NEWS

Inflation’s Progress Empowers Bulls

Source: Tenor.com

Better-than-expected inflation data helped get the bulls back on track, with tech and offensive market sectors leading. Bulls hope that tomorrow’s consumer price data can keep the party going. Let’s see what you missed. 👀

Today's issue covers PPI and Home Depot sending similar signals, Starbucks stealing Chipotle’s CEO, and a big earnings move in Sea Ltd. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with technology (+3.07%) leading and energy (-0.97%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,434 | +1.68% |

Nasdaq | 17,188 | +2.43% |

Russell 2000 | 2,095 | +1.61% |

Dow Jones | 39,766 | +1.04% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $LWAY, $CLW, $XP, $SLRN, $EXPRQ 📉 $SBUX, $PAVM, $QH, $TME, $RUM*

*If you’re a business and want to access this data via our API, email us.

ECONOMY

PPI Surprises While Home Depot Cautions 😵💫

Inflation’s downward trajectory continues, with headline producer prices (PPI) rising just 2.20% YoY, down from its 2.70% rise during June. The 0.10% MoM increase was also less than the 0.20% estimate, while core was flat MoM.

Final demand goods prices rose the most since February, but the largest service slide since March 2023 helped keep overall prices in check. 👍

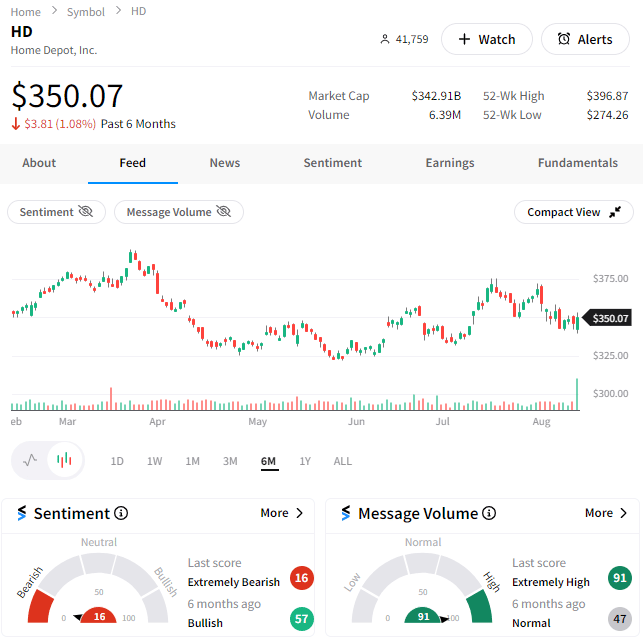

Speaking of inflation, popular housing barometer Home Depot signaled that some deflationary behavior continues among consumers.

CFO Richard McPhail said consumers have had a “deferral mindset” since the middle of 2023, with high interest rates causing them to put off buying and selling homes or taking on bigger projects like kitchen renovations until rates come down. 🗓️

All this boils down to a more cautious consumer contending with record prices, high interest rates, and a slowing economy. This has resulted in seven consecutive quarters of negative comparable sales.

And Home Depot doesn’t expect this to resolve itself anytime soon. Management now expects full-year comparable sales to decline 3% to 4% vs. its previous guidance of a 1% drop. 📉

Overall, Home Depot had expected this and has been playing defense, allowing it to properly manage Wall Street’s expectations and beat expectations via operational efficiencies.

That said, customer transactions fell 2% YoY, and the average ticket declined just over 1%, showing further evidence of slowness on the demand side. 🔻

Shares initially traded down as much as 6% in pre-market trading but ended the day up 1%. Still, Stocktwits users are skeptical, with sentiment currently sitting in ‘extremely bearish’ territory ahead of Lowe’s, Walmart, and other consumer-related reads expected later this week. 🐻

COMPANY NEWS

Starbucks Steals Away Chipotle’s CEO 👨💼

Brian Niccol is a food executive who knows his stuff. And today, he announced he’s taking his talents from Chipotle Mexican Grill to Starbucks, which has been battling years of underperformance.

Both stocks saw major moves, with Chipotle falling 8% and Starbucks soaring 25%. Investors likely looked at Chipotle’s stock performance since Brian took the helm and hope he can replicate that miracle in the coffee space. 👇

As investors digest the news, both stocks will likely remain in play for the days and weeks ahead. But for now, we just want to say a big congrats to all the Stocktwits users we highlighted in July for sticking with the embattled coffee chain despite many logical headwinds. 🫡

IN PARTNERSHIP WITH MONEYSHOW

Join Me At MoneyShow Orlando This October!

My presentation, “Social Sentiment's Growing Role in Navigating Markets,” will explain how investors and traders use Stocktwits’ unique social data to stay ahead of the market’s top trends. And don’t worry, I’ll leave the politics to the other speakers, lol. Register here, and I’ll see you then! 👍

Not an offer or recommendation by Stocktwits nor is this investment advice. See disclosure.

EARNINGS

Sea Ltd. Soars Amid Revenue Rebound 📈

Singapore’s Sea Ltd., best known for its e-commerce platform Shopee, continued its multi-week comeback today after better-than-expected results. 👍

It beat revenue estimates for the second quarter and raised its full-year Shopee guidance, citing robust demand and saying gross merchandise value (GMV) will grow mid-20% this year vs. an earlier forecast of high-teens.

E-commerce revenue, which makes up two-thirds of its total business, rose 34% YoY, signaling that the difficult resources reallocations it made to cope with the post-pandemic slowdown and increasing competition are paying off. Its digital entertainment segment and financial services business continue to chug along as well, each growing roughly 21% YoY. 💪

Shares rose 12% on the day toward their highest level of the year, while Stocktwits sentiment hit a one-year high in ‘extremely bullish’ territory.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Consumer price index (8:30 am ET).

Pre-Market Earnings: Workhorse Group ($WKHS), Crown Electrokinetics ($CRKN), BlueBird Bio ($BLUE), Creative Realities ($CREX), Bakkt Holdings ($BKKT), Sphere Entertainment ($SPHR), and LM Funding America ($LMFA). 🛏️

After-Hour Earnings: Cisco Systems ($CSCO), Dlocal Ltd. ($DLO), Cineverse Corp. ($CNVS), StoneCo Ltd. ($STNE), and Canoo Inc. ($GOEV). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Disclaimer: Stocktwits, Inc. (“Stocktwits”) operates the stocktwits.com website and Stocktwits mobile device applications (the “Apps”). Stocktwits is not a securities broker-dealer, investment adviser, or any other type of financial professional. No content on the Stocktwits platform should be considered an offer, solicitation of an offer, or advice to buy or sell securities or any other type of investment or financial product. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋