NEWS

Enron Wants In On This Bull Market

Source: Tenor.com

U.S. stocks pushed to new all-time highs, with Apple and mega-cap tech strength masking weakness under the surface. Meanwhile, the story of the day was the infamous Enron returning in its latest form…an alleged crypto scam. 👀

Today's issue covers Apple’s new all-time highs, troubles in the electric vehicle space, and Enron’s return 23 years after its record-breaking bankruptcy. 📰

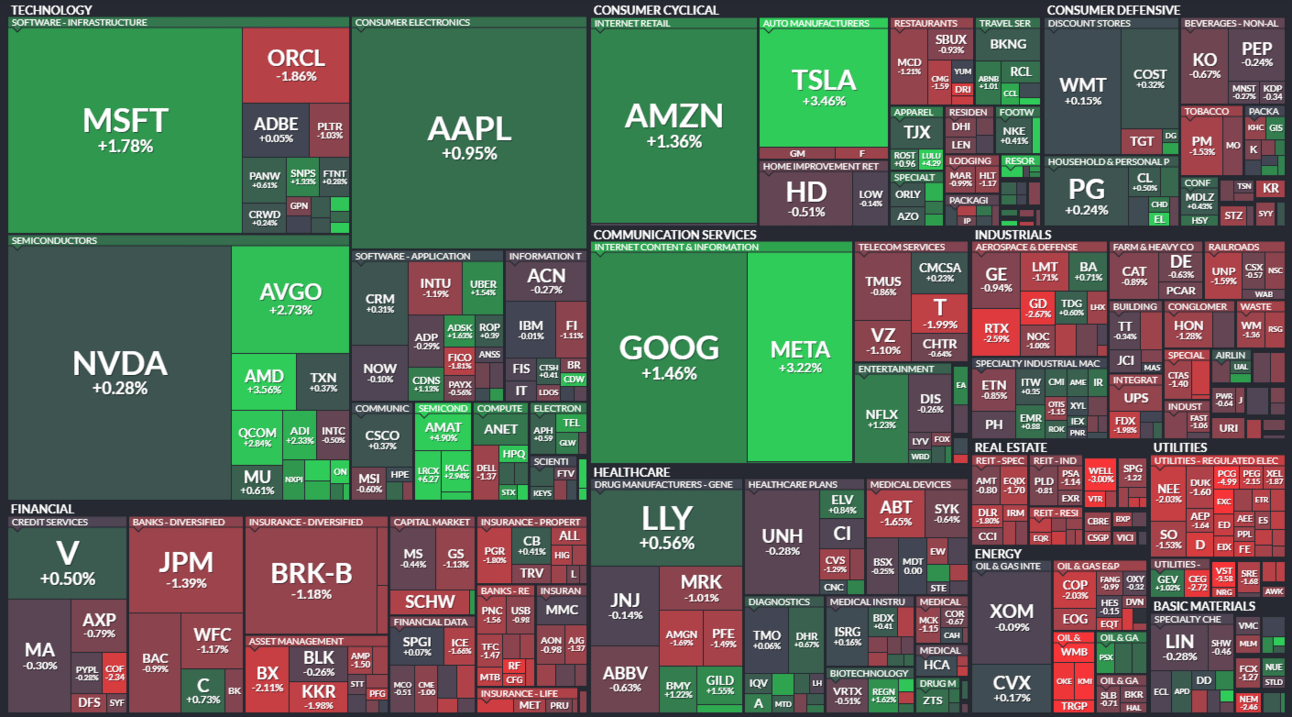

Here’s the S&P 500 heatmap. 3 of 11 sectors closed green, with technology (+0.95%) leading and utilities (-2.15%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,047 | +0.24% |

Nasdaq | 19,404 | +0.97% |

Russell 2000 | 2,434 | -0.02% |

Dow Jones | 44,782 | -0.29% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $QNRX, $SNTI, $PPBT, $JANX, $OMEX 📉 $PTCT, $RBLX, $REVB, $STLA, $FFIE*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Apple Joins The Crypto Craze 🤑

Mega-cap stocks were on the move during the first trading day of December, with Apple leading the charge by hitting new all-time highs. Remember Apple, the company we were all worried about because it “lacked innovation,” and Warren Buffett’s Berkshire Hathaway sold a large portion of its shares? 🤔

Well, it’s once again the largest company by market cap at $3.62 billion, adding a partnership with Coinbase to allow users to buy crypto via Apple Pay. The addition to Coinbase Onramp will allow the 60M+ U.S. users of Apple Pay to instantly bring money on-chain, giving Apple a small piece of the recent crypto craze.

Stocktwits sentiment pushed into ‘extremely bullish’ territory on the news, with polled users expecting the stock to rally to $250 in 2025. 🐂

Source: Stocktwits.com

Meanwhile, Nvidia shares and other semiconductors recovered as the sector digested the latest round of U.S. curbs on chip technology exports to China. Still, Nvidia remains in a holding pattern after two beat-and-raise earnings reports left prices stagnant near their all-time highs. 😐

One chip stock that did move was Super Micro Computer, which jumped 29% after its special committee found no ‘evidence of misconduct.’ It also appointed a new chief accounting officer and began the process of replacing its current CFO.

Although Super Micro’s new auditor, BDO, has not yet certified the company’s filings or publicly addressed previous auditors’ concerns, people are taking the special committee’s reports and actions at face value…for now.

Stocktwits community sentiment is currently in ‘neutral’ territory. However, a poll of over 4,000 users signals that over 70% of people believe these Special Committee results are a clear path to recovery. 🤯

Source: Stocktwits.com

Lastly, while we’re talking tech, we need to mention Jeff Bezos’ backing of an artificial intelligence chipmaker hoping to eat Nvidia’s lunch (or take a few bites out of it). The Amazon founder joined Samsung in a $700 million bet on Tenstorrent, which values the fledgling chipmaker at roughly $2.6 billion. 💵

SPONSORED

Do you know about the Bitcoin Mini?

Grayscale Bitcoin Mini Trust ETF ("BTC"), an exchange traded product, is not registered under the Investment Company Act of 1940 (or the ’40 Act) and therefore is not subject to the same regulations and protections as 1940 Act registered ETFs and mutual funds. Investing involves significant risk, including possible loss of principal. An investment in BTC is subject to a high degree of risk and heightened volatility. Digital assets are not suitable for an investor that cannot afford the loss of the entire investment. An investment in BTC is not an investment in Bitcoin.

Grayscale Bitcoin Mini Trust ETF aka the Bitcoin Mini (fund ticker: BTC) is the most cost-effective way to gain exposure to Bitcoin directly through your existing brokerage or retirement account (it has the lowest fee* of all spot Bitcoin funds in the market). Invest the same way you would invest in any other stock or ETF (though, brokerage fees may still apply). That’s right —you don’t need a separate crypto wallet or account on a crypto exchange!

Simply search ‘BTC’ on your preferred trading platform, or click here to learn more.

Grayscale is a crypto-focused asset manager and has been offering exposure to crypto through investment products for over a decade.

^3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. *Low fee based on gross expense ratio at .15%.

COMPANY NEWS

Stellantis CEO Forced To Step Aside 🧑💼

It was a wild ride for electric vehicle stocks today, with several in the news for not-so-great reasons. Let’s start with Stellantis, which fell 6% after its CEO abruptly stepped down following “different views” between him and the board of directors. A Special Committee is managing the search for a permanent CEO to replace Carlos Tavares.

In the interim, a new Executive Committee chairs by Stellantis board chairman John Elkann will lead the company through its rocky waters. The world fourth-largest carmaker has seen sales in its core markets like Europe and North America plunge, seeing its third-quarter net revenues fall 27% YoY. 📊

With industry veteran Carlos Tavares unable to drive the company forward, confidence among investors remains low. Stocktwits sentiment is now in ‘extremely bearish’ territory, with many looking elsewhere for opportunities until management can form a clear turnaround plan. 👎

Source: Stocktwits.com

On a positive note, the company’s joint venture with Samsung SDI won a $7.54 billion loan from the U.S. government to help it build two electric vehicle battery plants in Kokomo, Indiana. The loan is still being finalized but is expected to create at least 2,800 jobs at the plants and hundreds more for parts supply companies. 💵

General Motors was also down marginally today after announcing plans to sell its stake in a $2.6 billion electric vehicle battery cell plant to its joint venture partner LG Energy Solution. It will recoup its initial (roughly $1 billion) investment in the facility.

Lastly, Volkswagen’s workers held rolling two-hour strikes to protest proposed pay cuts and plant closures. Electric vehicle makers are struggling to keep pace with foreign competitors who have managed to lower their costs (and vehicle price points) and eat into global EV market share. Volkswagen argues that it must lower costs in Germany to stay competitive, though workers blame management for their failure to develop attractive products and entry-level EVs. 🪫

CRYPTO

Enron Is Back…Sort Of 🙃

The infamous energy and commodity conglomerate was once the largest corporate bankruptcy in the U.S. on December 2, 2001, after it was revealed to be a massive fraud. Given how crazy the markets have been recently, we can’t be surprised that Enron is supposedly back 23 years later, announcing that it has “something very special to introduce” next week.

It made its entrance into the world via an X post, with a one-minute video alluding to a rapidly changing future that Enron is going to be a major part of. 🤔

So, is the company back to make amends for its past transgressions and develop the world’s next great public service? Who really knows? Its press release says it will solve the global energy crisis and that decentralized technology will play a role in the new venture. Lofty goals indeed. ⚡

However, from the looks of the website, X handle, and press release, many are speculating that this is the latest instance of someone buying the naming rights and waiting for the right time to make a quick buck. With crypto cruising to all-time highs, what better time to gather attention, launch a crypto coin, and cash out?

We’ll have to see what the countdown brings next week. But for now, we’ll leave off with the saying, “Fool me once, shame on you; fool me twice, shame on me,” because boy, is some of the recent market action going to create a lot of fools… Stay safe out there! 🚨

CHART OF THE DAY

Palo Alto Prepares For Next Leg Higher 🔒️

Cyber stocks have been a beneficiary of the tech sector’s broadening breadth, alongside software and other industries. Within the cybersecurity space, Palo Alto Networks remains a clear leader, consolidating tightly above its former all-time highs, with Stocktwits user @JFDI and others suggesting its next leg higher is set to begin.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: JOLTs Data (10:00 am ET), RCM/TIPP Economic Optimism Index (10:10 am ET), Fed Kugler Speech (12:35 pm ET), Fed Goolsbee Speech (3:45 pm ET). 📊

Pre-Market Earnings: Bank of Nova Scotia ($BNS), Core & Main ($CNM), Donaldson Company ($DCI), REX American Resources ($REX), Citi Trends ($CTRN). 🛏️

After-Hour Earnings: Salesforce ($CRM), Marvell Technology ($MRVL), Pure Storage ($PSTG), Box ($BOX), Okta ($OKTA), Torrid Holdings ($CURV), Couchbase ($BASE). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋