NEWS

Earnings Are The Star Of The Show

Earnings are the name of the game these days, with a significant portion of the S&P 500 set to report results this week. Today’s targets were Tesla, Google, and others, as investors looked to get a read on the economy and these individual companies’ future prospects. Let’s see what you missed. 👀

Today's issue covers Tesla tumbling lower after earnings, Google’s YouTube concerns, Lockheed Martin and GE Aerospace’s leadership, and UPS failing to deliver while another stock hit the $SPOT. 📰

Here's today's heat map:

2 of 11 sectors closed green. Materials (+0.40%) led, & energy (-1.59%) lagged. 💚

U.S. existing home sales fell to their slowest pace since 2010, with prices hitting a new record (up 4.10% to $426,900) even as supply upticks. 🔺

Visa shares dipped after posting a revenue miss, with total payment volume, cross-border volume, and processed transactions growth slowing QoQ. 💳

General Motors fell 6% after further delaying electric vehicle plans. It will miss its goal of a North American production capacity of 1 million EVs by 2025. 🪫

Coca-Cola jumped 2%, with unit case volume growing globally but falling slightly in North America. It joined competitor Pepsi in citing softer U.S. consumer demand but raised its full-year guidance amid global strength. 🥤

Comcast shares dipped 3% after its earnings beat, but revenue missed due to weakness in its film studio and theme park segments. Peacock subscribers rose 38% YoY to 33 million, with that and 20% growth in its mobile phone business offsetting some of its 120,000 broadband customer losses. 🔻

P.S. With earnings season in full swing, be sure to check out Stocktwits’ new earnings call feature that’s elevating the experience to a whole new level. More info available below today’s main story. 🥳

Here are the closing prices:

S&P 500 | 5,556 | -0.16% |

Nasdaq | 17,997 | -0.06% |

Russell 2000 | 2,243 | +1.02% |

Dow Jones | 40,358 | -0.14% |

EARNINGS

Tesla Tumbles Amid Earnings Trouble

The market had high expectations of the electric vehicle maker heading into today’s report, given its price had nearly doubled over the last three months. 😮

However, it was unable to impress investors and is falling after hours.

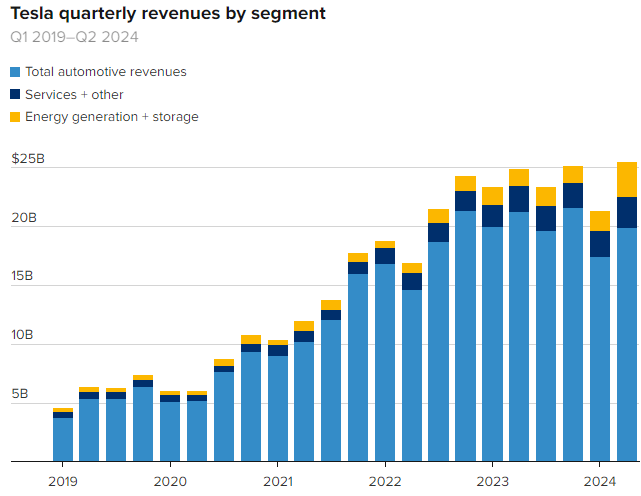

Adjusted earnings per share of $0.52 were well below the $0.62 expected, while revenues of $25.50 beat the consensus estimate of $24.77 billion. Investors were happy to see record revenues but not thrilled it’s coming from strength in its businesses other than its vehicles. 🙃

As a result, Tesla’s automotive revenue remains the key focus for analysts, rising 14% QoQ but falling 6.50% YoY. In addition, regulatory credits of $890 million were three times last year’s, contributing a sizeable portion of the total $19.90 billion in automotive segment revenue. 🔻

With fierce competition in the U.S. and abroad, Tesla was forced to offer discounts and other incentives to spur demand. That hit earnings significantly, with its adjusted earnings margin falling from 18.70% to 14.40% YoY.

Also, rival automakers saw sales of fully electric vehicles rise 33% YoY during the first half of this year, while Tesla’s sales fell 9.60%. 🔋

More importantly, Elon Musk and management failed to address investors’ concerns about how the company plans to navigate this difficult environment for EV makers. Or provide material updates on promises like the robotaxi fleet and the use of humanoid robots in Tesla factories.

So far, macro and other external factors have been blamed for much of Tesla’s struggles, and investors don’t believe those headwinds are set to disappoint anytime soon. 😬

Shares were down around 8% after hours, though the Stocktwits sentiment meter has moved back into bullish territory after nearly a month in neutral to negative territory. We’ll see if retail’s optimism pays off! 👍

NEW ON STOCKTWITS

Elevate Your Earnings Call Experience with Stocktwits 🚨

We are thrilled to announce Earnings Calls will now be LIVE on Stocktwits! Starting now, you can experience real-time financial insights and engage with the Stocktwits community like never before. Here’s what you can expect:

Pre-Earnings Chat: Discuss and predict earnings outcomes before the call starts.

Live Chat: Join the conversation and react as companies announce their key figures.

Shape Market Sentiment: Influence market sentiment with bullish or bearish reactions.

In-Depth Access: Get reports and key slides during and after the earnings call (coming soon).

Predict, react, and analyze with ease. Elevate your earnings call experience with Stocktwits.

EARNINGS

Google’s YouTube Miss Overshadows Results

Alphabet also reported today but experienced a muted reaction to its mixed quarter after the bell. As the CNBC summary below shows, it beat on top-line metrics but missed on YouTube advertising revenue. 😬

With YouTube’s YoY revenue growth falling from 20.90% last quarter to 13% now, concerns are that this business’s growth rate has reached its peak for the cycle and will trend lower in the coming quarters. YouTube remains the largest video platform in the world but faces increasing competition from TikTok and other video-based social media platforms.

The company’s “Other Bets” unit saw 28% YoY revenue growth to $365 million, but the primary thing to note was its new $5 billion multi-year investment in self-driving-car unit Waymo. 🤑

Overall performance and accelerating growth (albeit marginal) in its cloud business helped appease investors. Management continues to broaden its AI bets as it looks for the company’s next major growth drivers.

Google shares were down marginally after the bell, but notably, Stocktwits sentiment remained in “extremely bullish” territory as retail investors continue to bet on big tech. 👍

EARNINGS

UPS Fails To Deliver While Spotify Hits The $SPOT

Two well-known stocks moved 12% on earnings today but in opposite directions. Let’s see what news drove the moves. 📊

Starting with the good, Spotify posted a record quarterly profit, driven by its cost-cutting measures and product price increases. Additionally, paying Spotify subscribers rose to 246 million, topping expectations. 🎧

CEO Daniel Elk said, “It really comes down to the number of subscription offerings we have now. We’re moving from one-size-fits-all to have something for everyone.” This shows the company’s efforts to diversify its product offerings are paying off.

Profits rose 45% YoY while revenues rose 20% YoY, though analysts noted the company missed its monthly active users (MAUs) target by 5 million. However, directionally, things remain in good shape, and gross profit margins improved sequentially from 27.60% to 29.20%. 🔺

Meanwhile, transportation giant United Parcel Service continued underperforming FedEx and posted its worst daily decline on record.

The company’s adjusted earnings per share of $1.79 missed expectations by $0.20, while revenues of $21.80 billion were shy by 2%. Again, lighter U.S. volumes were the culprit, and the company could not offset that weakness with further price increases.

U.S. volumes grew for the first time in nine quarters, but the product mix is expected to continue pressuring its revenue per piece. However, with expense management and slowing labor inflation, the company expects to end the year with a U.S. operating margin of 10%. 📦

As a result of short-term conditions, management revised its full-year revenue forecast downward by $1.50 billion and capital expenditures by $500 million. As for its sale of RXO, Inc., it will use $500 million in proceeds for share repurchases when the transaction closes near the end of the year. It’s also looking to close its acquisition of Mexican express delivery company Estafeta.

Overall, Wall Street remains skeptical of management’s ability to navigate the continued macroeconomic headwinds impacting UPS and its peers. Notably, retail apparently views this weakness as a buying opportunity, with Stocktwits sentiment hitting a one-year high at 95/100. 🐂

STOCKTWITS “CHART ART”

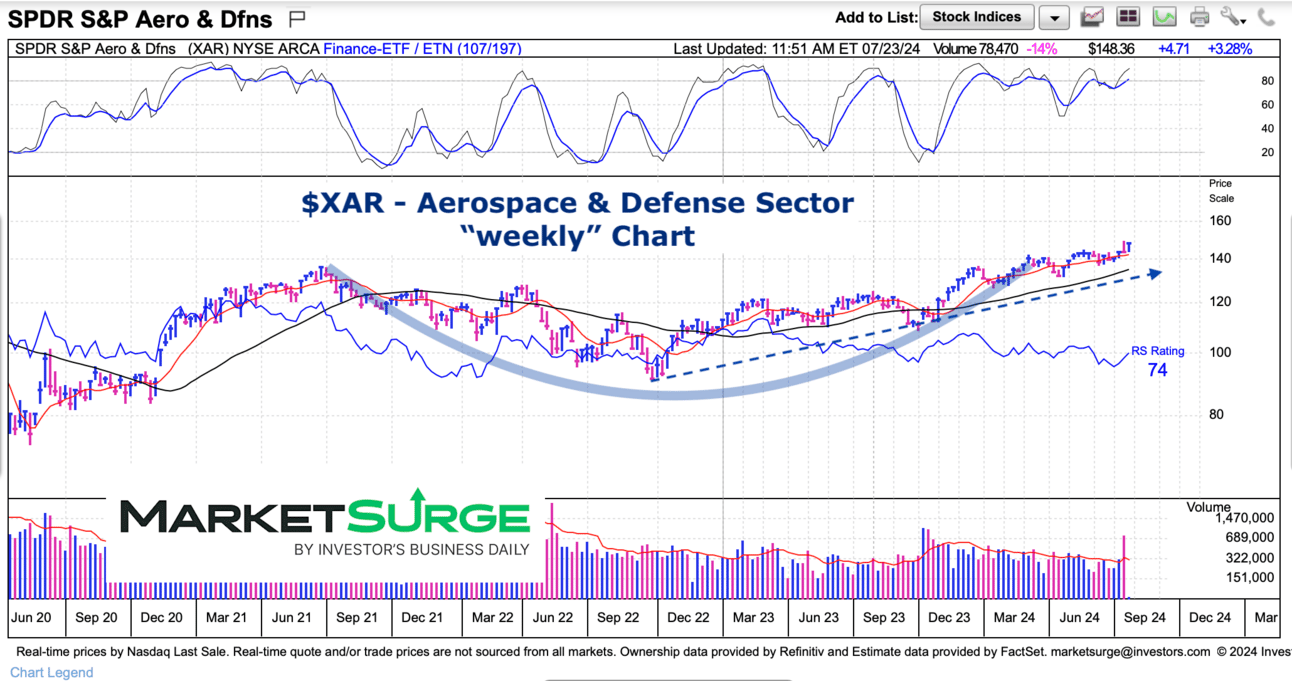

Aerospace & Defense Sector Sets New Highs 🛡️

Aerospace and Defense stocks were led higher today by Lockheed Martin and GE Aerospace’s strong quarterly results. Their leadership helped push the entire sector higher, including several popular ETFs.

Stocktwits user @andrewnyquist was one of many pointing to the ETF $XAR continuing its breakout of a 2-year base on the back of geopolitical tensions, strong travel demand, and an optimistic industry outlook. ✈️

The industrial sector has been quietly outperforming, and many are betting on it to continue as we approach a potential September rate cut.

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

Bullets From The Day

🙅 Wiz turns down Google’s $23 billion deal, bets on public markets. The $12 billion cloud security startup that Alphabet was courting has decided to remain a public company, instead opting to bet on itself making a public market debut sometime soon. Management told employees its goal is to reach $1 billion in annual recurring revenue before taking to the U.S. capital markets to see what valuation it can fetch. Yahoo Finance has more.

🕵️ FTC launches probe into surveillance pricing. Federal regulators are assessing how JPMorgan Chase, Mastercard, and their peers use people’s personal data to sell them a product at a price different from what other consumers might see. The Federal Trade Commission (FTC) calls this “surveillance pricing,” better known in the industry as dynamic pricing or price optimization, and it’s now investigating how this practice impacts the prices consumers at large pay. More from CBS News.

🤩 Meta releases the biggest and best open-source AI model yet. Llama 3.1 outperforms OpenAI and other rivals on certain benchmarks; now, Zuckerberg expects Meta’s AI assistance to surpass ChatGPT’s usage by the end of the year. Its system is significantly more complex than the smaller Llama 3 models it previously rolled out, being trained on 405 billion parameters using over 16,000 of Nvidia’s H100 GPUs. The company has also made a big push to advertise Meta AI as it looks to use its consumer reach to get this tech into the hands of hundreds of millions globally. The Verge has more.

Links That Don’t Suck

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍