NEWS

Green Markets, Red Earnings

All four indices are in the green today - the Dow for the seventh day in a row! In fact, almost everything was in the green at the close: crypto, oil, natural gas, silver, and gold. But for some individual companies that had earnings today, well, there’s no easy way to say it. For them, today sucked. 👀

Today's issue covers the three best-performing sectors YTD, what may be driving them and a rundown of just some of today’s earnings. 📰

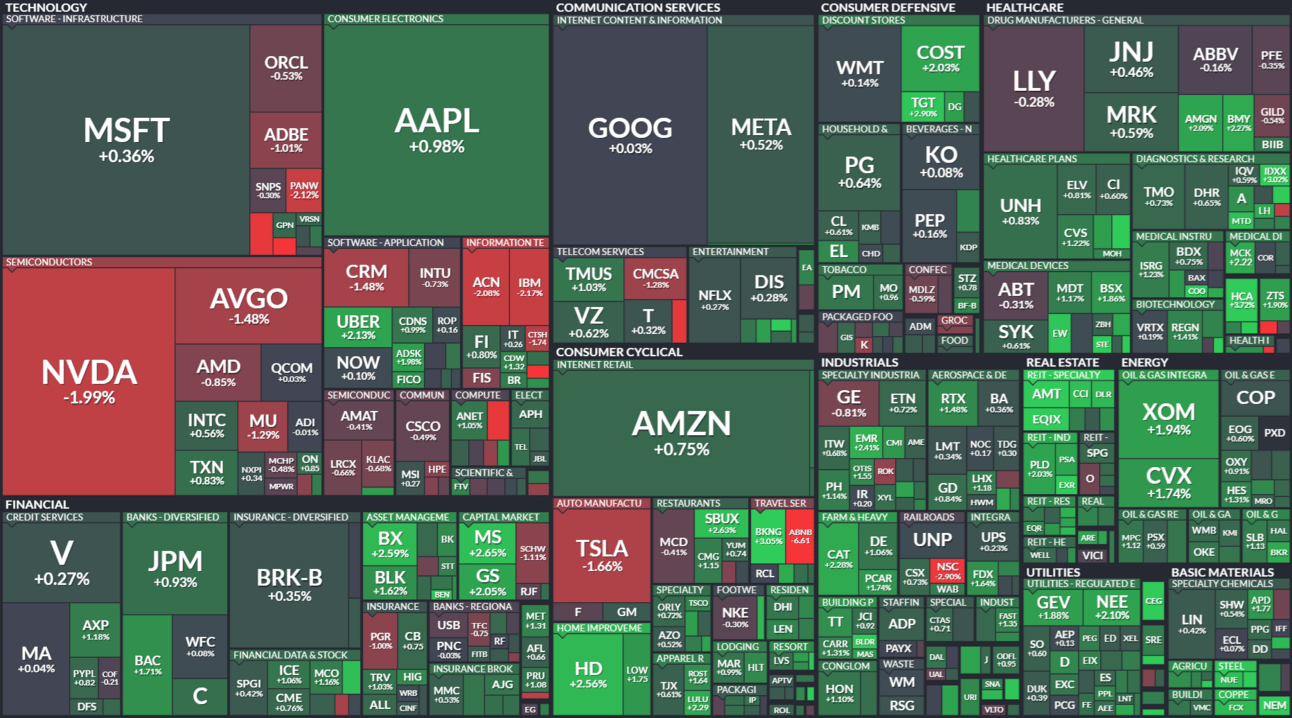

Here's today's heat map:

10 of 11 sectors closed green. Real Estate (+2.31%) led, & technology (-0.25%) lagged. 💚

U.S. initial jobless claims have unexpectedly risen to 231K, surpassing estimates and marking the highest level since last August. Despite the spike in jobless claims, continuing claims remained stable, suggesting potential short-term volatility rather than a long-term trend. 📊

30-year mortgage rates have dipped to 7.09% from 7.22%, breaking a trend of five consecutive weekly increases, as reported by Freddie Mac. Despite this decline, the rates remain too high to significantly stimulate the housing market, with many potential sellers reluctant to list their homes and forfeit lower rates obtained in previous years. 🏠

SF Fed President Mary Daly acknowledges considerable uncertainty in the inflation outlook and suggests a range of possible economic scenarios ahead. Despite receiving mixed signals from businesses about consumer spending and input prices, Daly notes a robust labor market and persistently high inflation. 📉

Barrick Gold ($GOLD) CEO Mark Bristow criticizes the current trend of mergers and acquisitions in the mining industry, arguing that such moves do not increase copper production, which is crucial for the global energy transition. With copper demand expected to skyrocket due to advances in the transport sector and global electricity needs, Bristow advocates for more investment in exploring and developing new copper mines. 🥇

Other active symbols: $LUNR (+3.58%), $ROOT (+11.81%), $GME (+14.70%), $CVNA (+5.66%), $HOOD (+2.75%), and $AMC (-3.92%). 🔥

Here are the closing prices:

S&P 500 | 5,214 | +0.51% |

Nasdaq | 16,346 | +0.27% |

Russell 2000 | 2,073 | +0.90% |

Dow Jones | 39,387 | +0.85% |

UTILITIES

What Rising Metal Prices Tell Us About Sector Growth and Economic Recovery 📊

So far in 2024, three sectors have outperformed the rest: utilities (+15.05%), Communication Services (+14.92%), and Energy (+13.19%). These sectors, often eclipsed by the more glamorous tech and consumer goods sectors, are revealing significant trends that investors should not ignore. ⌨️

Unveiling the Common Thread: The Role of Metals

While these sectors share similar infrastructure, technology, and regulatory support, an underexplored commonality is their reliance on metals, notably copper and silver. 🥈

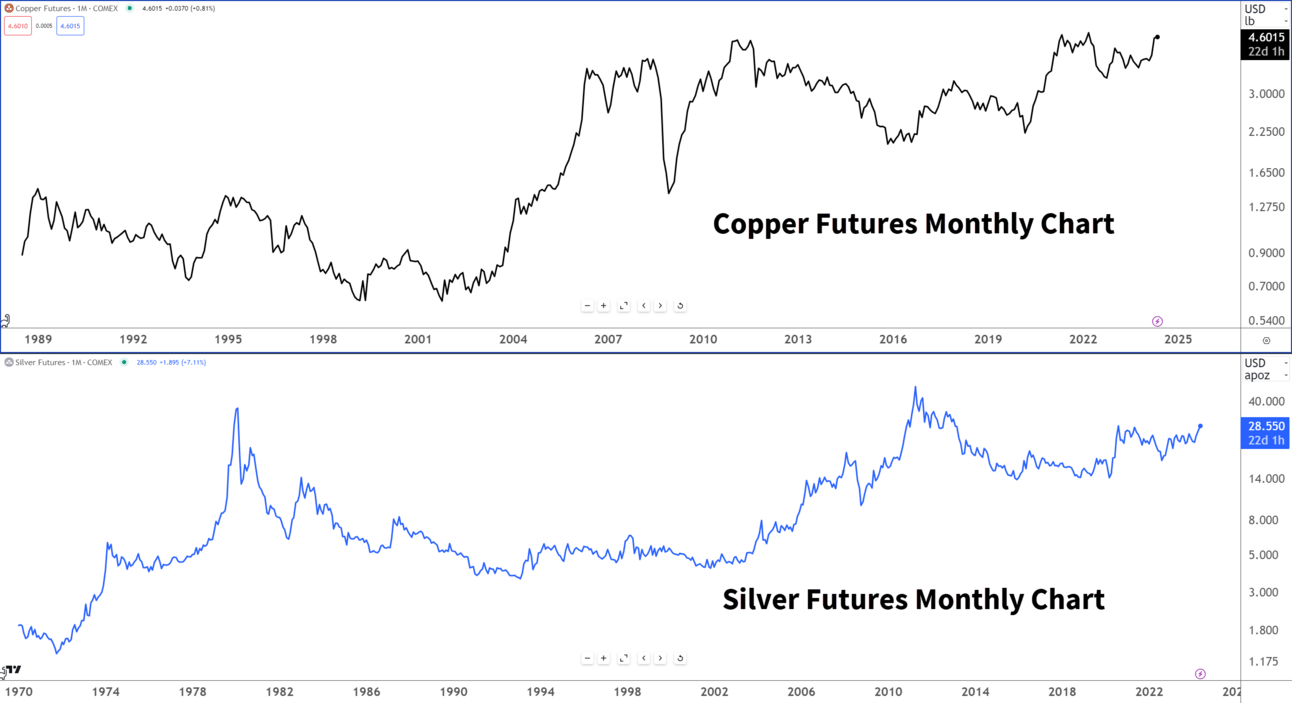

Copper, affectionately known as 'Dr. Copper' is a bellwether for economic health due to its extensive use in construction, electronics, and manufacturing. Analysts often interpret rising copper prices as a sign of economic growth, as more copper is required for various development projects. Copper's futures price is less than 40 cents away from all-time highs.

Silver may not be as celebrated as gold or copper, but its role is equally pivotal. Primarily driven by industrial demand, silver's superior thermal and electrical conductivity makes it essential in electronics, solar panels, and batteries. Its prices are approaching new 11-year highs. 🤯

Incoming Shortages?

There are growing concerns about potential shortages, particularly evident in the raw materials used in electric vehicles compared to traditional combustion engines.

Looking Ahead

As copper and silver prices move higher, sectors that leverage these metals are emerging as prime opportunities for investors. This shift could redirect attention from the tech-centric trends that have dominated investor focus, presenting new avenues for diversification and investment. 🔭

EARNINGS

Thursday Earnings Recap ✅

SNDL Inc.

$SNDL Inc. has reported a first-quarter revenue of $197.8 million, marking a 4% increase year-over-year, driven by improvements in its Cannabis and Liquor Retail segments.

The company also highlighted a significant reduction in operating losses and an impressive 25% gross margin, reflecting successful cost-cutting and operational efficiencies. With a strong cash position and no debt, SNDL is sitting pretty high right now. 🌿

Papa John’s

$PZZA revealed its largest revenue shortfall in over five years, with a 2.5% decline to $513.9 million, far missing the expected $544.5 million. Interim CEO Ravi Thanawala cited intense competition and cautious consumer spending.

Despite these challenges, adjusted earnings exceeded expectations at 67 cents per share, thanks to a 2.2% improvement in restaurant margins, but the overall market response was negative, sending shares down 7.4% in afternoon trading. 🍕

Plug Power

$PLUG Inc. reported a substantial increase in its first-quarter losses, totaling $295.8 million, or 46 cents per share, significantly missing analyst expectations of a 33-cent loss per share.

The company's revenue also declined sharply to $120.3 million from $210.3 million in the previous year, falling well below the expected $156.7 million, attributed to seasonal fluctuations and timing in electrolyzer deployments. 🔌

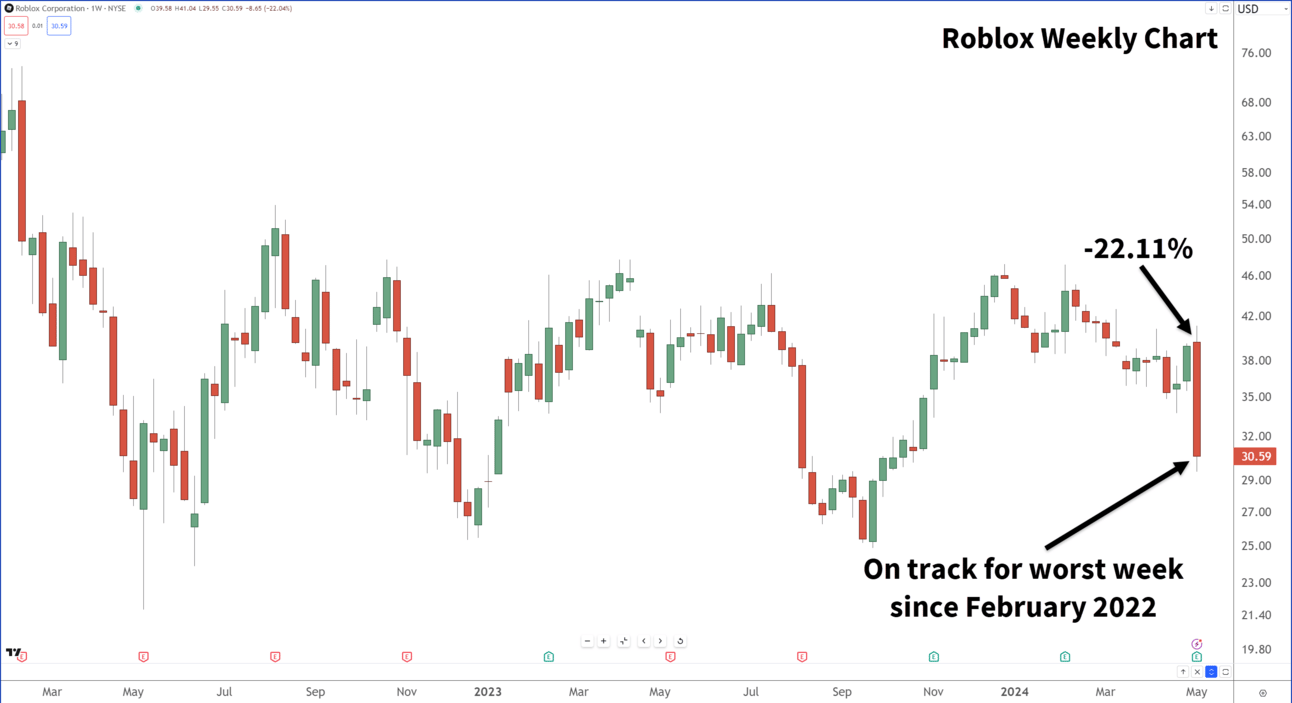

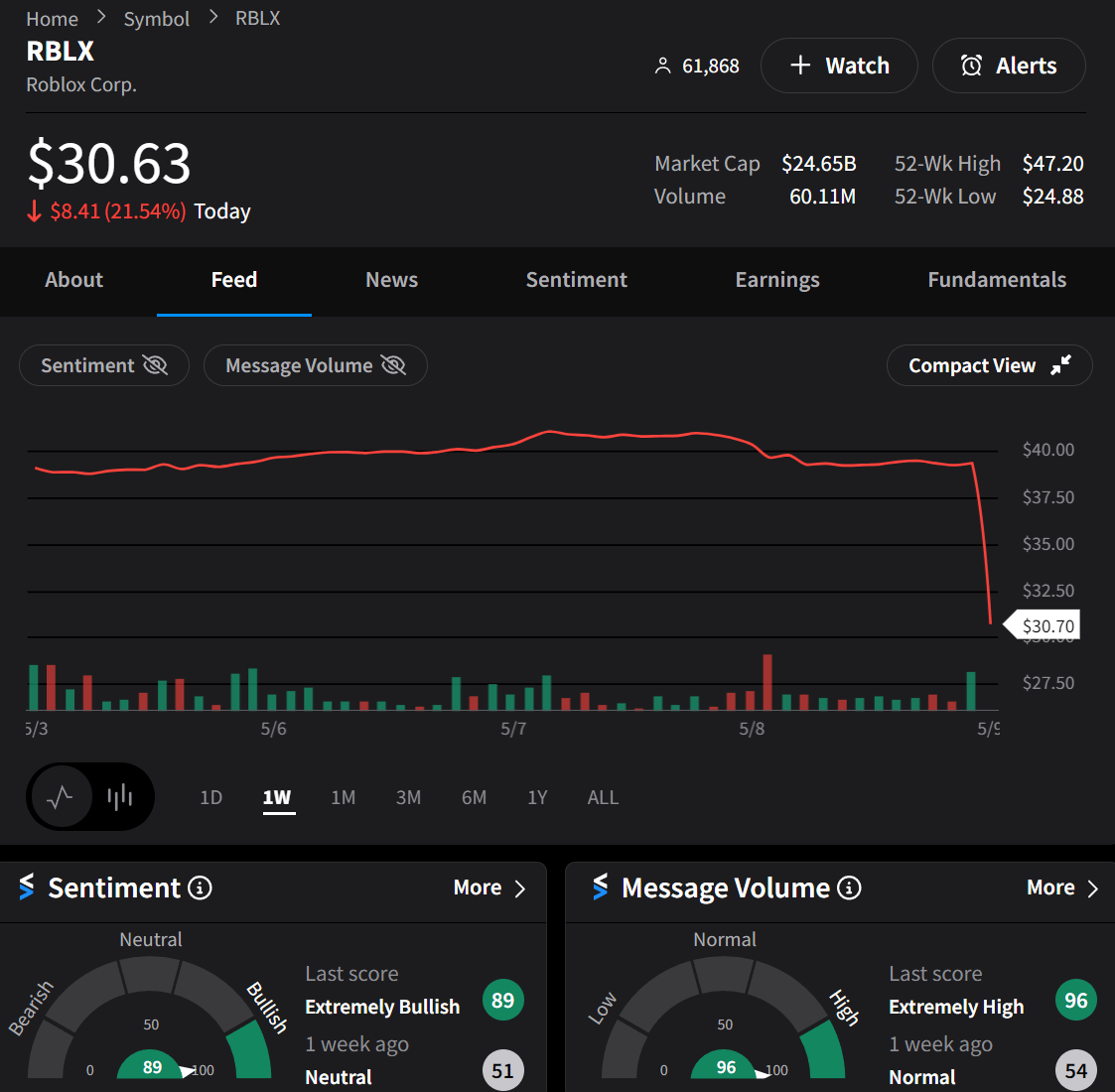

Roblox

$RBLX slashed its annual bookings forecast, leading to a 23% drop in shares—its steepest decline in over two years.

The company adjusted its full-year bookings projection to between $4 billion and $4.10 billion, down from previous estimates. This reflects reduced consumer engagement that's also impacting other major players in the video game industry, like Electronic Arts.

In response to the slowdown, Roblox is diversifying into digital advertising, introducing virtual billboards on its platform, with plans to ramp up ad revenue projections by 2025 as part of its long-term growth strategy. 🎮

Marathon Digital ⛏️

$MARA reported a significant first quarter in 2024, with a 142% increase in energized hash rate and a 28% rise in $BTC production compared to the previous year.

The company's revenue soared by 223% to $165.2 million, and net income nearly tripled to $337.2 million, driven by gains in crypto assets and a marked increase in adjusted EBITDA by 266%.

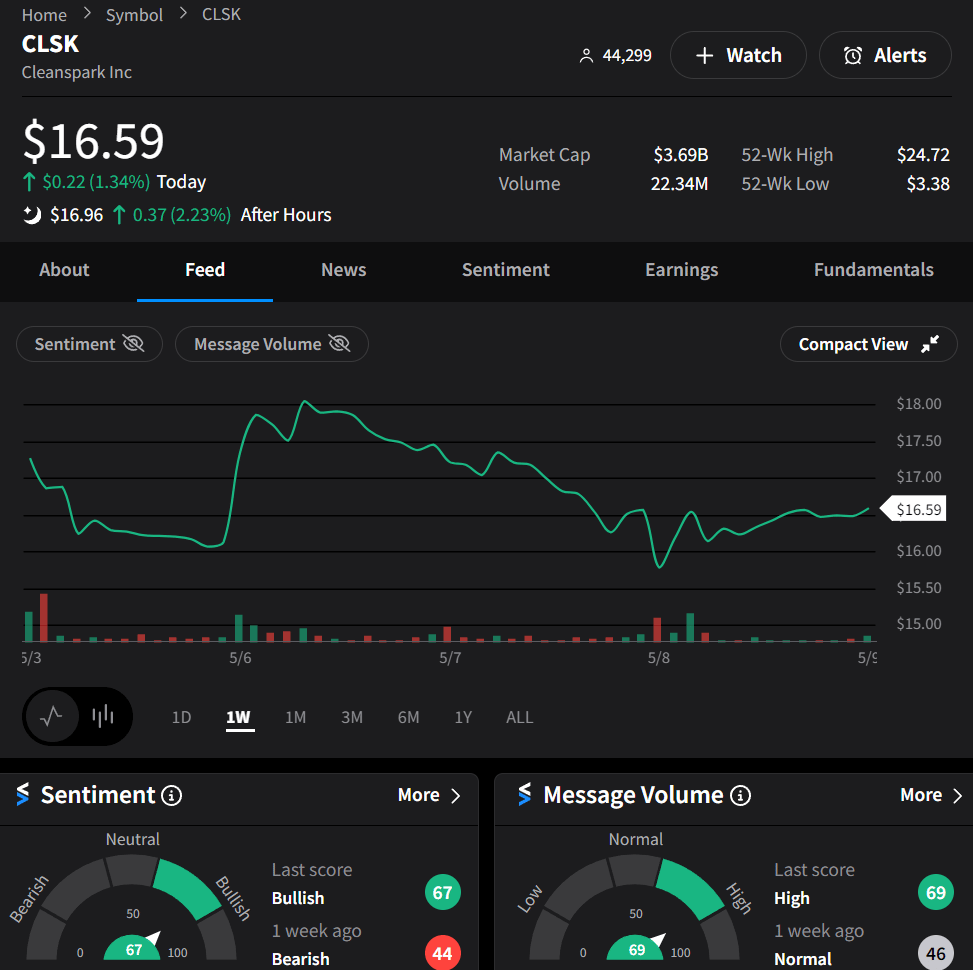

CleanSpark 💎

$CLSK reported a historic second quarter in FY2024, achieving a record revenue of $111.8 million, which represents a 163% increase year-over-year, and a net income of $126.7 million.

The company's successful expansion in operational capacity and strategic acquisitions in new facilities contributed to this growth, alongside gains in Bitcoin.With almost $700 million in cash and BTC and minimal debt, CleanSpark is well-prepared for future industry shifts and opportunities.

STOCKTWITS CONTENT

New “Trends With Friends” 🍿

Stocktwits co-founder Howard Lindzon chops it up with pals JC Parets and Phil Pearlman every Thursday on "Trends With Friends."

Bullets From The Day

🏢 Real Estate Investor Labels California and New York Economies as Disasters

Steve Witkoff, a real estate mogul and close associate of Donald Trump, voiced concerns over the economic states of California and New York, labeling them as disasters in a FOX Business interview. He highlighted the issues within the commercial real estate sector, exacerbated by rising interest rates and shifts towards remote work, which have led to increased foreclosures and fears of a credit crisis. More from Fox Business.

📉 Robinhood CEO Cashes Out $4.48 Million in Stock

$HOOD CEO Vladimir Tenev sold 250,000 shares for approximately $4.48 million, as detailed in a recent SEC filing, with prices ranging from $17.64 to $18.44 per share. The sale, executed under a pre-arranged 10b5-1 trading plan, is designed to prevent insider trading accusations by scheduling sales in advance. Post-transaction, Tenev’s direct ownership in Robinhood drops to zero, though he retains indirect control over 6,907 shares through a trust. Investing.com has more.

📲 TikTok Introduces AI Content Labeling

TikTok has announced on "Good Morning America" that it will begin automatically labeling AI-generated content uploaded from specific platforms to enhance transparency and inform users about content origins. This initiative makes TikTok the first video-sharing platform to adopt Content Credentials technology, which acts like a "nutrition label for content," providing details on content creation and edits. From ABC News.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍