NEWS

From ‘Nvidia Day’ To ‘Opposite Day’

Source: Tenor.com

Today’s market action was flipped from yesterday, with the stock market indexes going green while Nvidia shares dipped. Earnings drove the largest moves in the market, with retailers and the consumer remaining a key focus area. Let’s see what you missed. 👀

Today's issue covers Dollar General’s damning commentary, big tech fighting for a piece of the AI pie, GameStop’s bet on retro consoles, and expectations ahead of tomorrow’s core PCE inflation data. 📰

Here’s the S&P 500 heatmap. 7 of 11 sectors closed green, with energy (+1.30%) leading and technology (-0.90%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,592 | -0.01% |

Nasdaq | 17,516 | -0.23% |

Russell 2000 | 2,203 | +0.66% |

Dow Jones | 41,335 | +0.59% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SCWX, $FCUV, $DG, $MBD, $BBY 📉 $AILE, $DMRC, $LULU, $GLTO, $AZUL*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

Dollar General’s Damning Commentary 😰

The discount retailer is once again making waves in the market after slashing its full-year revenue and earnings guidance, telling Wall Street that its lower-income customers are struggling significantly in this economy. ⚠️

Adjusted earnings per share of $1.70 on revenues of $10.21 billion missed estimates of $1.79 and $10.37 billion. Same-store sales grew 0.50% YoY, with customer traffic rising enough to offset a decline in average transaction amounts.

Dollar General’s ‘core customers’ earn less than $35,000 annually and account for 60% of total sales. The company has consistently noted that rising costs have made it difficult for those customers to manage their budgets in the current environment, and today signaled those conditions are only worsening. 📉

CEO Todd Vasos said this during the company’s conference call:

I want to provide some additional context around what we're seeing and hearing from our customers. The majority of them state that they feel worse off financially than they were 6 months ago as higher prices, softer employment levels and increased borrowing costs have negatively impacted low income consumer sentiment. As a result, our core customer who contributes approximately 60% of our overall sales comes predominantly from households earning less than $35,000 annually. Inflation has continued to negatively impact these households with more than 60% claiming they have had to sacrifice on purchasing basic necessities due to the higher cost of those items, in addition to paying more for expenses such as rent, utilities and healthcare. More of our customers report that they are now resorting to using credit cards for basic household needs and approximately 30% have at least one credit card that has reached its limit.

In addition, the company has struggled operationally over the last few years due to its overly aggressive expansion strategy. As a result of these headwinds and continued company-specific headwinds, management lowered its full-year earnings and sales growth forecasts materially. ✂️

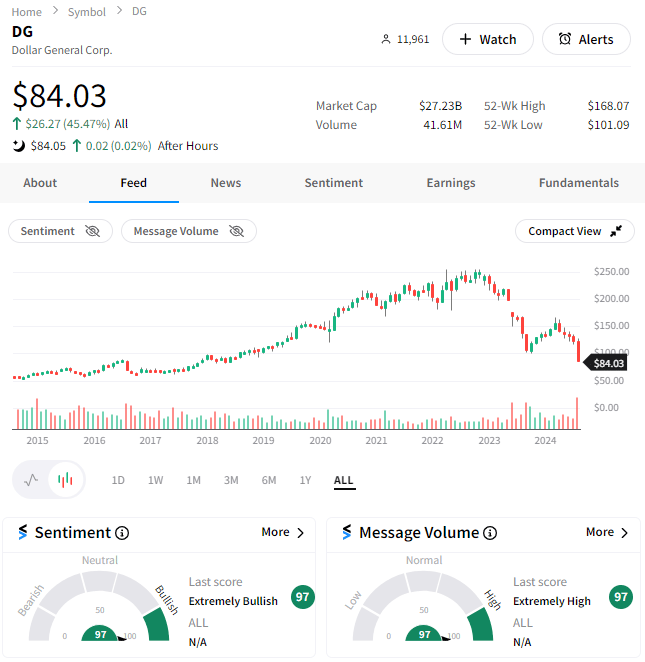

Shares experienced their largest daily drop ever, falling 32% to roughly 7-year lows. Still, Stocktwits sentiment remained in ‘extremely bullish’ territory, suggesting some retail investors and traders are betting on a rebound. 🤔

Source: Stocktwits.com

In addition to Dollar General, there were a ton of other big earnings movers, but too many to recap. Check out the earnings calendar and sort by percentage change to see some of the top movers and shakers. 🫨

A MODERN INVESTOR CONFERENCE

Unlock The Latest Trends In Investing & Alternative Data 🔓

Stocktoberfest is back with an intimate event for executives, influencers, and the most active investors in financial markets on October 20-22. 🤝

Network with industry thought leaders like Howard Lindzon, Michael Batnick, Brian Shannon, Michael Parekh, and many more during the 2-day palooza.

Less than 50 tickets remain, so grab your seat now, and we'll see you in beautiful Coronado, CA! 😎

EARNINGS

Big Tech Shares The Same Bed With AI 🤝

The largest tech companies are collaborating and paying whatever price they need to own a piece of the artificial intelligence (AI) pie. 💵

Yesterday, the big story was that OpenAI is looking to raise additional funding at a more than $100 billion valuation. And today, the follow-on news is that Apple and Nvidia are looking to join Microsoft and Thrive Capital in the round to strengthen their ties with a key partner in the AI race.

Source: Google News

Investors are concerned about the flow of money between these companies because many big numbers are being thrown around but not many business results yet to show. At least not for those who aren’t selling the ‘picks and shovels’ fueling this modern-day gold rush. 😐

And regulators have antitrust concerns, worrying that anti-competitive practices could stifle innovation and competition in the space. They have yet to step in aggressively, but as more and more deals happen, they’re evaluating the potential impact on the competitive landscape. 🕵️

MEME STOCKS

GameStop Gets Its Retro Gaming On 🕹️

Retail GameStop has been out of the game since the Roaring Kitty rally at the beginning of the summer, lacking a clear catalyst for prices to sustain their upward momentum. 😐

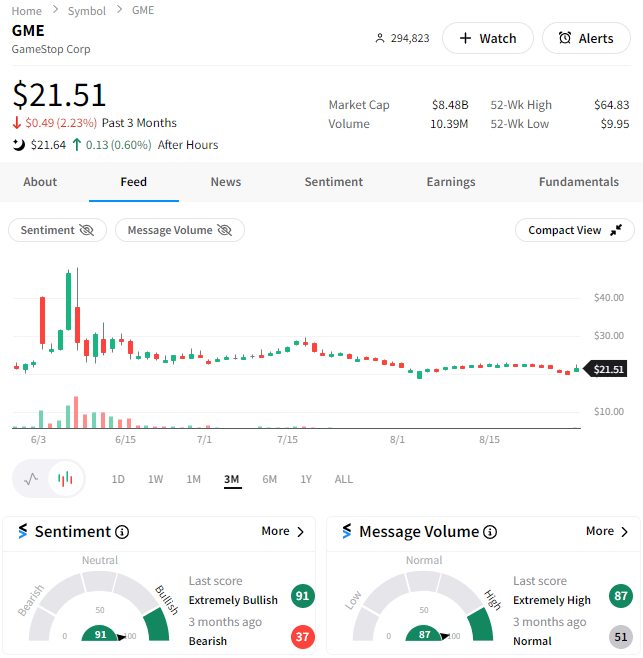

However, that may have changed today, with news helping push the stock up 8% and Stocktwits sentiment back into ‘extremely bullish’ territory.

The news? GameStop is jumping on the ‘Retro Gaming’ trend by launching overhauled locations that sell fan-favorite games for history’s greatest consoles. It’s betting that leaning into the comeback of old-school games can help boost sluggish sales. 🤷

Additionally, management closed its $250 million credit agreement with Wells Fargo in November 2021. By raising over $2 billion via equity sales during the June rally, the company’s balance sheet is in much better shape, allowing management to focus on driving sales.

The stock was up 8% today and will likely remain on traders’ and investors’ radar in the coming days and weeks to see if this is a large enough catalyst to create a sustainable run in the stock. 🐂

Source: Stocktwits.com

In the meantime, hop on Stocktwits to let us know your thoughts on the stock’s move and your favorite gaming console. 👀

CHART OF THE DAY

The Street’s Core PCE Predictions 🌡️

Tomorrow’s big economic event is the Fed’s preferred inflation metric. Fed expert Nick Timiraos outlines Wall Street’s expectations and how meeting those would impact the overall inflation trend.

While most investors and traders will be at the beach tomorrow, the fact that it’s month-end will likely lead to some volatility around this event. We’ll see you tomorrow for that release at 8:30 am ET. 👍

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Core PCE Price Index (8:30 am ET), Personal Income/Spending (8:30 am ET), Chicago PMI (9:45 am ET), and Michigan Consumer Sentiment Final (10:00 am ET). 📊

Pre-Market Earnings: JinkoSolar ($JKS), UP Fintech Holding ($TIGR), Frontline ($FRO), and MINISO Group Holding ($MNSO). 🛏️

After-Hour Earnings: None — have a great three-day weekend! 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🤑 Is your portfolio ready for a boost? Let IBD Digital help––save over 70% on a 4-month subscription*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋