NEWS

Eggflation Fears Spark Stock Slump

Source: Tenor.com

Nvidia continued its run today, but it was not enough to offset the broader weakness caused by lackluster economic data. Big banks kick off a new earnings season tomorrow morning, with individual company results adding more uncertainty to the already messy macro picture. 👀

Today's issue covers the impact of today’s economic data on the market, $AEHR’s soaring earnings, and a rundown of several popular stocks. 📰

P.S. We apologize for today’s newsletter's wonky formatting. We encountered an issue with the spacing between lines right before sending it and were unable to troubleshoot it in time. Thank you for your understanding.

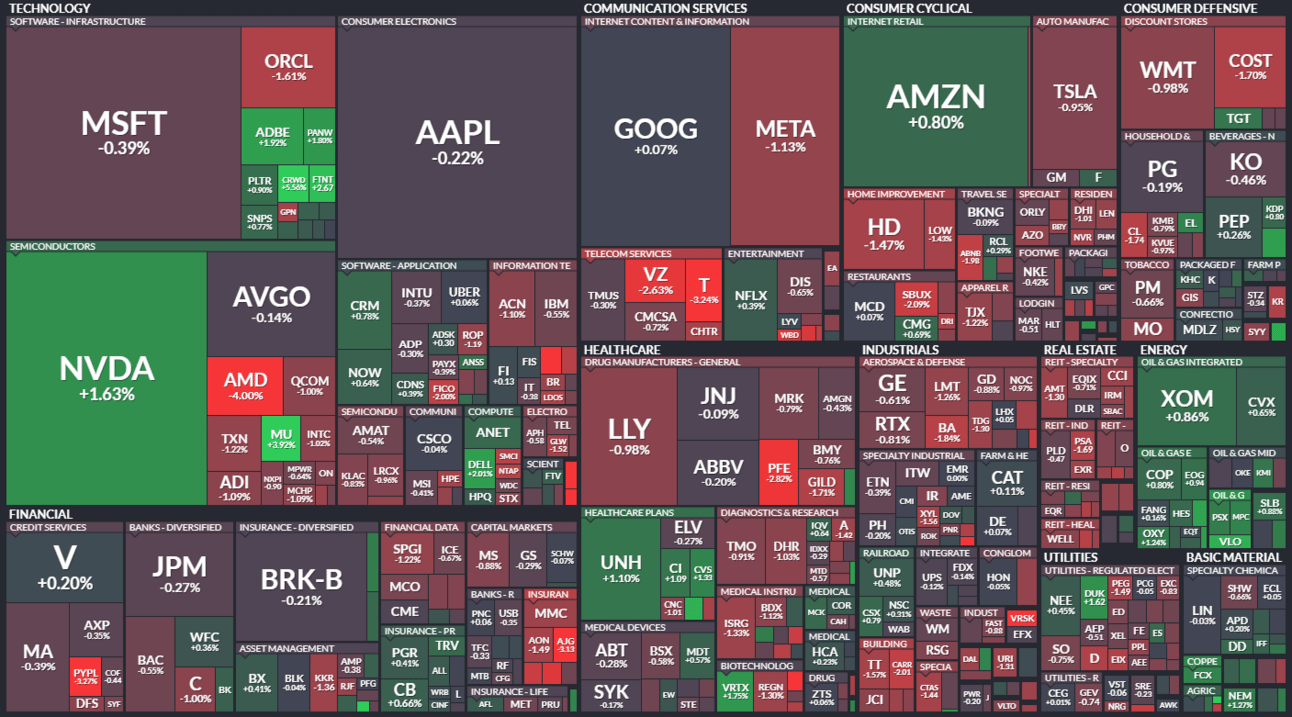

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with energy (+0.68%) leading and real estate (-0.83%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,780 | -0.21% |

Nasdaq | 18,282 | -0.05% |

Russell 2000 | 2,188 | -0.55% |

Dow Jones | 42,454 | -0.14% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $JTAI, $FSLR, $NET, $SYM, $TVGN 📉 $TD, $EPIX, $SNAX, $DAL, $BNGO*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Inflation Up & Employment Down Turns Stocks Around 🙃

Stock market investors and traders were betting on inflation continuing to cool today, but instead, they got a hotter-than-expected print.

The consumer price index (CPI) rose 0.2% MoM and 2.4% YoY, slightly more than the 2.3% increase anticipated by analysts. Stickiness in shelter prices drove the move, which remains the key driver of services inflation. 📊

Meanwhile, eggflation is back in action, with prices rising 0.8% MoM and 8.4% YoY as the lingering bird flu weighs on the supply chain. Although that factor didn’t help the hot print, it mostly makes for a funny headline…lol 🐣

In the labor market, U.S. initial jobless claims rose to 258,000, their highest level in a year, which could suggest companies are beginning to lay off or fire workers at a faster pace than they had been. Granted, this weekly dataset is volatile, so we’ll have to wait for a few more data points to confirm the trend.

With that said, inflation surprising to the upside and employment surprising to the downside is not what the market wanted to see. That’s why we saw stocks sell off today while gold and precious metals caught a bid.

Overall, this was not a major shift, but it did raise caution flags for investors who have been betting big on the party continuing into year-end. ⚠️

SPONSORED

Adobe-Backed AI Startup Grows from $5M to $85M, Partnering with Top Brands

Introducing RAD Intel, a high-growth AI startup driving success in the $633B content, data, and influencer marketing industry. Brands like Hasbro, Skechers, and Sweetgreen are using RAD Intel’s AI-powered platform to achieve up to 3.5X ROI, delivering real results that set them apart.

With backing from 7,800+ investors, including employees from Google, Meta, Amazon, and support from Adobe's Fund for Design, RAD Intel has skyrocketed from a $5M to $85M valuation in under three years. The company has already raised $35M, and now is your chance to invest early in this proven tech disruptor.

RAD Intel's platform uses AI to provide brands with data-driven insights, helping them cut through the noise and engage their audiences with precision.

Don’t miss out! Get 10% bonus shares if you invest by October 15th at midnight PST.

This is a paid advertisement for RAD Intel’s Regulation CF offering. Please read the offering circular and related risks at invest.radintel.ai.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Aehr Test Systems Is Today’s Biggest Earnings Mover 📈

The small-cap semiconductor tester tied to the electric vehicle (EV) industry reported better-than-expected first-quarter results.

Its adjusted earnings per share of $0.07 topped the $0.02 expected, while revenues of $13.12 million exceeded the $12.17 million consensus view. Bookings were $16.8 million, alongside a backlog of $16.6 million as of August 30th. Additionally, the company had $40.8 million in cash remaining. 💸

Management expects material bookings and revenue contributions from several other markets this fiscal year as it executes a strategy to expand the test and burn-in products in other fast-growing markets.

The stock soared 11% on the news, with Stocktwits sentiment ending the day in ‘bullish’ territory, suggesting the community is looking for more upside ahead. 🐂

Source: Stocktwits.com

STOCKS

Solar Slumps While Software Soars 🔀

Several popular stocks were on the move today, so let’s quickly recap. 👇

First off, Cloudflare ($NET) jumped 9% after announcing that a ServiceNow executive is joining as its new product head. The stock broke through technical resistance and the Stocktwits community is looking for further upside, with sentiment in ‘extremely bullish’ territory. 🔥

There was not much news about small-cap insurer Root Inc., but it popped 17% as Stocktwits sentiment pushed into ‘extremely bullish’ territory. Some users pointed to rising auto insurance rates as a catalyst for the industry. 🚗

Energy drink maker Celsius soared for a second straight day after traders spotted unusually bullish options activity as the stock held support. Stocktwits sentiment remains in ‘extremely bullish’ territory as traders look for the rebound to continue. ⚡

The solar industry slid after Jeffries lowered its price target for leader First Solar despite keeping a ‘buy’ rating on the stock. The move weighed on the entire sector, with First Solar, SolarEdge, and Maxeon Solar leading to the downside. 🔻

And the AMD artificial intelligence (AI) event turned into a “sell the news” event, even as it unveiled a new AI chip to rival Nvidia’s Blackwell. Still, Stocktwits user sentiment remains in ‘bullish’ territory, suggesting retail is looking to buy the dip. 🤷

STOCKTWITS “TRENDS WITH FRIENDS”

How To Trade The India-China Tech War 🦾

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Producer Price Index (8:30 am ET), Fed Goolsbee Speech (9:45 am ET), Michigan Consumer Sentiment (10:00 am ET), WASDE Report (12:00 pm ET), and Fed Bowman Speech (1:10 pm ET). 📊

Pre-Market Earnings: JPMorgan Chase ($JPM), Wells Fargo ($WFC), BlackRock ($BLK), Fastenal ($FAST), Bank of New York Mellon ($BK), and Bank7 ($BSVN). 🛏️

After-Hour Earnings: None — enjoy your weekend. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋