NEWS

Fed Can No Longer Fudge Its Forecast

The first quarter’s inflation and labor market data left the Fed no choice but to hedge its rate cut forecast, with Powell concluding two weeks of jawboning with his own hawkish comments. Let’s see what else you missed. 👀

Today's issue covers Fed Chair Powell’s comments, two healthcare giants heading in opposite directions, and one stock showing clear relative strength. 📰

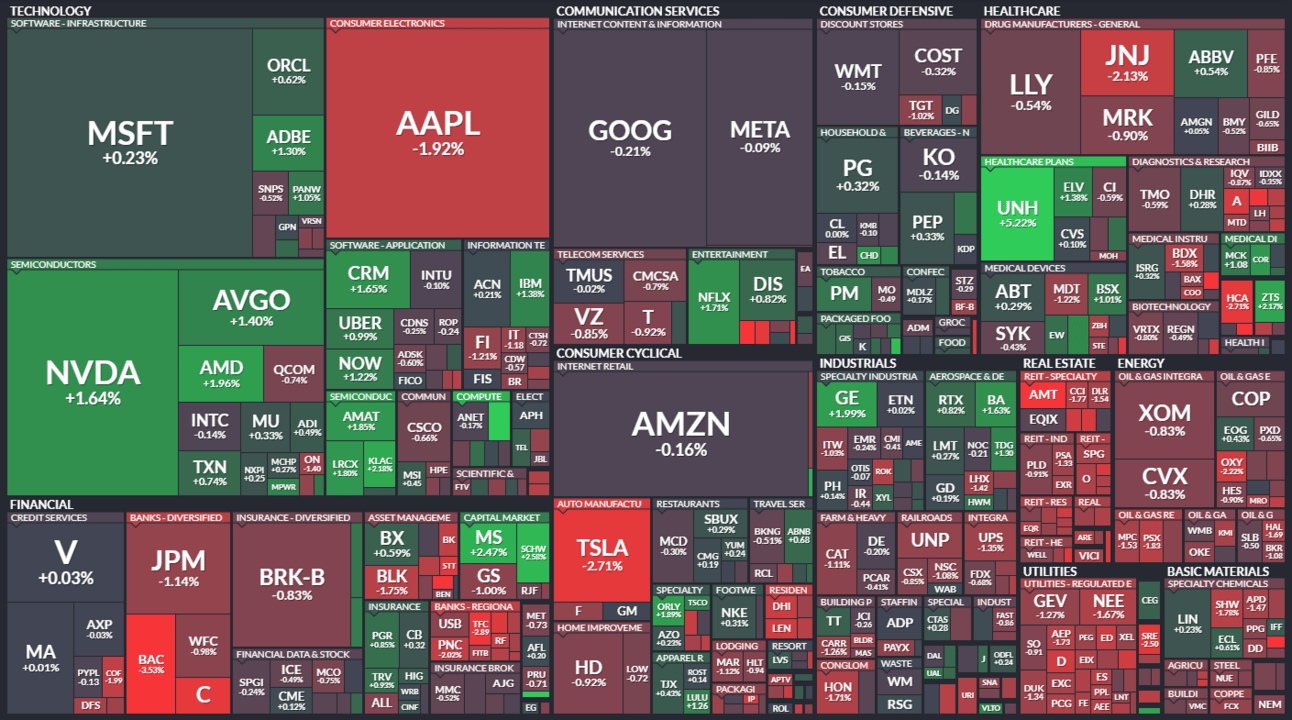

Here's today's heat map:

3 of 11 sectors closed green. Technology (+0.12%) led, & real estate (-1.53%) lagged. 💚

New home construction fell 14.70% in March, matching an April 2020 decline and recording its worst non-pandemic move since February 2015. Permits for single-family homes fell 5.70% in March and were flat for multi-family units. Mortgage rates continue to dictate builder confidence, causing lots of MoM volatility. 🏘️

Trump Media and Technology shares fell another 14% despite the company announcing plans to launch a new live TV streaming network. The network aims to provide a permanent home for high-quality news and entertainment that face discrimination on other distribution channels. 📺

Ticketmaster parent company Live Nation fell 8% after the Wall Street Journal reported that the U.S. Department of Justice is filing an antitrust suit. 🎫

Dr. Martens’ shares plummeted to fresh all-time lows after the shoemaker said its 2024 full-year results would be in line with estimates. It built out an operating cost base to support a larger business, but revenue growth never came. 👞

Other active symbols: $TSLA (-2.71%), $FSRN (+64.66%), $HUBC (-4.62%), $WISA (+248.57%), $JAGX (+50.08%), & $ONEI (-14.63%). 🔥

Here are the closing prices:

S&P 500 | 5,051 | -0.21% |

Nasdaq | 15,865 | -0.12% |

Russell 2000 | 1,967 | -0.42% |

Dow Jones | 37,799 | +0.17% |

EARNINGS

From Powell’s Lips To The Market’s Ears

The U.S. financial markets went from expecting as many as six rate cuts last November when risk assets began their rally to three cuts just a few weeks ago and now to potentially no cuts in 2024. ⏪

Federal Reserve Chair Jerome Powell topped off a number of Fed comments from the last few weeks that seemingly “hedged” the idea that rate cuts were coming anytime soon. 🚨

During his prepared remarks and Q&A session, he stated, “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence.”

He continued, saying, “Right now, given the strength of the labor market and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work.”

Adding to the sticky inflation fears was the International Monetary Fund (IMF) upgrading its global growth forecast due to “surprisingly resilient” economies. It also expects developed economies to lead the charge, with the U.S. at the front of the pack. 🚨

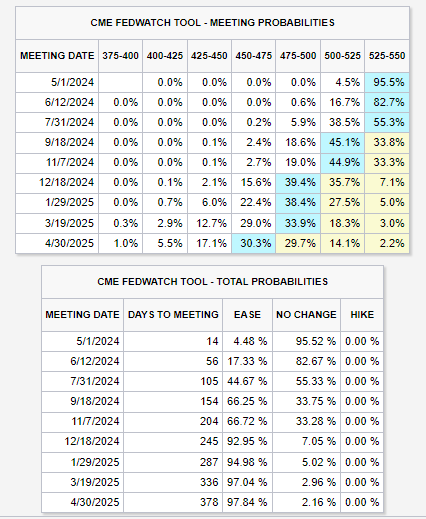

The CME’s “Fed Watch” tool really exhibits just how much the market’s expectations have shifted in just the last few weeks and months. Right now, it looks like the earliest rate cut may be September rather than May or June, which was anticipated about six weeks ago. 🤦

Overall, with the market finally accepting that rates (and inflation) are likely to stay high for the rest of this year, the focus will shift to earnings. 📝

If the economy stays strong and companies continue to grow earnings, then maybe the market won’t have to rely so much on lower interest rates to support the valuations people are willing to pay for stocks. Time will tell.

EARNINGS

Healthcare Giants Head In Opposite Directions

The Dow’s biggest healthcare companies reported results and headed in opposite directions, so let’s quickly recap what happened. 👇

First up is the insurer, UnitedHealth Group. The company reported $7.16 in adjusted earnings per share, topping the $6.61 expected. Its adjusted revenues of $100.08 billion beat estimates by about 1%.

The beat comes despite the company incurring a $7 billion charge related to the sale of its Brazilian operations, as well as adverse impacts from a cyberattack affecting its Change Healthcare platforms. It says the full-year impact from the cyberattack will be roughly $1.15 to $1.35 per share. 🔻

Its most widely-tracked metric, the medical costs ratio, was 84.30% in the first quarter. While that includes a 40 bps impact from the cyberattack, it topped estimates of 83.80% (which is a bad thing). This measures how much of every premium dollar goes toward medical costs.

That said, it wasn’t a total surprise, given that UnitedHealth and other insurers have been warning about higher medical costs for several quarters. Patients are still catching up on surgeries and other medical procedures put off during the pandemic, which means higher volume. Inflation has pushed medical costs up in general, which means higher costs per procedure. 🚨

The stock had been beaten down by many of these concerns, so its “not-that-bad” results were enough to stage a relief rally.

$UNH shares were able to find their footing at their 1-year lows, rallying 5% and pushing Stocktwits community sentiment into “extremely bullish” territory. 🐂

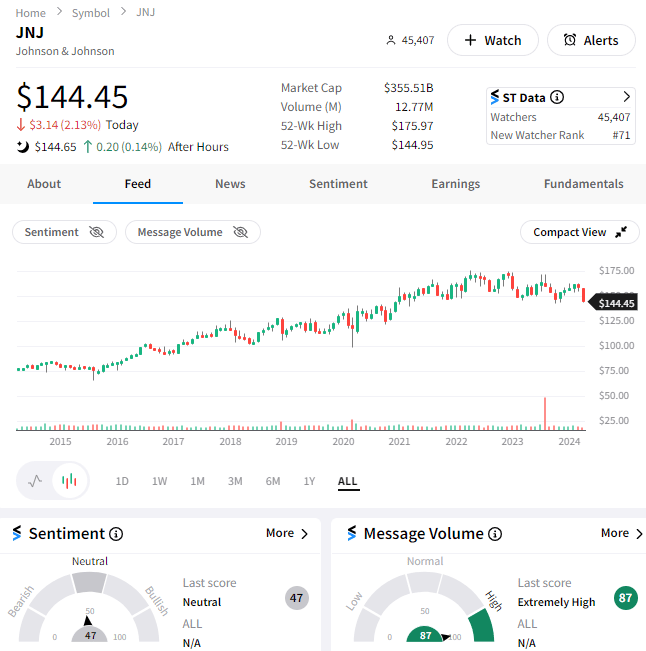

Johnson & Johnson reported yesterday and did not have the same luck.

The company’s jump in medical device sales helped its adjusted earnings per share of $2.71 beat the expected $2.64. Still, its revenue numbers missed expectations by a hair.

The Covid vaccine slowdown has weighed on its pharmaceutical sales, which were up 1% YoY. Excluding the vaccine, which has had four straight quarters without U.S. sales, revenues in that segment were up almost 7%. 💉

Overall, investors remain concerned about the company’s ability to drive revenue growth going forward. Questions remain about whether its continued expansion into the medical device space will be enough to get it back on track.

However, on a positive note, the company increased its quarterly dividend by 4.20%, marking its 62nd year of consecutive dividend increases. 💵

$JNJ shares were down about 2%, probing multi-year lows as Stocktwits community sentiment sits in neutral territory. 😐

STOCKTWITS CONTENT

The Future Trends You Don’t Want To Miss 👀

We will be live with ARK Invest’s Chief Futurist, Brett Winton, to discuss what the future holds for your money on Wednesday, April 17th at 4PM EST! 🗓️

Save your spot here and reply to our tweet with the questions you want answered!

STOCKTWITS “CHART ART”

Super Micro Flexes Its Relative Strength 💪

If you liked the chart and commentary above, you’ll love our new “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

To sweeten the deal for early subscribers, we’ve got two bonuses. 🎁

Receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

Subscribe during April to be entered to win 1 of 5 Stocktwits Edge annual subscriptions.

Bullets From The Day

🛒 TikTok is the latest social media site to get into ticket sales. The company is partnering with ticketing company AXS to sell tickets for events worldwide, introducing the feature to the U.S., U.K., Sweden, and Australia at launch. It builds on its existing ticketing efforts with Ticketmaster, which it partnered with during 2022 and 2023 in the U.S. and 20 other countries. TechCrunch has more.

🥤 TikTok continues to drive trends at multinational companies like Starbucks. The mixture of sweet and spicy has been dubbed “swicy” by users on TikTok, with brands leaning into the trend in order to tap the hyper-online Gen Z and Millennial consumer base. Starbucks is the latest company to do so, introducing a new line of lemonade drinks with three new flavors and a new spicy cream cold foam that can be added to any drink. It hopes this can help further fuel growth since cold beverages accounted for about 75% of beverage sales in Starbucks U.S. company-operated stores More from Axios.

😵💫 Ommitting disclosures is bad, but not securities fraud, says SCOTUS. The U.S. Supreme Court ruled that shareholders can’t sue companies under federal fraud law for not disclosing information about future risks unless the omission makes another statement misleading. The legal question at hand was around SEC Rule S-K, which requires companies to disclose “known trends or uncertainties that have had or that are reasonably likely to have a material favorable or unfavorable impact” in their regulatory filings. Axios has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍