NEWS

Imagine Betting Against Big Tech?

A cooling labor market is easing the upward pressure on interest rates, helping risk assets like tech stocks soar to new all-time highs. Traders continue to anticipate a crypto breakout, while others await a catalyst like the approval and roll-out of spot Ethereum ETFs. Let’s see what else you missed. 👀

Today's issue covers Nvidia joining the $3 trillion market cap club, why Lululemon’s problems are not black and white, and the Wall Street titans looking to form a new stock exchange. 📰

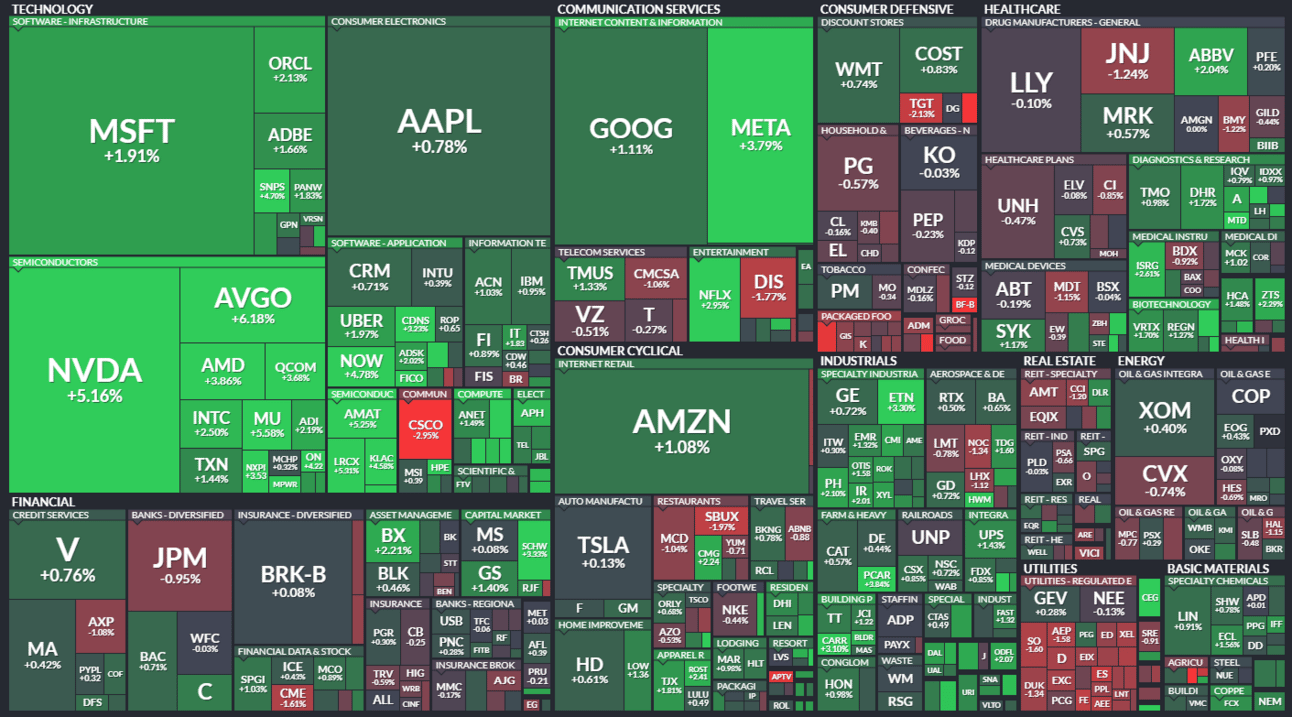

Here's today's heat map:

8 of 11 sectors closed green. Tech (+2.22%) led, & utilities (-0.57%) lagged. 💚

The Bank of Canada is the first G-7 country to begin its interest rate easing cycle, cutting 25 bps to 4.75%, forecasting more cuts as inflation continues to ease. ✂️

Crude oil and other energy commodities rebounded despite the U.S. Energy Information (EIA) report signaling a rise in inventories last week. Still, prices remain in a downtrend, with many expecting downside to continue. 🛢️

After briefly dipping into contraction territory during April, the ISM services sector PMI rebounded into expansion territory during May. Notably, the employment index contracted further, reiterating a softening labor market. 🔺

GameStop shares rose 19% as short seller Andrew Left bet against the “cult stock,” though with a smaller position to avoid being burned like in 2021. 🎮

Dollar Tree shares fell 5% after meeting first-quarter expectations. It’s exploring the sale of its Family Dollar brand, given the grocery-focused brand has struggled with rising costs and lower-income consumer trends. Discount retailer Five Below also shed 15% on disappointing revenue guidance. 💵

Software company WalkMe jumped 43% on the news SAP would acquire it in a $1.50 billion all-cash deal. Clothing company Hanesbrands also rose 15% after reaching a deal to sell its global Champion business to Authentic Brands. 🤝

Other active symbols: $AMC (+7.52%), $NVAX (+18.07%), $MNDR (+46.29%), $HOLO (-15.66%), $LPA (-82.86%), & $CCM (-46.19%). 🔥

Here are the closing prices:

S&P 500 | 5,354 | +1.18% |

Nasdaq | 17,188 | +1.96% |

Russell 2000 | 2,064 | +1.47% |

Dow Jones | 38,807 | +0.25% |

STOCKS

Nvidia Joins The Exclusive $3 Trillion Club

The ADP Employment report signaled that private payroll growth slowed further in May, reducing upward pressure on inflation and odds of rate cuts in the back half of 2024. 👍

This boosted the bond rebound further, providing a tailwind for risk assets…which technology stocks happily responded to.

Nvidia led the semiconductor surge today, rising 5% and achieving a feat only Apple and Microsoft have been able to achieve…a $3 trillion market cap. It also narrowly closed above Apple, making it the second-largest company in the world. 🤩

We’ve heard for years that these “Magnificent Seven,” or whatever we’re calling the largest U.S. tech stocks now, cannot grow further. Slowing growth, stretched valuations, regulatory risk, industry disruption, etc. have all remained risks, yet investors and traders continue to pile into these stocks.

The bull explanation for this seemingly irrational behavior is that each of these companies is a collection of dozens and dozens of smaller companies inside it, with strong core businesses funding moonshot bets in the hottest sectors like AI, electric/autonomous vehicles, augmented reality, etc. 🐂

The bear case relies heavily on the argument that systematic fund flows into “passive” investment funds like the S&P 500, which overweight the largest stocks in the world, are responsible for these unsustainable gains and not these companies’ fundamentals. 🐻

Who will ultimately be right will only be known in hindsight. But for now, it's hard to look at the top 10 market cap companies globally and conclude that it’s smart to bet against big tech without a clear catalyst to change this persistently strong trend.

Congrats to Nvidia on the milestone. We’ll see if it comes in hot tomorrow to try and knock Microsoft down from its #1 spot. 👑

SPONSORED

Earn rebates on every options contract traded at Public.com

Are you an options trader? At Public.com , you'll earn a rebate on every contract traded with no commissions or per-contract fees. That's because Public offers a rebate on every contract you buy or sell. Joining Public is easy, and your rebates can add up fast. If you trade 1,000 option contracts on Public, you'll earn $60 to $180 in rebates and avoid up to $1,000 in fees that other platforms charge.

So, don’t change your strategy; change your platform—and start earning rebates on every options contract traded. Plus, get up to $10,000 when you transfer your existing portfolio to Public.

Discover why NerdWallet recently awarded Public five stars for options trading (and 4.6/5 stars overall), and earn rebates on options trades with no commissions or per-contract fees.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

Lululemon Provides More “Color” On Its Future

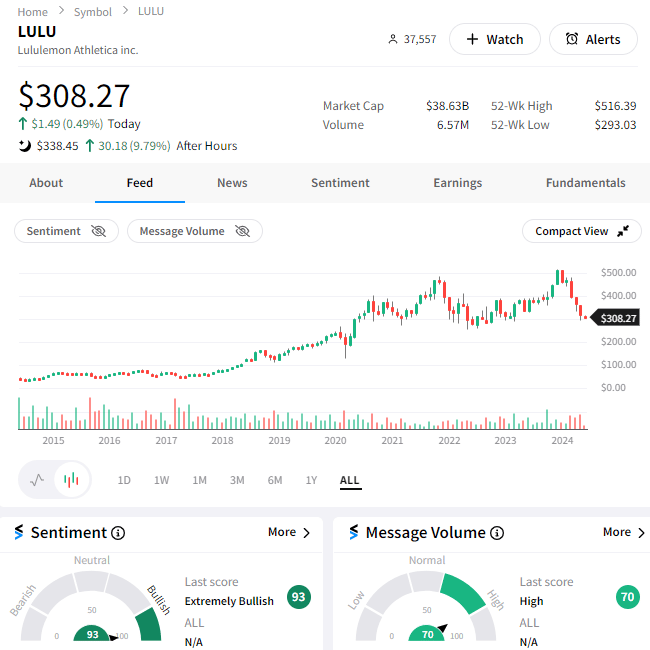

Certain apparel retailers like Nike, Lululemon, and others have had a rough ride over the last six months. However, today, the athleisure brand provided some additional “color” on its recent progress and outlook, sending shares rising the most since last October. 👍

Lulu’s earnings per share of $2.54 on $2.21 billion in revenues topped the $2.38 and $2.19 billion anticipated by analysts.

Management harped on the brand's strong position across its key markets and the fact that the weakness experienced in the Americas was due to operational missteps rather than a change in broader consumer trends. 👨💼

More specifically, they said that a lack of adequate “colors” and sizing in its recent lineup of women’s clothing was the primary driver of its weakness. They also did not order enough items that landed with their core customers, keeping products out of customers’ carts.

Executives mentioned the word “color” roughly three thousand times during the earnings call, as they attempted to paint their recent issues as “black and white” things they’ve already addressed for future quarters.

Still, some investors are skeptical since the company issued weak guidance for the current quarter as growth in the Americas continues to slow. 🤔

It expects $2.40-$2.42 billion in revenue vs. expectations of $2.45 billion and earnings per share of $2.92-$2.97 vs. estimates of $3.02. However, its full-year earnings guidance remains above the consensus view, while revenues are in line.

Nonetheless, with shares shedding more than 40% of their value over the last six months, expectations were pretty bleak. That allowed the company to deliver a “decent” quarter and still see its shares pop.

Lululemon is currently up about 10% after the bell, with Stocktwits community sentiment pushing back into “extremely bullish” territory as investors discuss and debate the results. Time will tell if their optimism pays off. 🐂

STOCKS

Wall Street Titans Team Up To Create New Exchange

When you’re rich, there’s a lot you can do. But when you’re super rich, there’s almost nothing you can’t do. That’s at least what BlackRock and Citadel Securities are hoping, as they back a new venture to challenge the onerous regulations at the New York Stock Exchange (NYSE) and Nasdaq.

The Texas Stock Exchange (TXSE) has raised $120 million and plans to file registration documents with the Securities and Exchange Commission in the back half of 2024. Ultimately, it hopes to begin trading in 2025 and secure its first listing in 2026. 🏦

So why a new stock exchange to challenge the existing duopoly? There are various reasons, but the current regulatory environment is the primary one.

A shifting corporate landscape has caused many companies to move into states with more favorable regulations and tax policies. Texas now has as many Fortune 500 companies headquartered there as New York, with both states just behind the #1 spot, California. 😮

Additionally, the New York Stock Exchange (NYSE) and Nasdaq have acquired most of the smaller exchanges over the years, allowing them to set policies that raise compliance costs for firms doing business with them.

Besides the many regulatory hurdles associated with starting a new exchange, the primary issue is attracting trading volumes to the platform. 💸

That’s why the backing of Citadel Securities, one of the largest electronic trading firms, and BlackRock, the world’s largest asset manager, is a significant development. Both firms have a history of backing new exchanges, including the MEMX, which now handles 2% to 3% of stock market volume.

Still, with other attempts from IEX and CBOE Global Market failing to gain traction in the stock-listings business, many eyes will be on this new attempt.

As for retail investors, improved optionality is always a positive. However, there will likely be some skepticism, given that these backers haven’t always been seen as the most “investor-friendly” by the retail crowd. 🤨

Bullets From The Day

✈️ American Airlines hopes 17% raises can clinch flight attendant contract. While strikes are extremely rare among airline employees, with the last taking place in 2010, the threat of strikes has forced renewed contract deals across the industry over the last year. To avoid a potential strike among its flight attendants, American is offering an immediate 17% raise and a new formula to increase profit sharing over time. However, the union remains focused on securing a longer-term deal, not a short-term fix. CNBC has more.

❌ U.S. appeals court deals blow to SEC’s PE/HF oversight rule. The Securities and Exchange Commission (SEC) has been handed its latest loss by the U.S. appeals court, which threw out its rule intended to give investors more transparency into private funds. The 3-0 decision found that the SEc exceeded its authority when adopting the rule last August, requiring fund managers to issue quarterly performance and fee reports, perform annual updates, and stop giving some investors preferential treatment. More from Reuters.

🕵️ FTC alleges ‘secret kickbacks’ at the largest U.S. alcohol distributor. The Federal Trade Commission’s (FTC) latest lawsuit is against Southern Glazer’s Wine and Spirits and could be brought to the courts in the coming weeks. Reports are it alleges the company has been providing secret kickbacks to large retailers and violating an (albeit obsure) 1936 antitrust law. It’s the agency's latest antitrust action, as it continues to aggressively pursue cases with the Biden Administration’s support. CNBC has more.

Links That Don’t Suck

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Content, news, research, tools, and securities symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. Read the full terms & conditions here. 🔍

Third-Party Advertisement Disclaimer: Paid endorsement for Public Investing, member FINRA/SIPC. Rebate rates vary from $0.06-$0.18 per contract depending on time of enrollment and number of referrals you make. Rates are subject to change. See terms & conditions of the Options Rebate Program. Investors must review the Options Disclosure Document (ODD). Options are risky and not suitable for everyone. See Fee Schedule and Options Rebate & Referral T&Cs: https://public.com/disclosures. Brokerage services for US-listed securities and options offered through Public Investing, member FINRA & SIPC. Supporting documentation upon request.