NEWS

Down But Certainly Not Out

The U.S. stock market indexes closed mostly lower on the day but made new all-time weekly closing highs as buyers climbed the wall of worry. Let’s see what you missed. 👀

Today's issue covers the marijuana sector marching higher, Trump’s DWAC giving back gains, and more from the day. 📰

Here's today's heat map:

2 of 11 sectors closed green. Communications (+0.20%) led, & financials (-1.17%) lagged. 💚

Chrysler parent Stellantis is sitting near all-time highs but cut another 400 salaried U.S. workers, citing “unprecedented uncertainties.” ✂️

Coffee chain retailer Dutch Bros fell 7% after announcing an 8 million share secondary offering priced at $34 per share. ☕

The athleisure retail wreck continued, with Nike and Lululemon both falling due to a weaker-than-expected sales environment. Overall, discretionary consumer brands remain challenged on the demand side. 🛍️

Papa John’s shares fell 4% on news that Shake Shack had poached its CEO, Rob Lynch, leaving the pizza chain without seasoned leadership at a time when the industry faces several major headwinds. 🍕

Other active symbols: $FDX (+7.35%), $RDDT (-8.80%), $OTLK (+22.59%), $SEZL (+14.28%), $OCGN (+22.39%), $GNS (-20.59%), & $PLNT (+1.77%). 🔥

Here are the closing prices:

S&P 500 | 5,234 | -0.14% |

Nasdaq | 16,429 | +0.16% |

Russell 2000 | 2,072 | -1.27% |

Dow Jones | 39,476 | -0.77% |

POLICY

Marijuana Sector Marches Higher

Cannabis companies have been fighting for their lives in the public markets over the last few years but found some footing last September and have been trying to climb out of their abyss ever since. 🪜

Well, today, the industry got another boost on news that Germany has decriminalized possession and growing cannabis at home beginning on April 1st. While likely not a major boost for any U.S. company, it’s further evidence of growing political support for the drug globally. 👍

Meanwhile, in the U.S., Treasury Secretary Janet Yellen said she would welcome legislation that would rectify the conflict between federal and state laws on the sales and use of marijuana that is preventing firms from accessing the banking system.

Current laws require businesses to hold large amounts of cash, with Yellen saying, “I think it’s a real problem, and it would be desirable to have legislation that alleviated this problem.”

More importantly, it’s an impediment to collecting taxes from these firms (that should certainly get legislators’ attention). That’s why Senate Majority Leader Chuck Schumer is asking other lawmakers to show their support for a marijuana banking bill as he pushes for further legislation. 📝

The combination of news helped boost a number of stocks in the space over the last few days. Time will tell if these runs can continue, but for now, traders have their eyes on them for next week. 👀

COMPANY NEWS

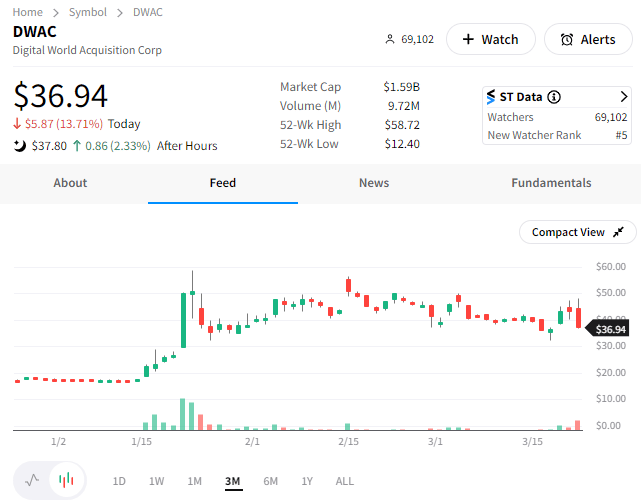

DWAC Gives Some Gains Back

Digital World Acquisition Corp.’s shareholders have finally approved a merger with Donald Trump’s social media company, Truth Social. That means the newly merged company, Trump Media, could begin trading under the new ticker $DJT next week. 👍

Despite the merger finally taking place, prices of the stock are currently down on fears that a lot of stock could be coming on the market soon.

That’s because Trump owns a majority of shares in the new company that are worth billions. And with him needing cash quickly to pay a $454 million civil fraud judgment against him, this is an obvious source of liquidity for him. 🤑

The good news for current holders is that Trump cannot sell shares of the newly formed company for at least six months. However, the board of directors could vote to allow Trump to sell shares earlier than that. So, if he stacks the board in his favor, he could sell much sooner. ⚠️

Then there’s the issue of Truth Social's actual business. Now that it’s a public company, it should start to trade (at least partially) on its underlying fundamentals instead of being a proxy for people betting on or against Trump.

And like many of the SPACs before it, those underlying fundamentals leave a lot to be desired. 😬

As a result, current shareholders are looking at some sizeable risks ahead of them that don’t seem to have clear solutions. That, combined with short sellers betting on the stock to fail, is adding selling pressure to the stock in recent days and weeks.

Still, $DWAC shares have managed to stay above their levels from the last two years and are likely to remain in focus as the 2024 presidential election looms. So, at the very least, if you’re not trading it, get your popcorn ready. 🍿

STOCKTWITS EDGE

Elevate Your Trading Game 👀

Unleash your trading potential with our new Edge subscription plan—featuring unique social data, an ad-free experience, and more!

Bullets From The Day

💰 AI startup Anthropic lines up a new slate of investors. Sovereign wealth funds and other heavy hitters in the investment world are trying to get their hands on artificial intelligence shares at any cost, with Anthropic looking to raise money north of a billion dollars. With that said, the AI startup has ruled out taking any money from Saudi Arabia due to national security concerns. Existing stakeholders, including Amazon and Google, are not expected to increase their holdings this round. CNBC has more.

😡 Users say Glassdoor added their real names without consent. The popular site which lets anyone anonymously sign up to review companies they have worked for, reportedly collected and added users’ names to their profiles without their permission. A user experience revealed that Glassdoor will add a user’s real name and other pertinent information to the user’s account without their permission if they learn of it. The only option to avoid this is to delete your account. Users are outraged, saying hacks or other breaches could reveal their identities and put their livelihoods at risk. More from TechCrunch.

✈️ Colorado startup looks to bring back supersonic air travel. After years of delays, Boom Supersonic took a major step this week toward its goal of returning commercial supersonic aviation to the skies. Its prototype aircraft, the XB-1, left the ground for the first time, taking a short, subsonic flight over the Mojave Desert. While it’s certainly progress, the company is still far from its goal of launching the first supersonic commercial aircraft since the Concorde ended operations 20 years ago. The Verge has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

/production/original_566953024.png)