NEWS

Finding Value At All-Time Highs

Source: Tenor.com

President’s Day weekend crypto shenanigans couldn’t derail the stock market bulls’ optimism, as several major U.S. indexes closed at new all-time highs today. As investors look for value, turnaround stories are beginning to take hold, and Bill Ackman announces a Warren-Buffett-like strategy he hopes will unlock growth. 👀

Today's issue covers the latest turnaround bets, Bill Ackman’s big plans, an explanation of the Libra crypto scandal, and more from a busy Tuesday. 📰

Here’s the S&P 500 heatmap. 8 of 11 sectors closed green, with energy (+1.37%) leading and communication services (-0.47%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,130 | +0.24% |

Nasdaq | 20,041 | +0.07% |

Russell 2000 | 2,290 | +0.45% |

Dow Jones | 44,556 | +0.02% |

STOCKS

Turnaround Stories Take Hold & Bill Ackman’s Latest Bet 🧐

Intel has caught fire over the last two weeks, rising over 40% as investors rethink its position in a semiconductor space that’s more critical than ever. With the Trump Administration focused on revitalizing U.S. manufacturing, other industry players are taking notice.

Over the weekend, news dropped that Broadcom and Taiwan Semiconductor are looking to buy certain pieces of Intel to diversify and strengthen their businesses. And as we know, attention from one suitor often attracts several others, causing the stock to pop 16% today…with retail looking for further gains. 🐂

Meanwhile, another beaten-down brand name also caught a bid today. Nike climbed 6% after announcing a partnership with Kim Kardashian’s SKIMS. The new brand, NikeSKIMS, will offer training apparel, footwear, and accessories geared toward women. 👟

With valuations rising and many stocks already experiencing major runs, investors continue to look for opportunities in names that have not participated in the bull run and could be poised for a rebound. Think of Disney, 3M, Starbucks, etc., which have experienced turnaround runs over the last 12-18 months. 🤔

Plus, famed investor Bill Ackman is looking to create a Warren-Buffett-like holding company after his closed-end mutual fund structure failed to gain traction. In a tweet, he outlined his grand plan, which involves purchasing Howard Hughes Holdings and will share more via a live presentation tomorrow on X.

Let's hope he has better luck than the previous investors who were dubbed the “next Warren Buffett” because most of them did not live up to the hype. 🙃

SPONSORED

Investors Are Hooked on This Fishing Breakthrough

Shiny tackle, graphite rods, live sonar, you name it – American anglers spend over $7B a year on equipment to get an edge. So it’s easy to see why ReelView Fishing is buzzing so much – among both anglers and investors.

ReelView’s patented RV1 system is the first fishing tech that transmits live video from fishing line to phone. This game-changing innovation lets anglers see exactly what’s happening underwater – giving them the ultimate edge. No wonder ReelView sold out pre-orders in just 30 days, garnering millions of views on social media.

With a growing market, emerging licensing opportunities, and a model built for expansion, ReelView is scaling fast. Don’t miss your chance to become an early investor and share in their growth.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. This is a paid advertisement for Pacaso’s Regulation CF offering. Please read the offering circular at invest.reelviewfishing.com.

CRYPTO

President’s Day Weekend Madness 🏛️

If you’re into crypto, you know the regular craziness that occurs, especially on days when traditional markets are closed. This weekend’s fiasco was centered around Argentina’s president and a memecoin he dubbed a “private initiative” designed to aid the economy. Our Litepaper writer, Jon Morgan, breaks down what happened…

A Solana-based memecoin, $LIBRA, stole the spotlight during the holiday weekend, shooting to a $4.5 billion market cap before cratering 90% within hours.

Argentine President Javier Milei hyped the Solana-based memecoin as a “private initiative” to aid the economy, only to face lawsuits and impeachment talks. 🔥

Quick Highlights

LIBRA’s Sudden Rise: Initially soared on Milei’s endorsement.

Total Collapse: Lost 90% of its value just as fast.

$87.4M In Mystery Profits: A lucky few appear to have snagged the bag.

“Libragate” Lawsuits: Investigators are calling it a potential rug pull.

Now, the blame game has shifted from Milei to Hayden Davis (aka KelsierVentures), the name at the center of multiple insider trading allegations.

Hayden Davis A.K.A. KelsierVentures 🎭

He pops up in every memecoin fiasco like the friend who always promises to pay but somehow never does.

Victim or Perp?: He calls himself a scapegoat, but interviews suggest otherwise.

Insider Trading Accusations: Preloading tokens, rigging launches, and front-running unsuspecting retail.

Liquidity Power Plays: Controlling liquidity pools to manipulate prices.

$100 Million Limbo: He reportedly has it, but no one’s sure where it’ll end up.

Despite claiming to be on the side of justice, Davis keeps surfacing in the biggest Solana-based insider scandals. 😬

Memecoin Con Job Exceeding $200M+ 🥷

SolanaFloor’s deep dive points to a bigger scam involving Davis and other industry bigwigs.

Defi Tuna Co-Founder’s Revelations: Vlad unknowingly provided liquidity for shady deals.

Melania Token Rug Pull: Allegedly netted $200M–$300M for Davis & crew.

Enron Token Launch: Witnesses saw multiple insiders front-running in real time.

Everyone feigns shock, but the money trail points to one of Solana’s and crypto’s largest “rugpull and run” operations yet.

STOCKS

Other Noteworthy Pops & Drops 📋

Venture Global ($VG +6%): Announced commercial operations at its Calcasieu Pass LNG facility will begin on April 15, ending a three-year commissioning phase. The company raised $1.75 billion in its IPO, becoming the most valuable U.S. LNG firm.

BHP ($BHP +1%): Reported a 23% drop in first-half profit to $5.1 billion, the lowest since 2020, while revenue fell to $25.2 billion from $27.2 billion. The company slashed its dividend to $0.50 per share, the lowest since 2017, citing weak Chinese demand and legal settlements.

Robinhood ($HOOD -7%): Wolfe Research downgraded the stock to ‘Peer Perform,’ stating that its previous bull case had already played out. Q4 revenue more than doubled to $1.01 billion, fueled by a 487% jump in crypto revenue.

TotalEnergies ($TTE +1%): Signed an agreement with Eni, Egypt, and Cyprus to export natural gas from Cyprus through Egypt’s Zohr facilities and liquefy it for European markets. TotalEnergies expects 3% hydrocarbon output growth in 2025, driven by Gulf of Mexico and Brazil production.

Bank of America ($BAC -1%) & Citigroup ($C): Berkshire Hathaway trimmed its holdings in both banks, cutting its BAC stake to 680.2 million shares worth $29.90 billion and Citi holdings to 14.6 million shares valued at $1.03 billion. Despite the reductions, both banks topped Q4 earnings expectations.

Hyatt Hotels ($H +2%): Rebounded after its Q4 EPS of $0.42 missed estimates of $0.76, though revenue met expectations at $1.6 billion. Barclays lowered its price target to $151 from $162, citing concerns about slower net rooms growth.

Diamondback Energy ($FANG -0.15%): Announced a $4.08 billion cash-and-stock deal to acquire subsidiaries of Double Eagle IV Midco, securing 40,000 net acres in the Midland Basin. The company committed to selling $1.5 billion in non-core assets to reduce net debt to $10 billion.

EARNINGS

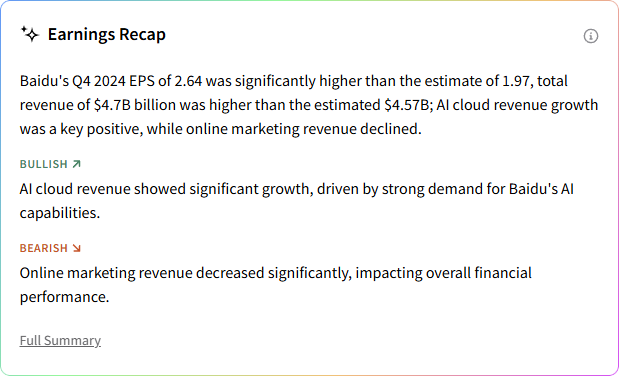

BIDU Booms, IQ Slumps 🛢

Baidu’s ($BIDU) Q4 revenue dipped 2% YoY to $4.68 billion, as AI Cloud growth of 26% offset online marketing weakness. Despite a 27% drop in operating income, net income doubled YoY, driven by cost controls and an improved business mix.

Stocktwits user sentiment remains bullish, with message volume sitting at the same high value (88) as yesterday and well above the low (26) rating from last week. 🐂

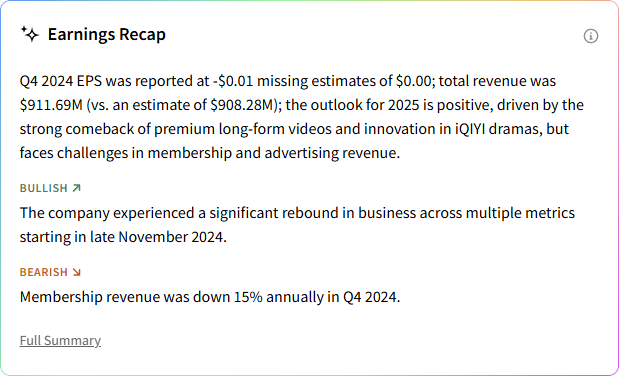

iQIYI ($IQ) reported a 14% revenue decline in Q4 2024, with net losses of $25.9 million as weaker content releases hit membership and advertising revenue. While costs were managed effectively, foreign exchange losses and lower margins kept profitability out of reach.

IQ closed the day lower by -9.25%, but StockTwits sentiment remains bullish, and message volume is at a six-month high. 🤔

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: MBA 30-Year Rate (7:00 am ET), Building Permits/Housing Starts (8:30 am ET) January FOMC Minutes (2:00 pm ET). 📊

Pre-Market Earnings: Fiverr ($FVVR), Wix ($WIX), Etsy ($ETSY), SolarEdge ($SEDG), Cinemark Holdings ($CNK), ProPetro ($PUMP), and MFA Financial ($MFA). 🛏️

After-Hour Earnings: Carvana ($CVNA), Bausch Health ($BHC), Vale ($VALE), Innovative Industrial Properties ($IIPR), Toast ($TOST). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋