NEWS

Earnings Mixed Ahead Of Fed Tricks

Another day, another decline in the S&P 500 and Nasdaq 100 driven by weakness in the semiconductor space. While the market awaits mega-cap tech earnings and the Fed’s latest decision, the Russell 2000 and Dow Jones Industrial Average remain decently big. Let’s see what you missed. 👀

Today's issue covers Microsoft and AMD’s earnings moves, Pinterest popping, and restaurant’s “consumer worries” being overlooked. 📰

Here's today's heat map:

7 of 11 sectors closed green. Energy (+1.55%) led, & technology (-2.51%) lagged. 💚

U.S. job openings inched lower to 8.02 million during June, with separations remaining little changed. The ratio of job openings to available workers is at 1.20, its lowest since June 2021 and just below pre-pandemic levels. 💼

Home prices hit a new record high in May, with the S&P Case-Shiller index rising 6.80% YoY, even as interest rates remained high and the labor market cooled. Meanwhile, the Conference Board consumer confidence index remained stuck in the narrow range it’s been in for about two years. 🏘️

Internationally, Germany’s economy unexpectedly contracted during the second quarter (-0.10%), even as the broader Eurozone expanded (+0.30%). 🔻

Domestic crude oil prices fell below $75 for the first time since early June as uncertainty about the global economy outweighed fears of potential supply constraints from continued conflict in the Middle East. 🛢️

Software company QXO Inc. cratered from a valuation of more than $90 billion last week to $40 million today after the firm unlocked millions of shares for sale via private placements registered yesterday after the bell. 📉

CrowdStrike shares fell another 10% today on reports that Delta Airlines has hired a high-profile lawyer to seek damages from the company’s historic IT outage. Delta had the toughest time recovering from the situation and is handling over 176,000 reimbursement requests after canceling ~7,000 flights. ❌

JetBlue jumped 12% after it announced a surprise profit for the second straight quarter. It also outlined its “Jet Forward” strategy, which is intended to save $800 to $900 million in costs through 2027. Meanwhile, budget-friendly Spirit Airlines is hopping on the “premium upgrades” bandwagon, adding snacks, Wi-Fi, and other amenities to its new ticket classes. ✈️

Here are the closing prices:

S&P 500 | 5,436 | -0.50% |

Nasdaq | 17,147 | -1.28% |

Russell 2000 | 2,243 | +0.35% |

Dow Jones | 40,743 | +1.85% |

EARNINGS

Microsoft Slips While AMD Rips

Big tech results set the market’s tone, with Microsoft and AMD in the spotlight today. Let’s quickly recap the results and investors’ reactions. 👇

Microsoft’s adjusted earnings per share of $2.95 on revenues of $64.73 billion topped expectations of $2.93 and $64.39 billion.

Despite the top-line beat, the finer details and guidance threw investors for a loop. Revenue from Azure and other cloud services grew just 29% compared to estimates of 31% (its first miss since 2022). The company’s total first-quarter revenue guidance also missed expectations. 👎

On a positive note, the PC market has started to solidify, but analysts are focused primarily on AI because it’s seen as the growth driver with the best chance of scaling (and fast).

Microsoft shares were down about 4% after the bell and about 13% off their all-time highs. That said, Stocktwits sentiment is bullish, suggesting retail investors are looking to buy the dip. 🛒

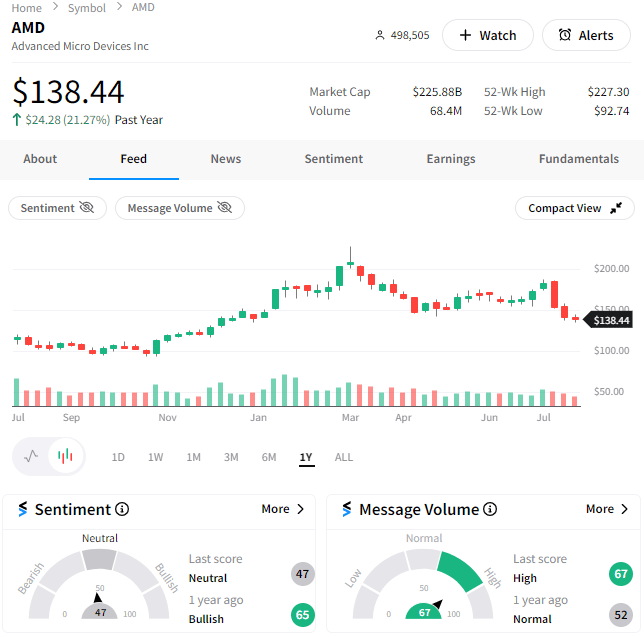

Meanwhile, AMD is rocking and rolling after saying that data center sales more than doubled YoY (+115%).

Adjusted earnings per share of $0.69 on revenues of $5.84 billion topped expectations of $0.68 and $5.72 billion. CEO Lisa Su said the company saw “higher than expected” sales of its AI chips and that revenue from its MI300 chips exceeded $1 billion. 🤩

AMD’s core business is making central processors (CPUs)) for laptops and servers, but like its competitors, AI chip sales in its data center segment have become the core growth driver as it chases Nvidia and other competitors.

Shares rose 8% after the bell, though Stocktwits sentiment is stuck in a neutral range as investors digest the news. With AMD shares lagging its peers, bulls hope these results and outlook can help reignite the stock’s momentum. 🐂

EARNINGS

Pinterest Shares Pop (But Not In A Good Way)

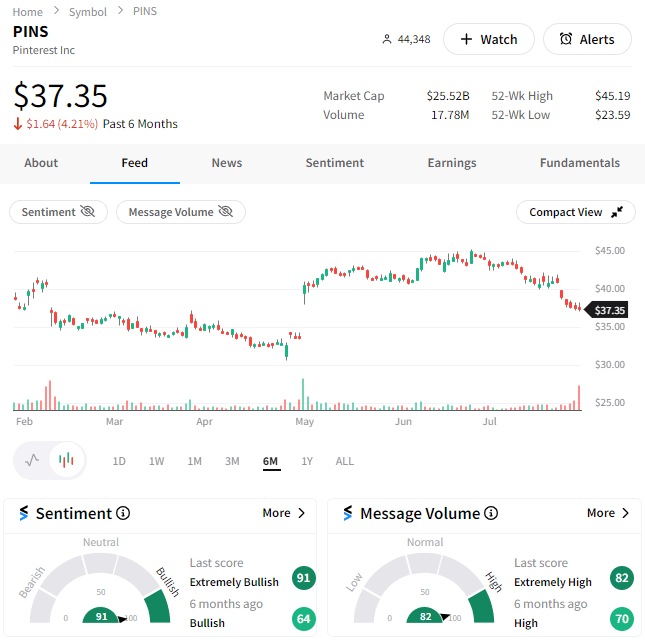

Social media is a fickle business, as Pinterest investors find out every earnings season when shares ultimately pop…one way or another. Unfortunately for investors, shares are popping in a bad way this time around… 🙃

Although the company’s revenue ($854 vs. $848 million) and adjusted earnings ($0.29 vs $0.28) beat expectations.

Its 522 million global monthly active users (MAUs) also topped estimates of 520.10 million. And global average revenue per user (ARPU) of $1.64 was in line with expectations, though the U.S./Canada is underperforming Europe and the rest of the world. 🔻

Its guidance was the primary issue this time. Third-quarter revenue of $885 to $900 million equated to 16% to 18% YoY growth but fell short of analyst’s $907 million expectation. Overall, the ad market is strong but remains spotty depending on which sector/industry you drill down into.

Pinterest shares are down about 10% after the bell, pushing back toward their YTD lows. Notably, Stocktwits sentiment has pushed back towards its highest levels of the last year in extremely bullish territory. 🐂

Analysts will be watching Meta on Wednesday and Snap Inc. on Thursday for more information about the ad market’s current health. Google’s YouTube advertising revenue miss last week put the market on alert, so we’ll find out if it was a market issue or a company-specific one. 🤷

EARNINGS

Are Restaurants’ “Consumer Worries” Priced In?

Yesterday, we highlighted McDonald’s shares rising despite same-store sales declining for the first time since Q4 2020. Today, we’re seeing similar action in Starbucks…which begs the question: Could most of the consumers’ woes be priced into these stocks already? 🤔

Getting into the results, the coffee chain’s quarterly earnings met expectations, but revenue fell short. China’s same-store sales fell 14%. Management reiterated its slashed outlook from last quarter, saying the overall sales slump will not end anytime soon.

Like McDonald’s and others in the space, Starbucks has rolled out a “value meal” to help drive customer demand and traffic. Investors expect that to hurt margins in the near-term, but would like to see the company retake market share using its scale in this “challenging” environment. ⚠️

As we noted above, Starbucks shares fell back toward their 2022 lows before earnings and rose 3% after the bell. Stocktwits sentiment is in “extremely bearish” territory, even as the price of the stock starts to stabilize. 🔺

For some contrarian investors, this widely negative sentiment in McDonald’s, Starbucks, Lululemon, Nike, and other consumer-focused companies is a sign that it is time to bet on a rebound. 🐂

On the other hand, bearish investors say this negative sentiment is warranted and that the headwinds in these stocks’ businesses remain clear and unmitigated by management yet. 🐻

Time will tell which side is right, but nonetheless, this is an interesting set of circumstances.

STOCKTWITS “CHART ART”

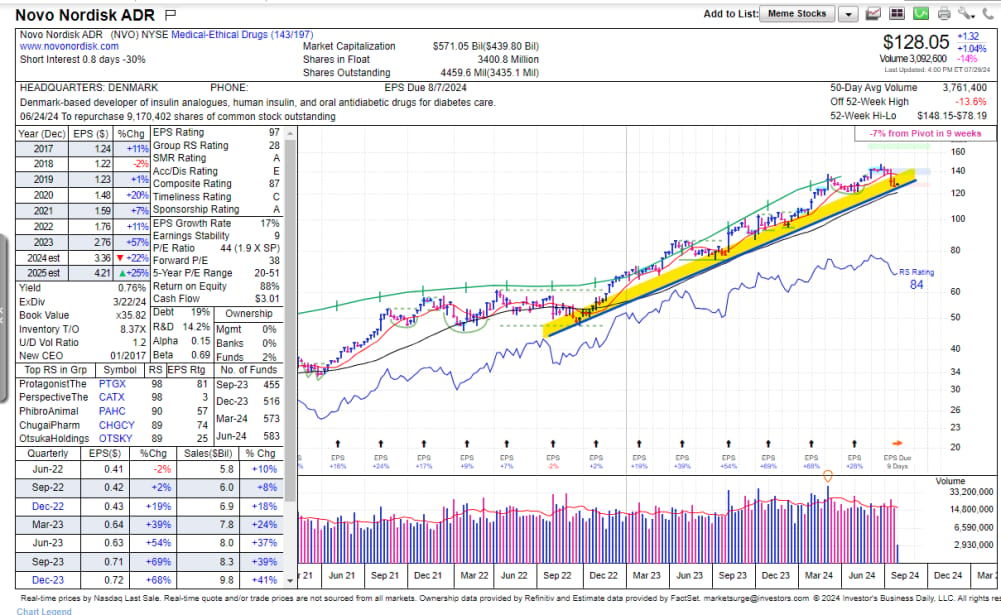

Novo Nordisk Needs Buyers To Show Up Here 😬

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Bullets From The Day

🤝 Perplexity AI creates a revenue-sharing model with publishers to stave off plagiarism accusations. After being sued by numerous publishers around the globe, the startup has debuted a revenue-sharing model designed to stop the lawsuits and get everyone back on friendly terms. So far, media outlets and content platforms, including Fortune, Time, Entrepreneur, The Texas Tribune, Der Spiegel, and Wordpress.com, have joined the “Publishers Program.” CNBC has more.

₿ a16z and Sequoia-backed crypto startup charged with fraud. The founder of crypto startup BitClout has been charged with fraud and unregistered securities offering related to him raising over $257 million in cryptocurrency. The Securities and Exchange Commission (SEC) complaint alleges he told investors that proceeds from the platform’s token would not be used to pay himself or employees, but he allegedly spent over $7 million on personal expenses. More from TechCrunch.

🕵️ U.K. regulator targets Google’s partnership with AI startup Anthropic. The antitrust watchdog is scrutinizing Google-parent Alphabet’s partnership with the AI startup and its impact on competition. This is the latest move by regulators to analyze deals between smaller industry startups and big tech giants and block them if they’re seen as inhibitive to competition. So far, regulators have targeted deals from Microsoft, OpenAI, Inflection AI, Mistral AI, Anthropic, Cohere, Alphabet, and more. Reuters has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey.📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍