NEWS

Cyber Shock Exacerbates Tech Wreck

Big tech’s breakdown continued today as a cybersecurity firm’s software issue took down Microsoft services used worldwide. That gave sellers an excuse to continue pounding tech stocks while defensive segments of the market held up slightly better. Let’s see what else you missed. 👀

Today's issue covers CrowdStrike causing a global meltdown, Elliott Management taking a stake in Starbucks, and how this week differed from the rest of the year. 📰

Here's today's heat map:

2 of 11 sectors closed green. Healthcare (+0.51%) led, & technology (-1.56%) lagged. 💚

Overseas, Japan’s above-target inflation fuels speculation that a rate hike could be coming soon. Still, the central bank remains focused on supporting the growth of the country’s sluggish economy. 🔺

American Express shares fell 3% as its earnings topped expectations, but revenues missed slightly. The company raised its full-year EPS guidance and reaffirmed its revenue forecast, saying that its bet on the high-income consumer continues to pay off. 💳

Comerica shares plunged 10% even as its net interest income beat expectations. High interest rates are pressuring its deposits and loan volumes. 🏦

Plug Power fell 14% after the green energy company announced it would sell $200 million of stock to aid its turnaround strategy. 🪫

Insurance giant Travelers dipped 8% after its revenue came in 2% below expectations and earnings beat. The news dragged peer insurer W.R. Berkley down more than 8% ahead of its earnings report on Monday. 📊

Hawaiian Electric jumped 37% after a Bloomberg News report said the utility joined a tentative deal to pay more than $4 billion to resolve hundreds of lawsuits related to last year’s Maui wildfires. Notably, the agreement is in the works but has not yet been finalized. 💰

AI-powered, low-emissions sidewalk delivery robot maker Serve Robotics soared over 200% on news that Nvidia has taken a 10% stake in the company. 🤖

Other active symbols: $TSLA (-4.02%), $AGEN (-17.95%), $GNS (-3.90%), $NAAS (-23.11%), $MLGO (+12.19%), and $MAXN (-10.32%). 🔥

Here are the closing prices:

S&P 500 | 5,505 | -0.71% |

Nasdaq | 19,523 | -0.93% |

Russell 2000 | 2,184 | -0.63% |

Dow Jones | 40,288 | -0.93% |

COMPANY NEWS

CrowdStrike Update Causes “Largest IT Outage In History”

One of the major selling points of technology companies is how scalable their businesses typically are, since large scale can mean large profits. However, that scale can be a double-edged sword when things aren’t going well, as cybersecurity provider CrowdStrike found out today. 🙃

A malfunction in the company’s threat-monitoring software crippled all Microsoft Windows systems, sending companies around the world into a wild tailspin overnight.

CNBC has a timeline of “live updates” that would take you an hour to read through, highlighting problems everywhere from the London Stock Exchange to India’s government to airlines around the globe.

And speaking of airlines, over 4,000 flights were canceled, stranding hundreds of thousands of passengers. 😱

The early-morning news hit both stocks in the pre-market but hammered CrowdStrike and boosted its competitors like SentinelOne, who may benefit from this massive screw-up over the longer term.

Ultimately, the company was able to deploy a fix. Still, experts say the effects of this outage will linger as the solution needs to be applied manually on a per-machine basis. 🤦

The news also attracted several analyst downgrades, with some believing this will knock the firm off its longer-term trajectory. They also warned of the unknown financial consequences of this issue.

So far, retail investors and traders agree with the negative outlook, as Stocktwits sentiment fell to extremely bearish levels (3/100) on extremely high message volumes. And from a technical perspective, traders are watching to see if prices can stabilize above their 2021 highs. Otherwise, technical analysts warned of more downside ahead. 🐻

As always, we’ll keep you updated as the story develops further. 😵💫

SPONSORED

Join the Online TraderLion Trading Conference on July 20-21 & 27-28!

The Annual TraderLion Trading Conference is back, bigger and better than ever! 🎉

Join the free live stream on July 20-21 & July 27-28 for expert insights from legendary traders like Stan Weinstein, Mark Minervini, and Ross Haber. Learn from over 30 top traders and level up your trading skills.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Elliott Management Takes A “Tall” Position In Starbucks

Starbucks shares have been stuck in a major drawdown lately as competition heats up, consumers pinch their pennies, and management struggles to define a clear vision for continued growth.

However, the drawdown has gotten significant enough that big players are ready to take a swing at enacting change and driving shareholder value. As we can see from the chart below, with the stock nearly 40% off its all-time highs, its dividend yield has risen to nearly 3%. 💵

That could be why Elliott Investment Management has been building a sizeable position in the company and engaging with management in recent weeks. However, not many details have emerged around its position size or demands, as it hopes to reach an agreement privately with management.

Technical analysts are also excited about the stock’s pop, as it occurred right around the high 60s to low 70s price range that’s acted as support over the last five years or so…and history could repeat itself (or at least rhyme). 🤔

Retail investors and traders on Stocktwits have also been sticking with the stock, with the sentiment meter reading “extremely bullish” or “bullish” for much of the last few weeks.

We’ll have to wait and see how things play out from here. But with money rotating from high-flying tech into beaten-down “blue chips,” many view Starbucks as the next big catch-up candidate. 💡

STOCKS

Here’s How This Week Stacked Up

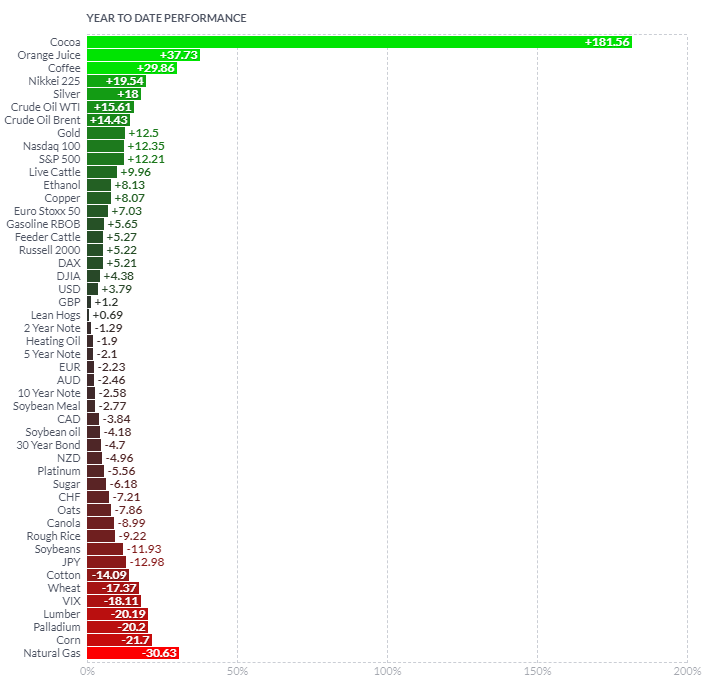

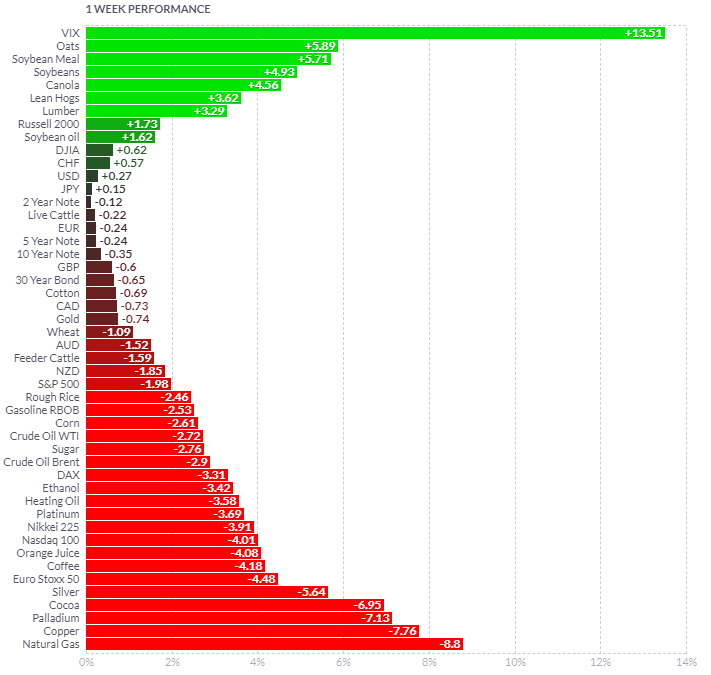

If this week felt different than the others this week, it’s because it was. Let’s quickly break down what we saw with two charts. 👀

The first year-to-date chart shows international stocks and large-cap U.S. indexes leading the charge to the upside. Meanwhile, the small-cap Russell 2000 is finally positive, up about 5% YTD after this week’s rally.

The volatility index is also down 18%, demonstrating just how quiet the environment has been so far. 🤫

This week, we saw the script flip, with volatility picking up and large-cap U.S. and international equities leading to the downside. The Russell 2000 was the only major equity index positive, as September rate cut bets pushed small-caps back into favor. 🤑

Now, one week has not reversed the long and strong trend of U.S. large-cap tech outperformance. However, we typically see volatility pick up around major turning points because volatility signals a struggle between buyers and sellers to maintain control. ⚔️

Right now, the thing worth watching is whether institutions actually continue putting capital to work in small-caps and other neglected areas of the market. We’ve seen blips of rotation over the last few years, but they have never established any staying power. 😒

We’re all thinking that small-caps should lead from here. But almost everyone is waiting on some form of “confirmation” to get them comfortable making bigger bets in the space.

Because remember, the early bird gets the worm. But the early worm gets eaten. (I don’t know what this means; it just sounded appropriate. Happy Friday, folks.) 🤷

What type of content would you like to see more of in The Daily Rip?

Bullets From The Day

🖼️ Art world transitions amid NFT sale slump. The Christie’s Art and Tech Summit in New York affirmed what has been apparent to anyone involved in the NFT market: sales are down…a lot. The market rout has given industry incumbents a comfortable excuse to dismiss the technology trying to disrupt the art market and maintain the status quo. Axis has more.

📺 Apple TV+ will soon have a lot more movies. While the company has positioned itself as a niche in the industry by providing strong original programming, allowing it to have a strong initial run. However, the company is now holding discussions with more than one large film studio about bringing them there to help diversify the service’s offerings. More from ArsTechnica.

💵 Asset managers rush to buy credit ahead of Fed rate cut. Top U.S. asset manager Vanguard favors high-rated corporate debt over riskier, high-yield companies’ bonds as it seeks protection against the possibility of a sharper-than-anticipated U.S. economic downturn caused by high borrowing costs. With investors largely expecting the U.S. central bank to begin cutting rates in September, investors looking for fixed-income exposure are looking to lock in rates before yields start preemptively coming down. Reuters has more.

Links That Don’t Suck

🧑🏫 Register for a free 2-hour trading workshop on 8/10 to learn the fundamentals of sound investing*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍