NEWS

Inflation Produces Lower Stock Prices

Source: Tenor.com

The markets slipped today as hotter-than-expected inflation data weighed on sentiment, with all the major indices closing the day in the red. Those expecting a slowdown ahead of the holiday season may be disappointed because the news flow just keeps on coming. 👀

Today's issue covers the mashup of global economic data, Broadcom’s breakout to record highs, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with consumer staples (+0.29%) leading and consumer discretionary (-0.83%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 6,051 | -0.54% |

Nasdaq | 19,903 | -0.66% |

Russell 2000 | 2,361 | -1.38% |

Dow Jones | 43,914 | -0.53% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $NX, $CIEN, $HIMX, $KROS, $AYRO 📉 $MRKR, $QTTB, $INO, $LOVE, $NUE*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

Anxiety Rises As Producer Prices Pop 😬

November’s producer price index (PPI) rose 0.4% MoM and 3% YoY, while core PPI (excluding food and energy) rose 0.2% MoM and 3.5% YoY. Both annual increases were the largest seen since February 2023, reigniting fears that inflation could bounce back. 🌡

Some 80% of the jump in final-demand goods prices came from a 3.11% surge in food prices. Chicken eggs soared 54.6% amid supply chain issues, while services costs also edged higher by 0.2%.

However, the Fed appears locked into another 25 bp cut next week, but 2025’s outlook remains at risk. 🔮

Several central banks cut rates this week, including the European Central Bank (ECB), which cut another 25 bps today to balance stubborn inflation and weak economic growth. Meanwhile, the Swiss National Bank (SNB) cut 50 bps to deal with the opposite issue of many countries: low inflation and a strong currency.

Chinese stocks gave back some of their recent gains as the market questions recent efforts to recharge its economy. Officials are trying to assure the markets that its borrowing, interest rate cuts, and other initiatives will offset Trump’s tariffs.

The bulls remain in control long term, though the short-term pullback in stocks continues after getting overheated. From a sentiment perspective, having President-elect Donald Trump ring the New York Stock Exchange (NYSE) opening bell and touting the strength of the market is about as bullish as it gets. 🥳

Time will tell how this all ends. But for now, companies are taking advantage of it while they can. ServiceTitan is the latest Nasdaq IPO to price up its offering and close significantly higher in its first day of trading. It’s the first notable venture-backed IPO since Rubrik came public in April, so it’s being closely watched by the market into 2025. Many expect the level of IPOs and other M&A activity to surge under the new administration, so the more appetite we see, the more Wall Street will deliver. 🤷

SPONSORED

$11M Raised — 6 Days Left to Invest in the AI Company Everyone’s Buzzing About.

It’s not just another buzzword-filled startup… Meet Atombeam, the AI-driven disruptor aiming to change how data moves — faster, safer, and smarter. Investors are taking note, with over a $3M waitlist from their last round and $11M+ raised in this round — but the offering is closing soon.

Up to 4X Faster, $2.4M+ Defense Contracts. Atombeam’s patented AI software can send up to 4x more data over existing networks — without expensive hardware upgrades. That’s why names like the U.S. Space Force, U.S. Air Force are already customers. In 2023, Atombeam secured $2.4M in defense contracts.

Building industry relationships within a $200B market… Atombeam’s partnerships span NVIDIA, Intel, Ericsson, and HPE.1 Atombeam has a projected $200B global data center market by 2025. Now, you can invest in Atombeam.

$3M+ waitlist in last round, and only 6 Days to Invest…before Atombeam’s current funding round is closed. Over 7,500 investors have already invested across offerings, and one previous offering sold out. Invest now before the round closes on 12/18.**

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. **This is a paid advertisement for Atombeam’s Regulation A+ Offering. This Reg. A+ offering is made available through StartEngine Primary, LLC, member FINRA/SIPC. Please read the Offering Circular and related risks at Atombeam’s webpage on StartEngine before investing. In addition, as described in the Offering Circular, the Company retains the right to continue the offering beyond the Termination Date, in its sole discretion.

EARNINGS

Broadcom Breaks To New Highs 📈

The chipmaker is surging after its adjusted earnings per share topped estimates while revenue missed. However, its first-quarter revenue forecast was marginally higher. 📊

Despite the mixed results, management commented that it’s seeing soaring demand from the boom in generative AI infrastructure. Full-year AI revenue jumped 220% to $12.2 billion, with CEO Hock Tan saying, “We see an opportunity over the next three years in AI. Massive specific hyperscalers have begun their respective journeys to develop their own custom AI accelerators.”

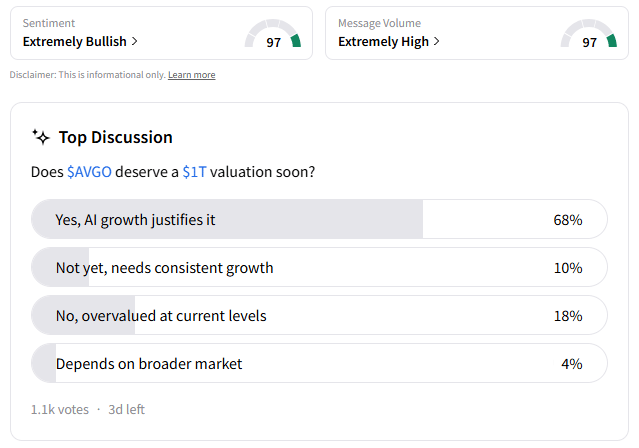

The Stocktwits community nailed this move, with 68% of people expecting a beat with bullish guidance. Congrats to all the bulls celebrating tonight! 👏

With shares rising another 13% after the bell, Stocktwits sentiment remains in ‘extremely bullish’ territory. Looking ahead, we’ve got a new poll going to see whether investors believe a $1 trillion valuation is coming soon. It’s leaning bullish now, but we’ll see how it develops into the weekend. 🐂

STOCKS

Other Noteworthy Pops & Drops 📋

Riot Platforms (+6%): The miner and third-largest corporate holder of Bitcoin completed a $525 million senior note offering to buy more of the crypto.

Bitdeer Technologies (+10%): The Bitcoin miner revealed plans to run up to $1 billion through the insurance of shares, debt, and warrants to increase its financial flexibility and ability to capitalize on business opportunities.

Robinhood (+4%): The retail brokerage reported November 2024 total assets under custody ($AUC) over $195 billion, net deposits of $5.6 billion, and funded customer growth of 6% YoY. Crypto trading volumes surged 780% YoY to $35.2 billion.

Keros Therapeutics (-73%): The company halted two high-dose arms in its Phase 2 TROPOS trial of cibotercept for pulmonary arterial hypertension.

Aptevo Therapeutics (-38%): The company announced promising leukemia trial results but paired gains as investors' attention turned to other ongoing challenges.

Ciena (+16%): The optical networking equipment maker missed earnings estimates, but its revenue was in line with estimates. Still, its upbeat guidance helped push retail sentiment into bullish territory as investors eyed further upside.

Warner Bros. Discovery (+13%): The media and entertainment giant rose to a one-year high after announcing corporate restructuring efforts.

Liquidity Services (+30%): The global commerce company posted fourth-quarter earnings that topped expectations, with revenues in its RSCG segment driving results.

Himax (+45%): TF International Securities analyst speculated that Himax may provide critical technology to Nvidia and Taiwan Semiconductor.

Intel (+3%): The two executives leading the struggling chipmaker after its CEO resigned said the company may be forced to sell its manufacturing operations if a new chipmaking technology slated for next year fails.

RH (+18%): The high-end housing retailer’s third-quarter earnings missed expectations, but revenue growth of 8.1% YoY was slightly better than anticipated. It also raised its full-year revenue guidance and operating margin, buoying prices.

Lovesac (-31%): The home furnishing company posted a third-quarter earnings miss and weak guidance, hitting its stock price and retail sentiment.

Buzzfeed (-20%): The struggling media conglomerate fell sharply on news it’s selling the ‘Hot Ones’ studio in an $82.5 million deal after buying the assets during 2021.

Houston American Energy Corp. (+4%): The oil and gas exploration and production company signed two non-binding letters of intent to acquire Abundia Global Impact Group ($AGIG) and RPD Technologies ($RPD).

Steel stocks Nucor Corp., Steel Dynamics Inc., and Commercial Metals Co. slumped after UBS downgraded the stocks, citing weak third-quarter earnings and guidance.

Links That Don’t Suck 🌐

🎧 Stocktwits “Daily Rip Live:” Market volatility, cannabis insights, and live updates from a historic day at the NYSE

Privacy: Your responses are confidential and will only ever be shown in aggregate after being combined with those of other survey respondents. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋