NEWS

Good News Is Bad News (Again)

Source: Tenor.com

It was a rough end to the week, as better-than-expected labor market data pushed any hopes of additional Fed rate cuts further out of reach. Energy stocks were the sole green sector today as new sanctions on Russia drove crude prices higher. As we head into next week, eyes turn from the Fed to company earnings and Trump’s economic policy plans, with investors hoping this recent dip is indeed just a dip. 👀

Today's issue covers why stocks got smacked by good economic data, two very different Constellation stock outcomes, the social media stocks betting on a TikTok ban, and more from the day. 📰

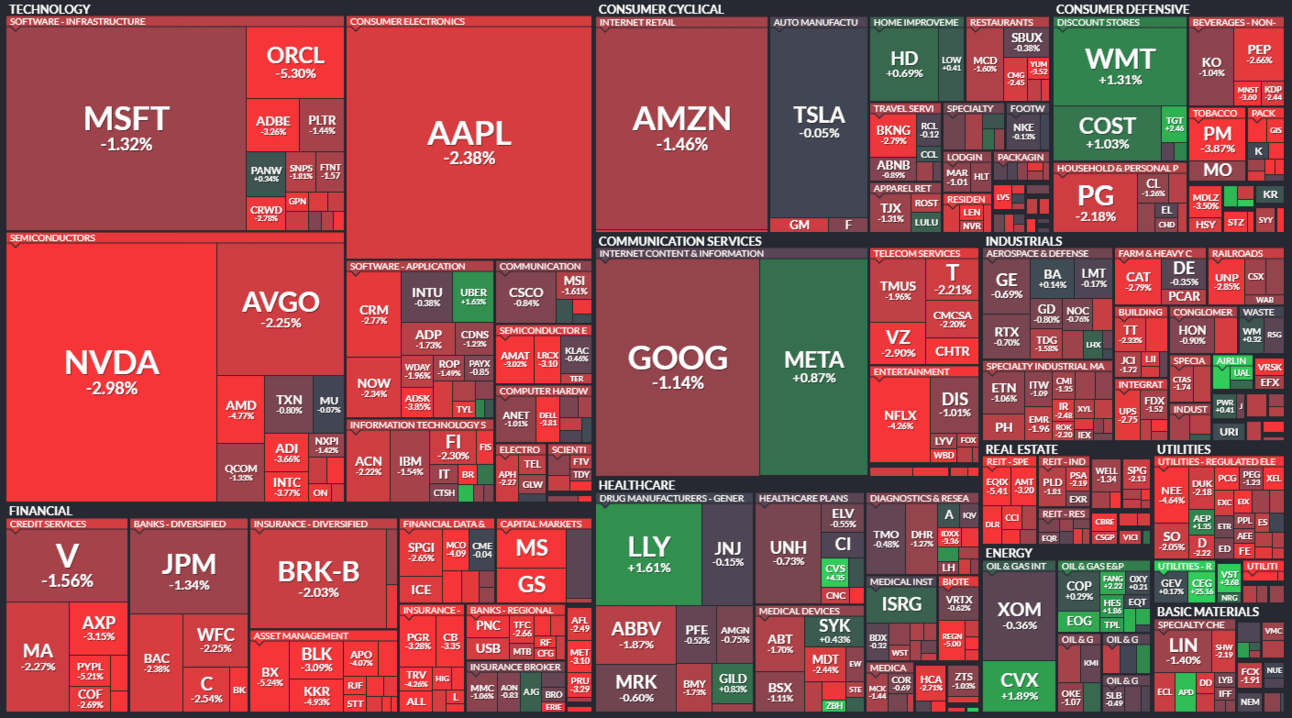

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with energy (+0.41%) leading and real estate (-2.46%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,827 | -1.54% |

Nasdaq | 19,162 | -1.63% |

Russell 2000 | 2,189 | -2.22% |

Dow Jones | 41,938 | -1.63% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $AMTM, $NBY, $DTIL, $ITCI, $PTLO 📉 $ALGS, $OSCR, $IGMS, $GOLD, $SNDL*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Strong Job Market Showing Shellacks Stocks 😨

We’ve been talking about it for quite some time now, so we’re not going to belabor the subject again here. But we need to cover today’s labor market surprise.

December’s nonfarm payrolls report showed hiring increased by 256,000 for the month, well ahead of the 155,00 expected and up from November’s 212,000. 📊

Average hourly earnings rose 0.3% MoM and 3.9% YoY, while the unemployment rate ticked down by 0.1% to 4.1%. Meanwhile, a broader jobless measure fell by 0.2% to 7.5%, its lowest level since June 2024.

Once again, the labor market has shown significant resilience in the face of higher interest rates. And while that’s good for the economy, that’s bad for the stock market. Because if the economy is holding up well, inflation risks remain to the upside, and the Fed is unlikely to cut interest rates anytime soon. 😢

As a result, stocks and other risk assets sold off, and the 10-year yield hit a new year-to-date high as it approached the oh-so-scary psychological level of 5%. 😱

Wall Street banks, strategists, analysts, and other forecasters are now tripping over each other to adjust their expectations, with Bank of America even saying this current rate-cutting cycle is over. We’ll see what next week’s inflation data brings, but the fear on Wall Street is that rates are going to stay higher for longerer (yes, we said longerer on purpose to make a point).

Stocktwits users' expectations for stocks are mixed, with bullish and bearish responses nearly evenly matched after 2,500 votes. 🤷

Source: Stocktwits.com

Meanwhile, this chart from the University of Michigan’s survey shows how different economic perceptions can be among Democrats and Republicans. The latest survey shows Republicans expect essentially 0% inflation (down from nearly 4%) over the next year, while Democrats’ expectations more than doubled from under 2% to 4.2%. 🙃

Source: Michael McDonough on X

The Fed has a difficult job of directing what’s perception and what’s reality, taking only into account what it feels most accurately reflects the economy’s prospects as it makes decisions around interest rates. Right now, the data (and the bond market) are screaming that the risks to inflation are to the upside, and more rate cuts are not needed as long as the economy and labor market remain resilient.

We’ll have to wait and see how the Fed reacts in the coming months and quarters. But for now, the market is adjusting its expectations further toward a “higher for longer” interest rate regime. As a result, traders are preparing for more volatility ahead as we head into the start of another earnings season next week. 😵💫

PRESENTED BY STOCKTWITS

Daily Rip Live With Jordan Lee & Michael Nauss 📺

The co-hosts discuss the labor market’s upside surprise, Jensen Huang sending quantum computing stocks into a tailspin, Tesla’s resilience, the outlook for Bitcoin and semiconductors in 2025, and hidden opportunities in this volatile market. 👀

COMPANY NEWS

One Good & One Bad “Constellation” 🙃

Two stocks with similar names were trending today but for vastly different reasons. Let’s take a quick look at which one is favored by the Stocktwits community. 🤔

First up is Constellation Energy, a utility stock that has gone “nuclear” in recent years as investors buy into the “artificial intelligence power boom” thesis and expect this stock to be a major player. The stock is back in the news after securing a $26.6 billion deal for its competitor, Calpine Corp., which will help it expand its geographical footprint and diversify further into natural gas power generation. ⚡

Next is Constellation Brands, which is a major player in the alcohol business. Although the company’s beer business saw its 59th consecutive quarter of depletion volume growth, the rate remains stubbornly in the low single digits.

Meanwhile, the company's wine and spirit business continues to shrink as it deals with the headwinds of reduced global alcohol consumption. Tariffs on Mexican goods could force Constellation to raise prices, further hurting demand. 🍺

If one of those stories sounds more bullish than the other, you’re right. As the chart below shows, Constellation Energy surged 25% to new all-time highs, while Constellation Brands fell 17% to fresh multi-year lows. 😐

Source: TradingView.com

Despite the vastly different performance, Stocktiwts sentiment for both stocks is in ‘extremely bullish territory,’ as some investors bet on a beer business turnaround.

Nevertheless, with one being today’s top performer in the S&P 500 and the other being the top loser, it’s worth highlighting each of their stories as they’re likely to remain on investors’ and traders’ radars throughout 2025. 👀

STOCKS

Other Noteworthy Pops & Drops 📋

Wolfspeed (-13%): Its fall to 27-year lows was fueled by a Bloomberg report detailing the Biden administration's impending export restrictions on chips. These measures, set to be finalized before Biden’s term ends, aim to curb AI chip access for countries like China and Russia.

Global Business Travel Group (-3%): The Justice Department (DOJ) filed a civil antitrust lawsuit to stop the firm, the largest business travel management company in the world, from acquiring its rival and third-largest player, CWT Holdings LLC (CWT).

Critical Metals Corp. (+21%): According to 13F filings, Barclays Plc. increased its holdings threefold from 2,477 at the end of Q2 to 2,477 at the end of Q3. JPMorgan Chase & Co. more than doubled its holdings, too.

PG&E Corp. (-11%): The California utility’s shares hit six-month lows as the wildfires in Los Angeles continued to spread. Investors priced in the potential risk that the company could be responsible, as the cause of the wildfires remains unknown.

Iovance Biotherapeutics (-10%): The selloff aligns with broader pressure on small-cap stocks within the Russell 2000 index, which is sliding into correction territory as fears over prolonged higher interest rates grip the market.

Novavax Inc. (-3%): A Stocktwits poll of more than 1,700 retail investors and traders indicates that two-thirds of respondents see the stock as currently undervalued.

Absci Corp. (-10%): The biotech announced a strategic partnership with AMD, which includes a $20 million investment pledge from the chipmaker.

Delta Air Lines (+9%): The airline’s first-quarter earnings beat estimates, and CEO Ed Bastian projected 2025 to be the firm’s best financial year ever.

Advanced Micro Devices (-5%): After HSBC’s double downgrade on Wednesday, Goldman Sachs has now revised its rating to ‘Neutral’ from ‘Buy’ and slashed its price target to $129, down from $175, according to TheFly.

Tilray (-10%): The cannabis and beer company reported disappointing fiscal second-quarter (Q2) results and projected a $20 million revenue blow for 2025. Cannabis net revenue fell slightly to $66 million from $67 million in the prior year.

Walgreens (+28%): The drugstore chain soared after revenue and earnings topped expectations, driven by cost-cutting and a stabilizing retail pharmacy business.

STOCKS

Social Media Stocks Are Back In Focus 📱

TikTok competitors were back on the move following reports that the Supreme Court is leaning toward upholding the law that could ban the Chinese-owned social media site on January 19th if its owner doesn’t sell it.

The nine justices on the conservative-majority court heard oral arguments but did not appear convinced by TikTok’s free speech arguments. Still, there’s uncertainty around how the court will handle the case, even as the law in question had broad bipartisan support. 🤔

As the situation develops, the stock market is seemingly preparing for the ban to take effect. U.S.-based social media companies that have a prominent short-form video feature caught a nice bid.

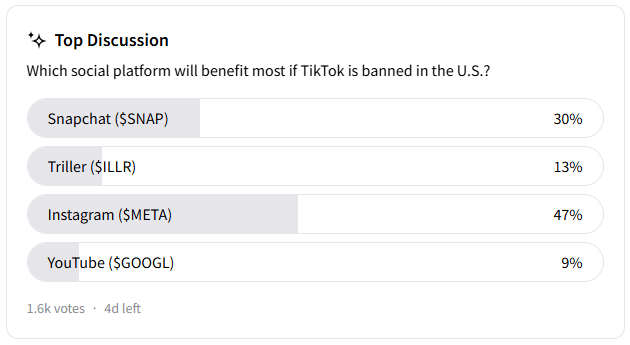

Despite many companies expected to benefit from this ban, a Stocktwits poll of over 1,600 users shows that nearly half of retail investors believe Meta’s Instagram will benefit most. Time will tell if they’re right, but the price action of the top two choices, Meta and Snap, were both positive in an otherwise choppy tape. 👍

Source: Stocktwits.com

COMMUNITY VIBES

One Tweet To Sum Up The Week 👀

Links That Don’t Suck 🌐

🤖 Stocktwits poll: retail investors bet RR stock will have most upside In 2025 among robotics players

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋