NEWS

Inflation Is Back In Play

Source: Tenor.com

Stocks sank and rates cranked following a hotter-than-expected inflation print. The continued macro headwinds keep the major indexes in a range, while earnings and company news put individual stocks in play day after day. 👀

Today's issue covers why January’s CPI print sent rates higher, software stocks’ breakout retests, Robinhood and Reddit results, and more! 📰

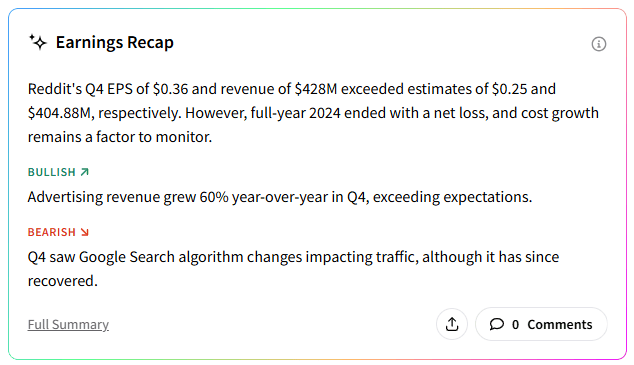

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with communication services (+0.11%) leading and energy (-2.41%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,052 | -0.27% |

Nasdaq | 19,650 | +0.03% |

Russell 2000 | 2,256 | -0.87% |

Dow Jones | 44,369 | -0.50% |

EARNINGS

Inflation Inches Up, Raising Market Fears 😨

Month-to-month inflation readings were put aside as an investor focus during 2024, as fears of labor market weakness and a slowing economy took center stage. However, we’ve discussed over the last several months that the job market and economy have remained resilient, halting inflation’s downward progress in its path.

January’s consumer price index (CPI) confirmed that fear, accelerating by 0.5% MoM and 3% YoY, topping estimates. Core CPI rose 0.4% MoM and 3.3% YoY.

Shelter costs remain a sticky situation, this time with “lodging away from home” prices rising 1.4% and driving a 0.4% increase in overall shelter inflation. Used vehicle prices, insurance, and food prices contributed to this month’s rise. 🔺

Source: CNBC.com

The news sent rates higher, stocks lower, and pushed Fed Fund Futures’ expectations for the first rate cut out even further…with market participants targeting September. Whether that expectation is correct will be seen over time, but inflation has clearly returned to the forefront of investors’ attention. 😢

SPONSORED

DeFi Technologies (CBOE: DEFI OTC: DEFTF) is redefining crypto investing.

DeFi Technologies (CBOE: DEFI OTC: DEFTF) is offering broad exposure to 60+ cryptocurrencies in one stock. No wallets, no exchanges—just seamless access to the $3T digital asset market.

With $1B+ AUM and 133% YoY growth, DeFi Technologies bridges traditional finance and DeFi, providing regulated and diversified access to digital assets like Bitcoin and Solana.

Key Highlights:

✅ Most diversified crypto stock

✅ Potential Nasdaq listing underway

✅ Strong analyst ratings & institutional interest

✅ Buy directly in your brokerage account (CBOE: DEFI OTC: DEFTF)

Get ahead of the next wave of crypto adoption by traditional finance.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

CHART OF THE DAY

Buyers Eye Salesforce As It Retests Prior Peaks 😋

Stocks started the day off on a rough note following a hotter-than-expected consumer price print. Meanwhile, traders continue to find opportunities to buy breakout retests amid the volatility. This example from @RotationReport in today’s Chart Art newsletter is one of many the Stocktwits community pointed out.

STOCKS

Other Noteworthy Pops & Drops 📋

CVS Health ($CVS +15%): The retail pharmacy giant posted better-than-expected earnings and revenues, with its 2025 guidance in line with estimates.

Intel ($INTC +8%): The struggling chip giant jumped after Vice President JD Vance’s speech supported U.S.-made artificial intelligence (AI) chips.

Gilead Sciences ($GILD +7%): Morgan Stanley, Wells Fargo, and Piper Sandler raised their price targets following a “solid” fourth-quarter earnings report.

Firefly Neurosciences ($AIFF +66%): Accepted into the Nvidia Connect program, which provides participating companies with software development resources and technical training.

Kala Bio ($KALA -30%): Announced the resignation of CEO Mark Iwicki, with President Todd Bazemore being named interim CEO.

Biogen ($BIIB -6%): The biotech giant’s 2025 profit forecast fell short of estimates.

Vertiv Holdings ($VRT -9%): Its upbeat fourth-quarter results were overshadowed by a lackluster 2025 outlook.

Atomera ($ATOM -39%): The semiconductor technology company’s fourth-quarter results were mixed and its future revenue guidance disappointed.

NXP Semiconductors ($NXP +5%): Morgan Stanley upgraded the stock to ‘Overweight’ from ‘Equal Weight,’ hiking its price target from $231 to $257.

Teradata Corp. ($TDC -18%): The provider of multi-cloud platforms reported mixed fourth-quarter results and forward guidance. Its CFO is also leaving this quarter.

CME Group ($CME +3%): The exchange reported better-than-expected fourht-quarter revenue and earnings, with its CEO saying 2024 was its best year ever.

Barrick Gold ($GOLD +7%): Fourth-quarter earnings topped estimates even as revenues missed. Strong operating cash flow and production boosted sentiment.

Spire Global ($SPIR -50%): The company flagged concerns regarding the consummation of its maritime business sale to Kpler Holding.

Lucid Group ($LCID +7%): Benchmark analyst Mickey Legg initiated coverage with a ‘Buy’ rating and a 5% price target, implying a nearly 75% upside from today’s levels.

Diana Shipping ($DSX +5%): The company announced it would be selling the 2010-built Post-Panamax vessel “Alcmene” for $11.9 million before commissions.

BlackBerry ($BB +11%): Blackberry’s decision to divest Cylance, an antivirus software developer, and the general improvement in sentiment following President Donald Trump’s election victory were among the catalysts driving a 75% YTD run.

EARNINGS

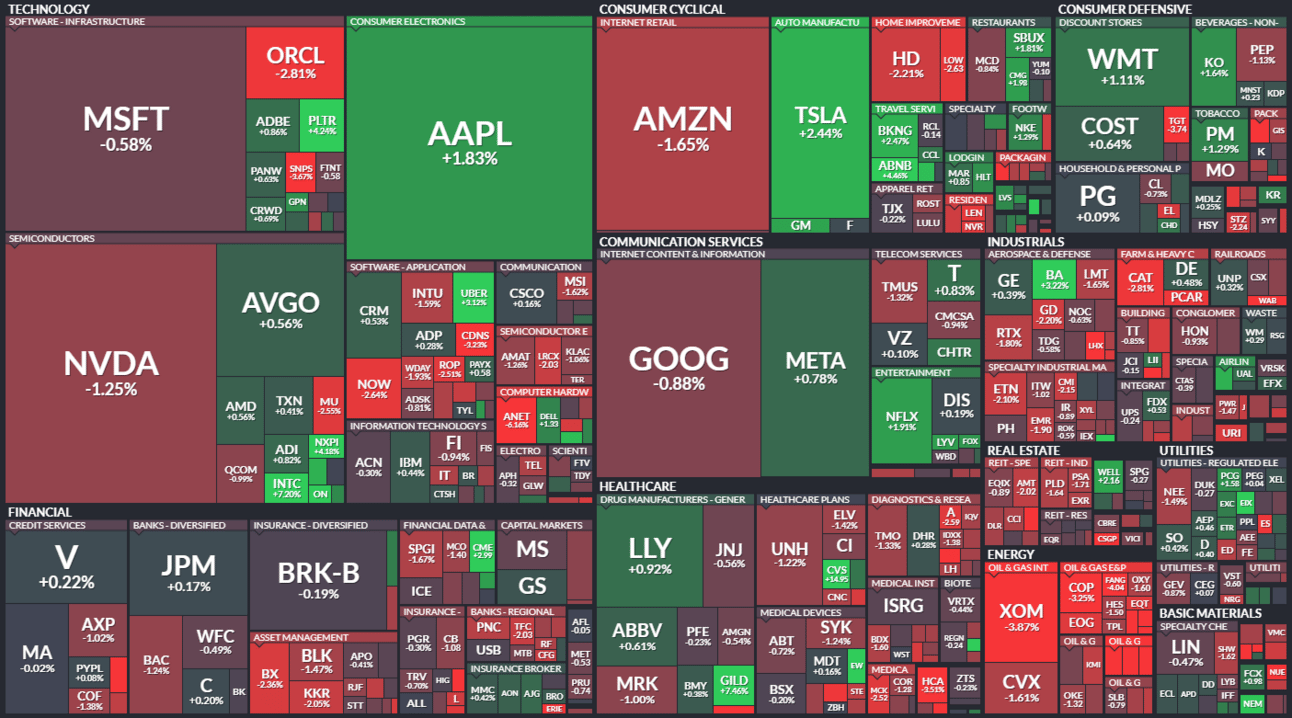

Robinhood Rises While Reddit Rolls Over 🙃

Retail brokerage Robinhood is up 14% after the bell, with Stocktwits sentiment surging into ‘extremely bullish’ territory as prices hit 3.5-year highs. 📈

Reddit didn’t have the same luck, falling 14% after the bell and seeing Stocktwits sentiment slump into ‘bearish’ territory. 📉

PRESENTED BY STOCKTWITS

CMT Lunch & Learn: Brian Shannon (@alphatrends)

Pro trader and Stocktwits user Brian Shannon analyzes AI stocks and CPI volatility and shares several key trading lessons for the current environment. His explanation of identifying valid breakouts vs. a false move is key for today’s market. 👌

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Producer Price Index (8:30 am ET), Initial/Continuing Jobless Claims (8:30 am ET). 📊

Pre-Market Earnings: Datadog ($DDOG), Palatin Technologies ($PTN), Veru ($VERU), PG&E ($PCG), Deere ($DE), CyberArk Software ($CYBR), Crocs ($CROX). 🛏️

After-Hour Earnings: Coinbase ($COIN), Roku ($ROKU), DraftKings ($DKNG), Airbnb ($ABNB), Twilio ($TWLO), Palo Alto Networks ($PANW), Applied Materials ($AMAT). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋