NEWS

Global Stocks Overlook ‘Lackluster’ China Stimulus

U.S. and global equities continued their rally after China unveiled a 6 trillion yuan bond issuance over the next three years to address local debt and bolster property market stability. The market had expected up to 10 trillion in stimulus. Still, crypto was the talk of the town after a weekend breakout, while several “catch-up” plays across equities soared as the bull market behavior braved on. 👀

Today's issue covers more catalysts for financial stocks, crypto finally catching onto “Uptober,” and several M&A activities from the day. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with technology (+1.30%) leading and energy (-0.04%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,860 | +0.77% |

Nasdaq | 18,5023 | +0.87% |

Russell 2000 | 2,249 | +0.64% |

Dow Jones | 43,065 | +0.47% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $SOFI, $COIN, $NU, $ARM, $VST 📉 $DUO, $MSTR, $BIDU, $ZM, $DG*

*If you’re a business and want to access this data via our API, email us.

STOCKS

Fintech Firms & Financials Feel The Love 🏦

Last week we covered the country’s biggest banks breaking out following better-than-expected results. But some of the smaller fintech and neo-bank plays have also been quietly on the move, getting a major boost today.

Upstart and Affirm both rose sharply after Wedbush Securities upgraded them from ‘underperform’ to ‘neutral.’ The online lending platforms are seen as a rate-cut bet, with credit more regularly available and an economy that’s holding up better than most anticipated, which means these stocks may be undervalued. 💳

Neobank SoFi Technologies also soared 11% after announcing a $2 billion loan platform agreement with affiliates of Fortress Investment Group, a deal aimed at expanding its personal loan capabilities. Under the agreement, it will refer pre-qualified borrowers to its loan original partners and originate loans for third parties.

Investors like the diversification into less capital-intensive businesses that provide feed-based sources of revenue. Shares closed at a new 52-week high, with Stocktwits sentiment hitting ‘extremely bullish’ territory. 👍

Meanwhile, JPMorgan Chase and its peers that also reported on Friday received several analyst upgrades, pushing retail sentiment further into bullish territory as shares neared new all-time highs. 🔺

Overall, a lower interest rate environment and strong(ish) economy bodes well for the overall financial services sector. And with many of these stocks already trading near all-time highs, investors and traders are looking at those that haven’t run over the last few years to finally play some catch-up. 💸

What do Nvidia and Amazon have in common?

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

Well, other than trillion-dollar market caps. Both Nvidia and Amazon chose to collaborate with Miso. Miso’s the leader in AI-powered kitchen robots. That’s why Nvidia offered Miso its premier AI vision tech, and Amazon handpicked Miso to partner and use its RoboMaker simulation environment. Now, Miso launched their first commercial AI-powered robot, and it sold out in seven days. On the back of that success, they’re focused on scaling to 170+ US fast food brands in need.

M&A

B Riley Bounces Amid An M&A-Filled Monday 🤝

Several deals made headlines today, so let’s quickly catch you up.

First off, embattled investment bank B. Riley Financial bounced back 23% after announcing that it will sell its appraisal and valuations division, Great American, to asset manager Oaktree Capital for roughly $400 million. 💵

The deal will net it $203 million in cash, $183 million in Class B preferred units of a new holding company for Great American, and 47% in the new Class A equity. It frees up liquidity for the company while also allowing it to maintain some upside exposure to the business.

Small-cap biotech Vanda Pharmaceuticals soared 15% after U.K.-based Cycle Pharmaceuticals affirmed its proposal to acquire all issued and outstanding company shares for $8 per share. 💰

While that offer values the company at $488 million, Vanda’s Board of Directors and some shareholders feel a higher offer is necessary to close the deal.

Meanwhile, Denmark’s Lundbeck is betting big on Longboard Pharmaceuticals’ epilepsy drug, acquiring the company for $2.6 billion in its largest deal ever. The M&A activity in small/mid-cap biotechs remains fierce as larger companies look to buy their next major growth drivers. 💉

CRYPTO

Crypto Stocks Cruise Higher Following Weekend Bitcoin Bump 🤑

Is Uptober here? Bitcoin’s back in the driver’s seat and everything else is along for the ride. After dipping down to $58,000 last Thursday, BTC surged 11.5% over the weekend and hit $66,000 today.

Now, crypto stocks like Coinbase and altcoin’s like Solana are riding the momentum, flashing green as they cling to Bitcoin. 🚀

Base Flexes Its Muscles

Coinbase-backed Base is on fire, processing over 6 million transactions daily and taking a commanding lead in the Ethereum Layer-2 race. For a project that’s been around for less than a year, Base has outpaced rivals like Arbitrum and Optimism, clocking in at 70 transactions per second (TPS).

Base’s TPS and growing ecosystem of dApps are making it the place to be in DeFi, especially for users looking for fast, cheap transactions. And let’s not forget the power move of peaking at 6.2 million transactions on October 10. With a TVL overtaking Arbitrum (depending on which data you look at), Base’s success is undeniable. 🏆

Solana Surpasses $6 Billion in TVL

Meanwhile, Solana is clocking its own milestones, with its TVL surpassing $6 billion for the first time since January 2022. Not just any growth—Solana’s DeFi activity is through the roof, powered by DEX activity and a thriving Liquid Staking Token (LST) ecosystem.

Even meme coins are getting in on the action, helping Solana’s oldest DEX, Raydium, reclaim its spot as a top player. 31% of all DEX volume is now on Solana’s various DeFi platforms.

Bitcoin may have hogged the spotlight this weekend, but crypto traders and investors are watching the other side of crypto: altcoins. The altcoin market is creeping towards the $1 trillion market cap level, a level it hasn’t seen since the beginning of August. 😵💫

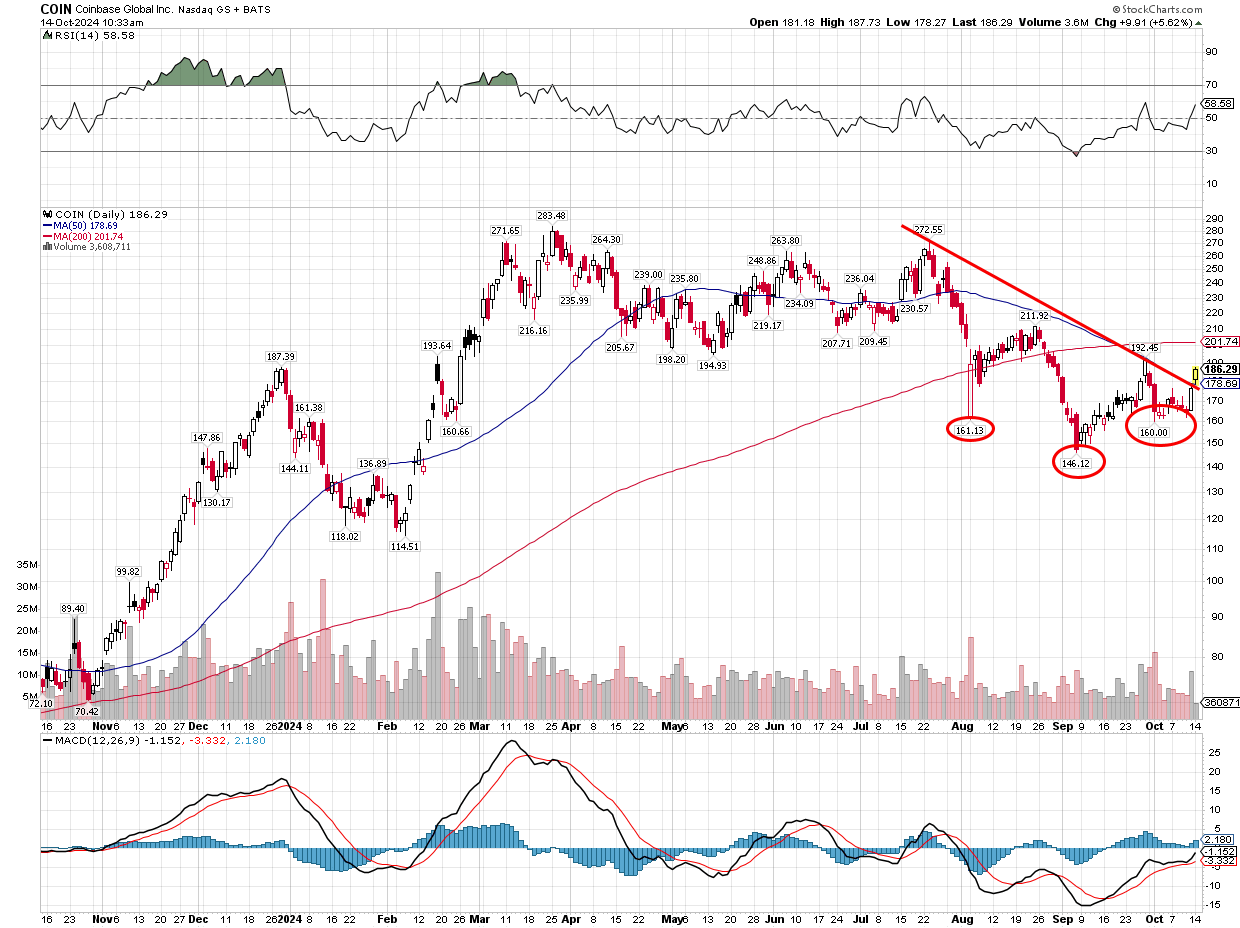

As for how equity market participants are approaching this situation, Stocktwits user @TheProphetOfProfit was one of several pointing to Coinbase breaking out of a classic “inverse head & shoulders” reversal pattern, which would target all-time highs if it holds.

In other words, many are betting on crypto-linked stocks to catch up to the Bitcoin and broader crypto rally we’ve seen develop over the last few weeks and months. Time will tell if they’re right. 🤷

And for more in-depth coverage of crypto, make sure to subscribe to our Litepaper Newsletter to stay on top of all the latest trends.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: NY Empire State Manufacturing (8:30 am ET), Fed Daly Speech (11:30 am ET), NOPA Crush Report (12:00 pm ET), Fed Kugler Speech (1:00 pm ET), and Fed Bostic Speech (7:00 pm ET). 📊

Pre-Market Earnings: Bank of America ($BAC), Citigroup ($C), Goldman Sachs ($GS), Charles Schwab ($SCHW), Walgreens Boots Alliance ($WBA), and United Healthcare ($UNH). 🛏️

After-Hour Earnings: United Airlines Holdings ($UAL), Interactive Brokers Group ($IBKR), Smart Global Holdings ($SMART), and JB Hunt Transportation ($JBHT). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋