NEWS

Friday, Only Slightly Better Than Fed Day

Source: Tenor.com

Stocks closed down on the day but green on the week, as utilities and consumer staples were the only sectors to close positive. Still, market participants continue to find opportunities on the long side as the Fed’s rate cuts fuel optimism. 👀

Today's issue covers beaten-down brands catching a bid, AI investments going nuclear, and signs Micron could be bottoming. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (+2.64%) leading and materials (-0.71%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,703 | -0.19% |

Nasdaq | 17,948 | -0.36% |

Russell 2000 | 2,228 | -1.10% |

Dow Jones | 42,063 | +0.72% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $LFLY, $NBY, $CEG, $CERO, $ZVRA, 📉 $CRBP, $FRES, $DRI, $CVNA, $BIOR*

*If you’re a business and want to access this data via our API, email us.

COMPANY NEWS

Beaten-Down Brands Catch A Bid 🙂

Starbucks' poaching of Chipotle’s CEO sparked a lot of bottom-fishing in the stock market’s biggest brands, which have been left behind in the bull market.

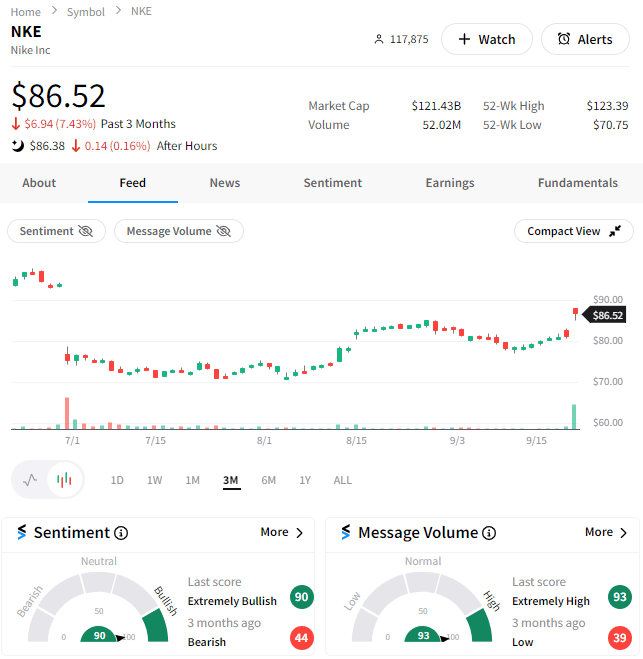

Nike is the latest beneficiary, with the struggling athletic footwear and apparel company’s CEO, John Donahoe, stepping down amid a leadership shakeup. Former senior executive Elliott Hill will rejoin the company, bringing his 32 years of experience in leadership positions across Europe and North America to get things back on track. 👨💼

Nike shares posted a 7% gain on the news, with analysts and retail investors cheering the move. Stocktwits sentiment pushed into ‘extremely bullish’ territory as turnaround hopes find some momentum. 📈

Source: Stocktwits.com

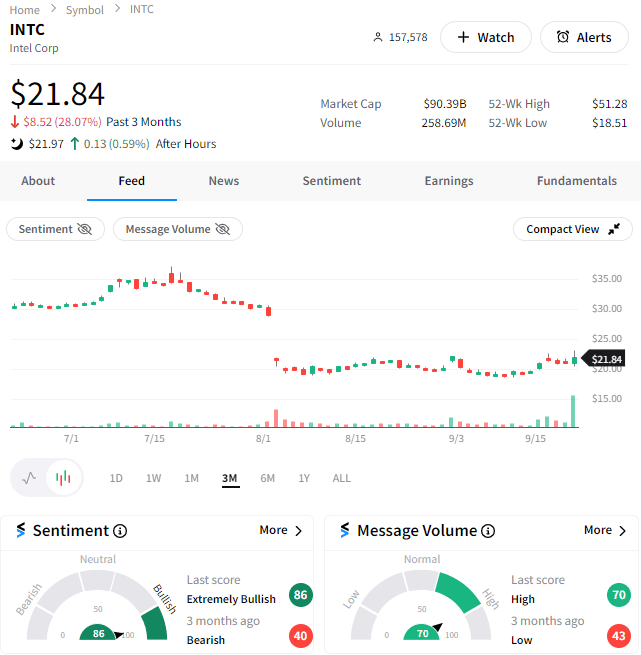

Intel was also in the news today, being halted late in the day on news that Qualcomm recently approached the company about a possible takeover. 😮

Source: Stocktwits.com

Analysts expressed some concerns that Qualcomm ($190 billion market cap) may not have the funding to take over the company, which currently has a market cap of $90 billion. Still, the company’s recent efforts around its foundry business and other initiatives have renewed optimism in the stock.

Stocktwits sentiment pushed into ‘extremely bullish’ territory as investors digested the news. 🐂

STOCKTWITS “CHART ART”

Micron May Have Bottomed Before Earnings 🤔

With semiconductor stocks perking back up over the last two weeks, Micron has failed to attract the same level of interest…at least until now. 🧐

Stocktwits user @TheProphetOfProfit pointed out that the stock has begun to stabilize above trendline support and its YTD lows, with momentum diverging positively.

Given the market has turned into positive territory and investors are taking shots at beaten-down stocks, Micron looks potentially ripe to rip. However, it does report earnings on Wednesday after the bell, so some volatility is anticipated. 🤷

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

COMPANY NEWS

The Amount Of AI Investment Goes Nuclear ☢️

If artificial intelligence (AI) will be as big a deal as the world is betting on, then we will need much more power. That’s why billions of dollars are being poured into infrastructure to support the industry, including nuclear energy.

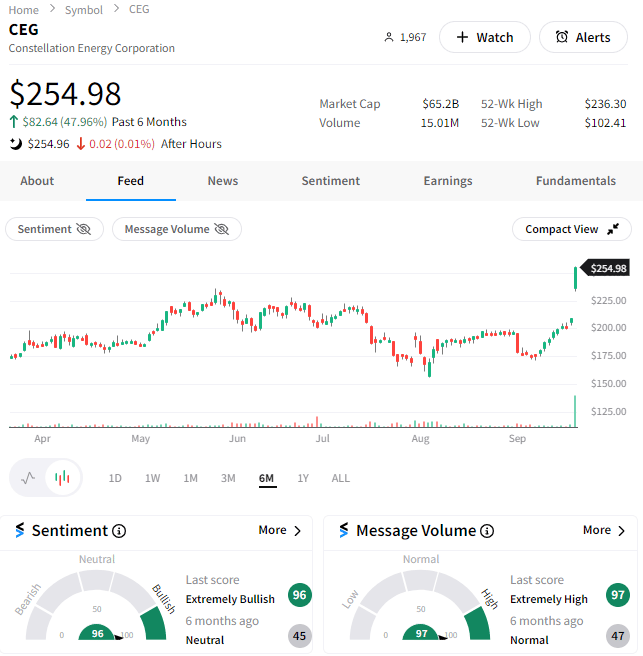

Constellation Energy and Microsoft have signed a power deal to help support the restart of the Three Mile Island nuclear power plant in Pennsylvania. It gives the utility giant the backing it needs to begin applying for the key regulatory permits needed to begin the project. 👍

The project faces an uphill battle as the companies try to resurrect a plant at the center of one of our country’s largest industrial accidents ever. Still, many believe this nearly carbon-free and reliable energy source will be key to delivering the world’s uninterrupted power needs and meeting climate goals.

So far, investors remain optimistic that this push will be successful over the long term. Shares of Constellation Energy popped 22% to new all-time highs, as Stocktwits sentiment pushed into ‘extremely bullish’ territory. ⚡

Source: Stocktwits.com

COMMUNITY VIBES

One Tweet To Sum Up The Week 😐

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋