NEWS

CPI Surprise Brings The Bears’ Demise

Source: Tenor.com

Cooler-than-expected consumer price growth and strong bank earnings put the bulls back on track, with crypto, big tech, and financials leading the charge. With the Fed’s next meeting two weeks away, all eyes now turn to earnings and Trump’s inauguration to determine the next major catalyst for the market. 👀

Today's issue covers two things giving bulls the green light, short-seller Hindenburg Research's retirement, crypto’s latest milestone, and a chance to hear great comedy while helping Stocktwits raise funds for LA wildfire relief. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with financials (+2.55%) leading and consumer staples (-0.34%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,950 | +1.83% |

Nasdaq | 19,511 | +2.45% |

Russell 2000 | 2,263 | +1.99% |

Dow Jones | 43,222 | +1.65% |

ECONOMY

Why CPI Gave Bulls The Green Light 🚦

Bulls cautiously bought back into risk assets yesterday following cooler-than-expected producer prices, hoping for more good news on the inflation front this morning. And luckily, the December consumer price index (CPI) report delivered the goods.

Headline CPI rose 0.4% MoM and 2.9% YoY, essentially meeting expectations. However, core inflation rose just 3.2% YoY, narrowly beating the 3.3% outlook. Shelter prices, which account for one-third of the CPI weighting, rose 4.6% YoY, representing their smallest one-year gain since January 2022. 📊

Sticky services inflation has been the primary concern for the Fed and markets, so seeing shelter’s growth rate decelerate is certainly a positive sign. More importantly, the market was simply relieved to see that inflation’s growth…although stagnant, has not re-accelerated higher just yet.

Investors will continue to watch the labor market and economic growth data like hawks, though, for signs that continued strength could place further upward pressure on prices. Additionally, the coming Trump administration’s policies are set to be heavily analyzed for their potential impact on inflation. 🕵

Nonetheless, the inflation problem has been kicked down the road for at least another month.

Meanwhile, better-than-expected results across the board from the major banks helped drive the financial sector higher. With investors looking for earnings season to help take some of the focus off the Fed, a hot start certainly excited the bulls. 🎉

JPMorgan CEO Jamie Dimon adopted his usual measured approach, delivering a solid earnings beat and saying the “U.S. economy remains resilient.” However, he noted two significant risks that still exist, saying,

“Ongoing and future spending requirements will likely be inflationary, and therefore, inflation may persist for some time. Additionally, geopolitical conditions remain the most dangerous and complicated since World War II. As always, we hope for the best but prepare the firm for a wide range of scenarios,”

Citi, Wells Fargo, Goldman Sachs, and BNY Mellon delivered beats, too, providing optimism alongside inflation’s cooler reading to put the bulls back in control. 🐂

FUNDRAISER

A Can’t-Miss Comedy Show For LA Wildfire Relief 🎤

Host Cipha Sounds will be joined by Mark Normand, Sam Jay, Jim Florentine, Jon Rudnitsky, Andrew Dice Clay, and more on Thursday, January 16th, at 8:00 pm ET at The Stand in NYC and everywhere on Punchup.live.

Stocktwits is proudly sponsoring the event, and all proceeds will benefit The American Red Cross. It’s an incredibly hard time for many people, so let’s have some laughs and raise some money for those impacted by this tragedy. 🤝

Source: Punchup.live

COMPANY NEWS

Hindenburg Research Hangs Up Its Cleats 🫣

Famed short seller Hindenburg Research announced today on X that its founder, Nate Anderson, has decided to wind down the firm.

Nate and his firm rose to national prominence after uncovering fraud at electric vehicle (EV) startup Nikola when it accused the company of rolling a prototype of its electric semi-truck downhill. 🪫

Some of the short seller’s other targets since launching in 2017 included:

SmileDirectClub in 2019, which it accused of “carelessly cutting corners in a field of specialized medicine.” It went out of business in late 2023.

Indian conglomerate Adani and Ichan Enterprises in 2023, questioning the accounting and business practices of two of the world’s wealthiest investors.

Super Micro Computer in 2024, when it uncovered what it said were accounting irregularities.

Today’s note expressed gratitude for supporters during the wild ride he’s been on since launching the firm while signaling his reason for stepping back is primarily to start a new chapter where he spends more time with his family and those he largely ignored while focusing on his business. 🙏

As for those market participants who will miss the firm’s research, Nate signaled that he will be sharing all of the knowledge he’s accumulated with his team in an effort to help those who wish to follow a similar path. More specifically, he said,

“…so over the next 6 months or so I plan to work on a series of materials and videos to open-source every aspect of our model and how we conduct our investigations.

My hope is that after we fully share our process, in a couple years I will get an unsolicited message from someone who reads this (maybe you), who embraces the same passion, learns the craft, and finds the confidence to shed some light on a subject that needs it, despite the obstacles in your way. That would make my day, even if I’m off trying to learn music or planting a garden or whatever I end up doing next.”

Potential fraudsters can rest slightly easier knowing they will not be Hindenburg’s target. But based on the firm’s great work and knowledge-sharing plans, it seems like a lot more stock market detectives will be coming down the pike to keep bad actors on their toes. So enjoy your peace while it lasts, scammers. 🧐

STOCKS

Other Noteworthy Pops & Drops 📋

Vertical Aerospace (+30%): The firm announced that Dómhnal Slattery returned as Chairman of the board of directors. He previously served as Chairman from January 2022 to August 2023 and has over 30 years of global aviation industry expertise.

Wolfspeed (+39%): The chipmaker completed a previously announced at-the-market (ATM) stock offering, generating approximately $200 million in gross proceeds.

Intuitive Surgical (+8%): Shares hit a new all-time high after its preliminary fourth-quarter and full-year 2024 results exceeded Wall Street expectations.

Keros Therapeutics (-15%): The company neared new all-time lows after it voluntarily halted dosing in the mid-stage trial of its intercept drug for pulmonary aerial hypertension (PAH).

Robinhood (+10%): Shares hit three-year highs after Morgan Stanley added the retail brokerage to the firm’s “Financials’ Finest’ list, citing several growth levers.

Crown Electrokinetics Corp. (-21%): The company’s shareholders approved a 1:200 reverse stock split, authorizing the board to enact a split with a minimum ratio of 1:2.

Trade Desk (+3%): It completed the acquisition of digital ad data company Sincera and received a price target revision from BMO Capital Markets, implying 37% upside.

WISeKey International (+5%) and its subsidiary SEALSQ Corp. (+30%) rose after the successful launch of its satellite into orbit by the SpaceX Falcon 9 rocket.

Energy Vault Holdings (+14%): The renewable power company said it had partnered with nuclear-power technology company NuCube Energy.

Amplify Energy Corp (-7%): The oil and natural gas player announced a merger agreement with Texas-based energy investment firm Juniper Capital.

Nvidia (+3%): The chip giant announced “Quantum Day” at the upcoming GPU Technology Conference (GTC 2025). Nvidia CEO Jensen Huang plans to host executives from several quantum computing companies, including D-Wave Quantum Inc. (QBTS), IonQ Inc. (IONQ), Rigetti Computing Inc. (RGTI), and Quantinuum.

CRYPTO

It Was A Big Day For Crypto On Stocktwits 🥳

With risk assets returning to the limelight, crypto had itself one heck of a day. We saw Bitcoin crack back above $100k, but the real winners were the altcoins.

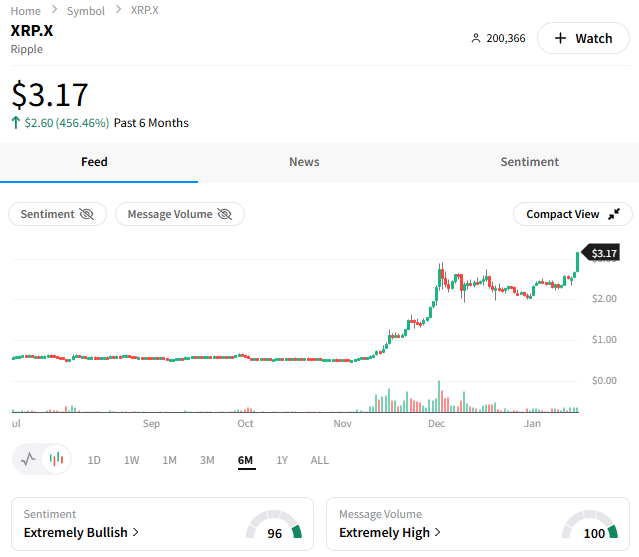

Ripple led to the upside, rising nearly 20% on the day as it cracked a new cycle high above $3 and challenged its highs from early 2018! Needless to say, the Stocktwits community’s sentiment is ‘extremely bullish’ on Ripple, and an active poll suggests 44% of respondents see it rising to over $10. 🤯

Others trending on the platform included LiteCoin, Stellar Lumens, Dogecoin, Jasmy, Hedera, and more of the usual suspects. 🤪

Additionally, the official @StocktwitsCrypto handle has reached its first 100,000 followers on the platform, and we’re hosting a giveaway to celebrate! Click the post below and drop your favorite thing about crypto on Stocktwits for a chance to win.

Source: Stocktwits.com

Lastly, if you’re into crypto and reading this far, you need to follow this account and subscribe to our crypto newsletter, The Litepaper. Otherwise, you’re missing out on critical market trends and insights! So go subscribe, and we’ll see you there. 🤙

Links That Don’t Suck 🌐

🧑🏫 Coming Jan. 16: Save your spot for IBD’s new webinar, “Swing Trading: Quick Action, Quick Results”*

😨 Hundreds of Washington Post staffers send letter to Jeff Bezos sounding alarm over paper’s direction

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋