell again in July, marking its 27th consecutive month in contraction territory. New orders fell sharply, signaling a pullback in demand as capacity utilization and shipments dipped, too. 🏭

Automaker Stellantis fell 4% to a new 52-week low after Deutsche Bank downgraded it from buy to hold, citing its inability to tackle key issues like inventory, pricing, and model age in a “tougher” environment. 🪫

Tesla shares rose 6% after replacing Ford as Morgan Stanley analyst Adam Jonas’ top pick in the U.S. auto stock space. Meanwhile, Rivian Automotive gained traction among retail investors, with Stocktwits sentiment hitting its highest level in a month. 🔋

Cybersecurity stock F5 Inc. soared 15% after reporting better-than-expected earnings and revenue. The stock is nearing its highest level in over two years as the cybersecurity space at large rebounds. 🛡️

And shares of life sciences company Revvity popped 9% after its adjusted earnings and revenue both topped expectations. 🔬

Here are the closing prices:

S&P 500 | 5,464 | +0.08% |

Nasdaq | 17,370 | +0.07% |

Russell 2000 | 2,235 | -1.09% |

Dow Jones | 40,540 | -0.12% |

EARNINGS

Retail Diverges From Price After McDonald’s Miss

Inflation has hit restaurant chains recently, as consumers look for deals and spend more money eating at home. As McDonald's earnings showed again today, fast food restaurants have not been immune to that headwind. 😬

The company’s adjusted earnings per share of $2.97 missed estimates of $3.07, while revenues of $6.49 billion came in shy of the $6.61 billion estimate.

Comparable store sales declined across every division, falling 1% YoY globally in its first decline since Q4 2020. While the company noted several external factors impacting performance, management also took responsibility for its inability to deliver the “value” customers sought. 📉

Recently, the company joined its industry peers in rolling out a $5 meal deal to entice shoppers back. Early results showed enough promise to entice 93% of the company’s franchisees to extend the promotion through August. 🍟

CEO Chris Kempczinski expressed confidence in the company's growth strategy. “...As consumers are more discriminating with their spend, we are focused on the outstanding execution of delivering reliable, everyday value and accelerating strategic growth drivers like chicken and loyalty,” he said in a statement.

Despite the stock stabilizing recently and prices rising 4% today, Stocktwits users remain skeptical about the company’s prospects, with sentiment sitting in “extremely bearish” territory. Several users questioned how margins could possibly hold up with the company so focused on promotional activity. 🤔

It’s a valid concern and one that Wall Street is overlooking for now. We’ll have to wait and see who ends up being right.

As for where consumers are spending money, wellness-focused grocery chain Sprouts Farmers Market hit a new all-time high after earnings. It beat estimates handily and raised its full-year revenue and earnings outlook. 🛒

STOCKTWITS & 11thESTATE PARTNERSHIP

Get Your Piece Of The $200m Uber Settlement

In 2019, Uber went public and raised over $8.10 billion. Soon after, the company faced major financial losses and several accusations. Uber was criticized for bypassing local regulations in many areas and for ignoring serious safety issues, including sexual assaults, deaths from crashes, and fatal assaults before the IPO.

Uber agreed to pay $200M to investors to settle claims that its subsidies increased costs during the IPO and that planned cuts could have risked key growth opportunities.

EARNINGS

ON Semi’s Sentiment Hits 1-Year Highs

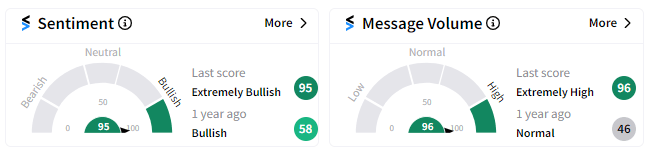

Retail investors are bulled up about ON Semiconductor, as Stocktwits sentiment hit one-year highs following the company’s latest earnings report. 🤩

Adjusted earnings per share of $0.96 topped the $0.92 expected, while revenues of $1.74 beat estimates by $0.01 billion. Adjusted gross margins were down 210 bps YoY, but 10bps better than estimates at 45.30%. 🔺

Investors remain excited about the company providing Volkswagen with advanced silicon carbide microchips for electric vehicles. Management reiterated the importance of that partnership and the longer-term potential of its business in the automotive space.

Meanwhile, Lattice Semiconductor tumbled 13% after its adjusted earnings per share and revenue missed expectations. 😨

Revenues fell 35% YoY to $124.10 million, missing the consensus estimate of $130.20 million and the midpoint of its own $120-$140 million guidance.

Management blamed cyclicality and said those headwinds are expected to persist, with its projected third-quarter revenue down significantly YoY and coming in well below analyst expectations. 📉

Unlike ON Semiconductor, Stocktwits sentiment for Lattice is back near the lowest levels of the year (21/100) as shares hit a nearly 2-year low.

The semiconductor space remains hot but volatile. Investors are looking for names with high-end AI chips or automotive exposure and avoiding those tied to challenged markets like smartphones and PCs, for now. 🧐

EARNINGS

Tilray Tops Estimates

The cannabis company delivered a rare earnings beat and provided an upbeat outlook, fueled by the craft beer bet it made last year by buying several brands from Anheuser-Busch. 🍻

As part of that pivot, the company now defines itself as a “global lifestyle consumer packaged goods company elevating lives through moments of connection.” In other words, it decided to sell things other than cannabis to save its business and that diversification strategy is working.

The company's beverage-alcohol division saw revenues rise 127% to $76.70 million, and gross profit rose 146% to $40.80 million. That helped narrow the company’s quarterly loss to $0.04 per share from $0.15 a year earlier. 👍

Revenues also topped expectations, coming in at $229.90 million, compared to Wall Street’s expectations of $226 million.

On the balance sheet side, the company “significantly” reduced its net convertible debt by ~$300 million and surpassed its cost-savings goals. 💵

Shares are up roughly 8% after the bell, and Stocktwits sentiment has shifted back into “extremely bullish” territory as investors digested the news. Meanwhile, traders will keep this name on their radar in the days ahead to see if its upward momentum (and short squeeze potential) continues. 👀

Bullets From The Day

🍿 “Deadpool & Wolverine” sets new R-rated film record. The third “Deadpool” movie brought in $205 million in domestic box offices over the weekend, even amid signs that “superhero fatigue” has weighed on other films of the type. Notably, IMAX and other premium screen formats helped drive performance at 18% of global sales. Additionally, the percentage of the audience watching was more than double that of typical R-rated movies. Axios has more.

🤔 Elon’s latest X post tests the platform’s own policy. Musk posted a digitally altered campaign ad of Vice President Kamala Harris on X, which appears to violate the platform’s policies against synthetic and manipulated media. The original post did label the video “Kamala Harris Campaign Ad PARODY,” though that context did not appear in Musk’s repost and commentary. It raises an important issue about the potential of artificial intelligence to be used nefariously during the upcoming elections and the guardrails (or lack thereof) against it on various platforms. More from The Verge.

🤖 Startup raises $7 million to train an AI assistant on users’ conversations. Bee AI has raised funding to build out its wearable AI assistant that listens to you to learn more about you, take notes, surface contextual reminders, and build lists. The company says its core focus is the software powering the assistant, but it built a wearable so that its app doesn’t need to constantly take control of a user’s phone mic to function properly. TechCrunch has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍