NEWS

Giving Thanks For All-Time Highs

Source: Tenor.com

The S&P 500 logged its best post-Thanksgiving Friday performance since 2012, with all major indices finishing in positive territory. Chip stocks rallied on reports of easing sanctions on China. Meanwhile, the dollar broke its eight-week winning streak, sliding to a one-month low. 👀

Today's issue covers risk assets continuing to rise, The Container Store slumping to fresh lows, and Bitcoin braces for another attempt at $100k. 📰

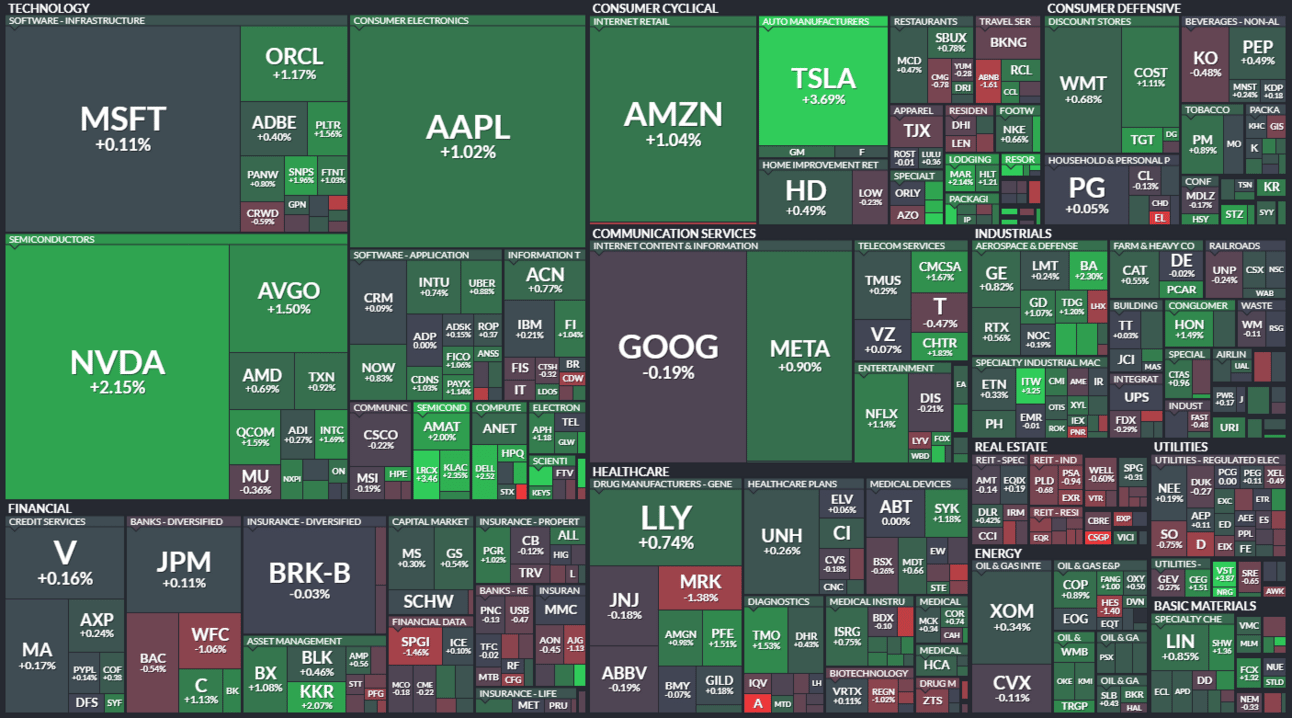

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with discretionary (+1.03%) leading and real estate (-0.46%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,032 | +0.56% |

Nasdaq | 19,218 | +0.83% |

Russell 2000 | 2,435 | +0.35% |

Dow Jones | 44,911 | +0.42% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $AIEV, $BSLK, $KLTO, $ATHE, $GRRR 📉 $MOBX, $RMCO, $HIMS, $ASML, $SPCE*

*If you’re a business and want to access this data via our API, email us.

STOCKS

The Trend Continues Through Thanksgiving 🥳

Technical analysts often say, “The trend is your friend,” and boy, is that ringing true this year. The S&P 500 just closed at new all-time highs, jumping 6% for November, as it tries to secure back-to-back +20% years for the first time since 1998.

Below is a monthly chart of the S&P 500 since 2009, with the 200-day moving average showcasing this secular bull market’s long-term performance. Despite all the reasons to be negative this year, the momentum remains on the upside, and bulls are taking advantage of it while they can. 📈

Source: TradingView.com

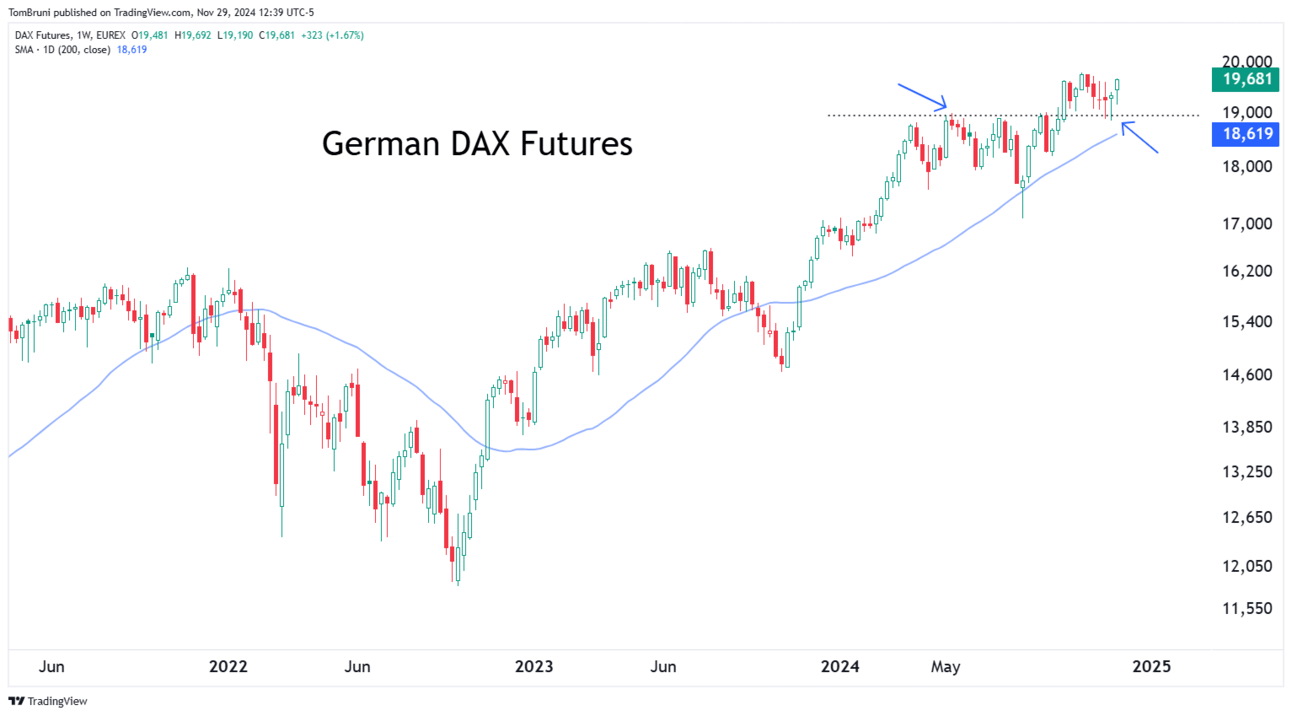

Global equities (and other risk assets) also continue to trend higher, providing a solid backdrop for U.S. stocks to climb the “wall of worry.” Here’s a good example of the German DAX pulling back to support (and getting the bears all riled up) before returning back towards all-time highs.

Source: TradingView.com

At some point there will be a catalyst to throw the bulls off their game. But for now, the path of least resistance remains to the upside. While that doesn’t mean being careless with your investing and trading, it probably means trying to play the short side of the market will continue to be an uphill battle. 🤷

SPONSORED

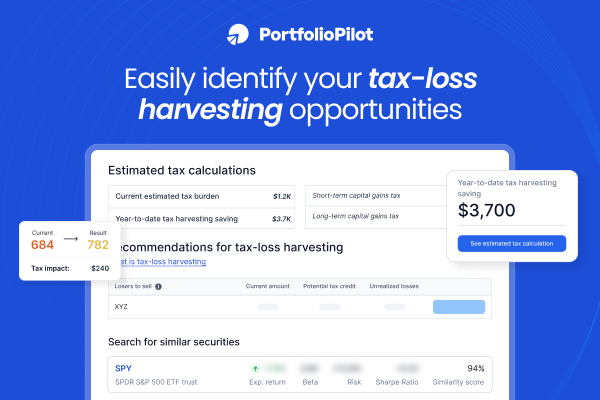

$11M+ in taxes saved already - how much can you make in the next 4 weeks?

Applicable if you:

Are a self-directed investor

Made 5+ buy trades in a taxed account in 2024

Invest in stocks, options, ETFs, crypto, or mutual funds

If these criteria apply, you probably qualify for tax-loss harvesting opportunities.

In less than 10 minutes, PortfolioPilot.com will scan your brokerage account for potential savings. Use the similarity search tool to find similar exposure securities to trade into.

P.S. PortfolioPilot also offers lots of other (completely automated) fiduciary financial advice, all without problematic human conflicts of interest. Already $20B assets on platform, targeted at self-directed investors that want to optimize their portfolios.

^3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. *PortfolioPilot is a product of Global Predictions, a SEC Registered Investment Advisor. $11M number calculated as 2024 YTD TLH savings study conducted across 24,000 PortfolioPilot users on November 18, 2024. $20B AOP as of July 14, 2024.

COMPANY NEWS

The Container Store Slides Towards Bankruptcy 😬

It’s Black Friday, and buyers are out shopping for deals at stores and in the stock market. Unfortunately for one retailer, not even a holiday shopping spree can help its share price stay off their all-time lows. 🛒

In 2019 and 2020, The Container Store was a cultural phenomenon, as the Netflix show “Tidying Up” caused customers to declutter their lives with storage bins, pantry and drawer organizers, shelves, and more. However, that effect has worn off, with a weak housing market and steep competition causing investors to lose hope in the company’s long-term potential.

In October, the company stopped providing financial guidance as it evaluated strategic alternatives. It also issued a “going concern” notice, which warns investors that the company’s management and auditors have substantial doubt about its ability to continue operating as a business for the foreseeable future (next 12 months). ⚠

Another infamous retailer, Beyond Inc., was supposed to provide $40 million to The Container Store as part of a strategic partnership. Still, recent reports indicate that the deal has begun to unravel…leaving TCS scrambling to find alternative financing.

Investors are stuck waiting for updates right now, with shares reaching a new all-time low today as the broader market makes new all-time highs. Sentiment among the Stocktwits community remains ‘bearish,’ as investors still haven’t heard a clear turnaround plan from management. Maybe this holiday shopping season will give the company some momentum, but it’s not a bet many investors are making. 👎

Source: Stocktwits.com

CRYPTO

Bitcoin Remains Below $100k 😴

Another week, another attempt for Bitcoin to break through that $100,000 milestone. With altcoins like Ripple, Algorand, Stellar Lumens, and others continuing to cruise higher, belief in the crypto bull market remains high among retail investors. 🐂

While we all relax and watch Bitcoin this weekend, we’re asking Stocktwits users what will continue to drive this “new era” of crypto. So far, 59% believe the mass adoption via TradFi vehicles will help drive the next leg higher.

Time will tell. But for now, share your thoughts in the poll and see how the consensus view develops in the coming days! 👀

Source: Stocktwits.com

STOCKTWITS SHOP

Get 20% Off Exclusive Stocktwits Merch 🎁

There’s no better way to celebrate the holidays than with exclusive “The Weekend Rip With Ben & Emil” and “Daily Rip Live” merch. We’re giving 20% off and free shipping on orders over $100 to celebrate their launches. Snag it while you can! 🛒

Source: Shop.Stocktwits.com

COMMUNITY VIBES

One Tweet To Sum Up The Week 🤔

Price is what you pay; value is what you get… Is Nvidia actually cheaper than it was before rallying 1,300% over the last two years???

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋