NEWS

International Stocks Slip As U.S. Churns

Source: Tenor.com

U.S. stocks had a mixed day, with crude oil continuing to rise and precious metals pumping. Foreign stocks took a breather, while consumer staples saw a major boost from Philip Morris’ strong quarterly results. All eyes turn to Tesla earnings tomorrow after the bell to set the tone for the rest of the week. 👀

Today's issue covers emerging weakness in global equity leaders, GM and GE diverging on earnings, and other noteworthy pops and drops. 📰

Here’s the S&P 500 heatmap. 4 of 11 sectors closed green, with consumer staples (+0.56%) leading and industrials (-1.18%) lagging.

Source: Finviz.com

And here are the closing prices:

S&P 500 | 5,851 | -0.05% |

Nasdaq | 18,573 | +0.18% |

Russell 2000 | 2,232 | -0.37% |

Dow Jones | 42,925 | -0.02% |

Most bullish/bearish symbols on Stocktwits at the close: 📈 $ULY, $SGMO, $CYCC, $BTOC, $PM 📉 $TXN, $ENPH, $DENN, $SBUX, $KO*

*If you’re a business and want to access this data via our API, email us.

EARNINGS

GM and GE Diverge On Earnings 🤨

General Motors and General Electric may have similar names, but they do not have similar performance today.

General Motors’ third-quarter adjusted earnings per share of $2.96 and revenues of $48.76 billion topped the expected $2.43 and $44.59 billion. The company also raised its full-year guidance, marking the third straight “triple beat” led by strength in its North American operations. 🚘

Strong pricing in the U.S. helped offset losses in China and YoY increases of $200 million in labor and $700 million in warranty costs. The average transaction price per vehicle remained over $49,000 from July through September.

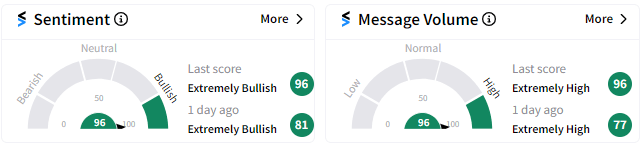

Shares jumped 10%, and Stocktwits sentiment surged into ‘extremely bullish’ territory following the news. 🐂

GE Aerospace has been one of the best-performing stocks this year, though it’s giving some of its gains back today. The company’s earnings and revenue both beat expectations, and management raised its full-year guidance. 📈

Expectations were sky-high coming into the report, with most analysts citing that as the reason for the stock price coming in today. Jeffries analyst Sheila Kahyaoglu noted that defense business profit margins fell 240 bps YoY to 9.8%, causing some concern among the analyst community.

Despite shares falling 9%, Stocktwits sentiment pushed further into ‘extremely bullish’ territory as investors look to ‘buy the dip’ in this YTD market leader. 🛒

SPONSORED

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

STOCKS

Weakness Emerging In International Stocks? 🤔

Global stocks have helped lead the charge for equities as an asset class in 2024, with Japan’s Nikkei 225 being the poster child of strength as the index made new all-time highs for the first time in over three decades. 🤩

However, since making those highs earlier this year, this market hasn’t done much as U.S. stocks and other markets have continued their onward march.

As a result, some technical analysts suggest that the Nikkei’s relative weakness and waning momentum is a warning sign that equities as an asset class are beginning to tire. 😩

Whether or not they’re right remains to be seen. But for now, analysts are looking at Japan’s stock market as a tell of what’s next for the global asset class. 👀

STOCKS

Other Noteworthy Pops & Drops 📋

Genuine Parts: The automotive and industrial replacement parts provider saw just 2.5% YoY revenue growth, marginally beating estimates. That was driven by acquisition benefits, with comparable sales falling 0.8% YoY. Adjusted earnings missed significantly, with industrial weakness and Europe weighing on profits. Shares fell 20%. 🪛

McDonald’s: Fell 9% after the Centers for Disease Control and Prevention (CDC) said an E. Coli outbreak linked to McDonald’s Quarter Pounder burgers has led to 10 hospitalizations and one death. The agency said the outbreak has hit 10 states, with “most” sick people reported eating a McDonald’s Quarter Pounder. 🍔

Verizon Communications: The telecommunication giant's revenue missed estimates, citing a slow phone upgrade cycle. Its net gain of 239,000 monthly phone subscribers beat expectations by about 8%, though that was not enough to offset an overall revenue miss. Shares fell 4%. 📱

Philip Morris International: The cigarette maker rose 10% to new all-time highs after beating third-quarter estimates and raising its annual profit forecast. Higher prices and strong demand for its smoking alternatives helped drive the growth, showing that its billions of investments in these cigarette substitutes are paying off. 🚬

Lockheed Martin: The defense contractor raised its annual profit and sales forecasts, though its F-35 fighter jet program faced payment headwinds stemming from the government contracting business. Drawn-out contract negotiations mean Lockheed has to incur procurement costs for jets set to be delivered in 2026 and 2027. Shares fell 6%. ✈

Nucor: The steelmaker saw revenues fall 15% YoY, but bested the $7.28 billion analysts had anticipated. Average sales price per ton fell 6% QoQ and 15% YoY, with shipments to outside customers down about 1% YoY. Management expects another profit drop during Q4, with prices and volumes falling further. Shares fell 7%. 🏭

3M: The industrial conglomerate beat third-quarter earnings and revenue estimates marginally, though its adjusted operating margin improved 140 bps YoY to 23%. Its operating cash flow was negative again, and its fourth-quarter guidance was softer than anticipated. Shares fell 2%. 🛍

Sherwin-Williams: The paint and coatings company missed third-quarter revenue expectations, noting that sales in its consumer brand group fell due to ongoing softness in the North American do-it-yourself market. Consumers continued to deal with inflation, higher debt levels and financing costs, and a slow housing market. Rate cuts have yet to impact the market. Shares fell 4%. 🖌

Cheesecake Factory: The restaurant chain’s shares popped and dropped on news that JCP Investment Management, which focuses on the restaurant industry, has built a roughly 2% stake in the company. The activists want management to split the North Italia, Flower Child, and Culinary Dropout restaurants into a separate company. 🧀

Denny’s: The stock has not been a “grand slam” for investors, with shares falling 20% to new all-time lows after a weaker-than-expected third quarter. Sales fell 2% YoY, with non-GAAP profits missing expectations by 9%. Gross margins were down eight full points YoY to 32.2% as the company reduced prices to get customers back in the door. Its low-to-middle-income core customers remain challenged in this environment. 🥞

Enphase Energy: The solar stock fell 9% to new 52-week lows after hours following third-quarter results and fourth-quarter revenue guidance that missed expectations. It follows a slew of analyst downgrades from previous weeks that have pressured the stock and its peers. 🌦

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Bowman Speech (9:00 am ET), Bank of Canada Interest Rate Decision (9:45 am ET), Existing Home Sales (10:00 am ET), Bank of Canada Press Conference (10:30 am ET), EIA Energy Inventories (10:30 am ET), and Fed Barkin Speech (12:00 pm ET). 📊

Pre-Market Earnings: Boeing ($BA), AT&T ($T), Coca-Cola ($KO), NextEra Energy ($NEE), Deutsche Bank ($DB), New Oriental Education ($EDU), General Dynamics ($GD). 🛏️

After-Hour Earnings: Lam Research ($LRCX), Viking Therapeutics ($VKTX), QuantumScape ($QS), International Business Machines ($IBM), Tesla ($TSLA). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋